Thanks for joining me this Friday the 9th May, I’m Grady Wulff, Market Analyst with Bell Direct and this is our weekly market update.

Quarterly corporate updates, global trade tensions and China’s economic recovery were the key drivers of market movements this week so let’s dive into the outlook and how each of these events impact your investment journey.

Investors were also very reactive to corporate updates this week both on the trading front and to companies revealing the extent to which they are impacted or exempt from Trump’s tariffs.

Wisetech Global (ASX:WTC) fell over 2.5% on Tuesday after warning of potential demand risks from tariffs while healthcare stocks came under pressure mid-week after Trump signed an executive order to incentivise drug manufacturing in the US as tariffs on imported pharmaceuticals are expected to be announced within the next two weeks.

I spoke to Bell Potter healthcare analyst John Hester yesterday to discuss how Trump’s pending pharmaceuticals tariffs may impact some of Australia’s listed healthcare companies, here’s what he had to say.

Elsewhere this week, Westpac (ASX:WBC) and NAB (ASX:NAB) delivered contrasting first-half results. NAB beat expectations with a $3.6 billion profit, lifting its interim dividend and showing a decline in credit impairments, while maintaining a stable net interest margin. In contrast, Westpac underwhelmed—its net interest margin fell, the dividend missed expectations, and profit slipped 1% year-on-year.

With bank valuations high, Westpac’s weaker results led to a share price dip as it struggled to justify its 16.8x PE ratio. NAB, however, delivered a stronger performance that reassured investors. Notably, NAB’s strong position in business banking is drawing increased competition, with Westpac and CBA (ASX:CBA) now eyeing that space more aggressively.

On a macro level, there was big news on the trade war front— The U.S. and China have agreed to restart tariff talks, lifting market sentiment on hopes of de-escalation. And closer to home, the materials sector rallied, as China’s growth outlook improves, giving a much-needed boost to Aussie miners after two tough years of depreciated demand from our number one trade partner.

At the same time, China’s central bank announced a 25-basis point cut to a key interest rate, lowering the lending rate to commercial banks to 1.5% in an effort to stimulate the economy. Additionally, officials pledged further support for publicly listed companies impacted by U.S. tariffs. This is a welcome boost as the most recent economic data out of China revealed a return to slowed economic growth with the country’s trade surplus declining, latest monthly GDP declining, business confidence falling, manufacturing output declining, retail sales easing, and services PMI also falling.

So, with a rebound in economic growth on the horizon for China and trade war de-escalation hopeful over the coming weeks, we may see a recovery rally for our big miners and companies with exposure to the region. On the healthcare front, as John Hester said, some company’s may be affected by US tariffs, but each have or will update the market on the exact impact if any.

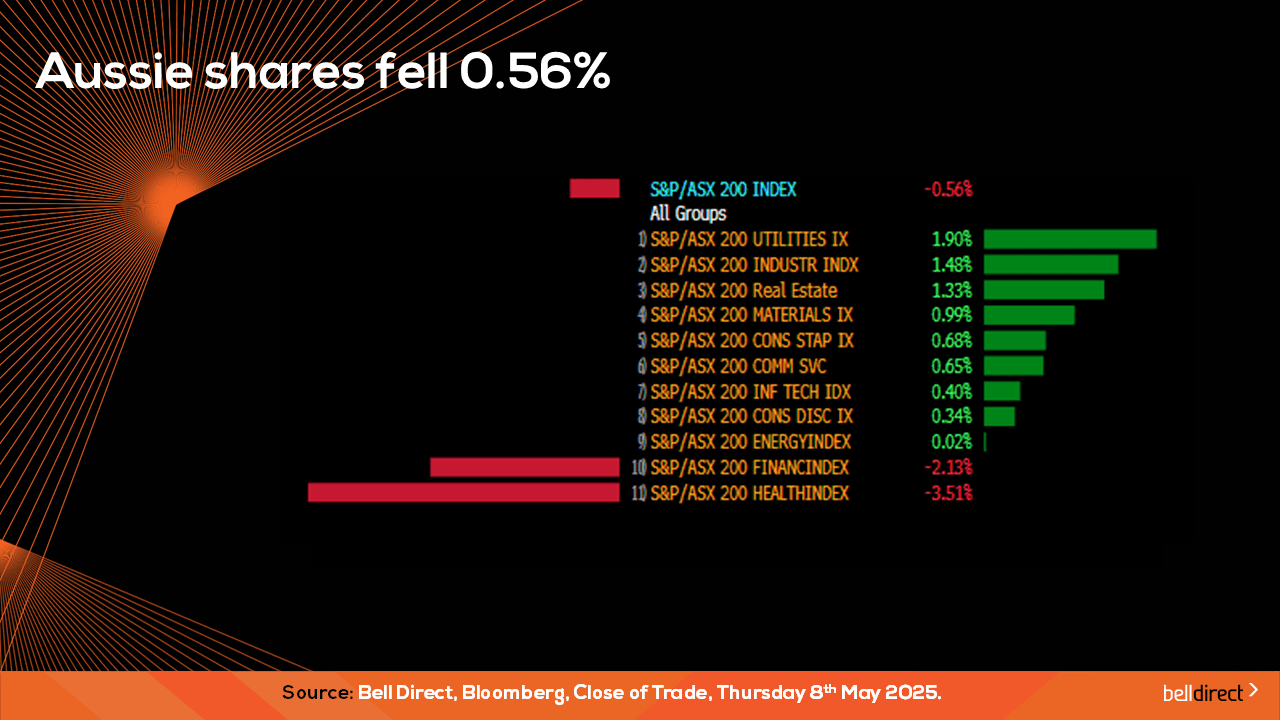

Locally from Monday to Thursday the ASX200 fell 0.56% following turbulence in the US and global trade concerns weighing on investor sentiment. Healthcare and financial stocks took the biggest hit this week while utilities stocks posted a 1.9% gain.

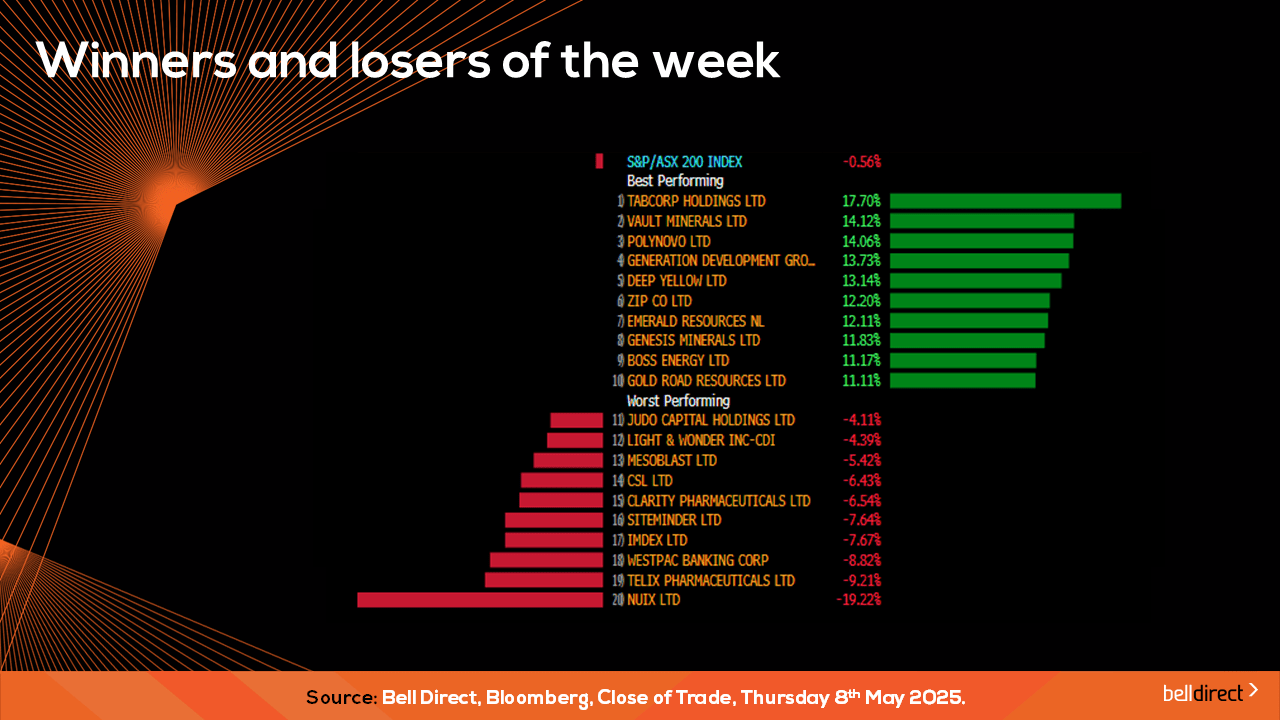

Tabcorp (ASX:TAH) was the biggest winner this week with a gain of 17.70% while Nuix (ASX:NXL) tumbled 19.22%.

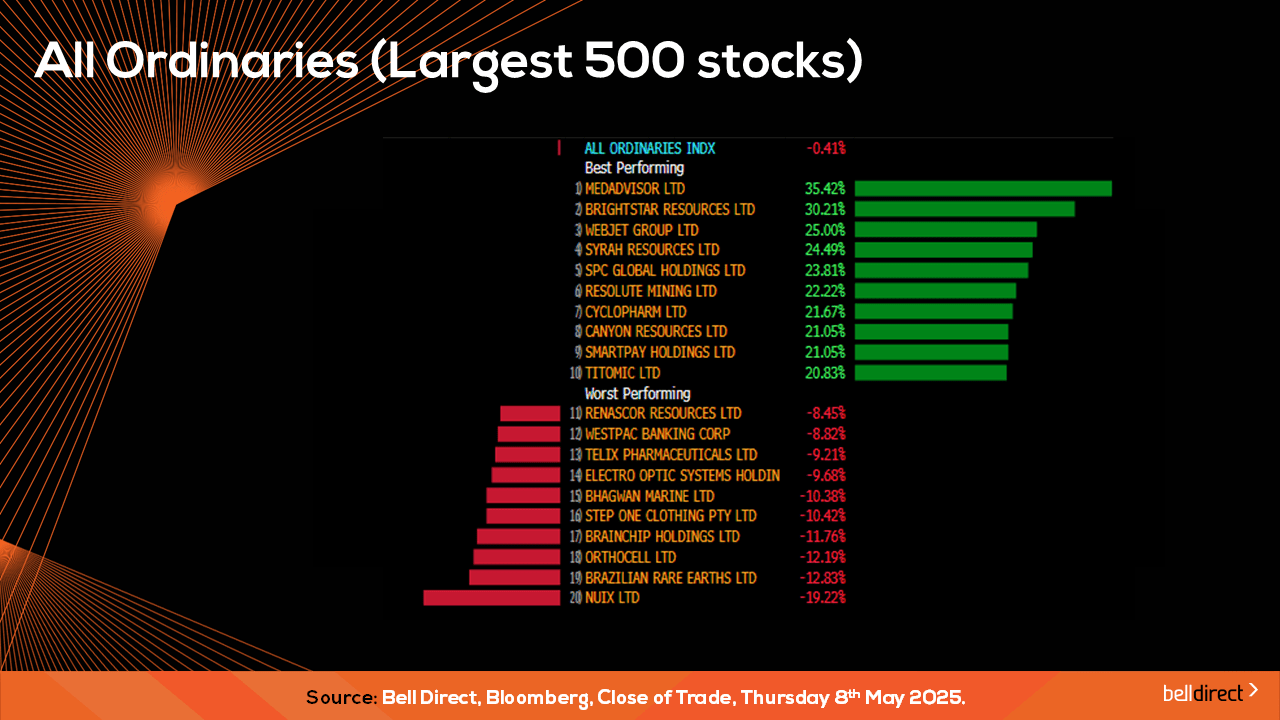

On the broader market index, the All Ords fell 0.41% over the four trading days this week as Medadvisor (ASX:MDR) rocketed 35.42% while Brazilian Rare Earths (ASX:BRE) fell 12.83%.

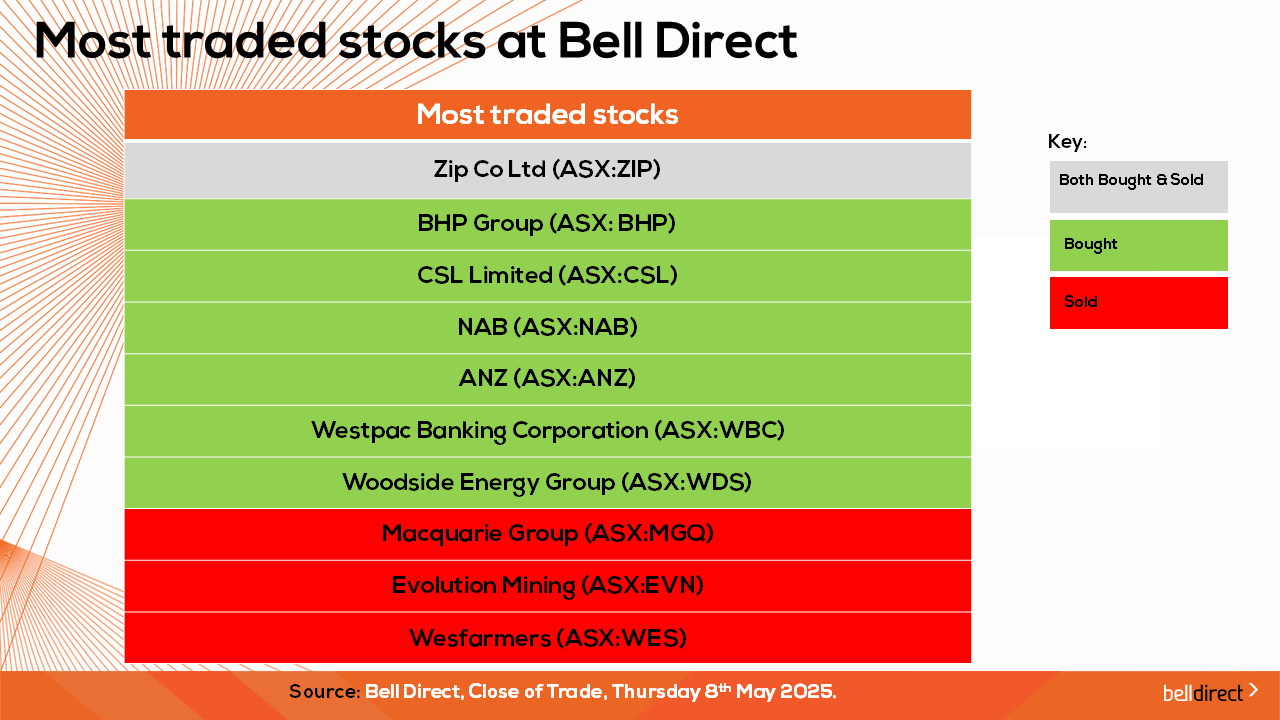

The most traded stock by Bell Direct clients this week was Zip (ASX:ZIP). Clients also bought into Westpac (ASX:WBC), ANZ (ASX:ANZ), Woodside (ASX:WDS), NAB (ASX:NAB), BHP (ASX:BHP) and CSL (ASX:CSL), while taking profits from Evolution Mining (ASX:EVN), Macquarie (ASX:MQG), and Wesfarmers (ASX:WES).

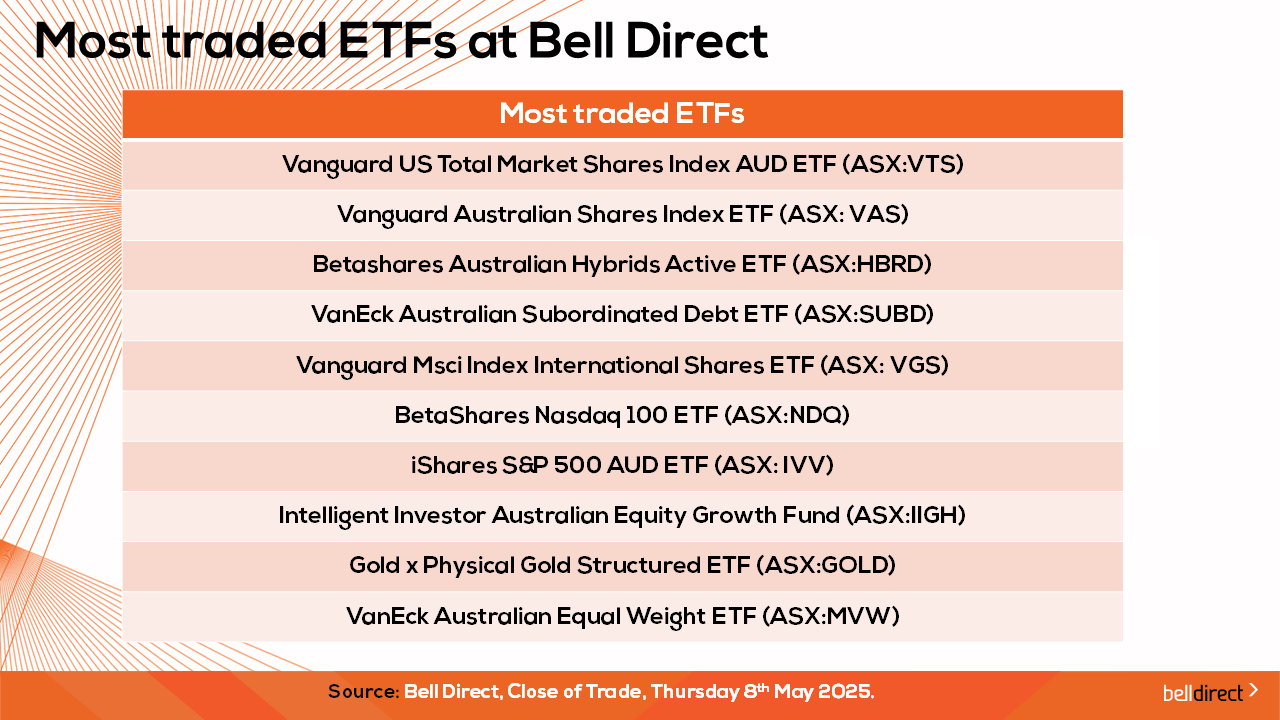

And the most traded ETFs were led by Vanguard US Total Market Shares Index AUD ETF, Vanguard Australian Shares Index ETF, and Betashares Australian Hybrids Active ETF.

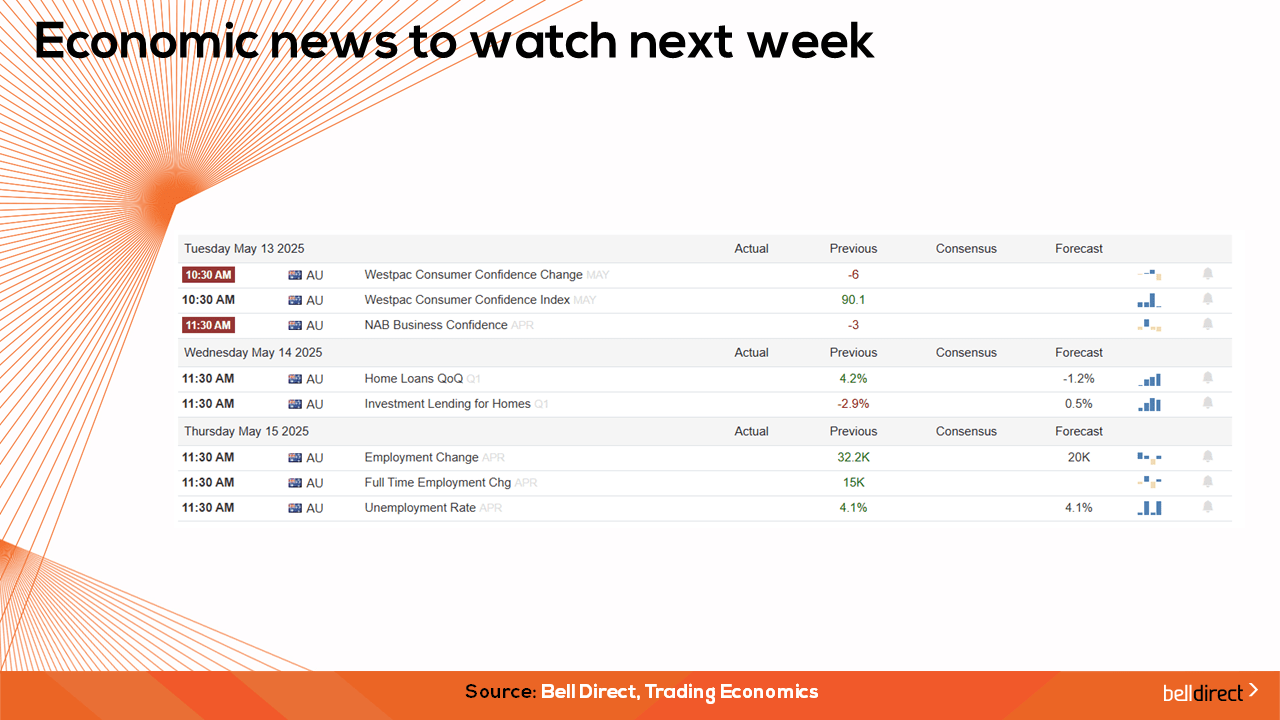

On the economic calendar front next week, we may see investors locally react to Westpac consumer confidence for May and NAB business confidence for April out on Tuesday, while overseas we will gain more clarity on the US inflation journey with key inflation, retail sales and PPI data out later in the week.

And that’s all for this week, we hope you have a wonderful weekend and happy Mother’s Day to all the mums out there. As always, happy investing.