Transcript: Weekly Wrap 14 March

At the end of 2024, the US elected President Trump and the S&P500 rallied. However, recent announcements around tariffs, immigration control and reducing government spending, has seen the S&P500 down approximately 9% from its highs in February.

This week, Australia failed to receive an exemption on President Trump’s new tariffs, that is, 25% on all US steel and aluminium imports, which will affect global trade. In response, Australian policymakers should be looking initially at the short-term support measures for immediate impact and identify opportunities for trade diversification in other regions.

There are major concerns around higher consumer prices, disruption to global supply chains, and geopolitical stability.

While the tariffs will directly affect metal producers, Aussie miners will also be impacted, for example, those who produce the raw materials used in metals manufacturing. Regarding exports, aluminium and steel are a fraction of the Australian mining sector, so the direct effect on miners is smaller.

Retaliatory tariffs are gradually being implemented by China, Canada and Mexico, expected to negatively impact bilateral trade between the US and these countries, seeking trade diversion by increasing trade with other trading partners.

In response to the US government’s announcements, rather than protectionist policies with a long-term view, policymakers can look at targeted and temporary measures, that may be easier to adjust or stop in the future.

We may now also see increased trade with Indo- Pacific trading partners. We could expect trade to pick up between Australia and these other countries, which may present opportunities for Australian manufacturers.

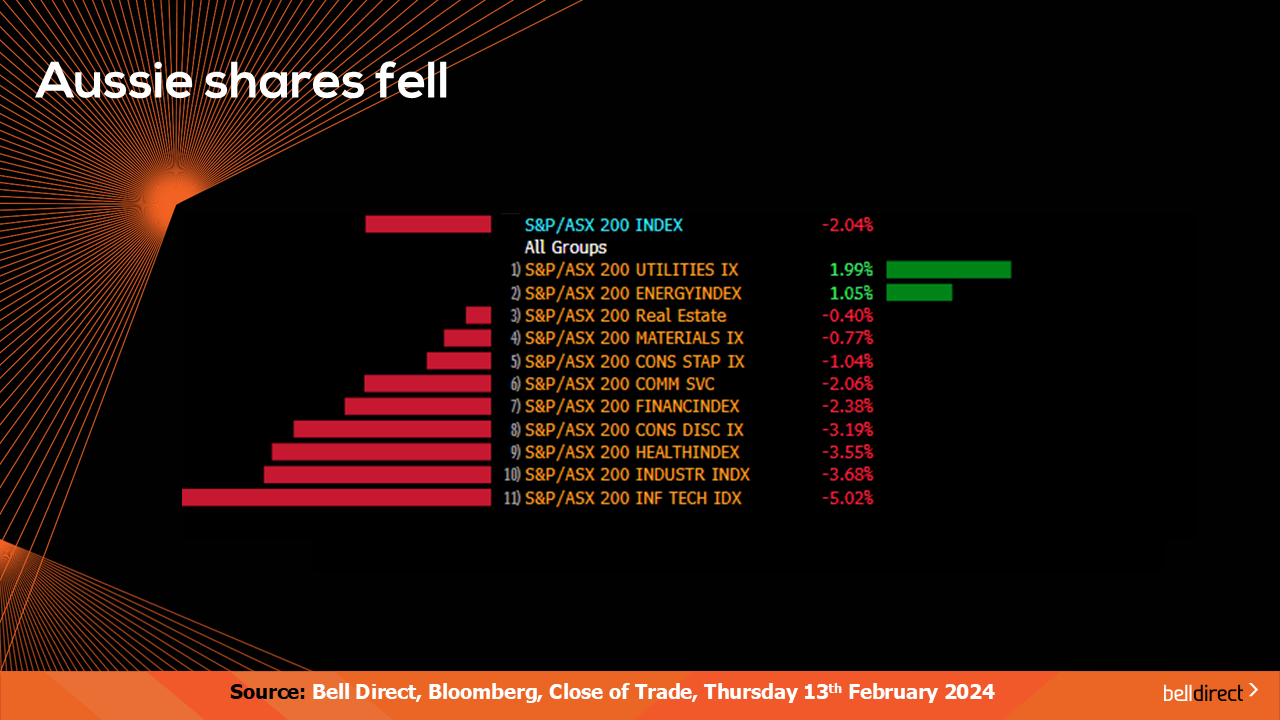

In terms of how the markets reacted to the news, let’s look at the Australian markets’ performance this week so far. News headlines around the US saw the Australian market decline over 2% Monday to Thursday this week, with information technology and industrials down the most. The only two industry sections in the green over this week so far, are utilities up 2% and energy up 1.05%.

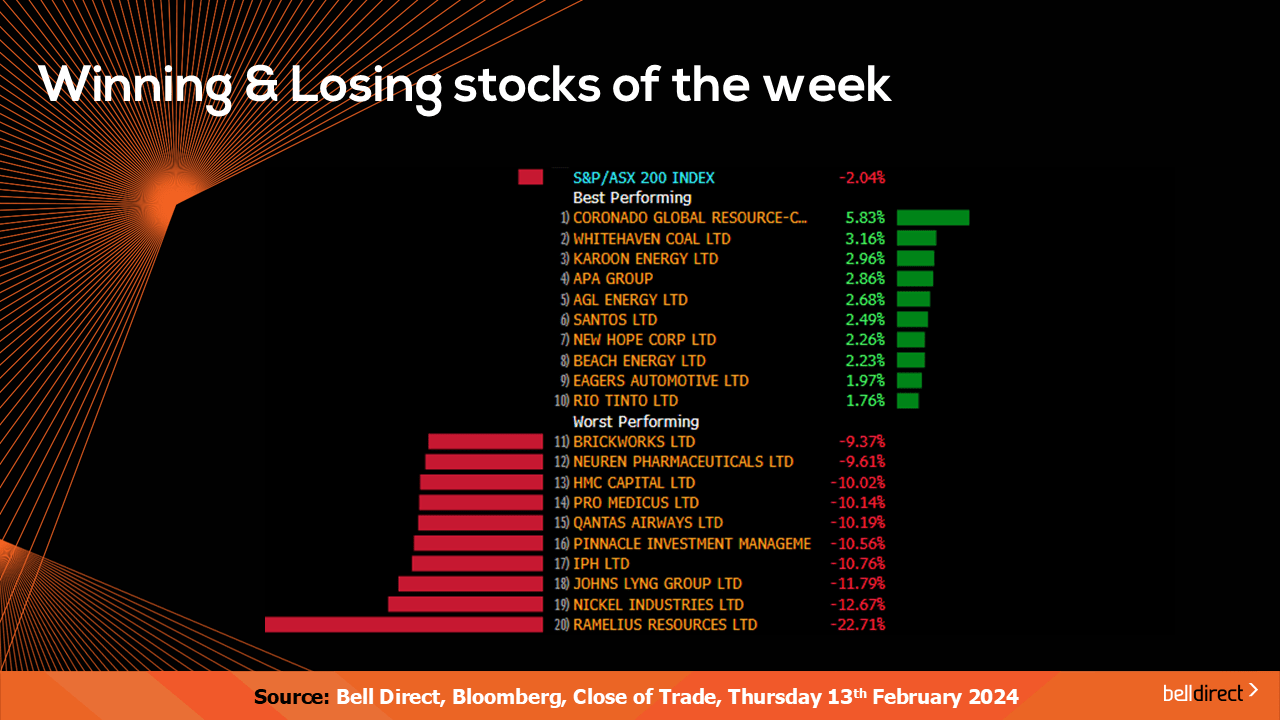

On the ASX200 leaderboard, Coronado Global Resources (ASX:CRN) advanced almost 6%, followed by Whitehaven Coal up over 3% Monday to Thursday. Although yesterday we did see coal shares decline amid the weaker coal price.

And in the red this week, Ramelius Resources (ASX:RMS) tumbled 22.7%. The gold stock saw heavy selling pressure after the company released its long- term mining and growth plans. Investors may be selling due to the $95 million in upgrade costs its Mt Magnet mill in Western Australia.

And Nickel Industries (ASX:NIC) dropped more than 12% this week, loosing almost a quarter of its value after reports of a major shareholder sold half their stock below the asking price.

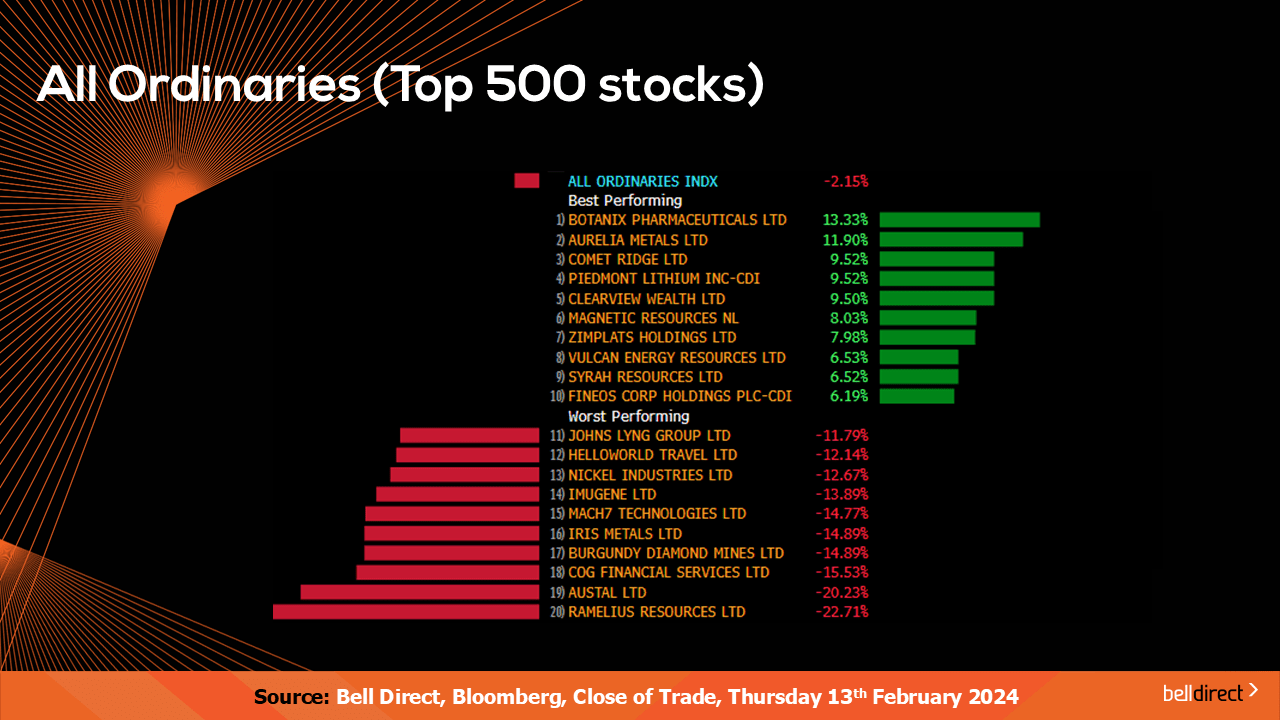

On the All Ords, Botanix Pharmaceuticals (ASX:BOT) is in the lead, while Ramelius Resources (ASX:RMS) declined the most again.

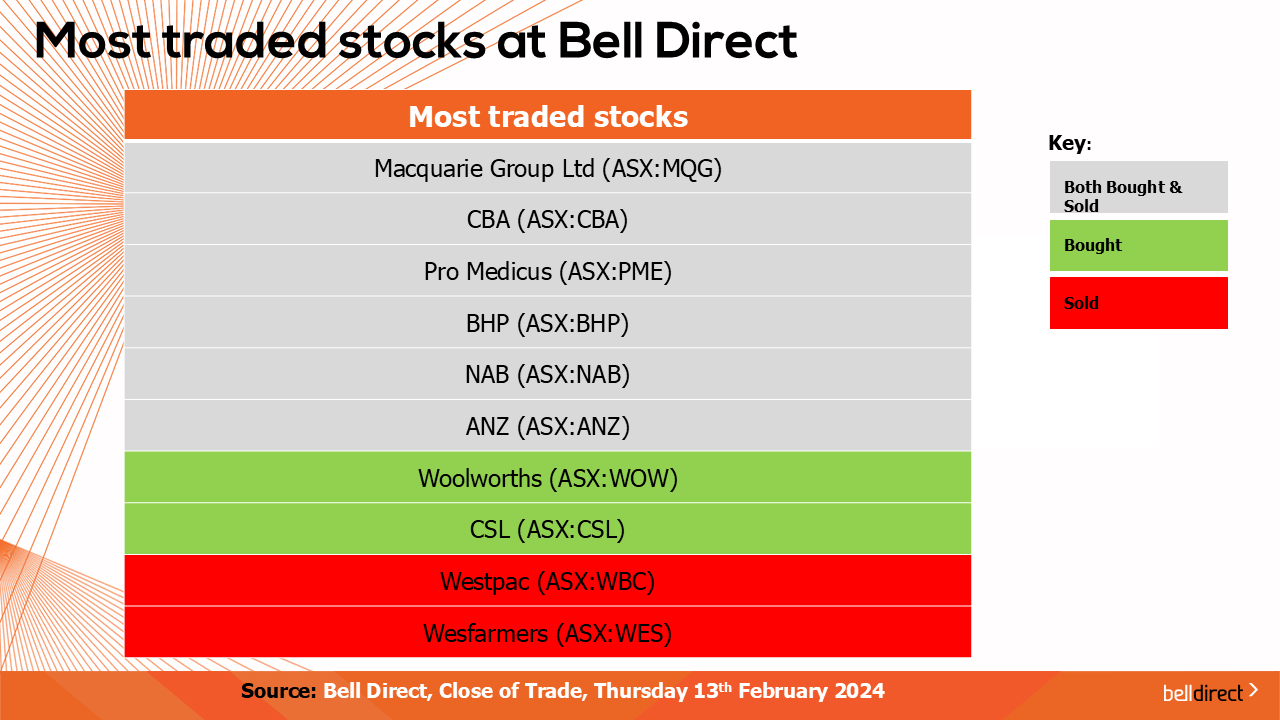

And the most traded stocks by Bell Direct clients this week were Macquarie Group (ASX:MQG), Commonwealth Bank (ASX:CBA), Pro Medicus (ASX:PME), BHP Group (ASX:BHP), NAB, and ANZ. Clients also bought into Woolworths (ASX:WOW) and CSL, while took profits from Westpac (ASX:WBC) and Wesfarmers (ASX:WES).

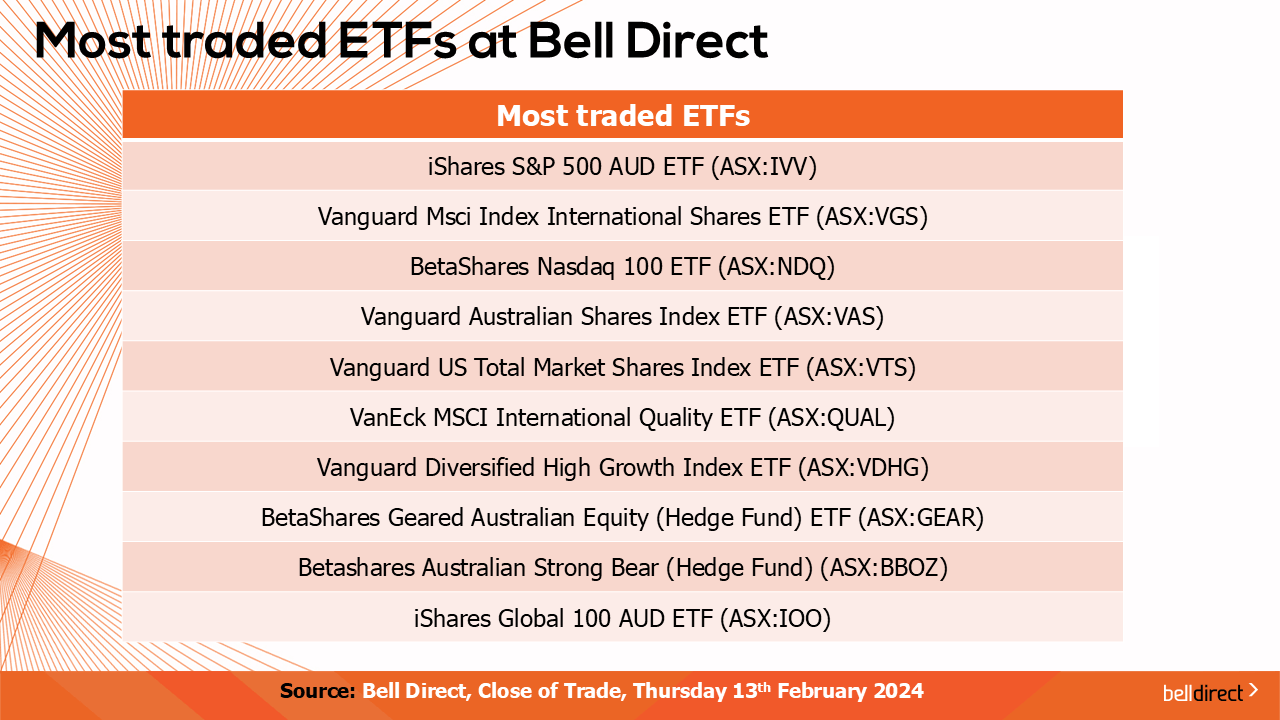

And the most traded ETFs by our clients this week were the iShares S&P500 ETF (ASX:IVV), the Vanguard MSCI International Shares ETF (ASX:VGS) and the BetaShares Nasdaq 100 ETF (ASX:NDS).

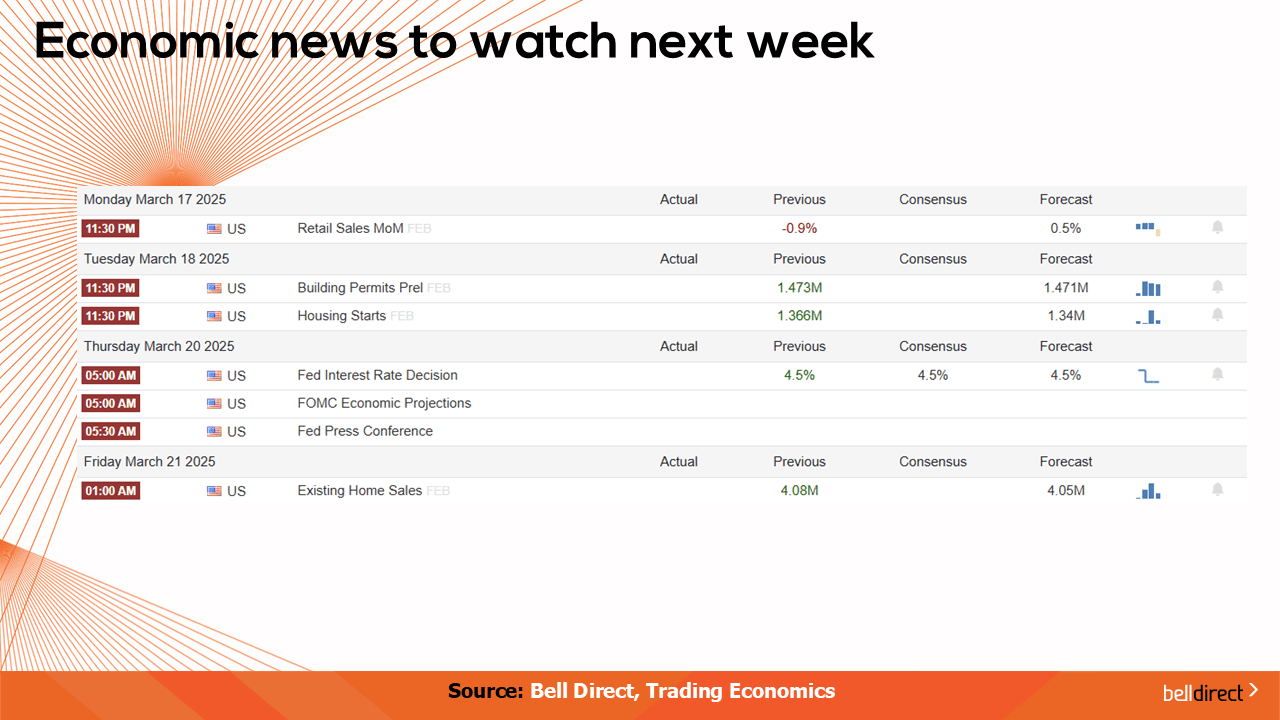

And to end, economic data to watch out for next week:

Keep an eye out for an update from RBA Assistant Governor Sarah Hunter on Tuesday, then on Thursday, unemployment data for February will be released.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great day and happy trading.