Thanks for joining me this Friday the 4th July, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is our weekly market update. Happy New Financial Year! Let’s dive into the key takeaways from FY25 and the outlook for FY26. FY25 saw some record highs and some serious turbulence in the form of geopolitical tensions, President Trump taking office, trade wars, tariffs, inflation and interest rate uncertainty, extended valuations on equity markets and China’s prolonged post-pandemic struggles to reignite material economic growth.

Market heavyweights, safe-havens and AI were the key drivers of the share market topping new records in FY25 despite the headwinds just mentioned, and it is important for investors to understand that while the ASX200 posted a 10% gain over the financial year, it was not a broad rally and was primarily driven by the financials, discretionary and tech sectors.

It was a tough year for our materials stocks. While gold performed well, iron ore miners struggled due to China’s sluggish post-pandemic recovery. Weak industrial output and factory activity data signal a grim outlook, dampening demand for Aussie commodities. With added tariffs, the sector took a heavy hit.

Energy stocks also fell out of favour with investors in FY25 as we saw geopolitical tensions and trade wars dampen the outlook for such companies and in a risk-off environment for our investors, such companies proved too volatile for investment.

Now we are in FY26 and the future is looking bright with the ASX200 already resetting its record close on just the 2nd day of the new FY. As an investor navigating uncertainty and headwinds creeping in from FY25, where are the opportunities you may ask?

This reporting season will provide a clearer outlook for FY26, though conservative guidance is likely due to volatility, tariffs, and macro uncertainties. The market expects single-digit earnings growth for FY25, with subdued consumer demand, high interest rates, and factors like Trump’s tariffs and geopolitical tensions impacting the second half. However, with rate cuts on the horizon and trade war tensions easing, the likelihood of a strong FY26 across the board is gaining momentum.

Several healthcare companies are expected to report key clinical trial results in FY26, presenting attractive opportunities, particularly as companies approaching commercialisation are well-positioned in the currently undervalued healthcare sector. Bell Potter’s latest buy recommendations include CSL (ASX:CSL), Telix Pharmaceuticals (ASX:TLX), and Mesoblast (ASX:MSB) within this space.

The global green energy shift has driven recent market gains and is set to grow further in FY26, boosted by the AI revolution. Rising nuclear power adoption to meet energy demands sustainably is increasing uranium demand, expected to continue into FY26. Bell Potter rates Boss Energy (ASX:BOE), Paladin Energy (ASX:PDN), and Deep Yellow (ASX:DYL) as buys.

During times of heightened volatility investors tend to find safety in defensive stocks, however, as Bell Potter suggests, focusing on select defensive stocks with clear value like Amcor (ASX:AMC) while avoiding expensive defensive stocks like Telstra (ASX:TLS), is the recommended strategy to navigate defensive exposure.

Bell Potter’s outlook for FY26 is cautious optimism with hopes and signals of more rate cuts to come as inflation drivers remain contained, while uncertainty and rising geopolitical tensions have unlocked an opportunity to invest in the high growth defence stock sector through the likes of DroneShield (ASX:DRO) or Austal (ASX:ASB).

If the RBA continues cutting rates in FY26 as is expected, the discretionary and REIT sectors stand to benefit. Lower rates reduce borrowing costs, encouraging consumer spending on non-essential goods. For REITs, cheaper financing supports expansion and higher dividends, making them attractive to investors. Both sectors should see growth as consumer and capital flows increase.

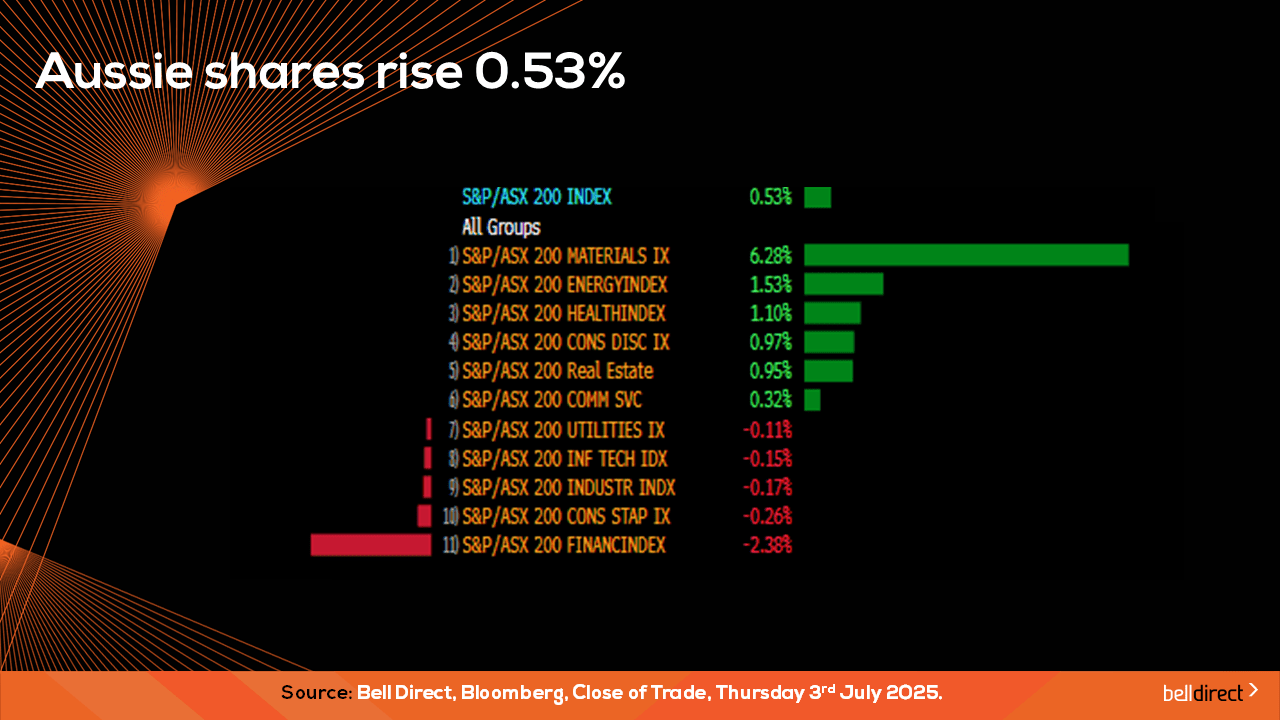

Locally from Monday to Thursday, the ASX200 posted a 0.53% gain as materials stocks surged 6.3% while financial and staples stocks fell 2.38% and 0.26% respectively.

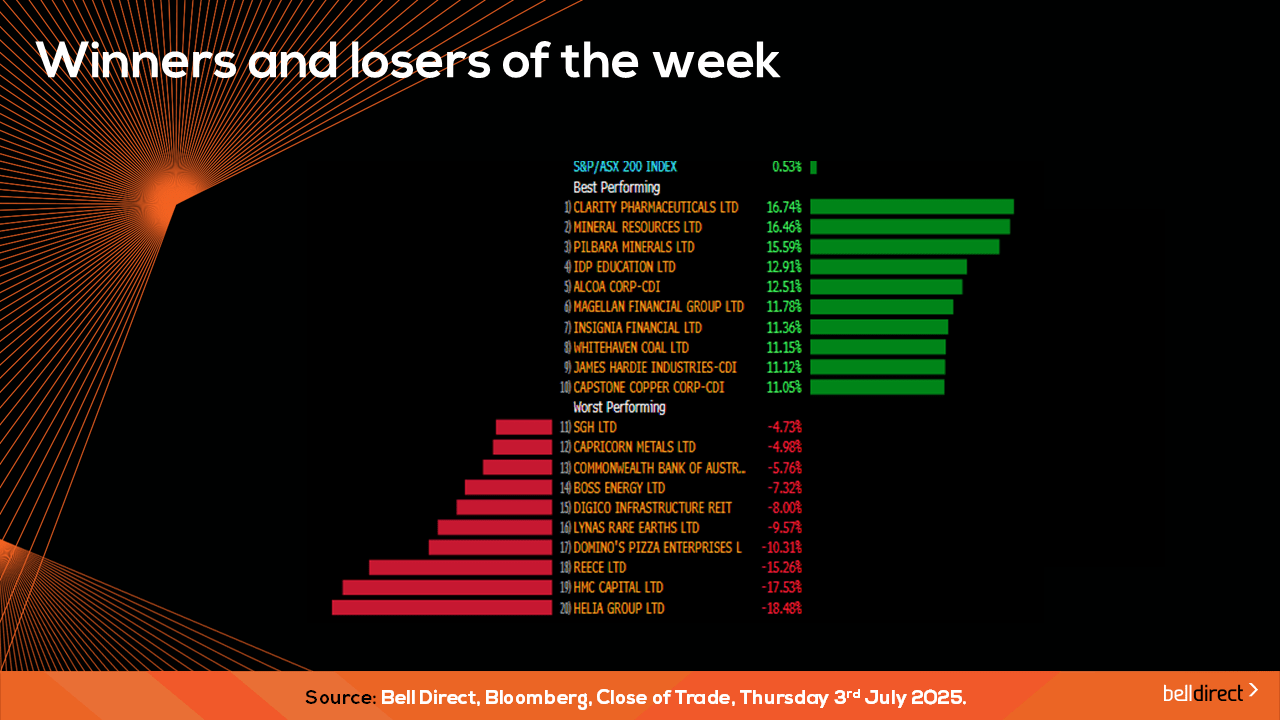

Clarity Pharmaceuticals (ASX:CU6) was the winning stock on the key index this week with a gain over 16.7% while Helia Group (ASX:HLI) tumbled 18.48% after losing its second major contract in as many months.

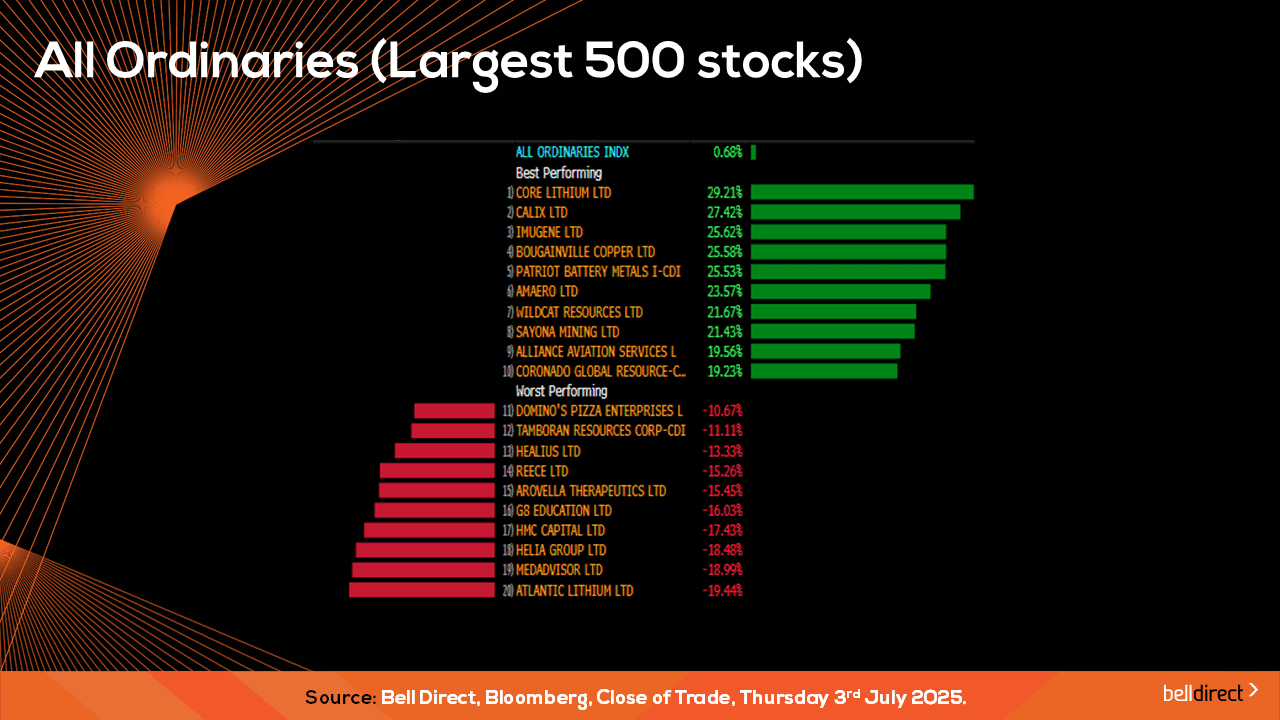

On the broader market index, the All Ords rose 0.68% this trading week as a battle of the lithium miners at either end of the index saw a 29% surge for Core Lithium (ASX:CXO) offset a near 20% loss for Atlantic Lithium (ASX:A11).

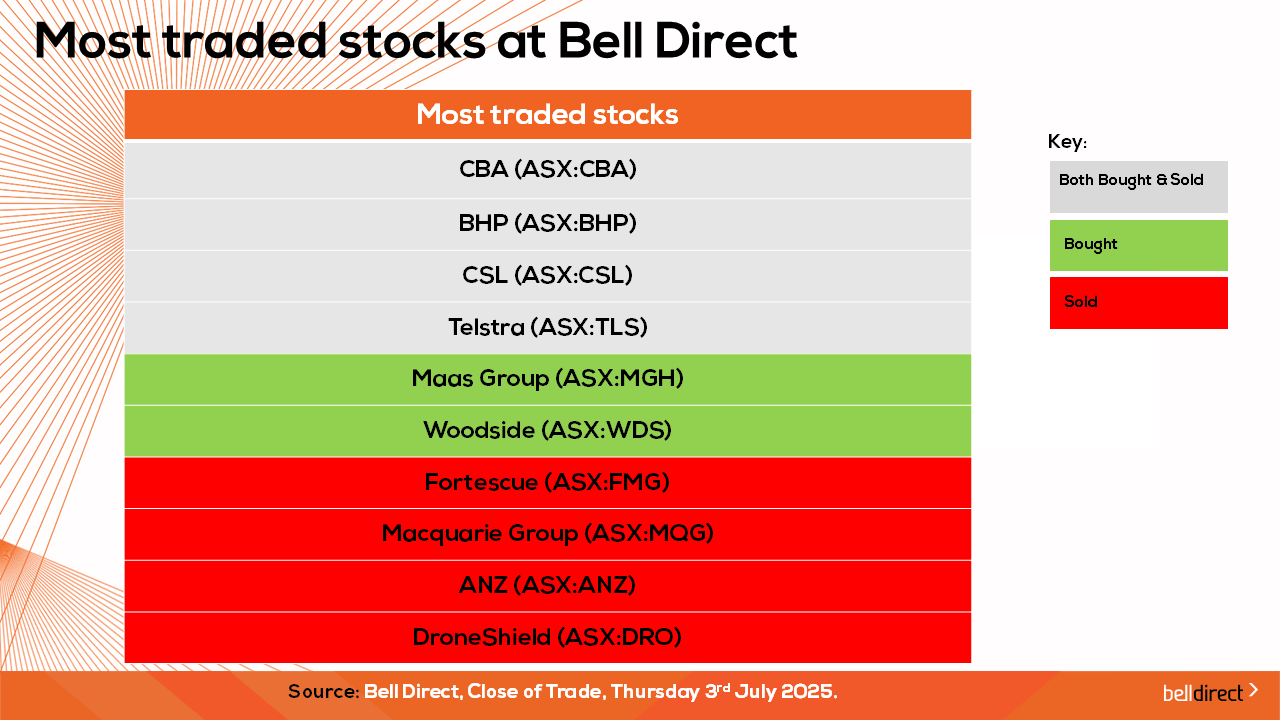

The most traded stocks by Bell Direct clients this week were CBA (ASX:CBA), BHP (ASX:BHP), CSL (ASX:CSL), and Telstra (ASX:TLS). Clients also bought into Maas Group (ASX:MGH) and Woodside (ASX:WDS) while taking profit Fortescue (ASX:FMG), Macquarie (ASX:MQG), ANZ (ASX:ANZ) and DroneShield (ASX:DRO).

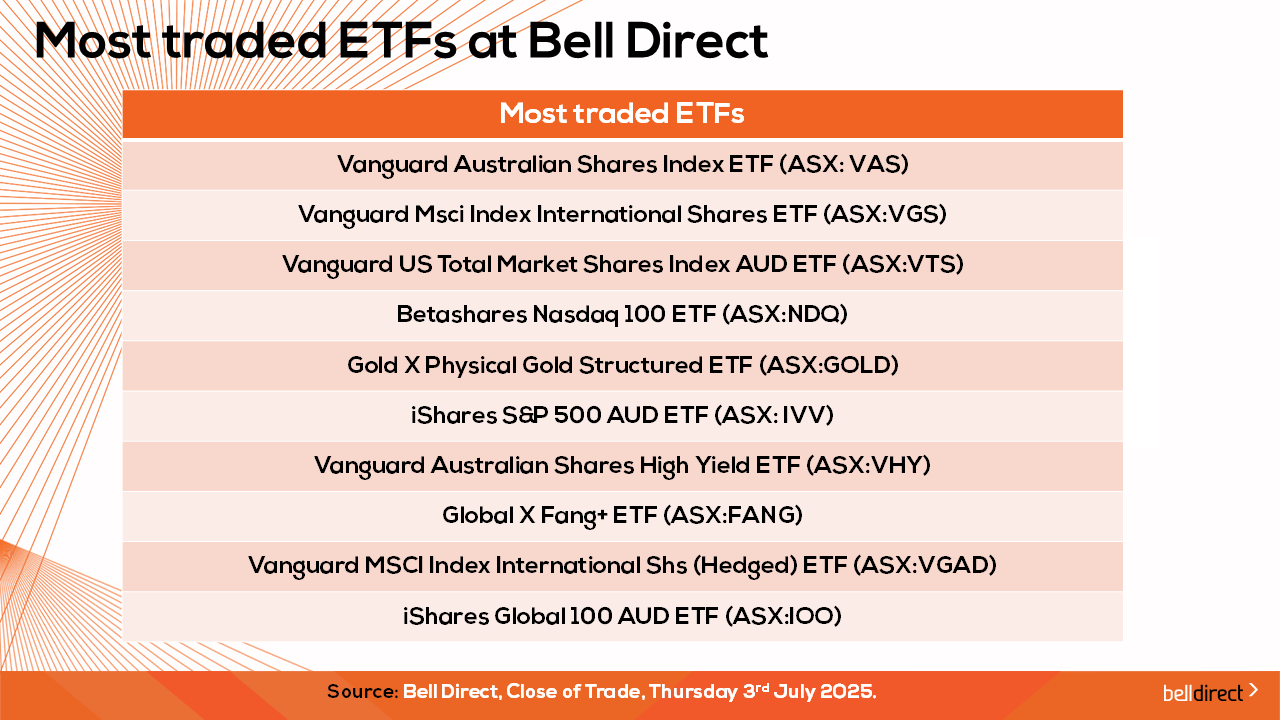

And the most traded ETFs were led by Vanguard Australian Shares Index ETF, Vanguard Msci Index International Shares ETF and Vanguard US Total Market Shares Index AUD ETF.

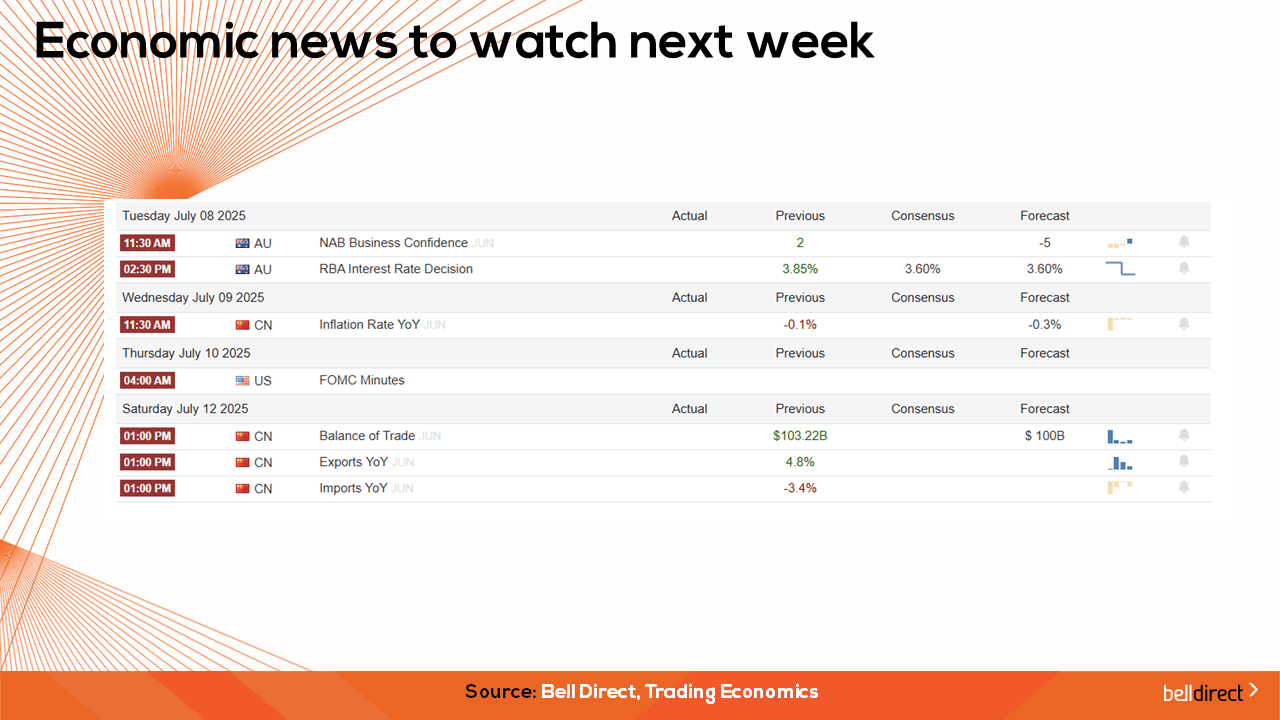

On the economic calendar front next week, we may see investors react to NAB business confidence for June out on Tuesday just before the RBA announces the latest rate decision where the market is pricing in a 98% chance of a rate cut. On Wednesday we will gauge consumer confidence for July.

Overseas, China’s latest inflation data and balance of trade are out next week while the US FOMC latest meeting minutes are also out later in the week.

And that’s all for this first trading week of July, have a wonderful weekend and happy investing.