I’M READY

I’M THINKING ABOUT IT

At Bell Direct, we understand that entering into the share market is exciting, but also perhaps a bit of a mystery, so we’ve put together this page to highlight all the tools and features you’ll receive that will help you kick start your investing journey.

Our investor solutions

So what makes Bell Direct simply better?

Daily Trading Ideas

When you open up an account with Bell Direct, you’ll receive six bullish and bearish trading ideas each day in your inbox, plus, a breakdown of the technical or fundamental supporting reasoning.

Easy Tax Reporting

This easy-to-read report includes details like: Your account summary, Holdings valuation, Direct Investment Account summary, Transaction summary, Brokerage and Estimated dividend summary.

Real Broker Research

You’ll get access to Bell Potter’s experienced and qualified analysts research every day after your first trade. This research covers Australia’s top ASX-listed companies and a range of selected mid-cap and emerging companies.

Competitive Fees

In the first place, Bell Direct was created because we felt the banks were ripping people off on brokerage. Years later, our fees are value for money, transparent and easy to understand.

We are backed by Bell Financial Group

a leader in the Australian stockbroking

industry since 1970

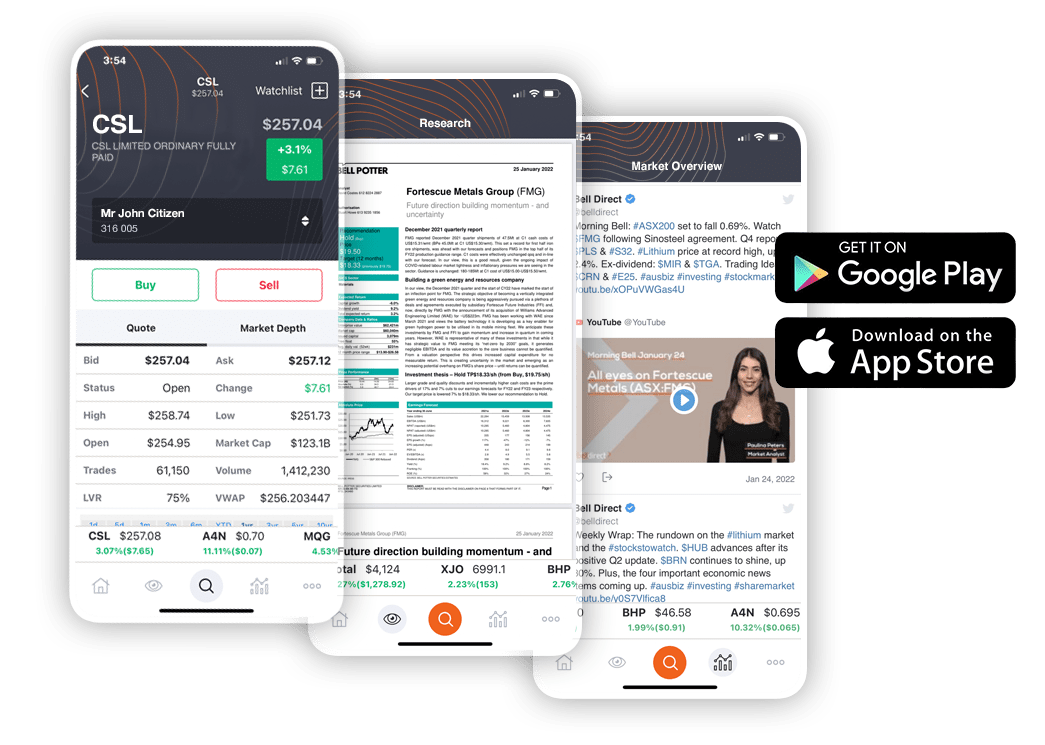

Mobile trading in the palm of your hand

No matter where you are, you can trade and manage your investment portfolio with the Bell Direct mobile app.

Research stocks on the go with broker research from Bell Potter, Morningstar & BuySellSignals at your fingertips.

The Bell Direct mobile app is available to download on both the App Store and Google Play.

Questions some new investors ask

If you have more detailed questions please call us on 1300 786 199

How soon can I start trading after opening an account?

You can generally start trading within:

– 3 working days if you have applied for a new holder identification number (HIN) for your trading account.

– 4 working days if you have requested for a HIN transfer across from your previous broker to your trading account.

We will contact you should we require any further information on your application.

Once the trading account has been activated, you can deposit funds into your Direct Investment Account. See how do this in the FAQ question below.

What I.D. do I need to set up an account?

– Your ID details so we can verify your identity online (i.e. Australian passport or driver’s licence)

– Your bank account details (from an Australian bank)

– Tax File Number (optional)

– Company or trust documents if you are opening an SMSF, company or trust account

– Your HIN if you’re switching from another broker

How do I deposit funds to start trading and withdraw funds from my account?

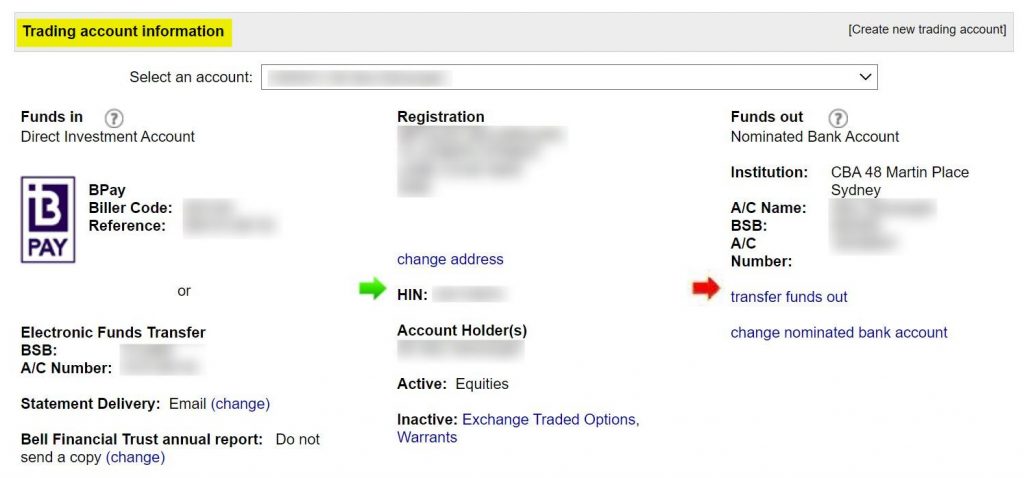

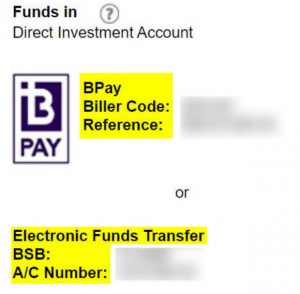

You can deposit funds into your Direct Investment Account electronically by either:

BPay: simply use the Biller Code and your BPay Reference

Electronic transfer: use your BSB and Account Number

To find your deposit details:

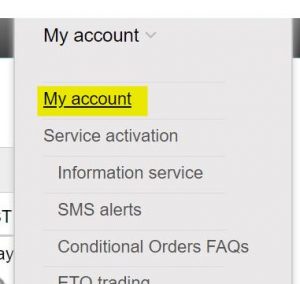

- Click on the “My account” tab underneath the “My account” drop down button (this will be in the top right of your page)

- Scroll down to the bottom of the page and you will see your ‘Trading account Information’.

- On the left hand side you can view the BPay Biller Code and Reference number as well as the BSB and Account Number for the Electronic Funds Transfer.

- Use either of these and you will be able to fund your Direct Investment Account.

Kindly note: You must first deposit funds into your trading account before you can start trading.

The timing of your funds deposit reaching your Direct Investment Account is dependent on your bank’s processing time.

If your deposit instruction was completed before your bank’s cut-off time, your funds will normally be in your Direct Investment Account the next business day. If your deposit instruction was completed after your bank’s cut-off time, your funds will normally be in your Direct Investment Account the following business day

To withdraw funds you simply:

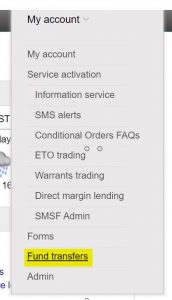

- Click on the “Fund transfers” tab underneath the “My account” drop down button (this will be in the top right of your page)

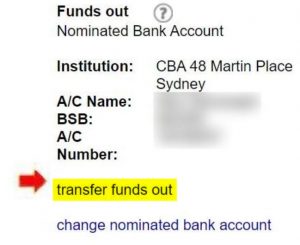

- Or, within your trading account information (under “My account” in step 1 of finding your deposit details), you can click on “transfer funds out”.

- Then, just follow the steps, and you will be able to submit a funds transfer request online at anytime from your Direct Investment Account to your nominated bank account.

- Please enter your trading PIN to complete the fund transfer request.

Your available transfer balance takes into account your cash balance and any buys pending settlement and open buy orders you have at the time of processing your transfer request. If you have sell orders that are due for settlement, you will only be able to transfer the funds out after the sell orders settle (T+2, between 12pm to 5pm AEST).

When you submit your transfer request before 2:30pm AEDT on business days, your funds transfer is processed on the same day and the funds should be in your nominated bank account the next working day.

After 2:30pm AEDT on a business day or on a non-business day, your instruction will be processed at 2:30pm the next business day.

Please note that the cut-off on non-settlement days and shortened ASX trading days such as Christmas Eve and New Year’s Eve is 12.30pm AEDT.

How do I transfer my holdings to Bell Direct?

To transfer shares to your Bell Direct account, follow these steps:

1. Determine where the shares are held: at another broker or at a share registry.

2. Fill up the right transfer request form:

For shares from another broker: once logged in, go to Forms in the My Account tab and fill up the Broker to Broker Transfer Request form.

Your details at the other broker must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, you will need to complete an Off Market Transfer Request form (found in Forms in the My Account tab once logged in) (at a cost of $55 per holding).

For shares from a share registry: once logged in, go to Forms in the My Account tab and fill up the Issuer Sponsored Conversion Request form.

Your details at the share registry must exactly match the details you have with us to allow the transfer. If shares are currently held in a different name, you will need to contact the share registry to change the details before submitting the Issuer Sponsored Conversion Request form.

All the request forms can be found on My account tab once you have logged in.

If you are in the process of opening a new account with us, you will have the option to transfer a HIN across during the online account setup process.

3. Send us your signed request form by:

Email at support@belldirect.com.au

Mail to Bell Direct, GPO Box 1630, Sydney NSW 2001

Once we’ve received it we’ll transfer the shares into your Bell Direct account within 3 days.

You can also watch our tutorial video:

Share Trading Customer Satisfaction Award Winner 2022

Bell Direct was awarded first place in Finder’s Share Trading Customer Satisfaction Awards for 2022.