- China’s recovery will continue to impact the miners and any company with exposure to the region.

- Retailers will continue to face eased consumer spend, but this may bode well for some niche retailers.

- Full year dividends will be the key to winning investors back come August reporting season.

- Cost management has been a downfall in H1, will companies rectify this in H2?

- Margin expansion should be a key focus heading into the second half of FY24.

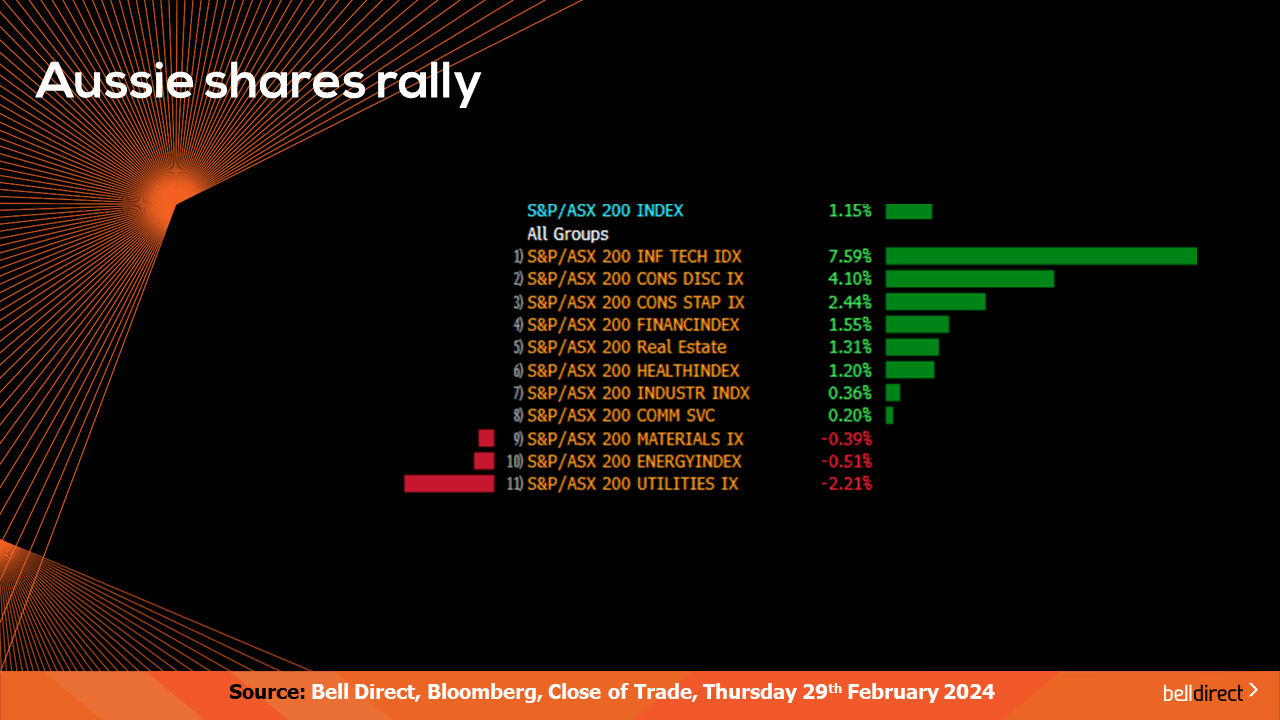

Locally from Monday to Thursday the ASX200 rose 1.15% on favourable economic data including Australia’s inflation rate remaining steady over the last month, and on the back of some strong corporate results being released. Information technology stocks did most of the heavy lifting with the sector rallying 7.6% over the four trading days, while utilities and energy stocks weighed on the key index this week.

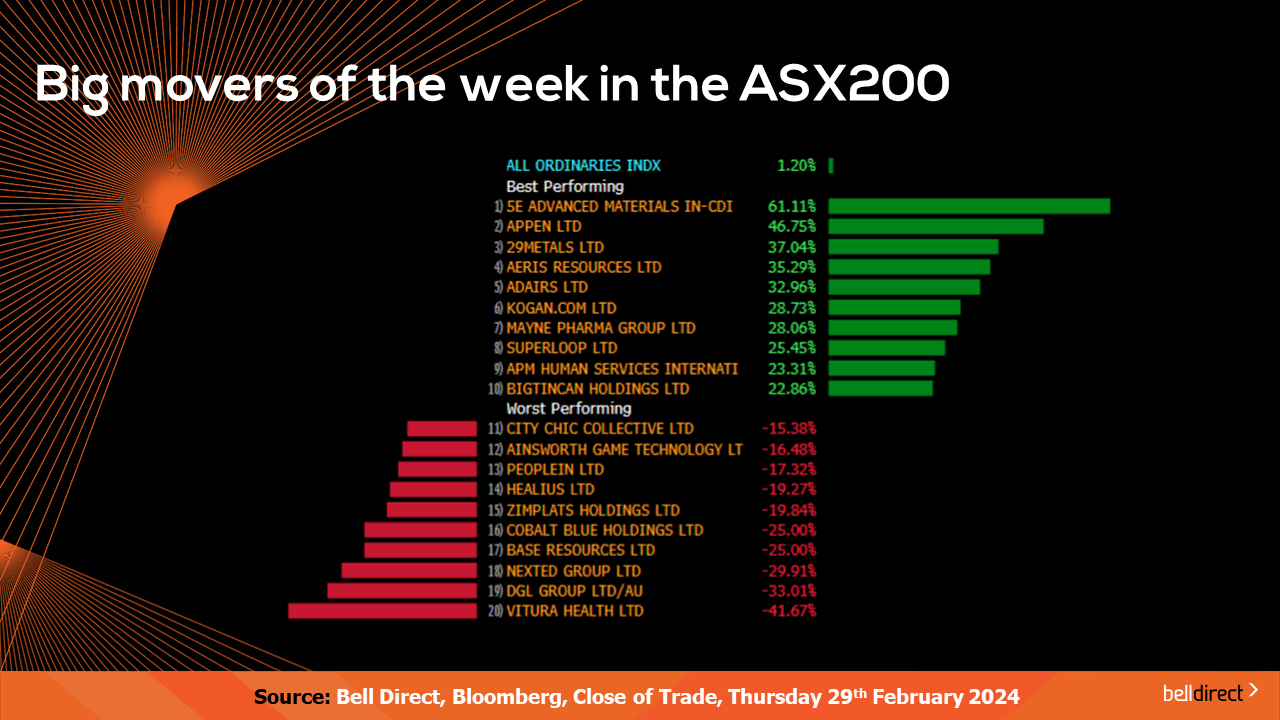

The winning stocks from Monday to Thursday were led by Block Inc. (ASX:SQ2) soaring 19.18% on strong first half results, Lovisa (ASX:LOV) jumping 18.83% for the same reason, and NextDC (ASX:NXT) also adding 18.54% again, for the release of very impressive H1 results.

On the losing end, Healius (ASX:HLS) tanked nearly 20% while Sayona Mining (ASX:SYA) fell 13% this week.

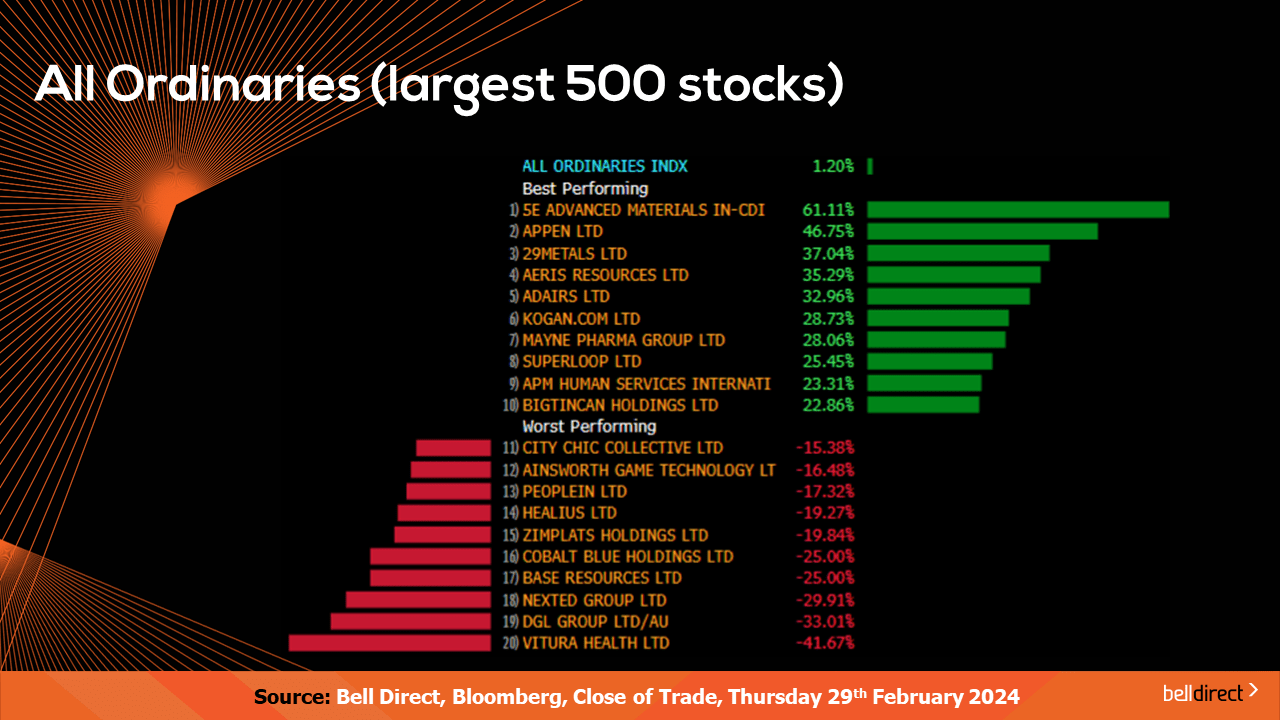

Looking at the broader market, the All Ords rose 1.2% this week as 5E Advanced Medical (ASX:5EA) rocketed 61% on release of an operational update, while Appen (ASX:APX) added almost 47% this week.

Vitura Health (ASX:VIT) and DGL Group (ASX:DGL) weighed on the All Ords this week, falling 42% and 33% respectively.

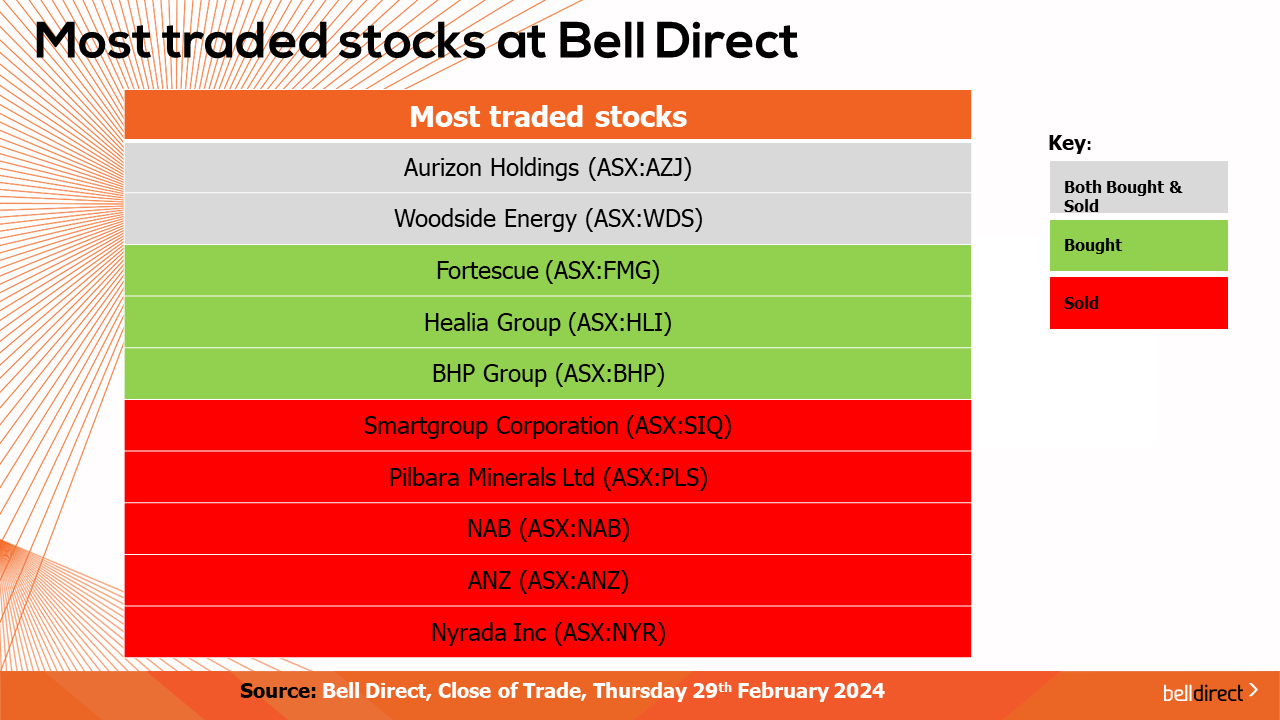

The most traded stocks by Bell Direct Clients over the four trading days were Aurizon Holdings (ASX:AZJ) and Woodside (ASX:WDS). Clients also bought into Fortescue (ASX:FMG), Healia Group (ASX:HLS), and BHP Group (ASX:BHP) while taking profits from Smartgroup Corporation (ASX:SIQ), Pilbara Minerals (ASX:PLS), NAB (ASX:NAB), ANZ (ASX:ANZ) and Nyrada (ASX:NYR) Inc.

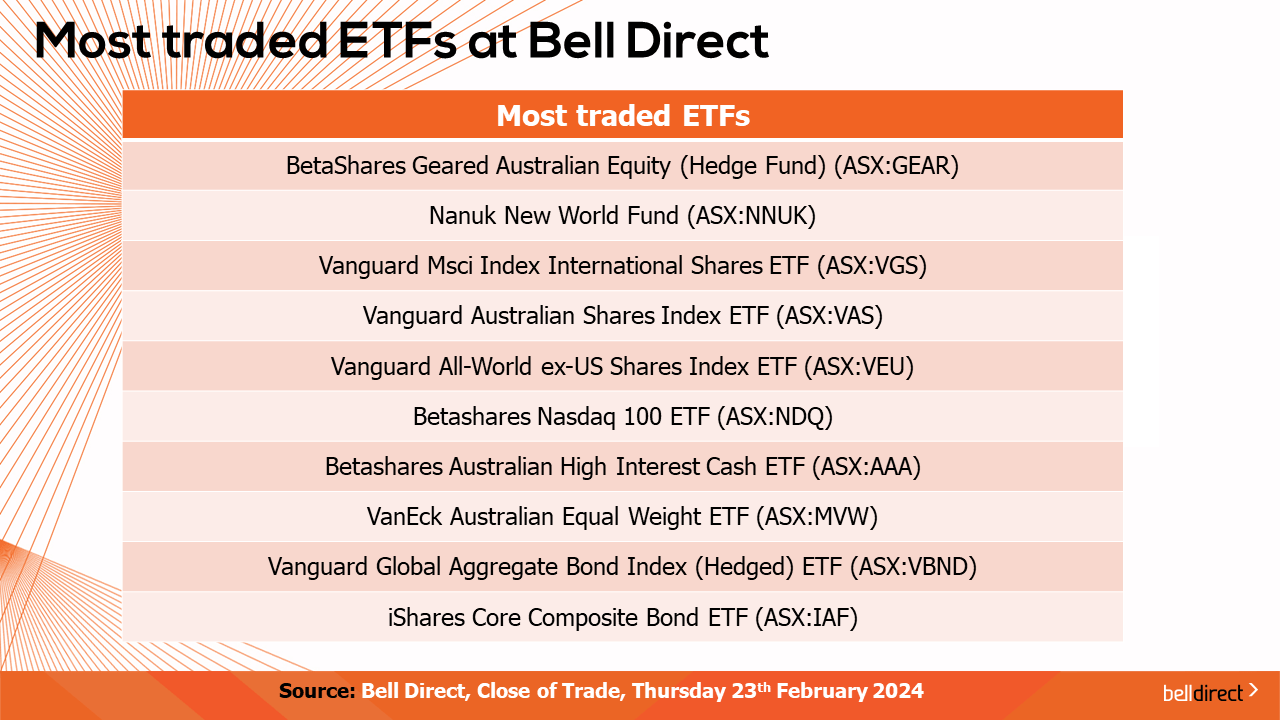

The most traded ETFs by Bell Direct clients this week were led by BetaShares Geared Australian Equity (Hedge Fund), Nanuk New World Fund (Managed Fund), and Vanguard Msci Index International Shares ETF.

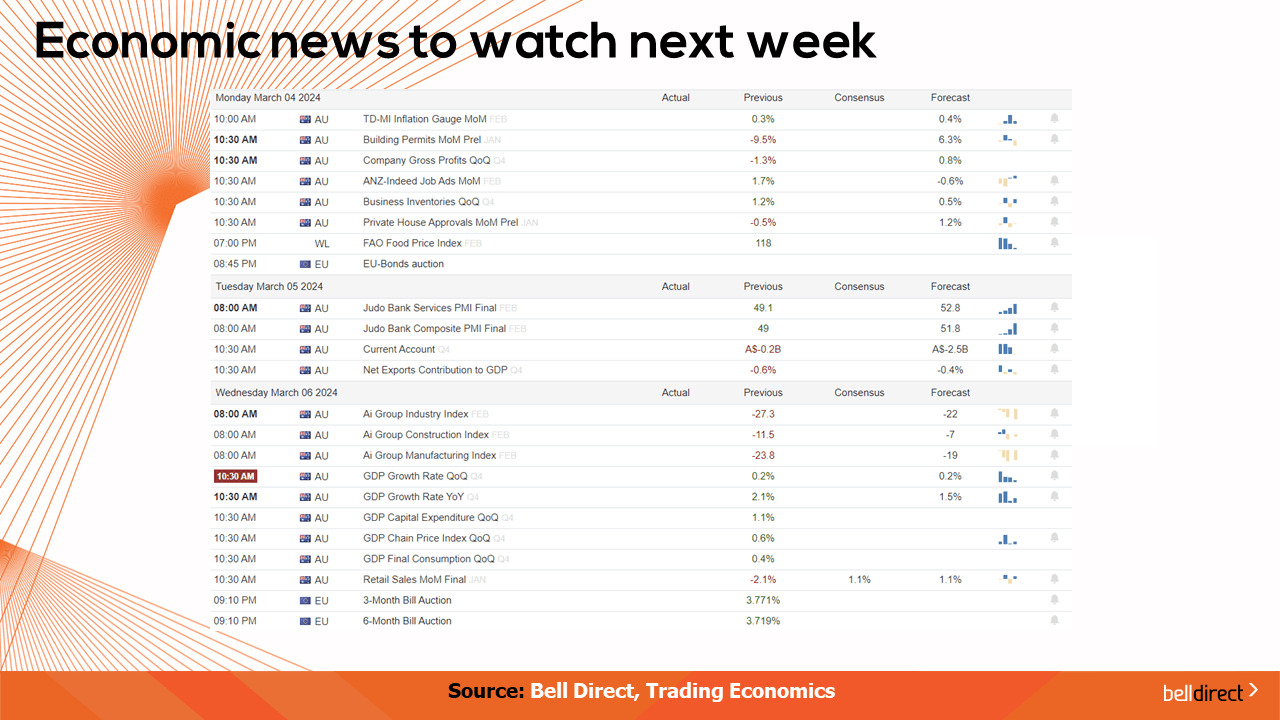

Looking ahead to next week on the global economic calendar, Australia’s all-important GDP growth rate data for Q4 is released on Wednesday with the expectation of 0.2% growth which is inline with the previous quarter’s growth rate. The nation’s trade balance is also out on Thursday for January which will indicate whether Australia’s trade surplus continued to decline or rebounded in January.

Overseas, key US jobs data will likely impact Wall Street sentiment over the week with JOLTs Job Openings data, Non-farm payrolls and unemployment rate data all out later next week.

And that’s all we have time for today, have a wonderful weekend and happy investing!