One of the first decisions you will need to make after you decide what to call your fund is whether you will have an Individual Trustee Structure or a Corporate Trustee.

This is a very important decision to make as your decision will impact on how the fund is administered, the guidelines which are relevant to your fund and the costs involved in administering your fund on an annual basis.

There are several factors which will influence the decision on which structure you should choose.

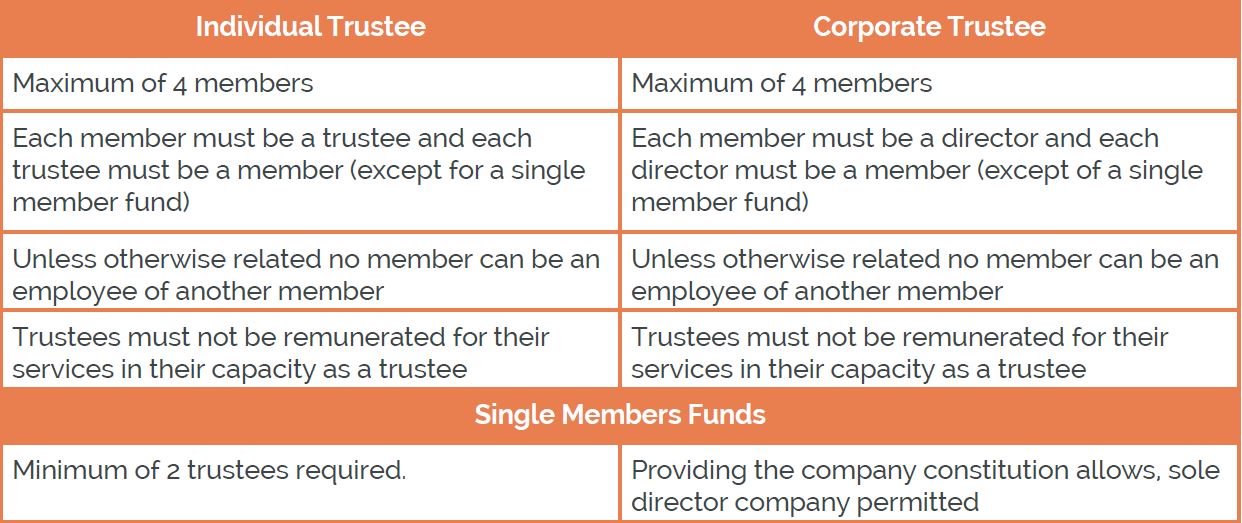

WHAT ARE THE MEMBER AND TRUSTEE REQUIREMENTS?

- Who will be a member in the fund?

- Who will the trustees be?

- What do you want to do in your fund?

The main characteristics are set out below.

From an investment perspective it should be noted that if the trustees wish to borrow in their fund to purchase a property most banks require a corporate trustee structure to be in place. Some lenders may allow individual trustees but the amount that they are willing to lend will be reduced. A lower LVR (Loan to value ratio) will be applied.

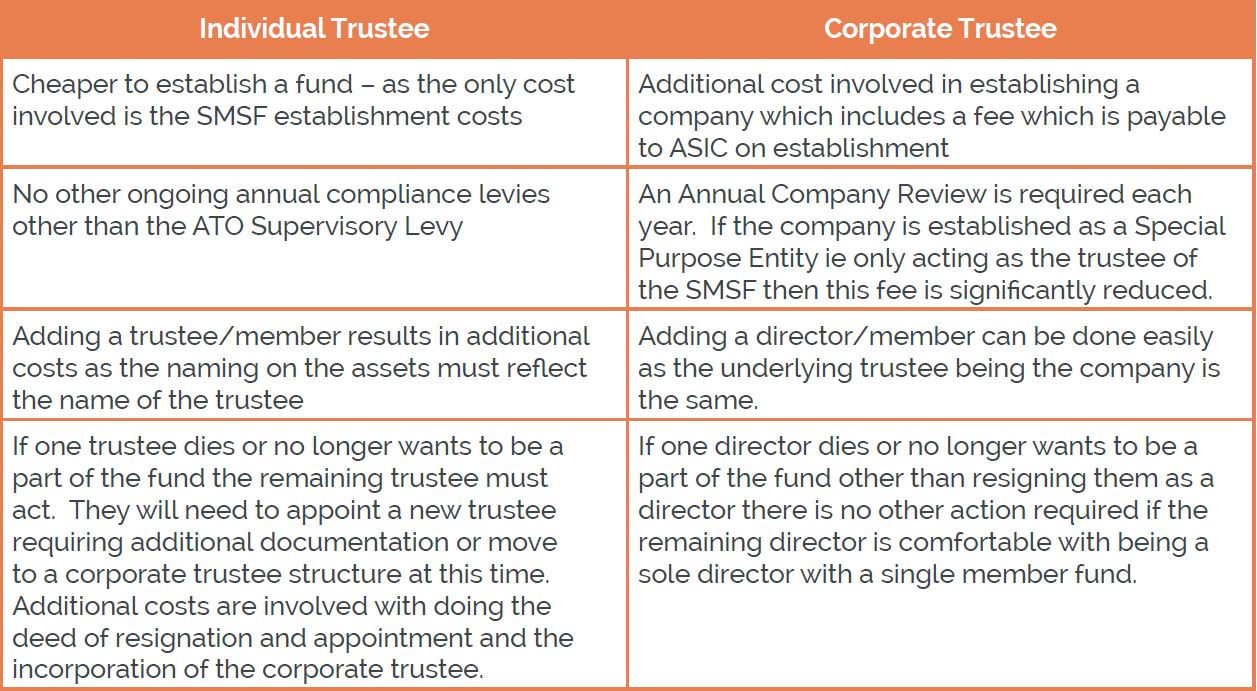

ASSOCIATED FEES AND COSTS

In selecting one structure over the other from both an operation and successional planning point of view needs to be considered.

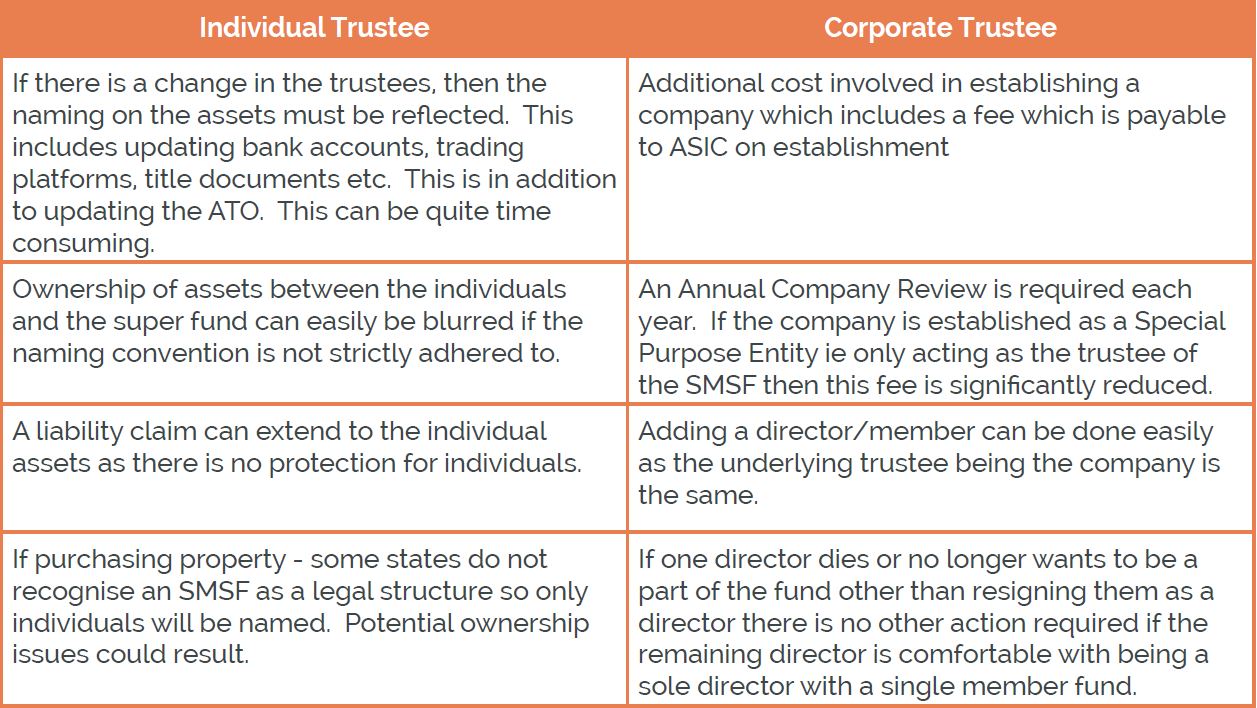

SEPARATION OF ASSETS

It is important to continually demonstrate the separation of assets at all times and that the SMSF is the clear ‘beneficial owner’ of assets rather than the Individual Member.

This information is provided by ExpertSuper™ Pty Ltd ACN 628 032 888 (Authorised Representative No. 1274492). The information is general information only and does not take into account your objectives, financial situation or needs. You should obtain professional advice before acting on any of this information. Please refer to ExpertSuper’s FSG (available at https://www.expert-super.com.au/wp-content/uploads/2020/02/ES-Financial-Services-Guide.pdf) for contact information and information about any remuneration and associations with product issuers.