Thanks for joining me this Friday the 2nd May, I’m Grady Wulff, Market Analyst with Bell Direct and this is our weekly market update.

Markets welcomed some positive news this week on the Trump Tariff front with a reduction in the US automotive tariff announced and news that a major trade deal will soon be announced with China.

While concerns on the tariff front began easing, other worries arose after key economic data out of the US reignited fears of a recession. In true Trump fashion, the US President blamed former president Joe Biden for the GDP slump when in actual fact it was driven by tariff fears causing US consumers and businesses to increase imports of foreign goods by 41.3% during Q1 before the tariffs, imposed by Trump, came into effect. i.e. the GDP slump was primarily driven by lower exports compared to imports during Q1. The GDP reading came in at a contracted annualised rate of 0.3%, marking the first decline in US economic expansion since Q1 2022. Consumer spending during this period also rose 0.7%, contributing to fears of inflation rebounding as consumer spend is a key driver of inflation. Economists are expecting a surge in inflation this year as a result of Trump’s import tariffs raising the cost of goods to be paid by US consumers (for those that pass the tariff onto the end user), which companies like Adidas warned of this week.

Consumer sentiment also tumbled in April with a decline of 32% to the lowest level since the 1990 recession, indicating just how concerned US consumers are about the current and future state of the world’s largest economy.

With no clarity on tariffs to date, extreme uncertainty and economic contraction, the Fed has a big job to do to stabilise the US economy.

Elsewhere, China’s post-pandemic recovery remains shaky as new data out this week paint a mixed picture about the growth of the world’s second largest economy. Paired with the ongoing trade war escalating between the US and China, we have a very murky outlook for Chinese economic growth and stability for the near-term. This week, Chinese manufacturing PMI fell to 49.0 index points in April, down from March’s 12-month high of 50.5 and well below market expectations of 49.8 as the first sweep of US tariffs hit Chinese manufacturing activity. This marked the first contraction in Chinese manufacturing activity since January, and the steepest decline since December 2023, despite Beijing’s stimulus packages being implemented to promote growth and post-pandemic recovery. Broadly, China’s economic data has been hit by tariff concerns and implications across the most recent reports with foreign orders shrinking at the greatest rate in 11 months, employment decreasing at a growing pace, buying activity declining for the first time in 3-months and confidence weakening to a 7-month low. The weakness in the Chinese economy has flow-on impacts to our local listed companies and Australian economy as China is our number one trade partner.

On a positive note this week, Australia’s latest inflation reading was released on Wednesday outlining the RBA’s path to tame inflation remains on track.

In the March quarter, Australia’s underlying inflation rose 0.9%, slightly above expectations and up from 0.2% in the two previous quarters, driven by housing, education, and alcohol prices. Annual inflation held steady at 2.4%, while trimmed mean inflation—a key measure excluding volatile items—fell to 2.9%, its lowest since 2021 and within the RBA’s 2–3% target range. Housing costs surged 1.7%, mainly due to a 16.3% spike in electricity prices as Queensland households exhausted government rebates. Education costs jumped 5.2% with significant increases in school fees, and fresh food prices rose 2.8% due to supply shortages. Overall, the data signals a favourable inflation slowdown, strengthening the case for a possible RBA rate cut in May. Rate sensitive sectors like REIT, discretionary and tech stocks rallied on the inflation report as such stocks benefit from a lower interest rate environment.

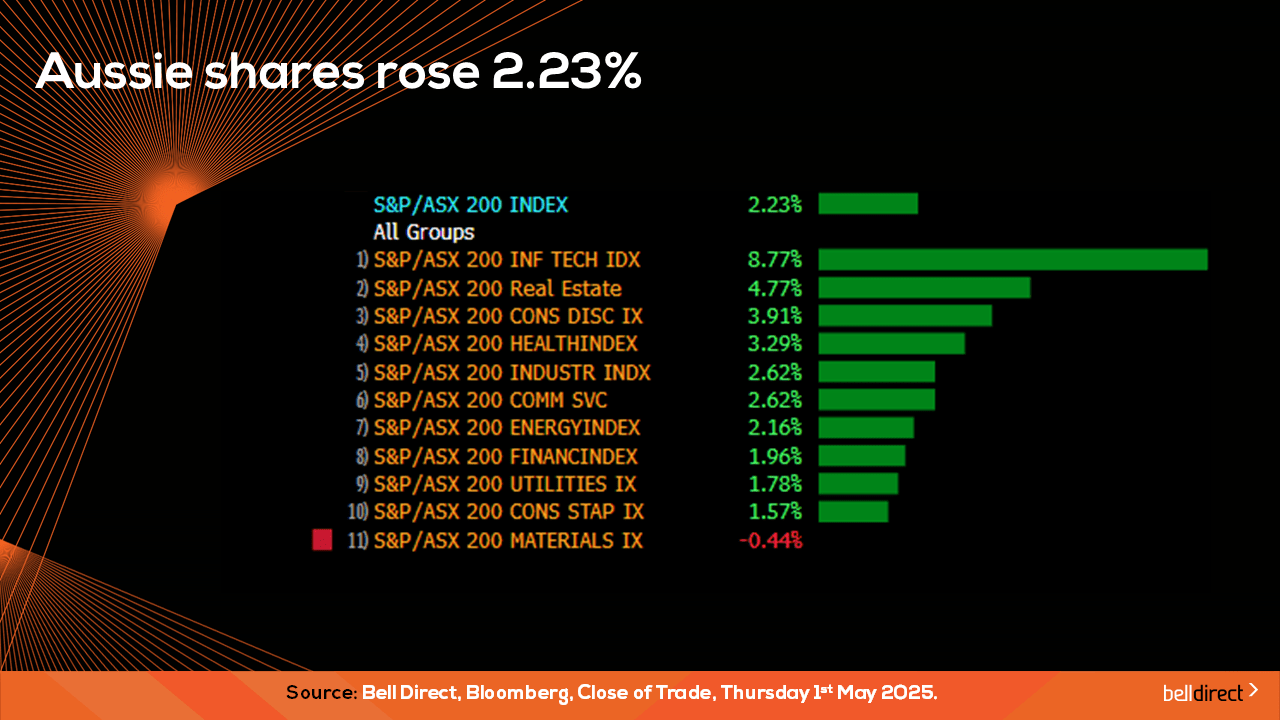

Locally from Monday to Thursday the ASX200 rose 2.23% to shake off the recent tariff sell-off, with every sector aside from material ending the week with a gain over 1%, while the tech sector soared 8.77% over the 4-trading days.

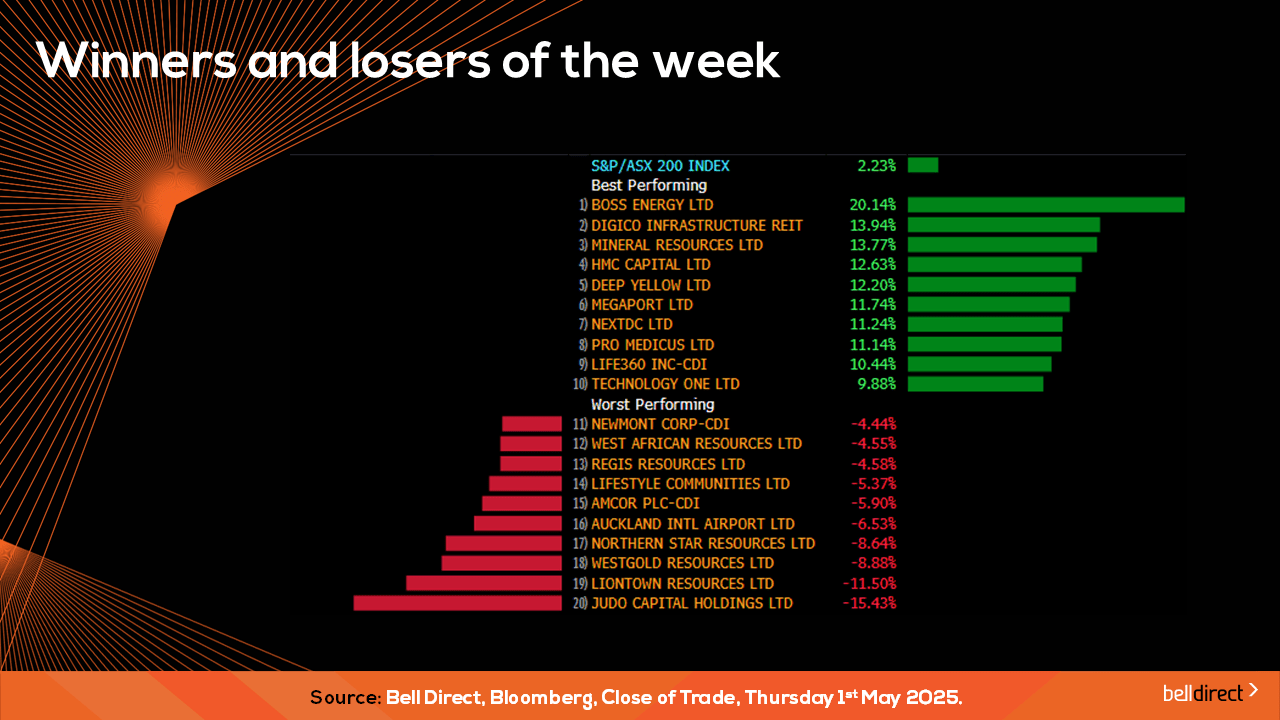

The winning stocks on the ASX200 were led by Boss Energy surging 20.14% as the uranium producer reported its first quarter of free cashflow at its flagship Honeymoon project. Digico Infrastructure REIT also soared 14% and Mineral Resources rose 13.77% this week.

At the other end, Judo Capital and Liontown Resources both fell over 11% this week.

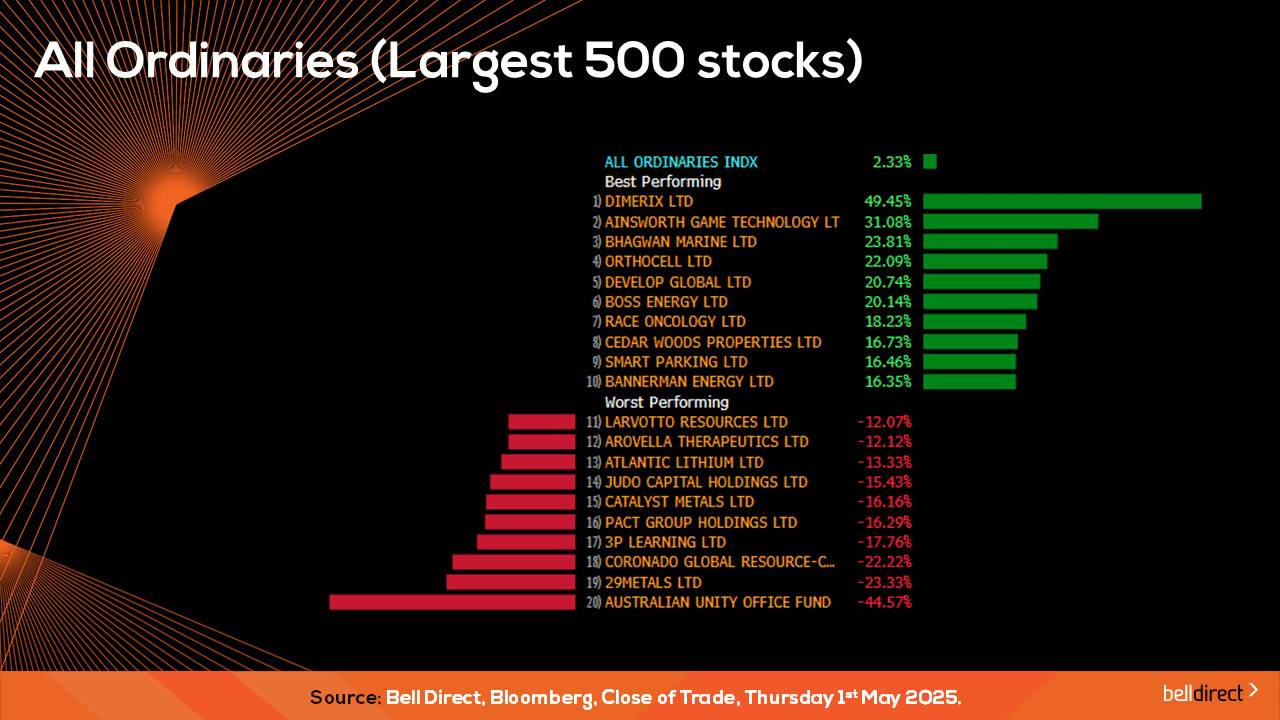

On the broader market index, the All Ords rose 2.33% this week led by Dimerix posting a near 50% gain while Australian Unity Office Fund tumbled 44.57%.

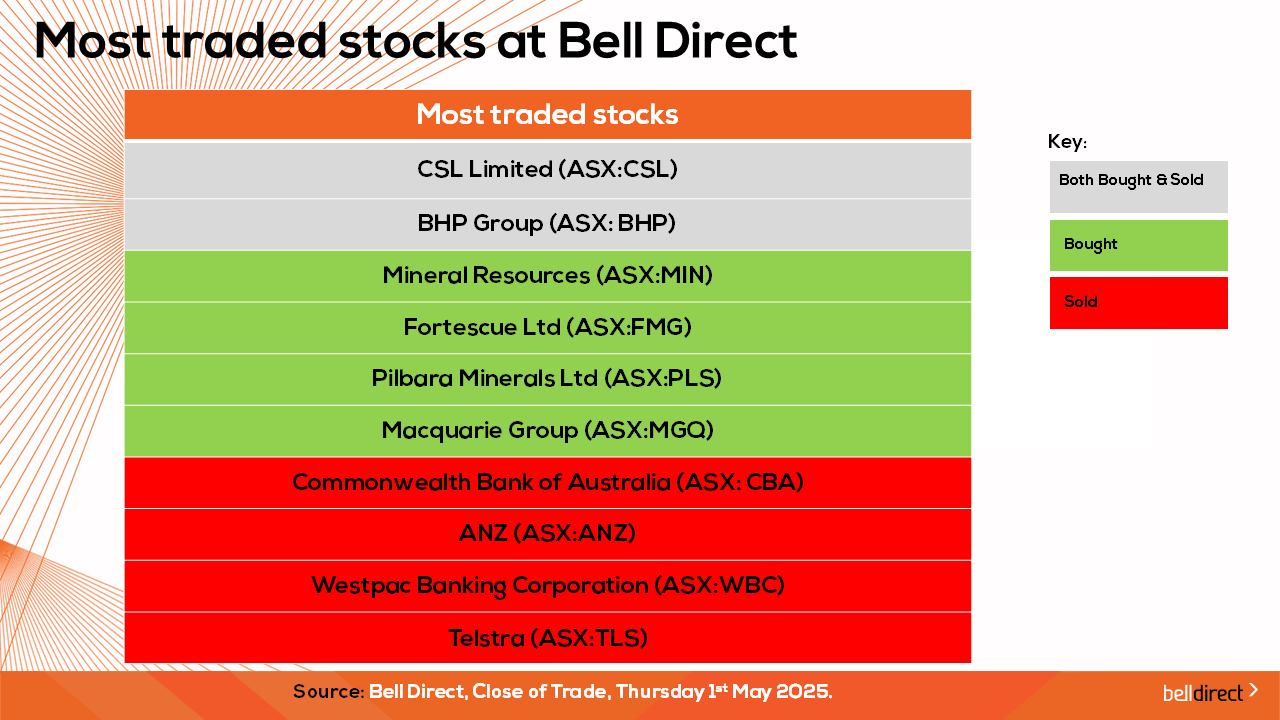

The most traded stocks by Bell Direct clients this week were BHP Group, and CSL. Clients also bought into Fortescue, PLS, Mineral Resources and Macquarie Group while taking profits from Telstra Group, CBA, ANZ, and Westpac.

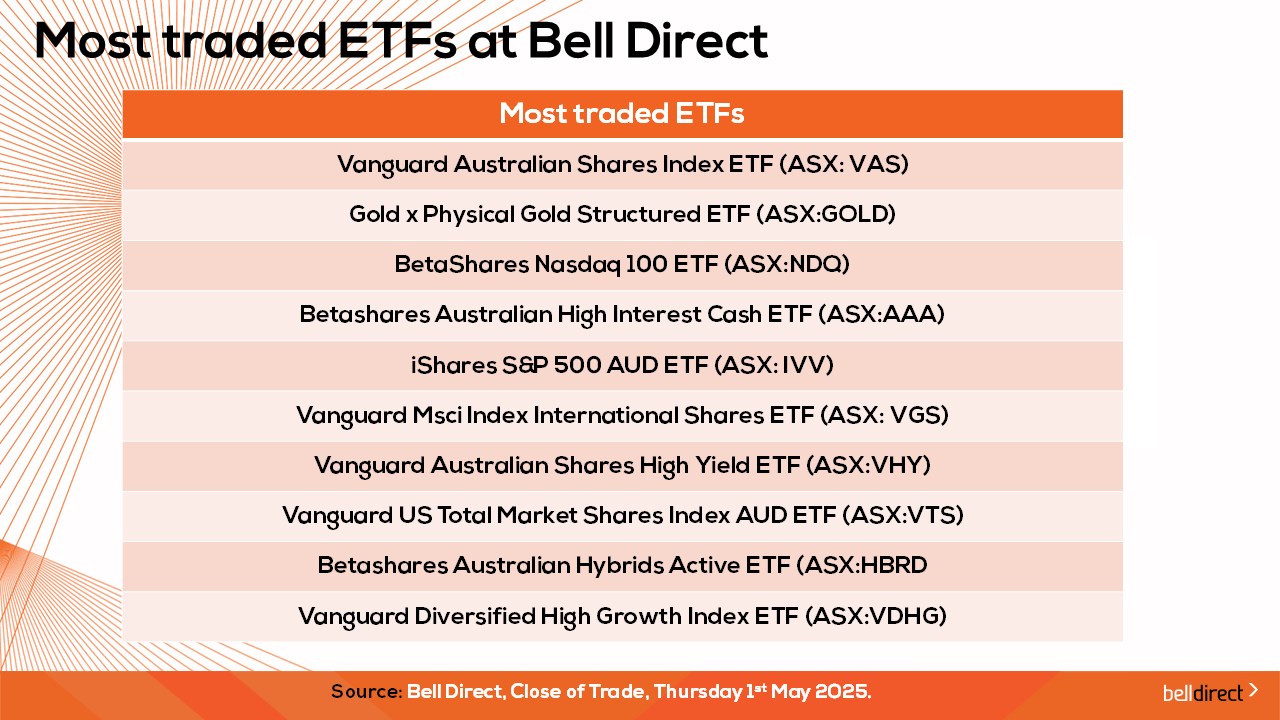

And the most traded ETF’s were led by Vanguard Australian Shares Index ETF, Global X Physical Gold ETF and Betashares Nasdaq 100 ETF.

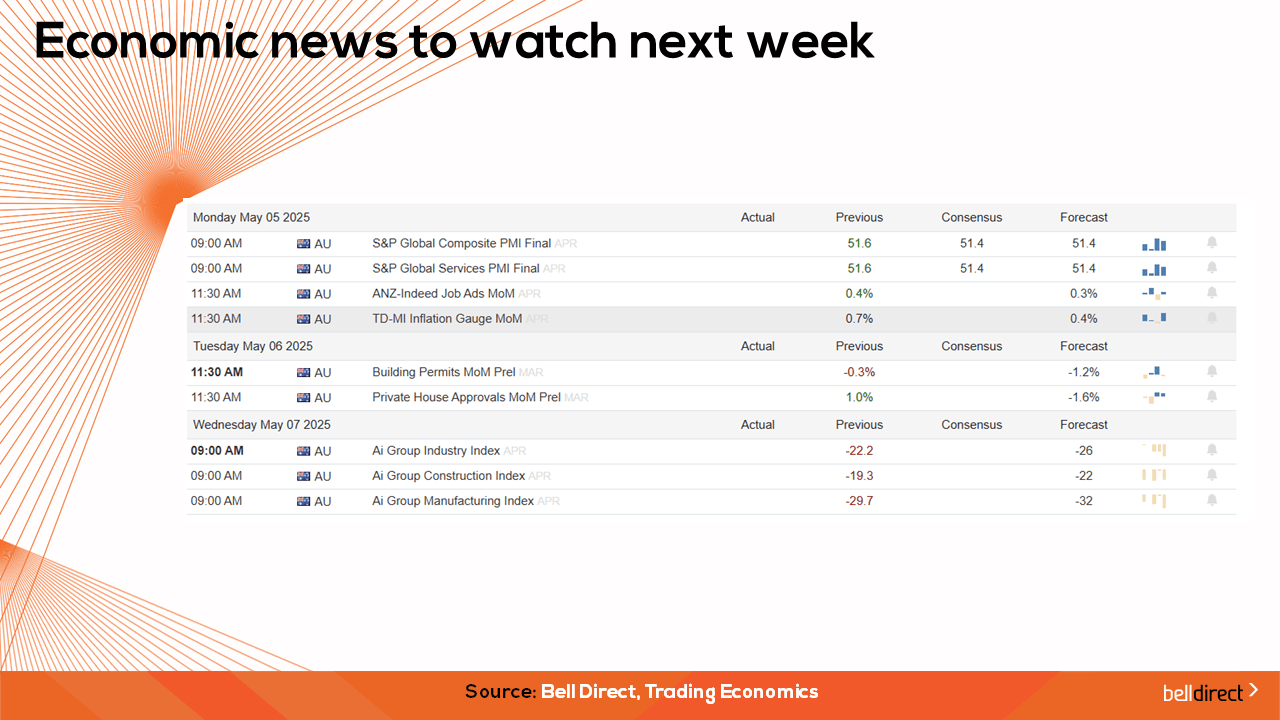

On the economic calendar next week we may see investors react to Australia’s building permits monthly data indicating the state of Australia’s building growth amid the current housing crisis, while overseas we will see US trade balance, the Fed’s latest rate decision, key US jobs data and important Chinese inflation data all out next week.

And that’s all for this Friday, we hope you have a wonderful weekend and happy investing!