Thanks for joining me this Friday the 16th May, I’m Grady Wulff, Market Analyst with Bell Direct and this is your weekly market update.

A long-awaited temporary trade deal between the US and China, favourable economic data and corporate trading updates were the drivers of global market moves and sentiment this week so let’s dive into the week that was on global markets.

The week started on a high as investors globally welcomed the temporary 90-day trade deal reached between the US and China over last weekend’s meeting which President Trump deemed as a great success.

The latest update from the China and US trade talks is that both nations have agreed to cut their respective tariffs on one another for 90-days, with tariffs on Chinese imported goods into the US to be 30% and tariffs on US good into China to be 10% for the period. While this is a step in the right direction and boosted markets early in the week, the temporary nature of the deal had investors concerned over what tariffs will look like after the 90-days are up.

Initial concerns over a US inflationary rebound due to tariff imposition were eased on Wednesday after US CPI data for April was released which fuelled investor appetite for growth and higher risk stocks again, leading to a pullback in safe-haven assets by midweek. US CPI data for April came in at an increase of 2.3% on an annual basis which was lower than economists’ were expecting and indicate the US inflation journey remains under control despite fears of tariffs boosting CPI, while this is only one reading it boosted investor sentiment that inflation continues to ease, and a recession may be avoided.

Locally on the economic calendar front this week we had a mixed reading of the current inflationary outlook for Australia after wages growth came in stronger-than-expected for the first three months of the year but

For the 12-months to the March quarter, wage price index rose 3.4% which was an uptick on the 3.2% wage price growth reported in December, primarily driven by private sector wages rising 0.9% and public sector wages rising 1%. New state-based public sector enterprise agreements were another driver of the rise in WPI during the March quarter, but the overall uptick in the data provides a challenge for the RBA to assess ahead of the next rate meeting next week where it is currently a 50:50 split in market expectations that the RBA will cut the current cash rate to 3.6%.

Jobs data out on Thursday outlined the resilience and strength of the current Australian jobs market that could work against the RBA’s rate journey as more jobs were created than expected in the last month. For the month of April, 89,000 Aussies found work which was a significantly higher number than the 22,500 markets were expecting, while the unemployment rate remained steady at 4.1%. With more Aussies finding work, more money circulates within the economy and drives inflation higher through greater consumer spend.

While global markets experienced some boosts this week, all eyes will be on the RBA next week when Australia’s central bank will meet to hand down the latest interest rate decision.

Now on a stock specific level we had some strong share price movement this week from:

- Xero as shares rallied on Thursday after the cloud-based accounting software platform reported a 23% increase in operating revenue to NZ$2.1bn for the full year, while annualised monthly recurring revenue grew 22%. Xero also reported a 30% increase in NPAT to NZ$227.8m.

- Aristocrat Leisure tumbled 13% on Wednesday after the gaming giant released first half results that missed investors hefty expectations. For the period, ALL reported a 9% increase in revenue YoY to $3bn, EBITDA up 13% to $1.2bn and NPAT rose 0.1% to $664.9m.

- GrainCorp as the ag company rallied on a solid first half result including upgrading its full-year guidance following a strong east coast harvest season.

- And Location tracking tech giant Life 360 soared over 10% on Tuesday after releasing record Q1 results including a 33% increase in total subscription revenue to US$81.9m, a 32% increase in total revenue to US$103.6m and positive operating cash flow of US$12.1m, up 13% YoY, and the company ended the quarter with cash, cash equivalents and restricted cash of US$170.4m.

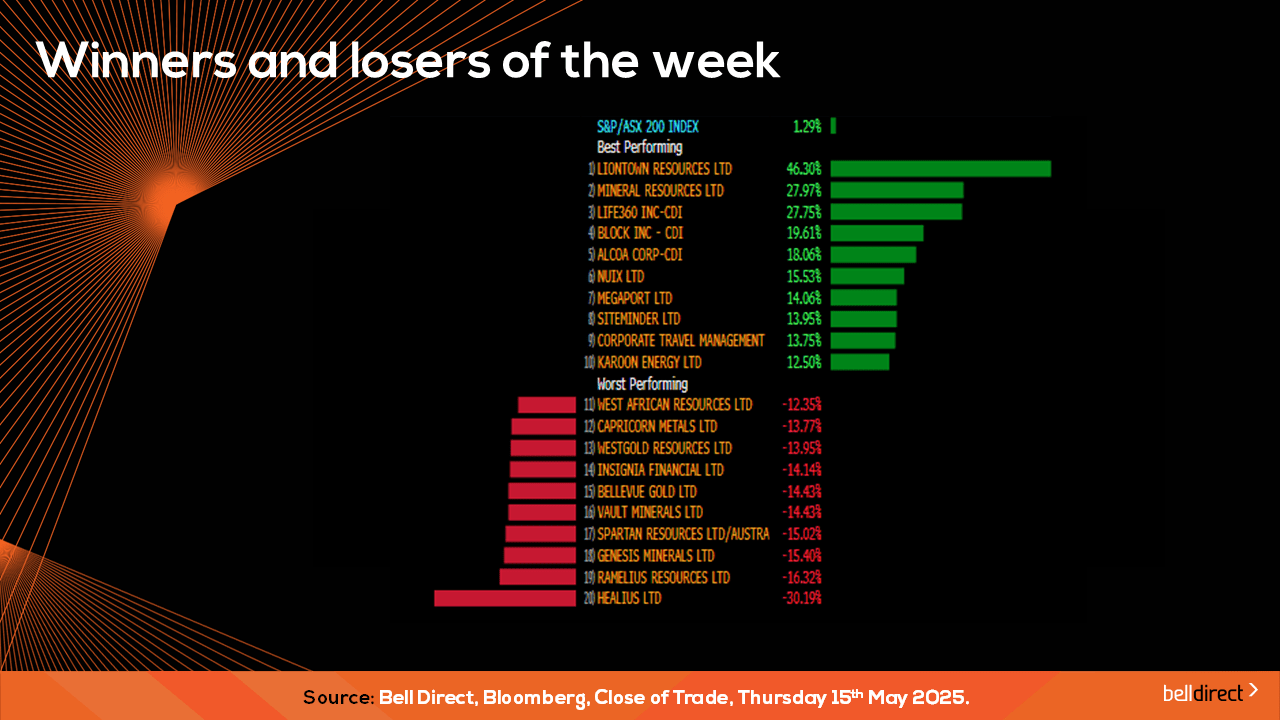

Locally from Monday to Thursday the ASX200 rallied 1.3% as a more than 8.5% surge among tech stocks offset weakness for the utilities, staples and REIT sectors.

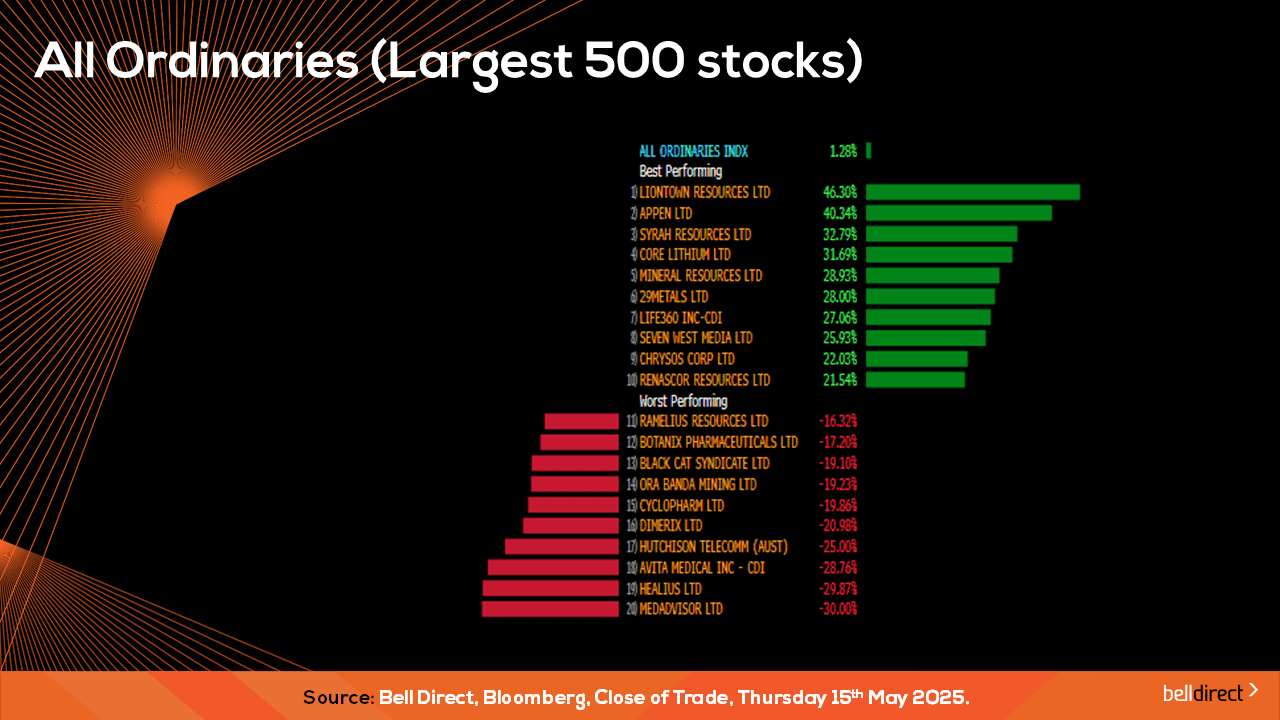

On the broader market index the All Ords gained 1.28% this trading week led by Appen (ASX:APX) rising 40.34% while Medadvisor (ASX:MDR) fell 30%.

The most traded stocks by Bell Direct clients this week were BHP (ASX:BHP), Macquarie Group (ASX:MQG), and Woodside (ASX:WDS). Clients also bought into CSL (ASX:CSL), ANZ (ASX:ANZ), Aristocrat Leisure (ASX:ALL), and Northern Star Resources (ASX:NST) while taking profits from Fortescue (ASX:FMG), CBA (ASX:CBA) and Zip (ASX:ZIP).

And the most traded ETFs were led by iShares S&P 500 AUD ETF, Vanguard Msci Index International Shares ETF and Global X Fang+ ETF.

On the economic calendar front next week we may see investors locally react to the RBA’s rate decision announced on Tuesday, while overseas we will gain further insight into China’s recovery through industrial production and retail sales data out on Monday.

And that’s all for this Friday and week, have a wonderful weekend and happy investing.