This year has been particularly daunting for new share market investors as the COVID-19 pandemic and lockdowns took a sledgehammer to economies worldwide.

In Australia, the unemployment rate reached its highest level since the 1990s and government debt reached record levels, while wage growth all but disappeared. With limited freedom to leave home, the fear-inducing headlines and news reports were hard to escape during the first half of the year and the uncertainty and negative sentiment resulted in share markets being sharply sold-off.

Meanwhile, the latter half of the year has been an entirely different story for share markets. In spite of still rising COVID-19 infection numbers across Europe and North America, world markets have surged after investors’ quick exit in response to the pandemic back in February and March.

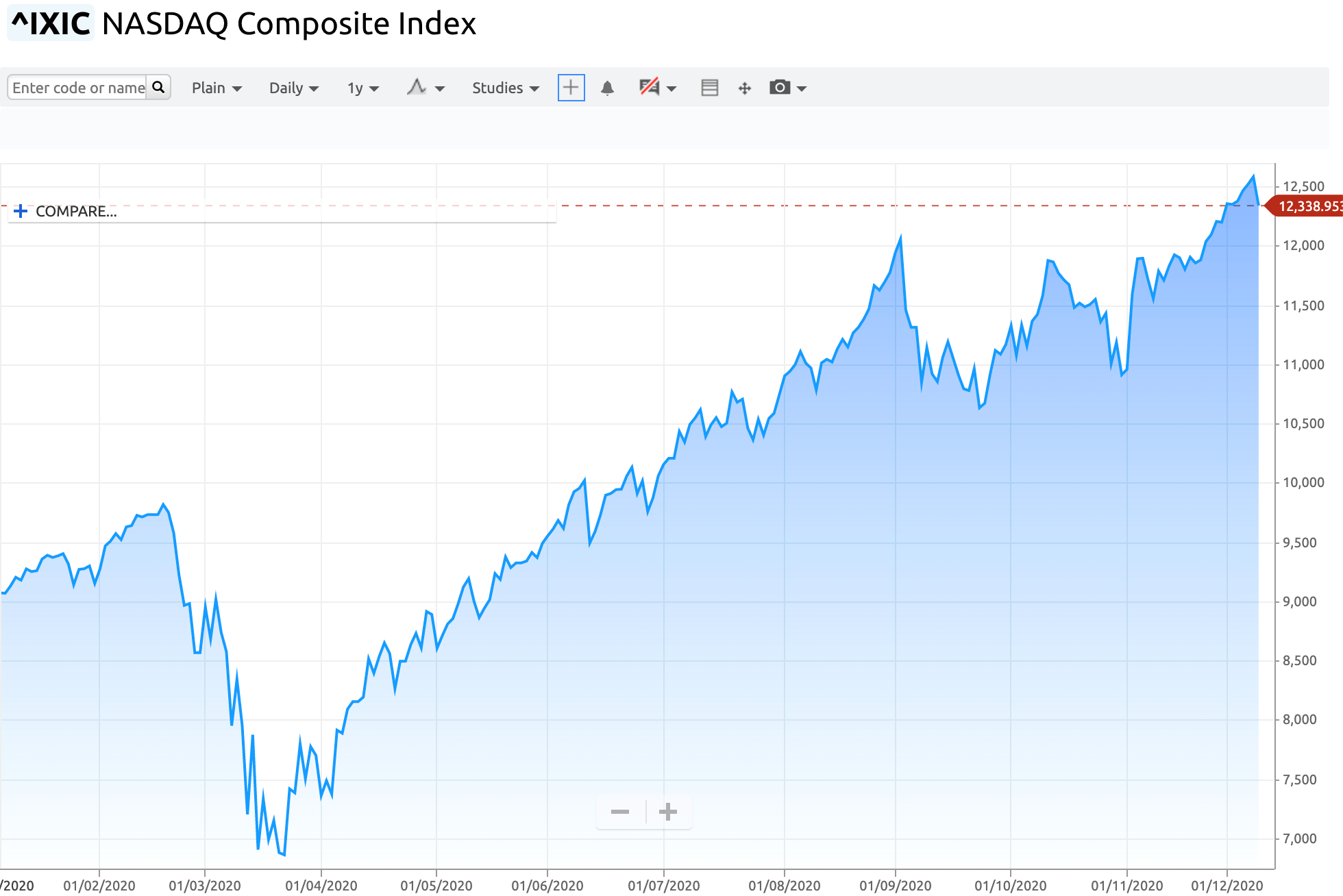

In the U.S., the Dow has broken through the 30,000 level for the first time ever and the Nasdaq remains near recent record highs, boosted by positive vaccine news and hope that the Biden administration will bring U.S. political stability and more economic stimulus.

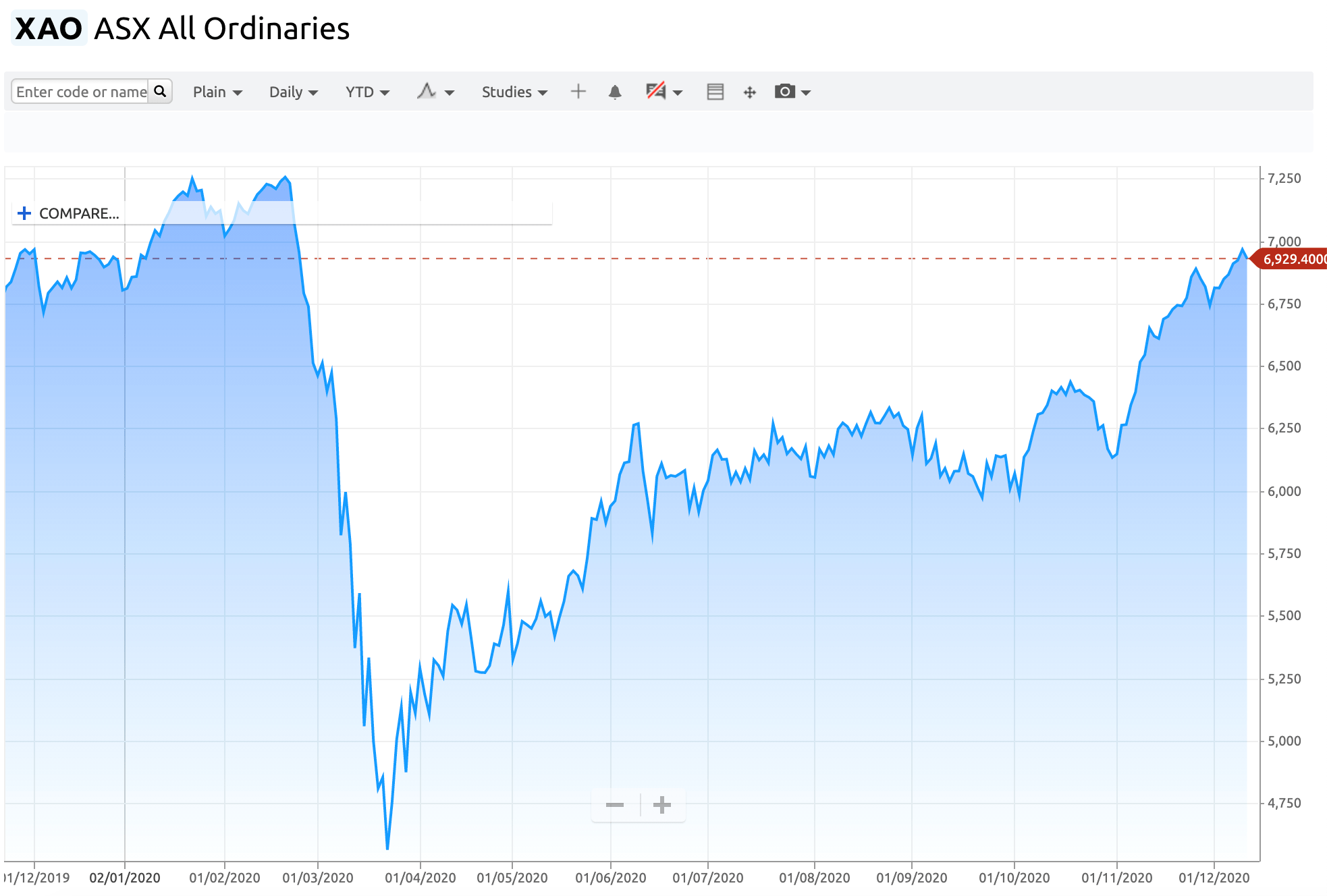

Locally, the ASX recorded its best month in 30 years in November and has now recovered more than 90% of its February-March sell-off — a strong comeback after suffering its sharpest 30+ per cent crash on record.

Yet having missed the market lows in March and the quick recovery since, some investors remain on the sidelines, uncertain of what’s to come and wondering whether it’s too late to jump in. But there are reasons for optimism…

Low rates boost stocks

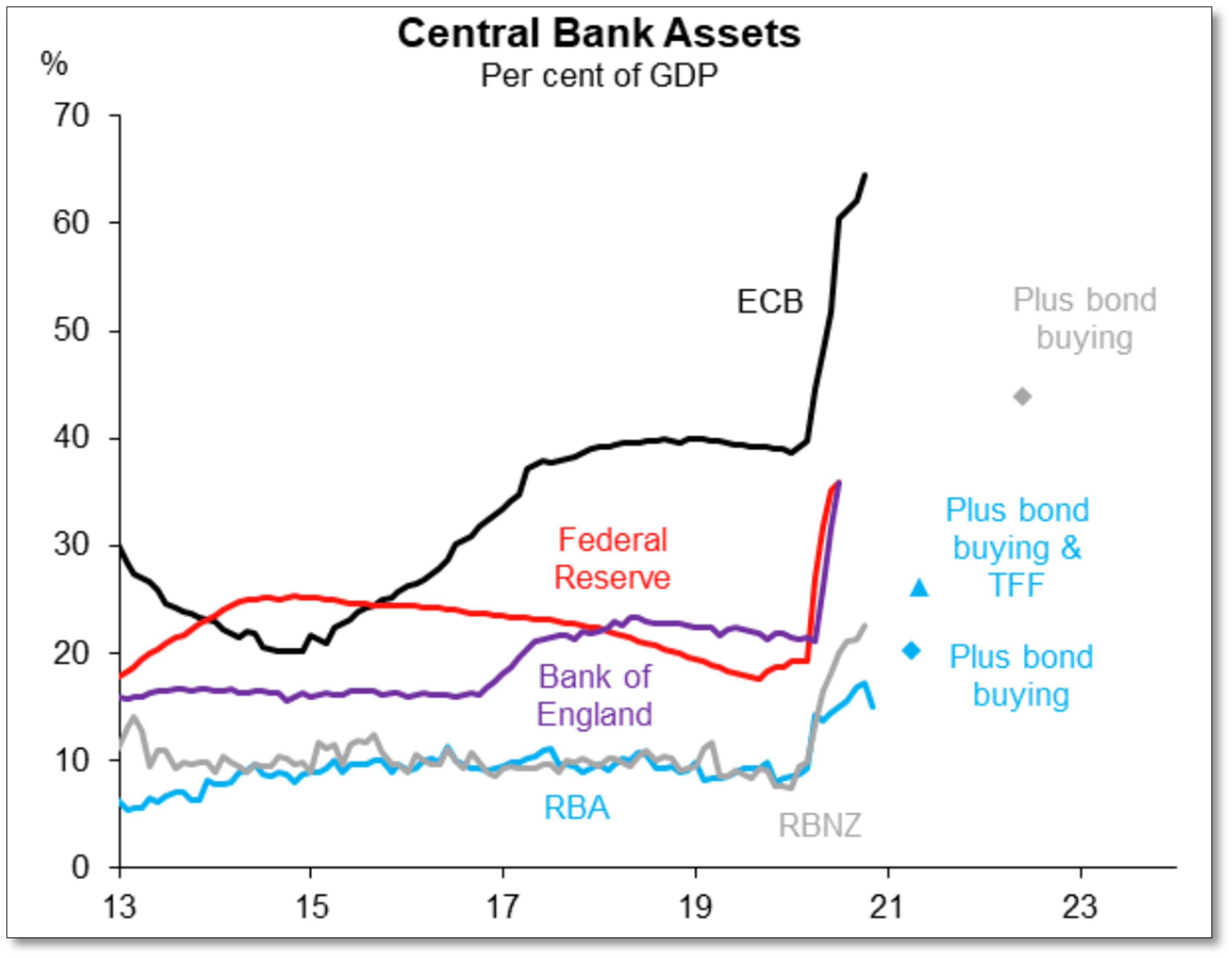

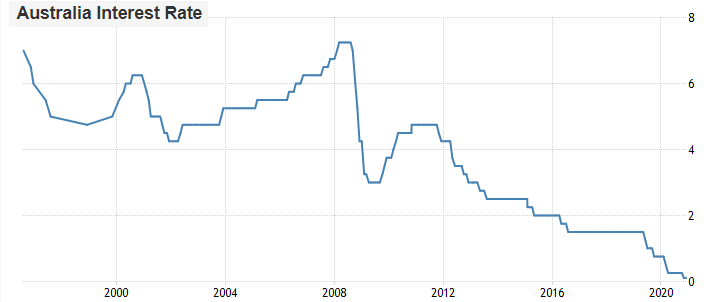

In response to the economic impacts of the pandemic, central banks and governments worldwide have acted decisively, propping up economies by cutting interest rates and delivering fiscal stimulus.

Source: Macquarie

At home, the Reserve Bank cut the cash rate to a new all-time low of 0.1 per cent in November and announced a $100 billion bond-buying program in addition to earlier government tax cuts and initiatives such as JobKeeker.

Source: tradingeconomics.com | Reserve Bank of Australia

That’s not good news for those with savings accounts and term deposits who rely on their investments for income, but it’s great news for mortgage holders.

Maybe surprisingly, it’s also great news for share market investors.

The reduced borrowing costs and unprecedented fiscal stimulus should encourage investment by both businesses and households and has essentially put a floor under share markets.

Ultra-low interest rates are likely to be the norm for years to come, so once the health crisis does ease globally, corporate earnings should recover and help support higher market returns — especially for high quality businesses with sound fundamentals.

The recent market strength has been due to a rotation into poor quality cyclical value stocks — those beaten down by the COVID-19 environment, largely across travel, tourism, energy and the financials.

So don’t worry if you missed the rally that began in March — we are in the midst of a larger, longer term trend with opportunities to invest in high quality businesses that have been overlooked in the current rally.

If you instead wait for another major correction, or even a dip in the market, it could have serious negative impacts on your long-term wealth. There are a number of reasons for this.

Firstly, ultra-low interest rates can result in a negative real return on cash since any interest earned is unlikely to cover the rise in living costs.

Secondly, low interest rates support share markets, so if you’re holding cash that’s a return that you’re missing out on in the market.

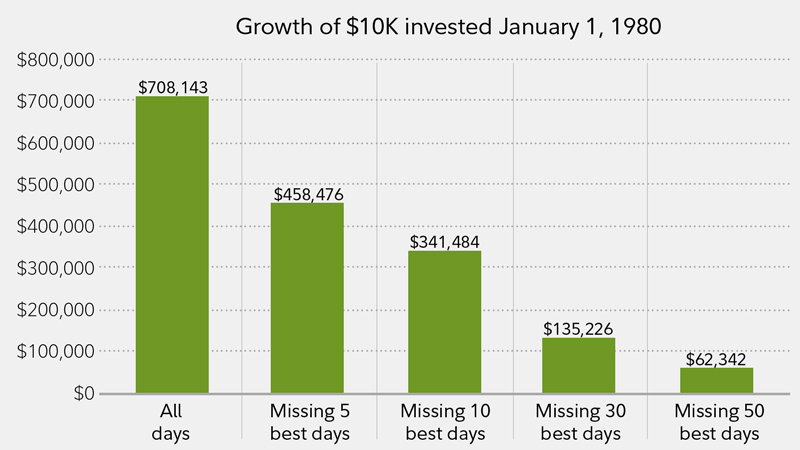

And most importantly, given that markets tend to rally strongly in the lead up to a correction, by waiting in cash for a pullback, you’re likely to miss some of the market’s best performing days. Market timing strategies have rarely worked in the past and can have a large negative impact on long term portfolio returns.

Source: Fidelity. S&P500 1980-2018

But which stocks exactly?

While now is an attractive time to be invested in the stock market, how do you know which individual stocks to buy? Do you jump into stocks that have already run higher? Or will you get a better bang for your buck by buying those still at more depressed prices?

The answer could be neither, either, or both. Simply, it depends.

The best option is to buy quality, financially healthy companies. But with over 2,000 companies listed on the ASX, it can be hard to know where to start.

A platform such as Lincoln Indicators’ Stock Doctor lets you quickly sort through the market and help identify quality, sustainable companies set to outperform over the long-term, whether you’re looking for growth or income stocks.

Stock Doctor systematically screens every ASX stock for quality and Financial Health factors using 12 meticulously selected accounting ratios. The effectiveness of this bottom-up approach has been demonstrated over decades, through both bull and bear markets.

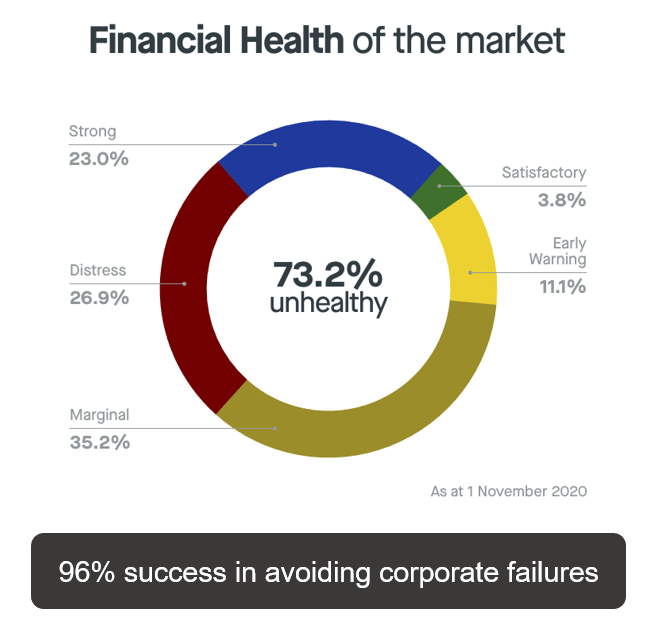

Perhaps even more importantly, Stock Doctor alerts you to companies’ Financial Health weaknesses and identifies which stocks are at risk of corporate failure with 96 per cent classification accuracy.

As of 1 November, a massive 73.2% of the stocks on the ASX were found to be financially unhealthy.

Source: Lincoln Indicators

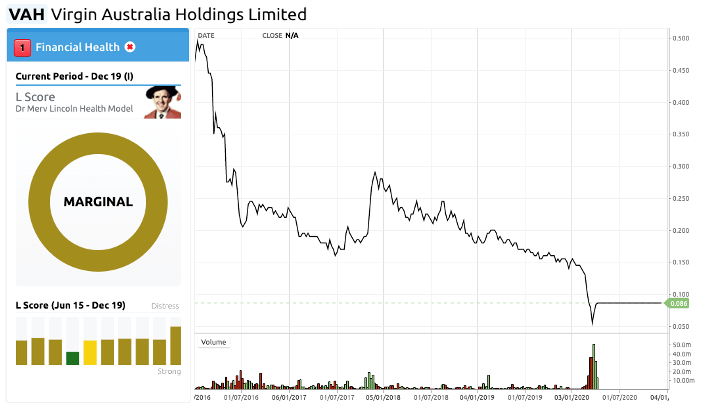

Take Virgin Australia for example. The airline went into voluntary administration this year, yet its failure wasn’t due to the onset of the COVID-19 pandemic and the halt in travel — that was just the final nail in the coffin after a long period of poor Financial Health.

Here you can see that all the way back in February 2015, Stock Doctor flagged Virgin as “Early Warning” — ahead of five years of decline and the company’s eventual failure where investors lost everything.

Source: Lincoln Indicators Stock Doctor

So while you might be wary after this year’s volatility and the share market’s quick recovery, there’s good reason to believe that the market will continue to rise for years to come. Furthermore, over the long term, quality businesses should outperform regardless of the noise of the wider market.

Visit Stock Doctor today to find out how we can help you identify high-quality, fundamentally healthy ASX stocks, whatever the market is doing.

Tim Lincoln

Tim Lincoln is the Co-Founder, Chief Investment Officer and member of the Investment Committee at Lincoln Indicators. With 30 years of industry experience, Tim is highly regarded as one of Australia’s most experienced financial professionals. He has received many industry and business awards and is an active member of numerous industry bodies.