1. When do the bonds you are considering mature? Known as ‘duration’.

What is duration? In simple terms, duration measures a bond’s price sensitivity to changes in interest rates. Some bonds have 1-year to maturity and others have 30 – the longer the bond, the more sensitive it is to changes in rates.

For example: Assume the duration of a 1-year bond is 0.8 and a 30-year bond is 20. If yields increase by 0.5%, the impact on each of these bonds will be very different:

- The 1-year bond’s price falls by 0.4% (0.8 x 0.5%)

- The 30-year bond’s price falls by 10% (20 x 0.5%)

After the US election, many commentators talked of an imminent bond market crash based on expected US inflation. Bond markets did in fact fall in price (yields rose), only to recover.

Our example shows why it’s important to be aware of the duration of bonds. It shows how important this concept is when thinking about the impact of rate or inflation changes on bonds. Those commentators focused on the much longer-dated government bonds globally – and they are very sensitive to rate and inflation expectations. In contrast, corporate bonds are mostly

shorter-dated. In fact, the average duration of XTBs is currently around 3.5 years.

2. If rates increase, when will they?

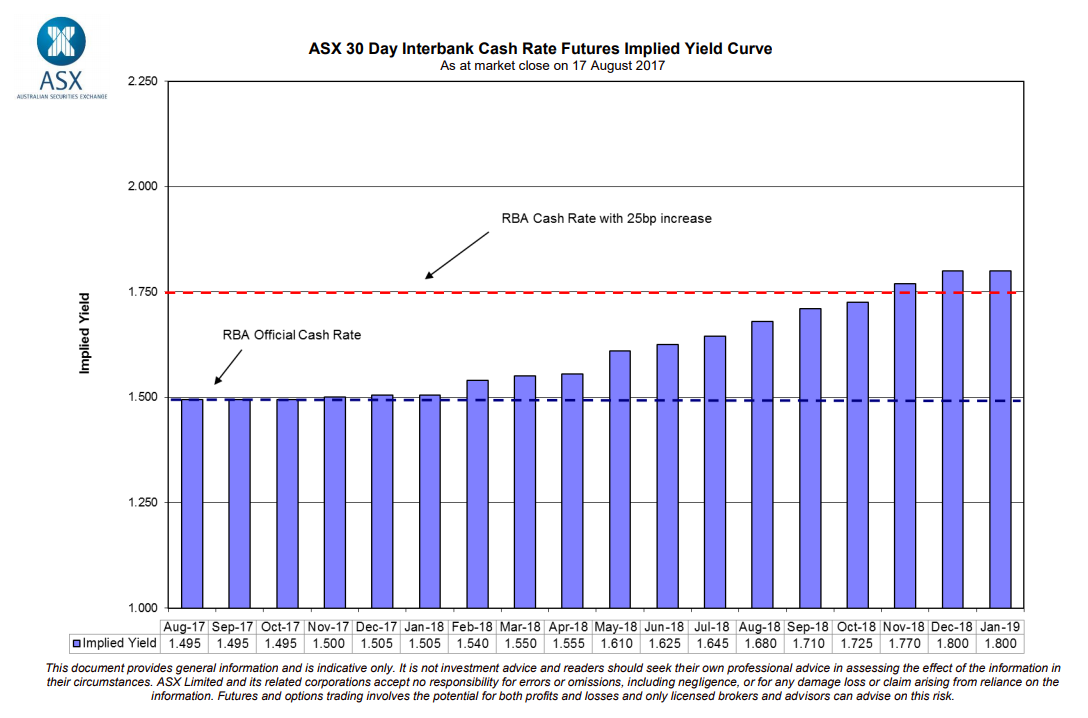

The ASX publishes a helpful chart of the market’s consensus view. Based on the Inter Bank Futures contract, it currently implies a rate increase by late 2018.

View the chart at any time, here.

View the chart at any time, here.

We have established that 3.5 years is the average duration of XTBs today – this time next year, that 3.5 year XTB will have 2.5 years until it matures. As the duration of the XTB decreases over time, the effect of a rate rise has less impact on its price.

From our experience, 95% of XTB investors hold to maturity. For these investors, it’s irrelevant what rates do. If they rise, or even if they fall further, they have no impact on the $100 investors receive at maturity.

3. The benefits higher yielding bonds over TDs

With rate rises potentially coming, the next question to consider is: “If I bought today and rates do rise, would I be better off in rolling TDs?”

To consider this question, we analysed seven different rate scenarios, comparing Total Returns from rolling TDs, and fixed-rate XTBs over a two-year period. The results demonstrated the fixed-rate investment is better in most scenarios except for aggressive rate hikes. The reason for this is the higher yield offered by fixed-rate bonds.

The full research can be found here.

4. The Maturity Ladder strategy – make rate increases your friend

This may at first glance be hard to fathom because we’ve established that fixed-rate bond prices fall when yields rise. However, this strategy is a means of using rising rates to your advantage.

The Maturity Ladder takes advantage of the fact bonds mature at $100 no matter what rates do.

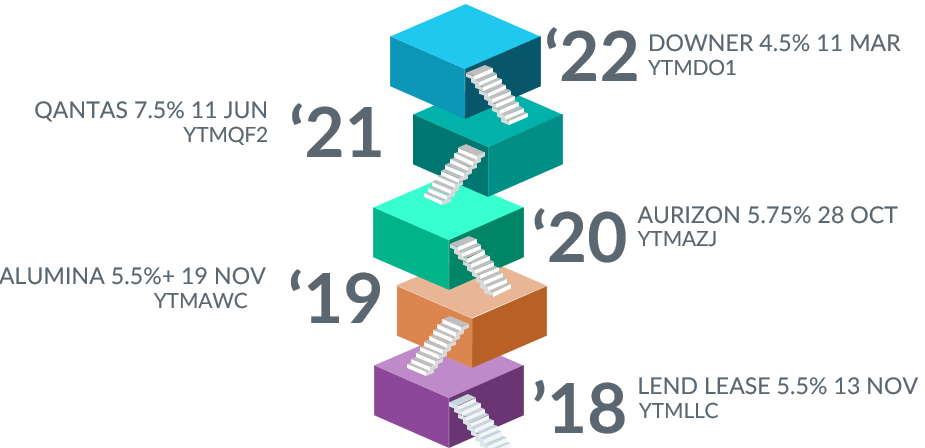

A 5-year example:

- You buy 5 XTBs with one maturing in each of the 5 years.

- You have capital coming back each year for 5 years.

Using the market consensus from ASX, let’s assume from mid-2018 yields jump by 25 bps and keep increasing every 4 months at that rate for 5 years. This is a 3.75% increase by mid-2022. Not the perfect time to have bought fixed rate bonds, or so you’d think. With a Maturity Ladder strategy, this is how it could play out for you:

- You bought a 5 XTB portfolio in August 2017.

- Your first bond matures just after the first yield increase (remember this has no impact on the $100 you receive at maturity).

- In 2018 you roll the $100 you received into a new 5-year XTB (remember by then, what was your 5-year XTB, is now your 4-year XTB).

- Yield increases affect the new 5-year XTB before you buy it – making it cheaper.

- Your portfolio moves one-step up the ladder each year, taking advantage of yield increases over time.

With a Maturity Ladder strategy, investors receive interest rate-impervious capital and reinvest it in cheaper and cheaper bonds as yields increase. In fact, with this strategy you’re actually hoping for rate rises. This approach turns an apparent weakness into a strength.

The 5-Year XTB Maturity Ladder Portfolio:

It’s important to remember that with this approach you do need to hold to maturity. If you sell, yield increases will have a negative impact on your longer-dated XTBs.

It’s important to remember that with this approach you do need to hold to maturity. If you sell, yield increases will have a negative impact on your longer-dated XTBs.

5. Floating-rate XTBs

About 20% of XTB inflow to date has been in floating-rate XTBs. Most investors have chosen this approach as an alternative to cash management. This is due to the ultra-low volatility offered by Floating-Rate bonds. However, some investors have taken this approach to take interest rate risk off the table.

A Maturity Ladder strategy and comparing returns from higher yielding bonds versus TDs are both great ways to generate competitive returns from fixed-rate bonds. However, for some investors the simplicity of investing in floating-rate bonds is a better approach.

You can model your own Maturity Ladder portfolio, with the XTB Cash Flow Tool.

In conclusion

If rising rates meant fixed-rate markets shut down until the next rate-cut cycle, then this global market would have died out years ago when floating-rate bonds arrived. This part of the bond market has been around for centuries because investors can keep generating returns in rising and falling rate worlds.