Time to take stock of your portfolio

But make sure you focus on more than just your stocks

A new financial year is often a good time to take a step back and take stock of your portfolio to ensure it’s still working for your objectives.

Taking stock: It’s important not to interpret this phrase too literally. Many investors tend to focus most of their attention on equity markets, overlooking other asset classes. Putting it another way, many Australians could be considered obese when it comes to equity and property exposure, but woefully underweight in fixed income.

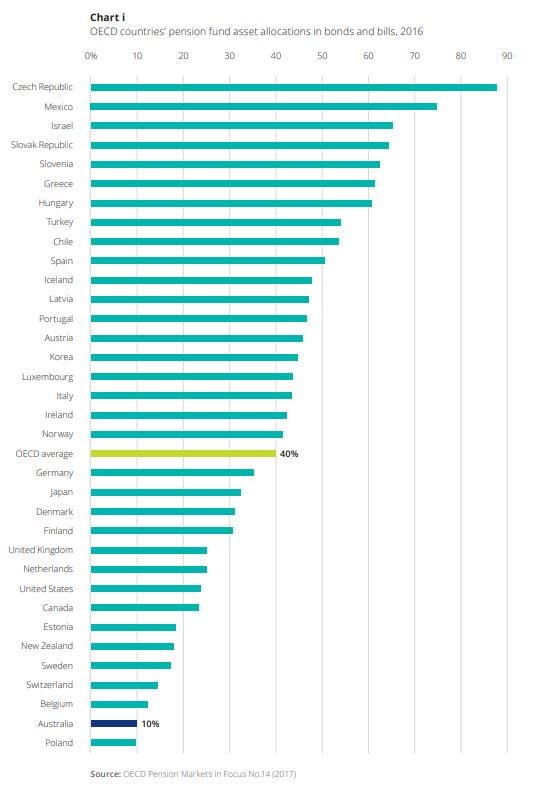

According to a recent report by Deloitte Access Economics, Australians actually tie for last with Poland among OECD countries in their pension fund allocation to bonds, at just 10%.

Source: Deloitte Access Economics, The Corporate Bond Report 2018 Australia’s growing appetite for corporate bonds

Cash and Term Deposits – The Australian answer to fixed income

This doesn’t mean that Australians don’t have exposure to fixed income. But, the instruments most Australians have been relying on to defend their portfolios are cash and Term Deposits. Both of these work well as portfolio defenders, but in the current environment both are very low yielding.

The cash rate has been on hold for a record 22 consecutive months, and the general market view is that this won’t change until late this year, possibly well into next year. This has meant that for most Australians fixed income returns have been on the slide. Are you dreading the next time you need to roll your TD and end up with another drop in the rate you’re receiving? This has been the case for a considerable time now – in fact it was August 2017 that TD rates first hit the lowest on record; not much has changed since then[1].

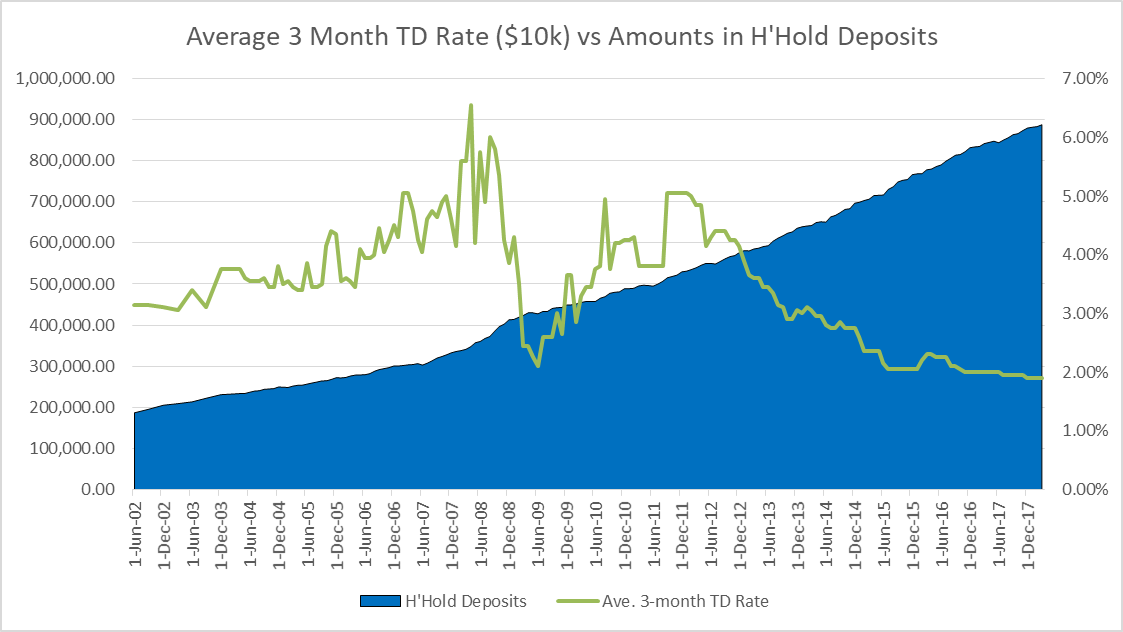

This is probably no surprise to most of us, but what may be more of a surprise is that the amount of money in bank household deposits has done the reverse. It’s been on a steady increase. In fact there’s now close to $900 bn sitting in bank deposits – deposits that are paying record low rates of return[2].

Chart 1 shows the steady increase of household deposits against the average 3-month TD rate. As you can see, the gap between the two has never been more extreme.

Chart 1: The savings income gap

Source: APRA and RBA

This pattern tells us that Australians recognise the need for defence in their portfolios. They are looking for ways to ensure their capital is protected, ready and waiting for the next stock market buying opportunity or to fund their retirement with a stable source of income.

We all understand the need for a properly diversified portfolio and this chart shows us there’s demand for fixed income. What we may not be aware of is that there are other options available. Options that could give income a boost, whilst still playing that all important defensive role. The answer could be something that professional investors and high net worth investors are increasingly adopting[3].

Is it possible to have the best of both worlds?

Corporate bonds could offer uplift, while still providing protection

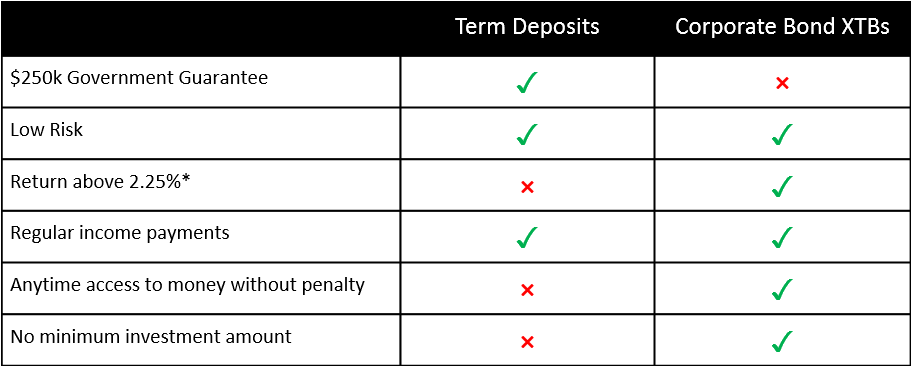

First, let’s clarify what a corporate bond is. A corporate bond is a loan to a company that can be traded. Investing in corporate bonds is similar to investing in Term Deposits – investors receive regular income and a known outcome (subject to no default). Corporate bonds have a slightly higher risk profile as they don’t have a $250k government guarantee, but in return, they offer a considerable uplift over TDs. Both securities sit at the bottom section of the risk return spectrum along with all fixed income securities.

Term Deposits vs Individual Corporate Bond XTBs

Source: Canstar 3-6 month TD top 4 bank & Australian Corporate Bond Company. May 29 2018

How do the returns stack up?

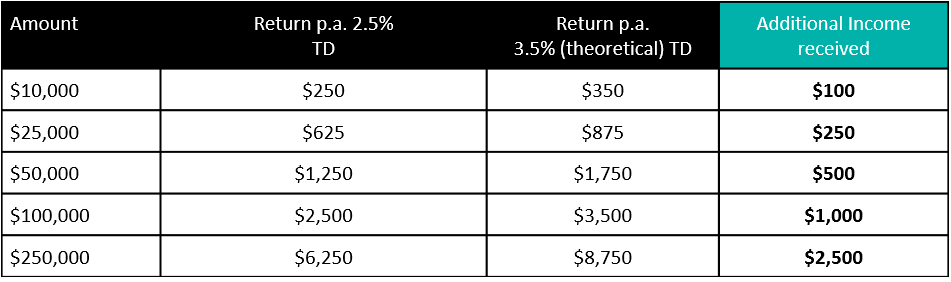

One of the key benefits of fixed income investments is predictability of returns. You know what you will get back before you invest. This makes comparing returns much simpler.

Let’s look at how this plays out if you had your fixed income allocation in a 2.5% 1 year TD and were able to switch your investment into a 3.5% 1-year TD (assuming such a 1-year TD was available).

The above example is provided for illustrative purposes only, the higher paying TD is not currently available.

The above example is provided for illustrative purposes only, the higher paying TD is not currently available.

The benefits of moving to the higher paying theoretical TD stack up – providing a yield increase of up to 40%. However, current average TD rates[4] are actually closer to 2%.

Corporate bonds, via XTBs, can generate a yield to maturity of approximately 3.5%, generating similar investment returns to the higher paying theoretical TD, above. Investing in XTBs, can provide access to a similar uplift in cash flows.

The added benefit of increased flexibility

Like TDs, many corporate bond investors have the intension to hold to maturity. But there is one additional benefit which corporate bonds, and in particular ASX-traded XTBs offer – the flexibility to sell should you need to. Unlike TDs where you are penalised for breaking the terms, corporate bond XTBs don’t lock you in until the maturity date. If the unexpected happens, you aren’t penalised as you would be by breaking your TD – you simply sell your XTBs on ASX. It is important to note, that if you sell XTBs before the maturity date you may not receive the yield to maturity you locked in on the purchase date.

Keep the risks to a minimum with ASX 100 companies

As a first time bond investor, starting with investment-grade bonds means you’re starting at the safer end of the spectrum. Think about bonds from companies in the Top 100 ASX – names you’re familiar with and may already have in your equity portfolio. Companies such as Telstra, Qantas and Dexus to name a few. Bonds from companies such as these still give you the benefit of a significant uplift on a TD, but avoid the additional risks of smaller or unlisted companies.

How to incorporate corporate bonds in your portfolio

There are a number of options:

- Over-the-Counter (OTC): For those looking at very large investments, there are a number of OTC brokers – many have minimum portfolio sizes of $250,000 or more. Remember by going OTC you miss out on the transparency and flexibility of ASX trading.

- Bond Funds and ETFs: A popular choice for many investors. They are very good at providing a diversified bond portfolio, but they have one key drawback. If you’re looking for an investment similar to a TD, a bond fund or ETF may not be the answer. They don’t have a maturity date, so cannot offer a fixed date for return of capital. They also cannot offer a fixed amount you will receive. Therefore they do not provide the same level of predictability as individual corporate bonds.

- XTBs (Exchange Traded Bond units): A solution that blends the best of OTC and ETFs. They provide the benefits of ASX trading, coupled with all the predictability of an individual holding. You can buy them in amounts starting from $100. There are more than 50 individual corporate bond XTBs available, all over top ASX-listed companies.

[1] SMH & RBA (https://www.smh.com.au/money/saving/term-deposit-interest-rates-dwindle-to-new-record-lows-20170802-gxo0g0.html)

[2] APRA

[3] Deloitte Access Economics, The Corporate Bond Report 2018 Australia’s growing appetite for corporate bonds

[4] Canstar 29 May 2018