I’M READY

I’M THINKING ABOUT IT

Direct to your financial goals

Bell Direct’s Direct Investment Account is tailored for investors, companies, trusts and SMSFs, providing you with the security to confidently manage and grow your wealth. Your Direct Investment Account is an account purely for your trading settlement to allow ease of transparency and reporting.

Trade with confidence and control:

Seamless trade settlement

Streamlined trade execution, allowing you to seize investment opportunities as they emerge without the hassle of transferring funds between accounts.

Low brokerage

It’s value for money. Trade from $5 when settling to your Direct Investment Account.

Secure & easy

Trade from $5 when settling to your Direct Investment Account, allowing you to focus on your investment strategy without the hassle of complex processes.

Reporting & visibility

Enjoy the added benefit of comprehensive reporting, including the flexibility to share data with your accountant or financial adviser and easily organise and search your transactions.

With Bell Direct’s Direct Investment Account, you’ll have no minimum balance requirements:

| Direct Investment Account balance | Interest rate |

|---|---|

| $0 to $100,000 | 0.95% pa |

| >$100,000 | 1.10% pa |

Information on Direct Investment Account interest rates

For more information about the Direct Investment Account (formally named the Bell Financial Trust ARSN 164 391 119) PDS and Additional Information click here.

The Bell Financial Trust Target Market Determination (TMD) is available free of charge by contacting Bell Potter Capital Ltd on 1800 061 327 or by clicking on this link. Previous versions of the TMD are available by calling 1800 061 327.

Interest rates are subject to change. Current interest rates are not a reliable indicator of future interest rates. The Direct Investment Account (formally named the Bell Financial Trust ARSN 164 391 119) is a managed investment scheme that is registered with ASIC. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL No. 235150 is the responsible entity of the Trust. The Trust is administered by Bell Potter Capital Limited ABN 54 085 797 735 AFSL No. 360457. The Trust Company (RE Services) Limited is a wholly owned subsidiary of Perpetual Limited (ABN 86 000 431 827). Bell Financial Trust is secured over the assets of Bell Potter Capital. Guarantee details and associated risks are disclosed in our PDS. The information provided in this document is general information only and does not constitute investment or other advice. The content of this document does not constitute an offer or solicitation to subscribe for units in the Fund. Any investment decision in connection with the Trust should only be made based on the information contained in the disclosure document for the Fund. Neither Bell Potter Capital nor Perpetual guarantee repayment of any particular rate of return from the Fund. Perpetual do not give any representation or warranty as to the reliability or accuracy of the information contained in this document. All opinions and estimates included in this document constitute judgments of Bell Potter Capital as at the date of this document and are subject to change without notice.

Plus, the more you trade, the more you save:

| Trades | |

|---|---|

| Your first 10 trades per month | $5 ($0 to $1,000) $10 ($1,000 to $3,000) $15 ($3,000 to $10,000) $25 ($10,000 to $25,000) 0.1% ($25,000+) |

| Your 11th to 30th trades per month | $13 or 0.08%, whichever is greater |

| Your 31st trade onwards per month | $10 or 0.08%, whichever is greater |

Where can I find more information on the Direct Investment Account?

For more information about the Direct Investment Account (formally named the Bell Financial Trust ARSN 164 391 119) PDS and Additional Information click here.

The Bell Financial Trust Target Market Determination (TMD) is available free of charge by contacting Bell Potter Capital Ltd on 1800 061 327 or by clicking on this link. Previous versions of the TMD are available by calling 1800 061 327.

The Direct Investment Account (formally named the Bell Financial Trust ARSN 164 391 119) is a managed investment scheme that is registered with ASIC. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL No. 235150 is the responsible entity of the Trust. The Trust is administered by Bell Potter Capital Limited ABN 54 085 797 735 AFSL No. 360457. The Trust Company (RE Services) Limited is a wholly owned subsidiary of Perpetual Limited (ABN 86 000 431 827). Bell Financial Trust is secured over the assets of Bell Potter Capital. Guarantee details and associated risks are disclosed in our PDS. The information provided in this document is general information only and does not constitute investment or other advice. The content of this document does not constitute an offer or solicitation to subscribe for units in the Fund. Any investment decision in connection with the Trust should only be made based on the information contained in the disclosure document for the Fund. Neither Bell Potter Capital nor Perpetual guarantee repayment of any particular rate of return from the Fund. Perpetual do not give any representation or warranty as to the reliability or accuracy of the information contained in this document. All opinions and estimates included in this document constitute judgments of Bell Potter Capital as at the date of this document and are subject to change without notice.

More settlement options

Macquarie Cash Management Account

A Macquarie Cash Management Account (CMA) provides you with easy access to funds for trading and complete visibility of transactions, via detailed online reporting.

Find out more information about the CMA here, and view the full Terms and Conditions including current interest rates and fees at macquarie.com.au/cma.

Brokerage:

| Trades | |

|---|---|

| Any trade value | $19.95 or 0.12% of the value of the trade (whichever is greater). |

Bell Direct Margin Lending

Whether you’re boosting your potential returns with leverage or want to access more funds for investing, margin lending is a powerful investment strategy.

A margin loan enables you to borrow money by using your existing portfolio holdings as security. By accessing more funds, you can increase the amount you have invested. This means you can work on building the portfolio you thought was out of reach.

Brokerage fees

| Direct margin loan brokerage fees | Your first 10 trades per month | $0 to $10,000 | $15 |

| $10,000 to $25,000 | $25 | ||

| $25,000+ | 0.1% | ||

| Your 11th to 30th trades per month | $13 or 0.08%, whichever is greater. | ||

| Your 31st trade onwards per month | $10 or 0.08%, whichever is greater. | ||

| Third party margin lenders | $15 admin fee + direct margin loan brokerage fees. | ||

Direct margin loan interest rates

Variable loan rate of 9.40% p.a. effective 04/02/2026.

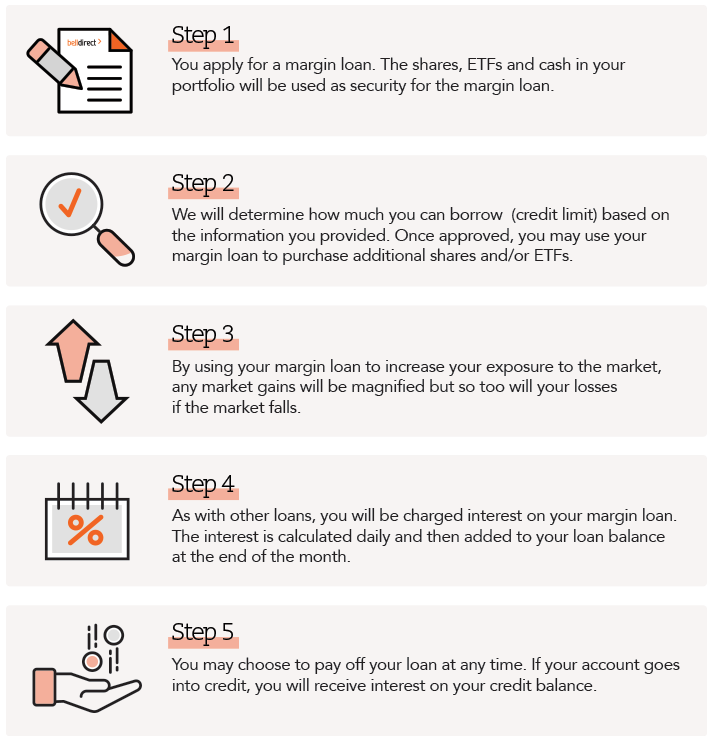

How does it work?

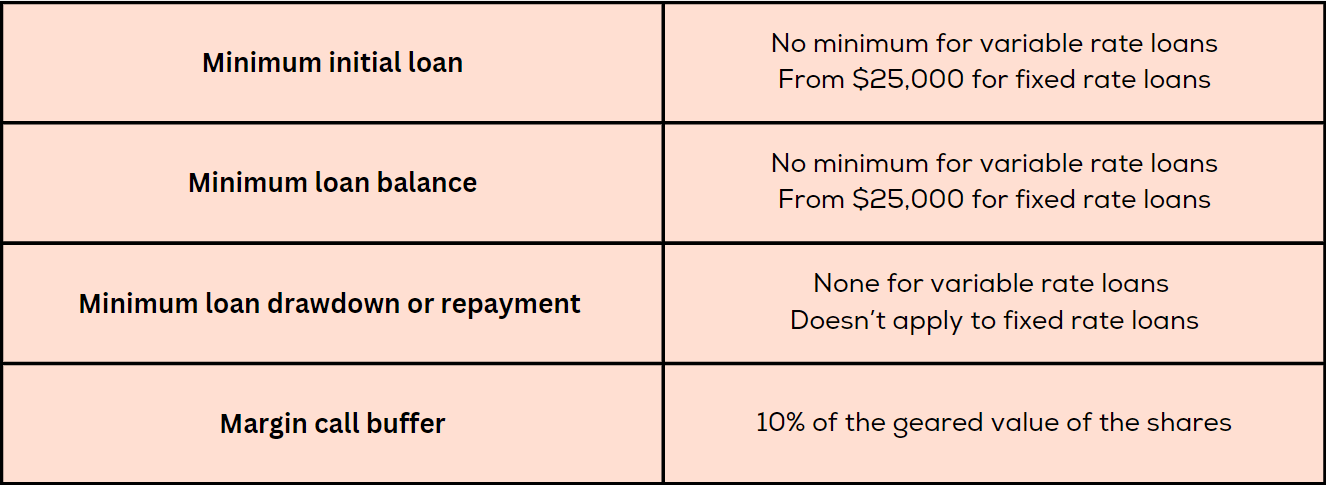

Key features of the Bell Direct Direct Margin Loan