2019 was a big year for the exchange-traded funds (ETF) market as it cracked $61 billion in assets and accelerated its lead over the listed investment companies and trusts (LICs & LITs) sector in funds under management.

ETFs generated a combined daily turnover of $224 million during the year, according to the latest ASX Investment Products Monthly Update. Compare that to LICs & LITs, which manage $53.14 billion in capital and turn over $34 million daily.

Once thought of as a fad, it’s now clear that ETFs – which are largely passive index trackers – have come of age. Their rise has coincided with diminishing investor appetite in active investing, scrutiny over fees charged by stock pickers and unitholder fatigue over LICs and LITs whipsawing unpredictably between premiums and discounts for extended periods of time.

Pardon the pun, but it seems investors just want beta returns.

As the ETF market booms, we thought it was worth looking at what online investors have been trading. Bell Direct has kindly supplied their top 10 most transacted ETFs over 2019 to Livewire; and we got Jessica Amir, Market Analyst at the online broker, and Tim Murphy, Director of Manager Research APAC at Morningstar, to crunch the key takeouts from the data and provide some forward-looking commentary.

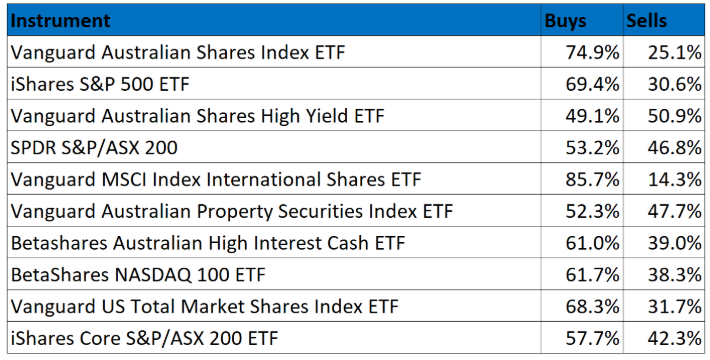

Bell Direct – 10 Most Traded ETFs in 2019

Source: Bell Direct, 1 Jan 2019 to 31 Dec 2019

#1 – Bottom drawer investments

As a starting point, Murphy notes that the Bell Direct list is dominated by core, diversified exposures to broad market index ETFs, with buys significantly exceeding sells in most instances for these instruments.

“This would appear to indicate that investors are making sound, long term investment decisions to achieve their desired market exposure, be that domestic or global,” he says.

While income stocks got a bad rap over the year as major payers like the banks slashed dividends and A-REITs underperformed the broad market, the Vanguard Australian Shares High Yield (VHY:ASX) and Vanguard Australian Property Securities Index (VAP:ASX) ETFs drew significant interest, with the latter being the third-most purchased ETF in 2019 based on industry fund flows.

Looking forward

While the data is retrospective, the drivers of certain investment themes remain intact.

- Income & A-REIT ETFs – Given investors in the retirement phase have a need for income, Murphy expects to see continued demand for ETFs with a tilt to higher income levels as VHY and VAP do. Amir agrees and reckons that with the market expecting two interest rate cuts this year, equity income and A-REITs are good places to allocate capital in 2020.

“The forward-looking consensus Aussie share market dividend yield for 2020 is 4.2%, which means investors will continue to take on more risk, seeking high yield, with high yield ETFs to continue to be on investors radars,” she says.

Additionally, A-REITs may also see some capital growth as the rate cuts would boost lending activity and push property values higher.

- Global equities – Predicting another good (not great) year for global equities, Amir expects further flows into popular broad US and international market ETFs like the iShares Core S&P 500 (IVV:ASX) and Vanguard MSCI Index International Shares (VGS:ASX).

Murphy adds investors have become more comfortable with investing internationally, and the market environment for global equities has generally been strong. “Investors are taking advantage of that through these two ETFs which represent some of the cheapest ways to gain diversified exposure to the US and global equity markets respectively.”

#2 – Penny-pinching extravagance

“The grim irony of investing is that we investors as a group not only don’t get what we pay for, we get precisely what we don’t pay for.” – Jack Bogle, Vanguard

That’s one of the late Vanguard Founder Jack Bogle’s most famous quips on fund fees and it still echoes today. With five Vanguard ETFs on Bell Direct’s top 10 list, investors have taken that message in stride and have gone for the cheapest of the cheap. Investors handed Vanguard $5.1 billion out of the total $13.7 billion in inflows for the ETF industry in 2019.

Vanguard and BlackRock-owned iShares have been aggressively cutting fees across their suite of ETFs to attract flows and that move is paying dividends for investors.

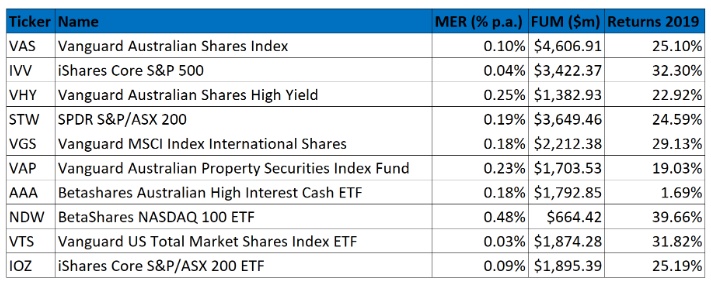

Why costs matter is illustrated in the table below. Take for example the Vanguard Australian Shares Index ETF (ASX:VAS) and iShares Core S&P/ASX 200 ETF (ASX:IOZ) and compare their returns to the more expensive State Street SPDR S&P/ASX 200 ETF (ASX:STW). For comparable broad market exposure, the Vanguard and iShares products delivered superior returns largely due to fees, which can add up over time.

“When it comes to Aussie equity ETFs, Vanguard’s VAS and iShares’s IOZ remain the two front running ETF funds. In 2019, Vanguard’s VAS also dropped its fee in the year to 0.10%, while BlackRock’s IOZ is 0.09%,” says Amir.

Bell Direct – Most Traded Listed Funds (Fees, FUM and Returns)

Source: Bell Direct, ASX

While STW remains popular among investors, it saw outflows of $227 million in 2019, the most of any ETF on the ASX. Investors are likely to continue to scrutinise fees charged by ETFs offering similar exposures.

#3 – Cashing out

The interesting theme which came up on the list was the Betashares Australian High Interest Cash ETF (ASX:AAA), which offers rates competitive with ‘at call’ bank and term deposits and pays monthly income.

In addition to diversification, Amir says the ETF was used as part of a general flight to safety strategy when markets got rough. She adds AAA is popular among investors as it offers the benefits of a term deposit with T+2 liquidity, meaning investors can quickly sell parcels of shares and instantly park proceeds in the ETF instead of waiting for settlement and then transferring funds into a deposit account.

“Cash in a portfolio is a diversifying tool, while some investors also flew into cash vehicles in 2019 as the US-China trade deal was not yet signed, sealed and delivered,” Amir says.

#4 – Patience in active managers dwindling

ETFs saw record inflows of $13.7 billion over 2019, up from $8 billion in 2018 and $6.4 billion in 2017, with the growth rate at 23% per annum over the last five years, according to ASX data.

With the key features of low cost, instant diversification and ease of access, Amir and Murphy predict that ETFs will continue to boom in popularity and steal active managers’ thunder. This can already be seen in the data, with ETFs holding $61.52 billion in investors’ capital, compared to $53.14 billion for LICs.

“It seems investors are moving with their feet in the longer term, into ETFs, away from LICs. When investors pay for performance, they often demand performance and rightly so. Typically, investors’ patience runs out faster than a poorly performing active manager’s marketing budget – and this is the trend we are seeing globally.” – Jessica Amir, Bell Direct

That’s not to say the appetite for active managers will vanish entirely, with Amir advocating for a combination of the two to achieve portfolio outperformance, and Murphy predicting continued strong growth in active ETFs.

One risk to watch

During their genesis, providers’ thinking was to design ETFs as simple ‘buy and hold’ index-tracking investments. But as the market has grown, several providers have and will continue to introduce more funds designed for short-term trading.

Murphy says this is a risk, with ETFs such as the BetaShares Australian Equities Strong Bear Hedge Fund (ASX:BBOZ) and Betashares U.S. Equities Strong Bear Hedge Fund (ASX:BBUS) losing over 40% of their value over 2019 (of course, the real return for investors would be contingent on how they timed their positions in these products).

He suggests investors shouldn’t succumb to the temptation of using ETFs as “hedging tools”, but rather stick to a long-term strategy with exposure to a diversified range of asset classes.

“Short term trading and attempts at market timing are more often than not destructive to achieving long term investment objectives.” – Tim Murphy, Morningstar

This article was first published on livewire.