I’M READY

I’M THINKING ABOUT IT

Our Direct Margin Lending solution

To make it easy, we’ve given you a comprehensive margin loan calculator. Plus, your trading and gearing are integrated in one solution, administered by Bell Potter Capital. Check out the benefits.

For your loan

For your trading

-

- Cash and geared shares consolidated into one account

- Portfolio immediately updated

- Free conditional orders

- Access to Bell Potter research and trading tools when you trade

- Loan to Value Ratio displayed for every stock on the order pad

- Real-time data for: credit limit, current loan balance, funds available and portfolio holding balance

Key features of the Bell Direct DML

Check how much you can borrow

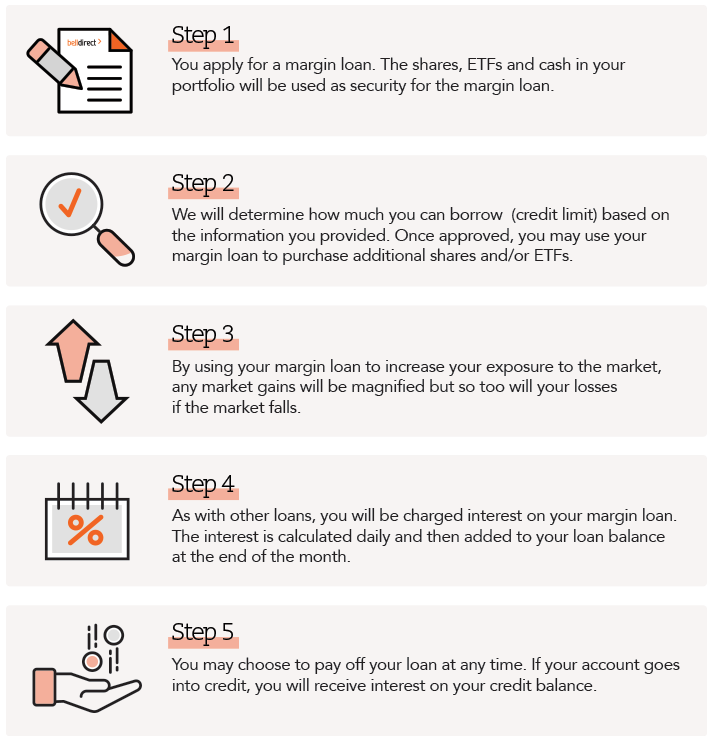

How to invest with a margin loan

To invest using margin lending, you can choose between 2 options:

You want to open a Direct Margin Loan with us

- Go to our application page. When you see: Which account do you want to use to settle your trades? Select ‘A new margin loan account‘.

- When you’ve completed your account application, you’ll get an email with a credit limit request form to complete, sign and send us back. In this form, we ask you about your income, expenses, assets and any debts you may have so we can assess how much you can borrow.

- You’ll also get an email with your DML application form to complete, sign and send us back.

- After we’ve reviewed the forms, we’ll open your account.

You want to use an existing margin loan

- Go to our application page. When you see: Which account do you want to use to settle your trades? Select ‘An existing margin loan account‘ and provide the details of your existing lender.

- When you’ve completed your account application, contact your existing margin lender to authorise Bell Direct as your broker. We’ll verify that your lending facility is active and open your account.

If you’re already a Bell Direct client, your details will be pre- populated in the application.

Please note the margin lending is not available for superannuation accounts.

What is a margin loan?

Whether you’re boosting your potential returns with leverage or want to access more funds for investing, margin lending is a powerful investment strategy.

A margin loan enables you to borrow money by using your existing portfolio holdings as security.

By accessing more funds, you can increase the amount you have invested. This means you can work on building the portfolio you thought was out of reach.

Find out how it works below.

How it works.

The upside and the flipside of margin lending.

THE BENEFITS

Boost your investing power – you can access more funds to make more investments and increase your potential returns and dividends.

Diversify your portfolio – with these additional funds, you can increase your investment options and invest in more sectors and asset classes.

Claim tax benefits – you may be able to claim the interest on your margin loan as a tax deduction.

THE RISKS

Losses are magnified – borrowing to buy more shares increases the size of your investments but also increases the risk of capital loss.

Interest rates can fluctuate – unless you’ve opted for a fixed rate loan, interest rates could rise and increase your borrowing costs and potentially reduce your profits.

Margin calls can be triggered – if the value of your portfolio falls sufficiently, you may receive a margin call and must either sell part of your portfolio, provide additional security or repay the loan.

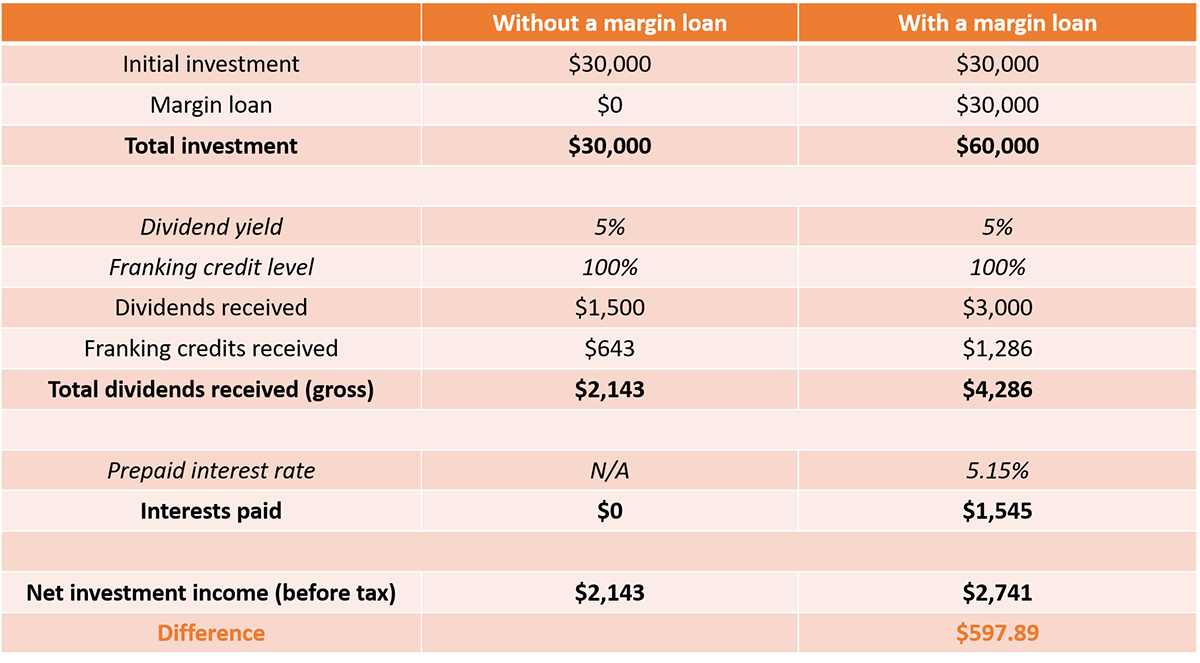

The power of a margin loan in a table

Check out this case study which compares the difference in potential returns between an investment with a margin loan and without.

In this example, a 50% level of gearing has improved returns by 27.90%. The net investment income has increased and the exposure to the share market has doubled.

Please note: the interest rates, dividend yields and franking credits used in this case study are for demonstration purposes only.

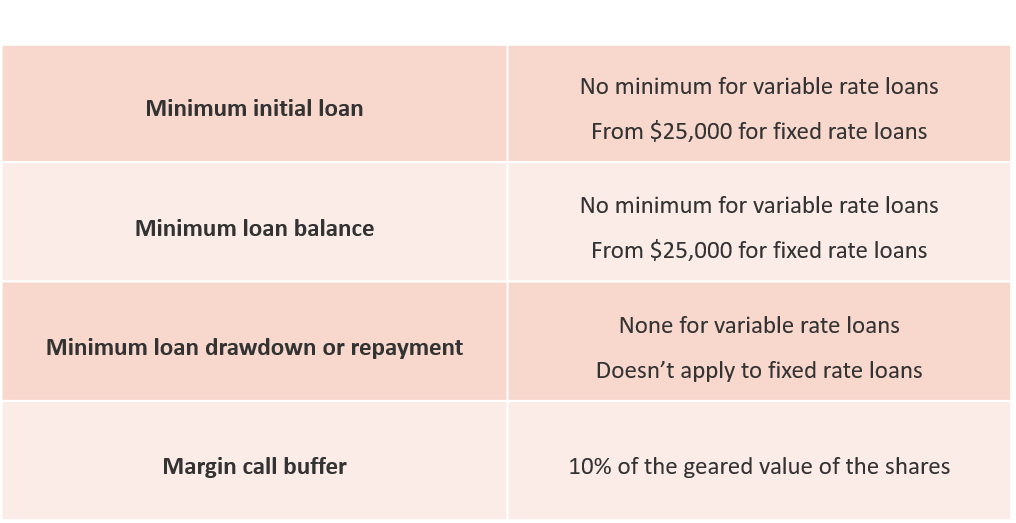

The fine print

Where can I find more information on the Direct Investment Account?

For more information about the Direct Investment Account (formally named the Bell Financial Trust ARSN 164 391 119) PDS and Additional Information click here.

The Bell Financial Trust Target Market Determination (TMD) is available free of charge by contacting Bell Potter Capital Ltd on 1800 061 327 or by clicking on this link. Previous versions of the TMD are available by calling 1800 061 327.

The Direct Investment Account (formally named the Bell Financial Trust ARSN 164 391 119) is a managed investment scheme that is registered with ASIC. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL No. 235150 is the responsible entity of the Trust. The Trust is administered by Bell Potter Capital Limited ABN 54 085 797 735 AFSL No. 360457. The Trust Company (RE Services) Limited is a wholly owned subsidiary of Perpetual Limited (ABN 86 000 431 827). Bell Financial Trust is secured over the assets of Bell Potter Capital. Guarantee details and associated risks are disclosed in our PDS. The information provided in this document is general information only and does not constitute investment or other advice. The content of this document does not constitute an offer or solicitation to subscribe for units in the Fund. Any investment decision in connection with the Trust should only be made based on the information contained in the disclosure document for the Fund. Neither Bell Potter Capital nor Perpetual guarantee repayment of any particular rate of return from the Fund. Perpetual do not give any representation or warranty as to the reliability or accuracy of the information contained in this document. All opinions and estimates included in this document constitute judgments of Bell Potter Capital as at the date of this document and are subject to change without notice.

What is the maximum gearing allowed before a margin call is triggered?

If your margin loan is fully utilised, a decline of 9.1% in the total lending value of your portfolio will trigger a margin call and you’ll need to top up your loan balance by selling some investments, transferring cash or additional security.