Transcript: Weekly Wrap 25 August

Thank you for joining me this Friday the 25th August, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update. So far this reporting season, 192 companies have reported, with 64 beating expectations, 70 meeting expectations and 58 falling short of expectations. 29 companies have been upgraded by brokers while 23 have been downgraded. The supermarket giants released results this week with vastly different reactions from investors.

In FY23 Woolworths (ASX:WOW) reported Group sales up 5.7% to $64.3bn, which cements the company’s leadership position in the Australian market after Coles (ASX:COL) posted Group Sales revenue of $41.47bn which was growth of 5.3% on FY22, which fell short of Woolworths growth. Across the broader metrics, Woolworths excelled in FY23 including gross margin as a percent of sales rising 26.8%, group EBIT up 15.8% to $3.116bn, NPAT up 4.6% to $1.618bn and the final dividend rose 9.4% to 58cps, while Coles held the final dividend flat at 30cps. In response to the strong FY23 results, investors sent the WOW share price up 5% intraday.

Another staples stock that had investors clucking was Ingham’s (ASX:ING) with shares in Australia’s leading poultry producer lifting 15% upon results being released. Throughout FY23 the company reported and feed prices moderating which had been a headwind in previous financial years, as well as a return to longer-term growth outlook for FY24 being expected as volumes rise. From an operational standpoint, Ingham’s revenue rose 12% year-on-year to $3.044bn, underlying NPAT rose 68% year-on-year to $71.1m and net debt was reduced to $394.7m. The company is also allocating $100m to capex in FY24 toward automation options.

The flying Kangaroo reported on Thursday with the company continuing to reap the benefits of built-up travel demand post COVID-19 lockdowns. Across FY23, Qantas (ASX:QAN) reported underling profit before tax of $2.465bn, up from a loss of $1.859bn in FY22, statutory EPS of 96cps, net debt at $2.89bn, well below the target range of $3.7bn – $4.6bn, FY23 group capacity returned to 77% of pre-COVID levels. Revenue for FY23 also jumped significantly from $9.108bn in FY22 to $19.815bn in FY23. Shares in Qantas traded higher on the result, and it has been a positive turnaround for a business that claimed to be 11 weeks from bankruptcy during the pandemic.

Shifting focus to the mining sector and as the theme has been with any company with exposure to China, the big iron ore miners have felt margin pressures and repercussions from uncertainty on the demand front from China. BHP (ASX:BHP) shares slightly dipped on the release of results after the big iron ore miner announced higher inflation costs and lower commodity prices have hurt its key iron ore business. BHP reported a 37% drop in profit for FY23 to US$13.4bn, while revenue dropped 17% to US$53.8bn.

As healthcare companies continue to feel the brunt of investor sell-off in 2023, Ramsay Healthcare (ASX:RHC) was the latest company to report earnings results that disappointed investors. The company’s shares fell 10% after FY23 results unveiled the full year dividend was nearly halved to 25cps, while NPAT rose just 8.8% to $298.1m. Inflationary pressures were the blame for higher labour costs. On the outlook front for Ramsay, no quantitative guidance was issued but the company expects the ‘current environment will dictate some change in the emphasis and focus on long term strategy’ for the company, while expecting single digit growth as the market continues to recover.

Across the board the key themes remain this reporting season; China exposure is hurting the outlook of companies operating in this region, margin contraction is an area investors are punishing this reporting season, and failure to provide quantitative outlook is an area of concern for investors heading into the new financial year.

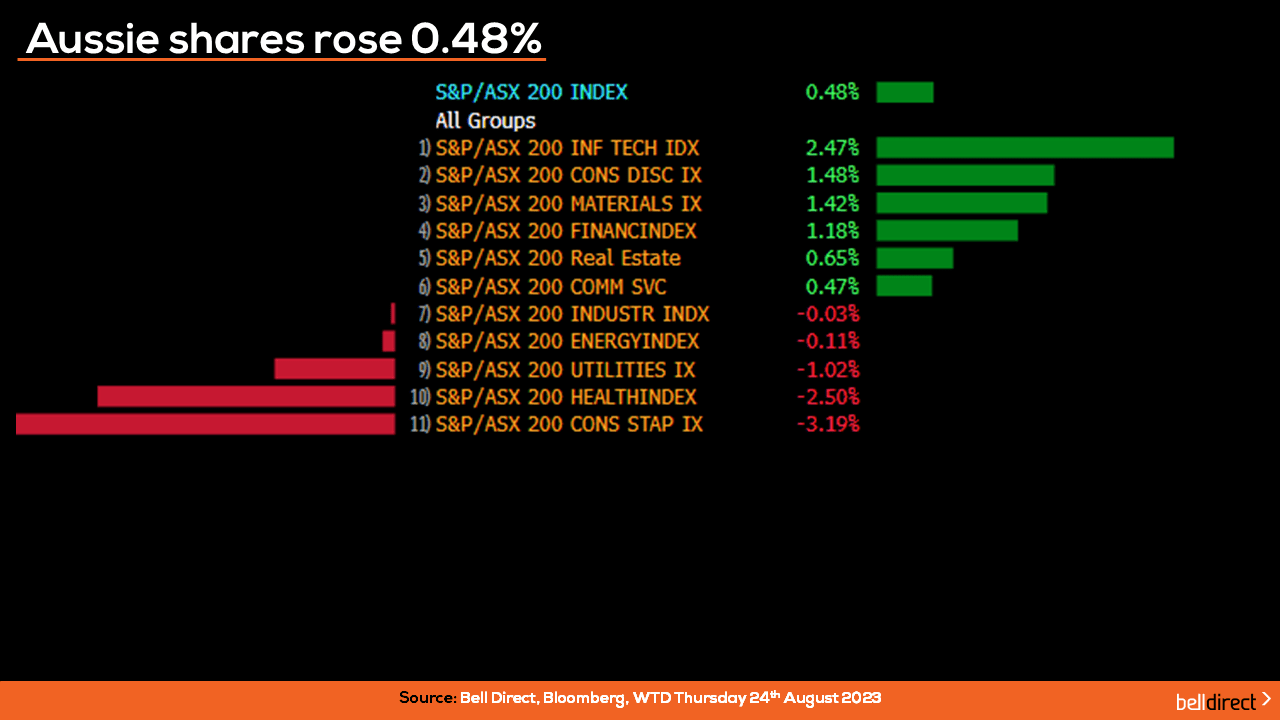

Locally from Monday to Thursday, the ASX200 rose 0.48% as rally on the Nasdaq in the US fuelled a rally for local tech stocks with the tech sector rising 2.5% over the 4-trading days. Consumer staples stocks took a hit with the sector closing over 3% lower from Monday to Thursday.

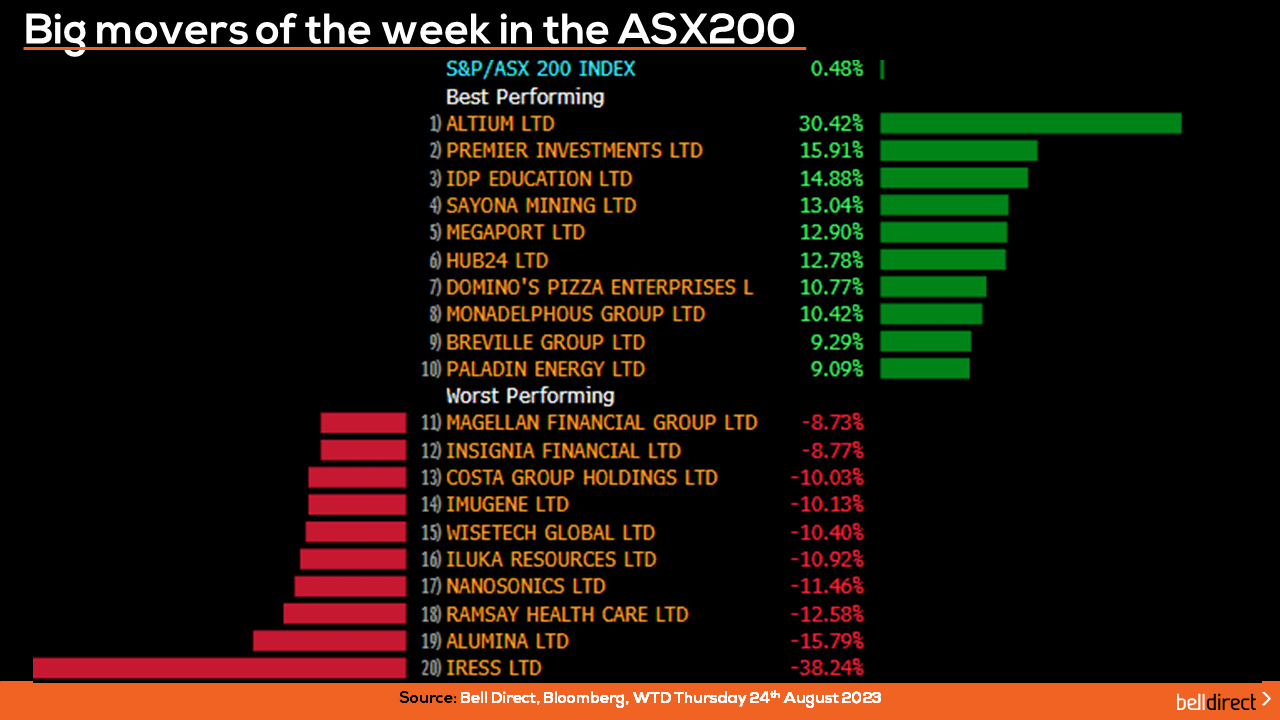

Looking at the winning and losing stocks on the ASX200, Altium (ASX:ALU) rose 30.42% on the release of positive FY23 results, followed by Premier Investments (ASX:PMV) rallying almost 16%. IRESS (ASX:IRE) fell just shy of 40% on the release of disappointing FY23 results while Alumina (ASX:AWC) also fell 15.8% from Monday to Thursday.

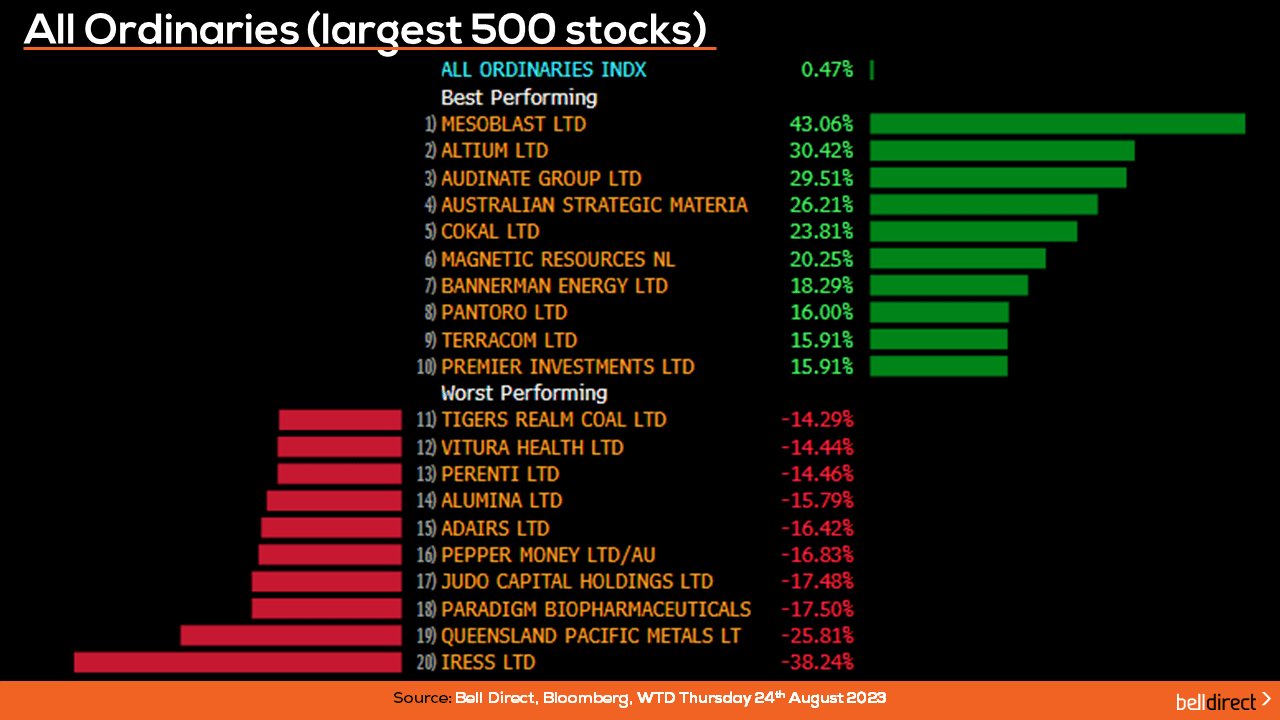

On the broader market, the All Ords rose 0.47% over the last four days led by Mesoblast (ASX:MSB) rising just over 43%, while Audinate (ASX:AD8) rose just shy of 30%.

On the other end, Queensland Pacific Metals (ASX:QPM) fell 25.81% over the four trading days and Paradigm Biopharmaceuticals (ASX:PAR) fell 17.50%.

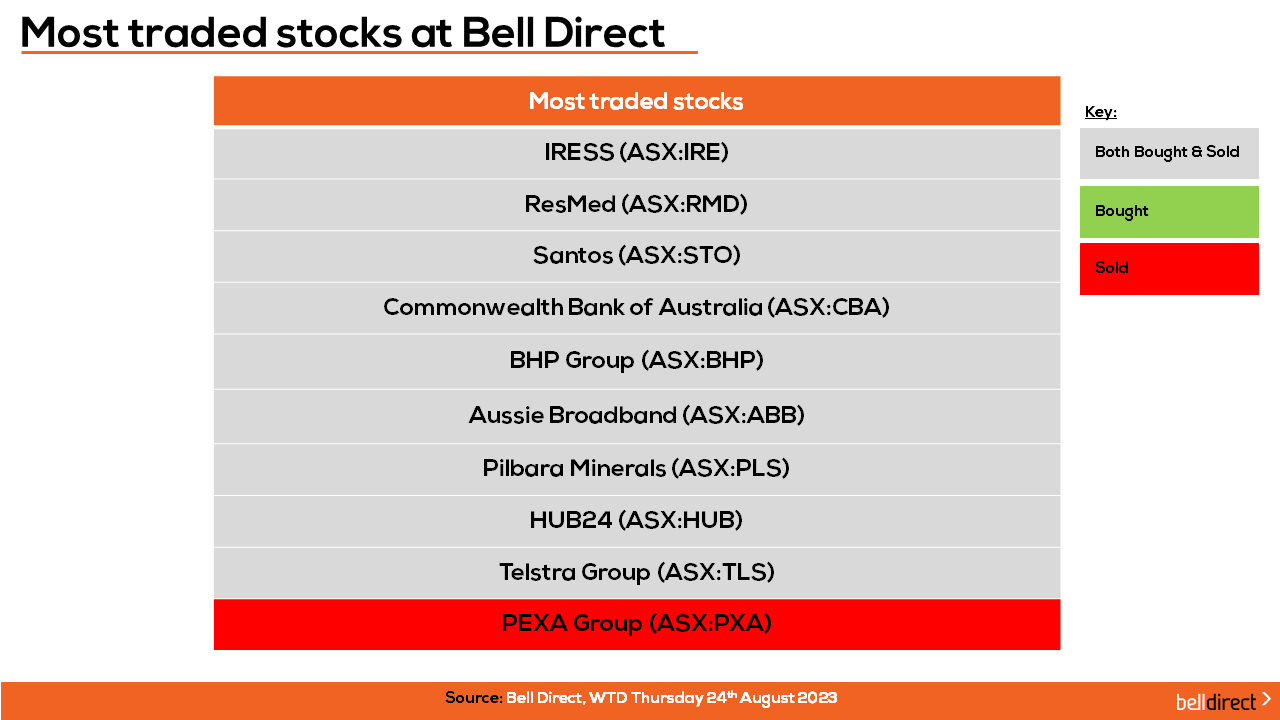

The most traded stocks by Bell Direct clients from Monday to Thursday were IRESS (ASX:IRE), ResMed (ASX:RMD), Santos (ASX:STO), Commonwealth Bank of Australia (ASX:CBA), BHP Group (ASX:BHP), Aussie Broadband (ASX:ABB), Pilbara Minerals (ASX:PLS), Hub24 (ASX:HUB), and Telstra Group (ASX:TLS).

Clients also sold out of PEXA Group (ASX:PXA).

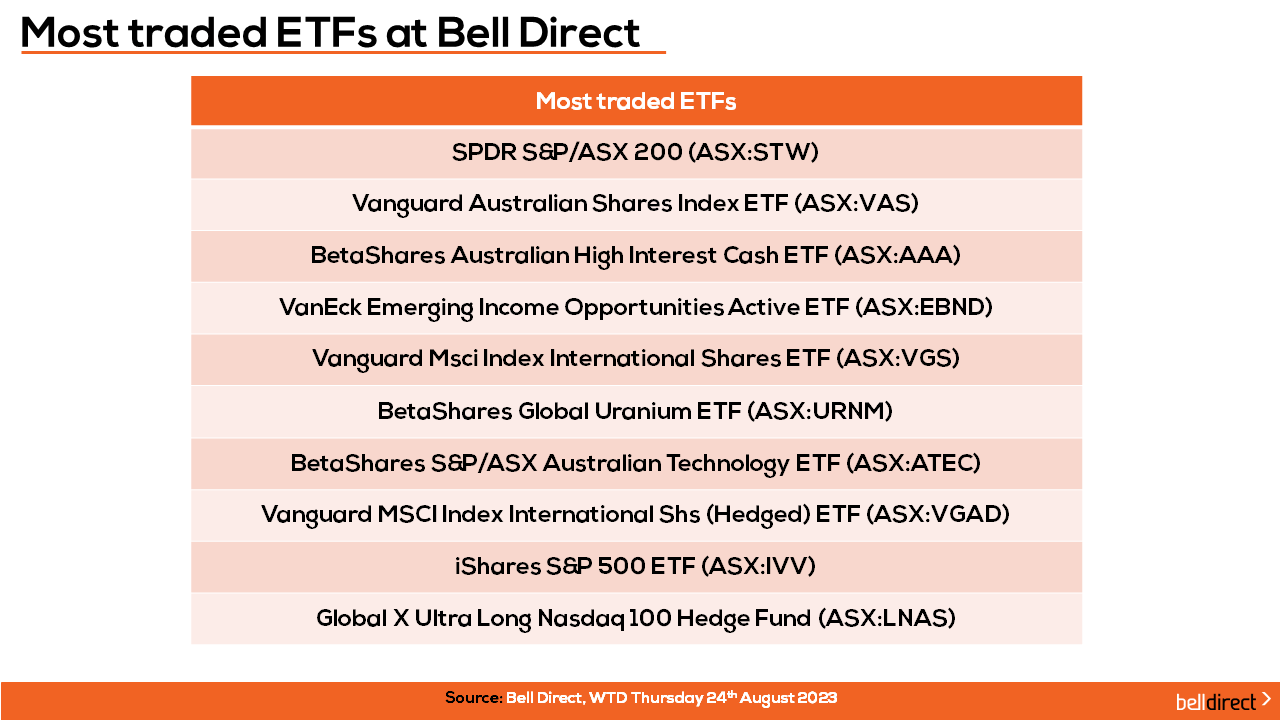

And on the diversification front, the most traded ETFs by Bell Direct clients were led by SPDR S&P/ASX200 Fund, Vanguard Australian Shares Index ETF and BetaShares Australian High Interest Cash ETF.

Taking a look at the week ahead, on the local earnings season front we will be keeping an eye out for results out of Fortescue Metals Group (ASX:FMG), Mineral Resources (ASX:MIN), Brambles (ASX:BXB), IGO (ASX:IGO) and Flight Centre (ASX:FLT).

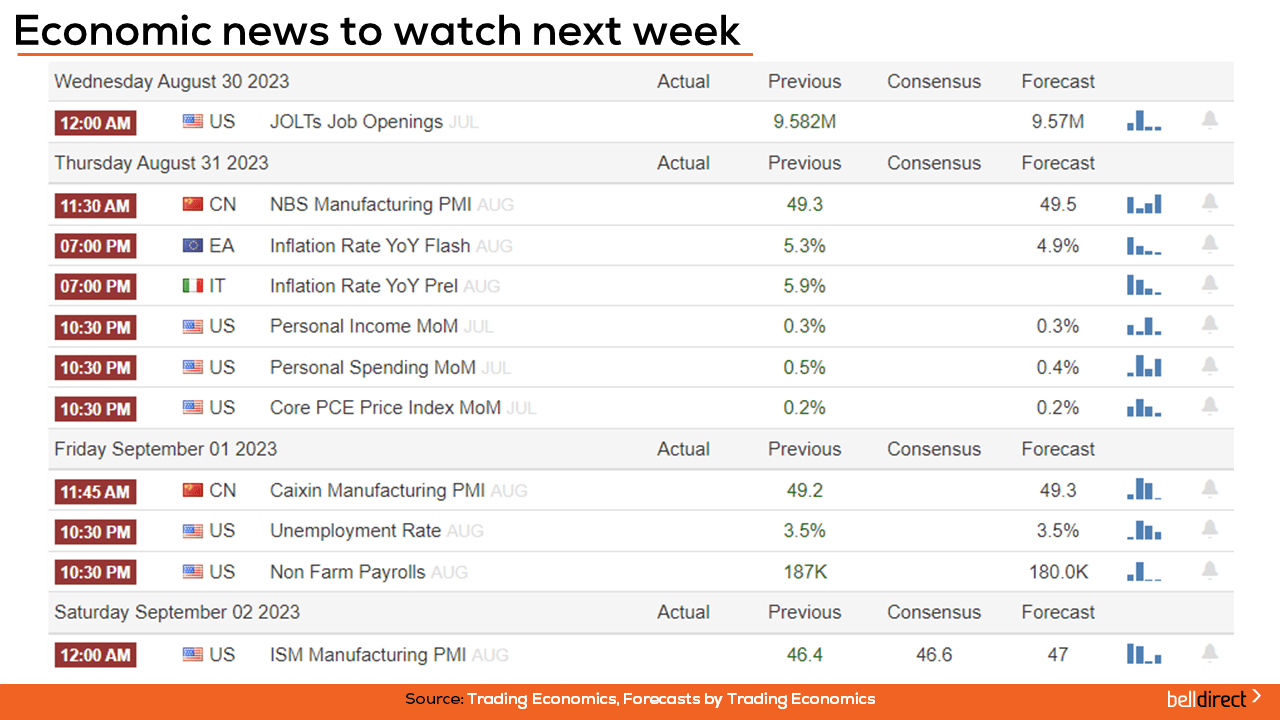

On the economic calendar next week, Jolts job openings data will be out in the US on Wednesday with the market expecting a slight uptick in the number of job openings in July. Chinese Manufacturing data is out on Thursday for August with the forecast of a slight rise to 49.5 points in August from 49.3 points in July. And the flash inflation rate for the European region data in August is out on Thursday with the forecast of a slight contraction to 4.9% from 5.3% in July.

And that’s all we have time for today. Have a wonderful Friday, a great weekend and as always, happy investing!