Thank you for joining us this Friday 27th June, I’m Sophia Mavridis, Market Analyst with Bell Direct and this is the weekly market update.

As the June quarter nears its end, global markets are navigating market turmoil while breaking through record highs. Meanwhile, July’s outlook is shaping up for the potential risk of the looming tariff pause ending on July 9. And as the tariff pause which briefly dragged down global markets comes to an end, markets will be keeping a close eye on supply chains and business confidence. Additionally, the Israel – Iran conflict was the key focus this week, as airlines rerouted flights, then as the ceasefire appeared to hold, demand for gold as the safe haven declined.

If you’re considering where to invest amid the current market turmoil, our research team at Bell Potter have just released their latest Analyst Outlook and Stock Picks report. The full report is available to clients actively trading with Bell Direct. Let’s take a look at some of the stock picks recommended in the report.

Agricultural and FMCG investments include Bega Cheese (ASX:BGA), a manufacturer and distributor of diary and associated products to both Australian and international markets, and Elders (ASX:ELD), a leading supplier of fertiliser, agricultural chemicals and animal health products in rural and regional Australia, with strong agency positions in livestock, wool and real estate. Bell Potter values BGA at $7.00 and ELD at $9.10. Consider this sector as high risk, with volatility from both commodity prices and seasonal factors.

Bell Potter have a positive view on the outlook for the technology sector given the above average forecast revenue and earnings growth, as well as the easing interest rate environment which has commenced. Lower interest rates are generally positive for high growth stocks with low or negative cash flow. However, the sector has still performed well the last few years in a rising interest rate environment, leading to large cap stocks with reasonable cash flow and earnings. Bell Potter’s picks include WiseTech global (ASX:WTC) with a $122.50 price target and Gentrack Group (ASX:GTK) with a $13.50 price target.

Considering healthcare, 9 of the 35 healthcare names covered by Bell Potter trading at a premium to their 31 December market price and the XHJ healthcare index. Bell Potter’s healthcare analysts are recommending Telix Pharmaceuticals (ASX:TLX), a leader in the radiopharmaceuticals sector with a $34.00 price target and Neuren Pharmaceuticals (ASX:NEU) a drug developer with a $20.00 price target.

And gold has continued to tick the boxes, setting further all-time highs in both USD and AUD terms. Central Bank buying and de-dollarisation of certain sovereign balance sheets has continued to be supportive of the gold price. And the volatility in global trade policy saw the gold price reach an all-time high of US$3,500 an ounce in April. While these supportive factors have run much of their course and seen a couple of months of price consolidation, the Israel – Iran conflict now skews gold risk to the upside, in Bell Potter’s view. Bell Potter’s gold stocks include Minerals 260 (ASX:MI6), Santana Minerals (ASX:SMI) and Evolution Mining (ASX:EVN).

Bell Direct clients can access the full report, which includes Bell Potter’s stock picks within each industry sector.

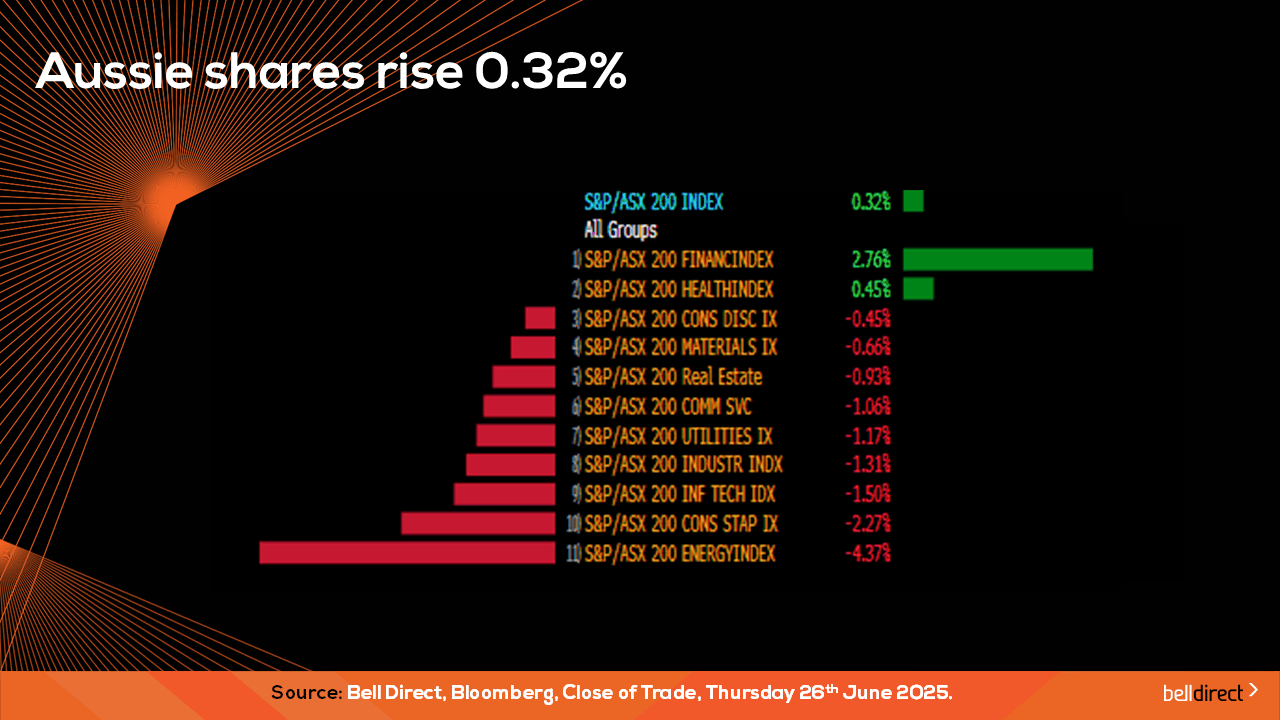

Moving on to the market’s performance this week so far,

The ASX200 has gained 0.32% (Monday to Thursday) despite 9 of the 11 industry sectors in the red. Energy has declined the most down more than 4%, while financials are in the lead, up 2.76%.

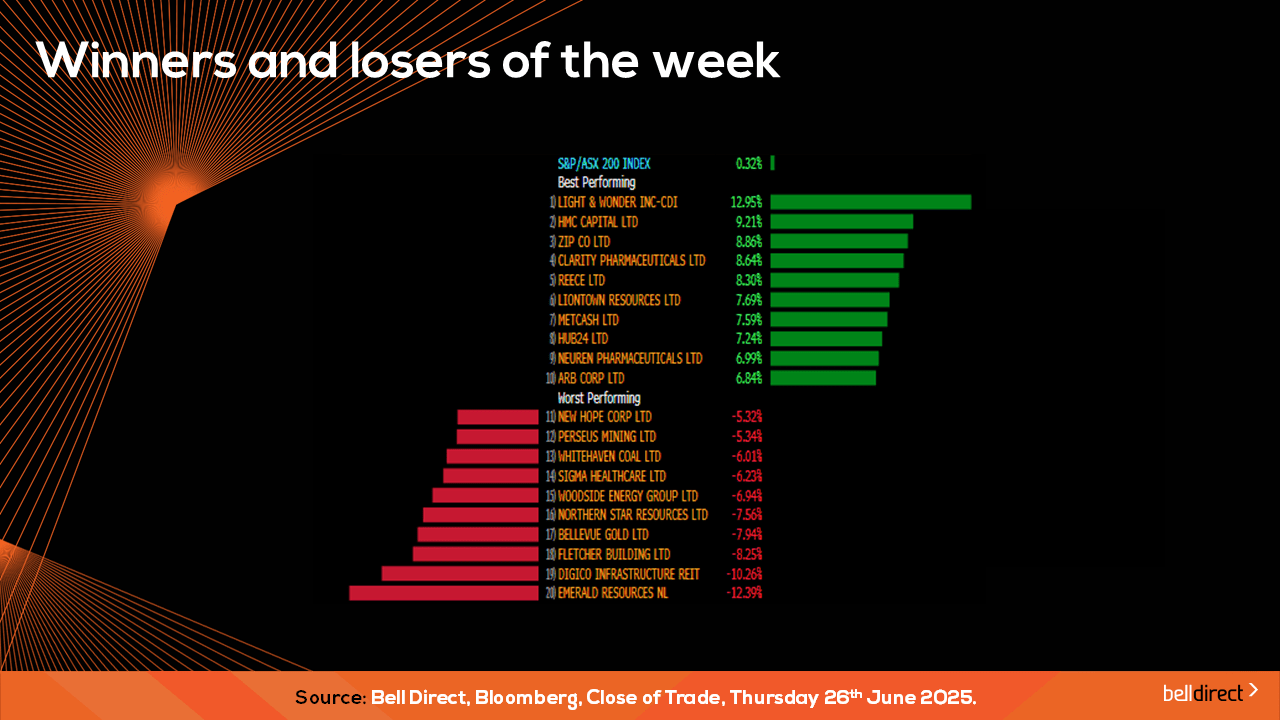

On the ASX200 leaderboard, Light and Wonder (ASX:LNW) is in the lead up more than 12%, while Emerald Resources is down more than 12%. Light and Wonder has earnt a US courtroom victory in an ongoing Aristocrat trade secrets battle. The US District Court for the District of Nevada said the company does not need to disclose the math models behind its Hold N’ Spin game titles and that Aristocrat must detail any trade secrets it is looking to protect.

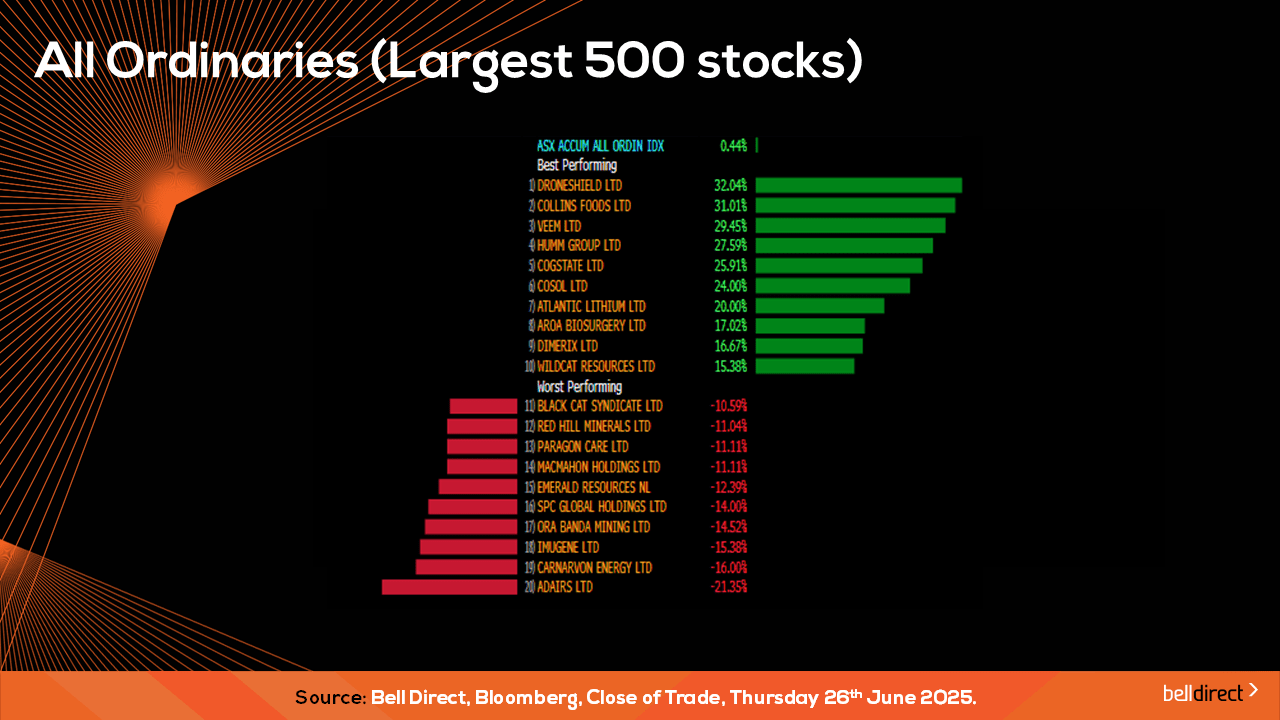

And strong gains were posts on the All Ords with DroneShield (ASX:DRO) and Collins Foods (ASX:CKF) each advancing more than 30% this week so far, while Adairs (ASX:ADH) was the worst performer, down over 20%.

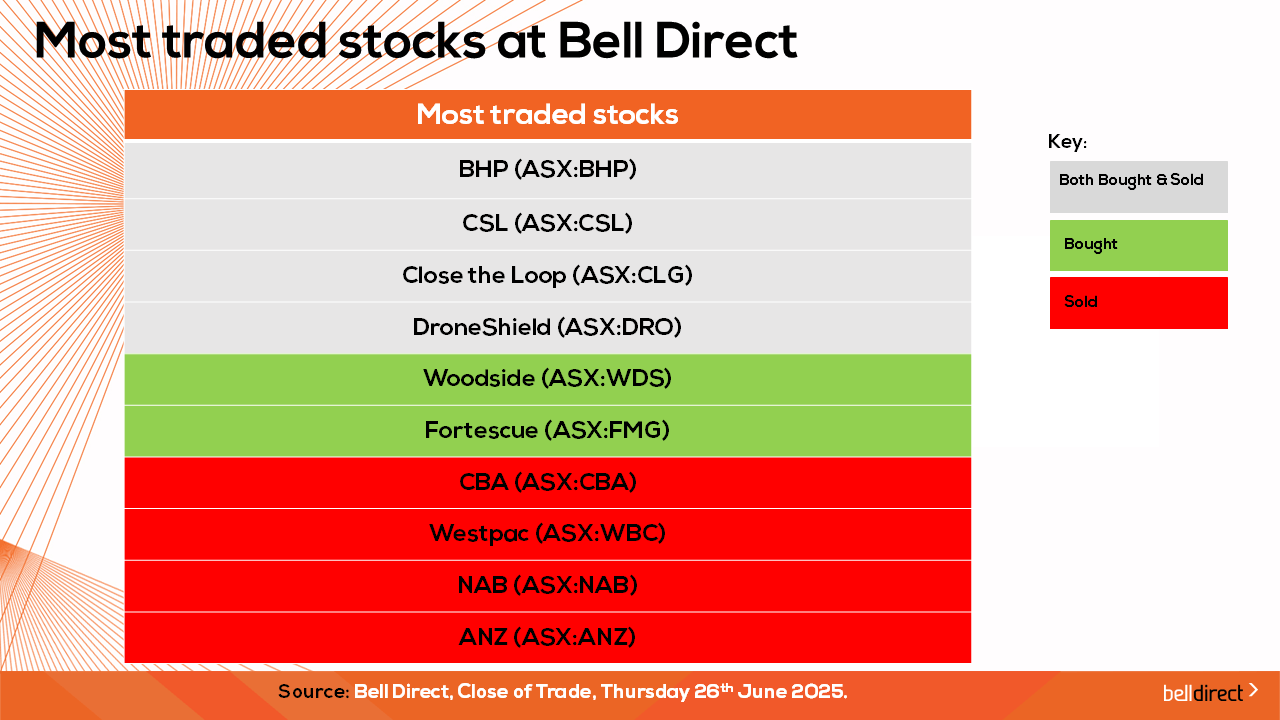

The most traded stocks by Bell Direct clients this week were BHP (ASX:BHP), CSL (ASX:CSL), Close the Loop (ASX:CLG) and DroneShield (ASX:DRO).

Clients bought into Woodside (ASX:WDS) and Fortescue (ASX:FMG), while took profits from the banks, CBA (ASX:CBA), Westpac (ASX:WBC), NAB (ASX:NAB) and ANZ (ASX:ANZ).

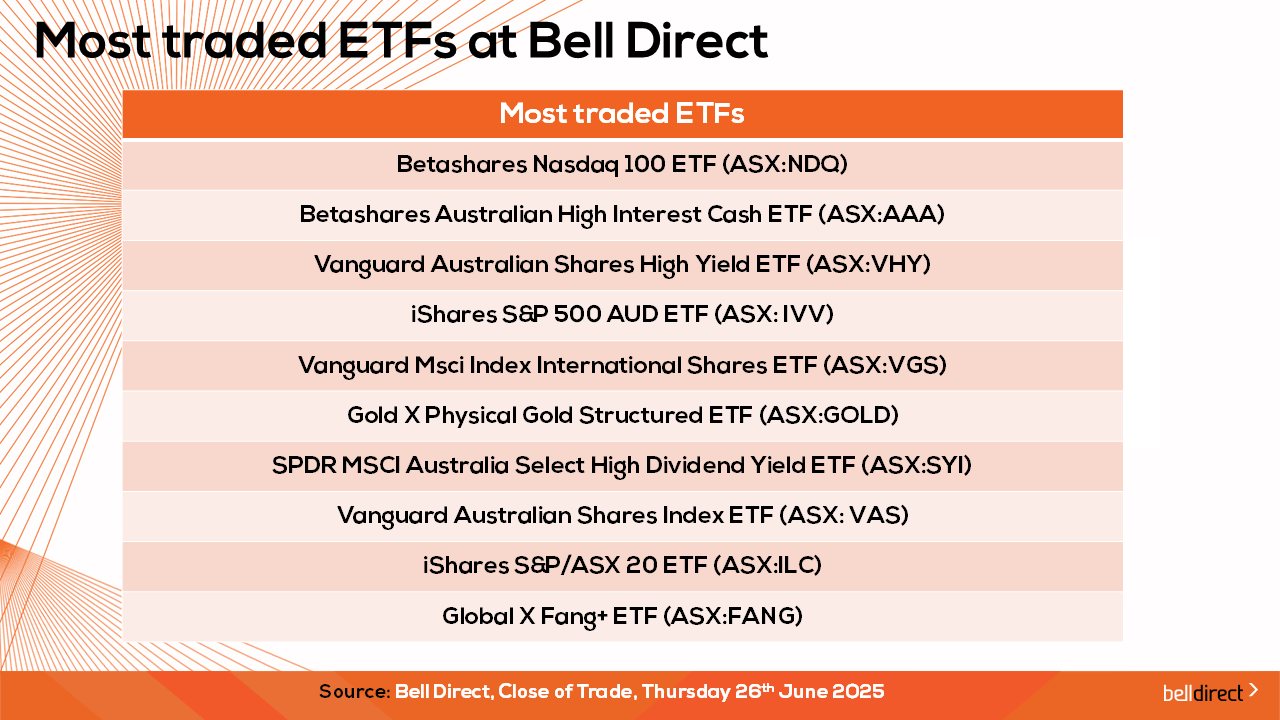

And the most traded ETFs included the Betashares Nasdaq 100 ETF (ASX:NDQ), the Betashares Australian High Interest Cash ETF (ASX:AAA) and the Vanguard Australian Shares High Yield ETF (ASX:VHY).

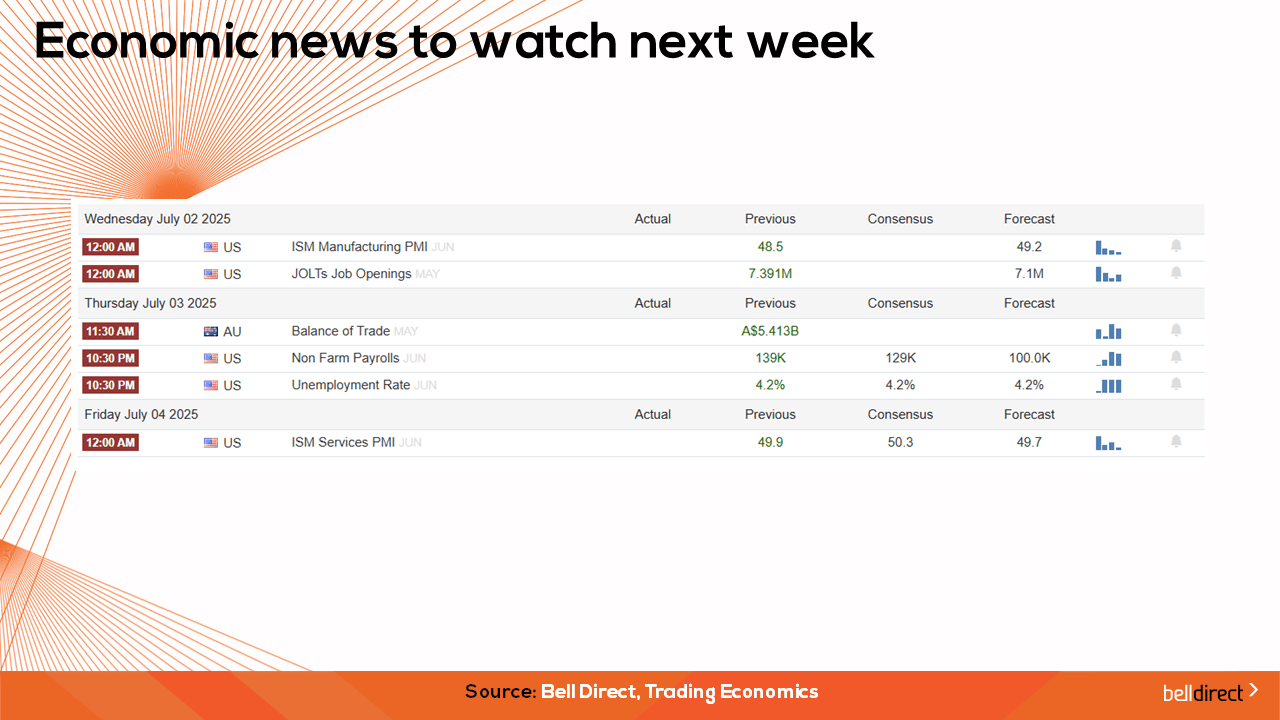

And to end, economic news items to watch out for next week. Private sector credit figures are out on Monday. The S&P Global Manufacturing final PMI for June is out on Tuesday, forecast to come in at 51, indicating an expansion from the month prior. And balance of trade data for May will be released on Thursday.

And that’s al for this week. I’m Sophia Mavridis with Bell Direct. Have a good weekend and we’ll see you again on Monday morning.