Thank you for joining us this Friday 5th December. I’m Sophia Mavridis, a market analyst with Bell Direct and this is the weekly market update.

Bell Potter recently released a note on emerging markets to consider, which we’ll break down for you today and why it might be a good time to look closer at emerging economies such as India, China, Brazil or South Korea.

Emerging Markets are expected to grow their economies faster than the developed countries we live in. While they only make up about 10% of the main global stock index, they account for 40% of the world’s economic output. That difference in growth is expected to keep widening over the next five years, which is a big tailwind for the companies operating in those countries.

This growth is fuelled by the rising middle class, especially in Asia. As incomes rise and people move to cities, they start buying more—including consumer goods, better healthcare, and financial services like mortgages and insurance. By 2030, Asia is expected to be home to two-thirds of the global middle class. This is creating a large new group of consumers eager to spend, making these economies less reliant on what they sell to the rest of the world. Therefore, the growth story is strong for the medium term, but considering the present, Bell Potter highlights two short-term factors. The first is price. Right now, emerging market stocks are considered cheap. They are trading at a significant discount compared to developed market stocks—a discount that historical data suggests is too steep. Essentially, you can buy into the same strong earnings growth expected over the next few years, but at a much lower price.

The second factor is the US Dollar. When the US Dollar gets weaker—which is Bell Potter’s expectation over the next year—it’s historically a tailwind for emerging market stocks, as a weaker dollar makes it cheaper for emerging market governments and companies to pay back their debts, often in US Dollars. It also gives their central banks more flexibility to support their economies.

So, how to get started? Bell Potter has a two-part approach. A broad fund to give you exposure to the entire emerging market index. For this, they recommend the JPMorgan EM Research Enhanced Index Equity Active ETF (ASX:JEME). This gives you a diversified, index-aware foundation.

Then, a targeted allocation to the area with the strongest earnings growth—and that is Asia. They suggest the Fidelity Asia Active ETF (ASX:FASI), which is managed by experts on the ground to capture the best opportunities in that specific region.

Now, moving onto our local market’s performance this week so far, the ASX200 is trading flat over Monday to Thursday this week. Energy, materials and utilities are the best performing sectors, while healthcare and real estate have declined the most.

On the ASX200 leaderboard, Capstone Copper (ASX:CSC) advanced the most, as the price of copper hit a new all-time high, boosting ASX- listed copper shares. The price of copper has been on the rise due to potential US tariffs and increased orders at the London Metals Exchange, which as increased concerns around support and arbitrage opportunities. Copper companies can benefit from rising demand due to its crucial link in the global energy transition.

On the other end, AUB Group (ASX:AUB) was down the most. The insurance broker was in takeover talks with EQT Holdings (ASX:EQT) and CVC limited (ASX:CVC) but there was no agreement made.

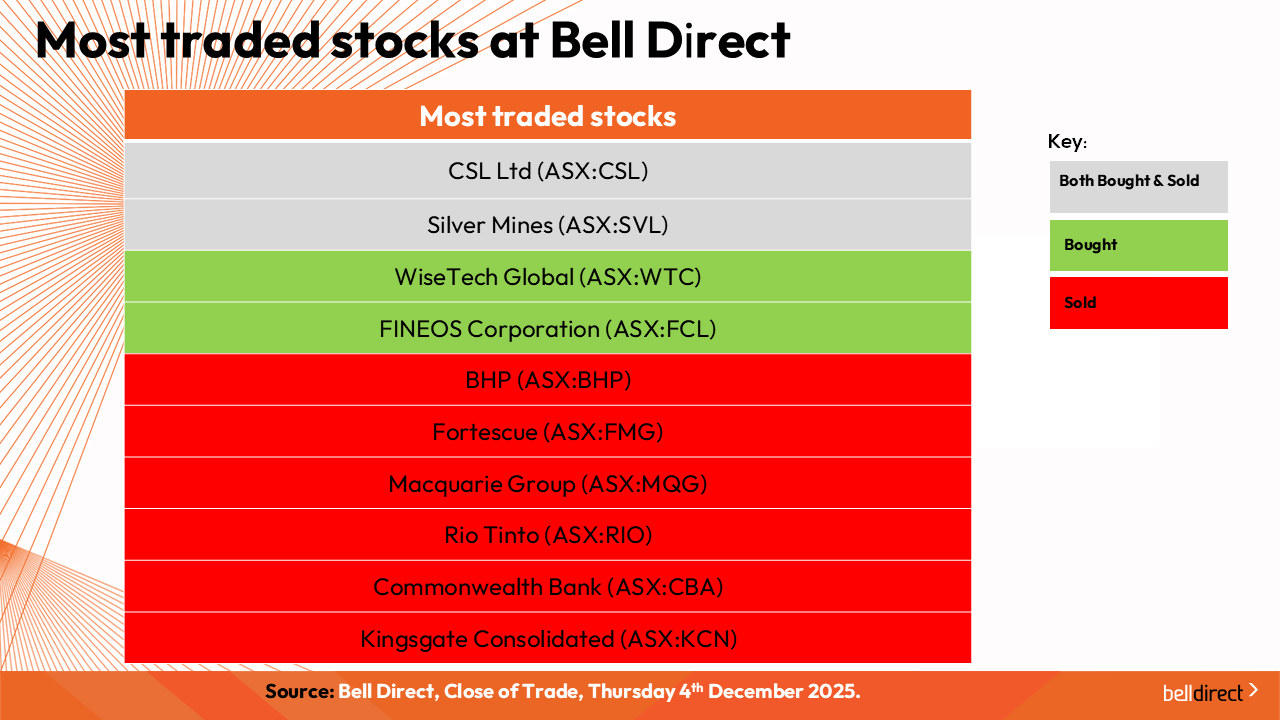

As for the most traded stocks by Bell Direct clients this week, these included, CSL (ASX:CSL) and Silver Mines (ASX:SVL). Client bought into WiseTech Global (ASX:WTC) and FINEOS Corporation Holdings (ASX:FCL). While they took profits from BHP Group (ASX:BHP), Fortescue (ASX:FMG), Macquarie Group (ASX:MQG), Rio Tinto (ASX:RIO), Commonwealth Bank (ASX:CBA) and Kingsgate Consolidated (ASX:KCN).

And the most traded ETFs were Global X Physical Silver (ASX:ETPMAG), Global X Physical Gold (ASX:GOLD) and the Vanguard MSCI International shares ETF (ASX:VGS).

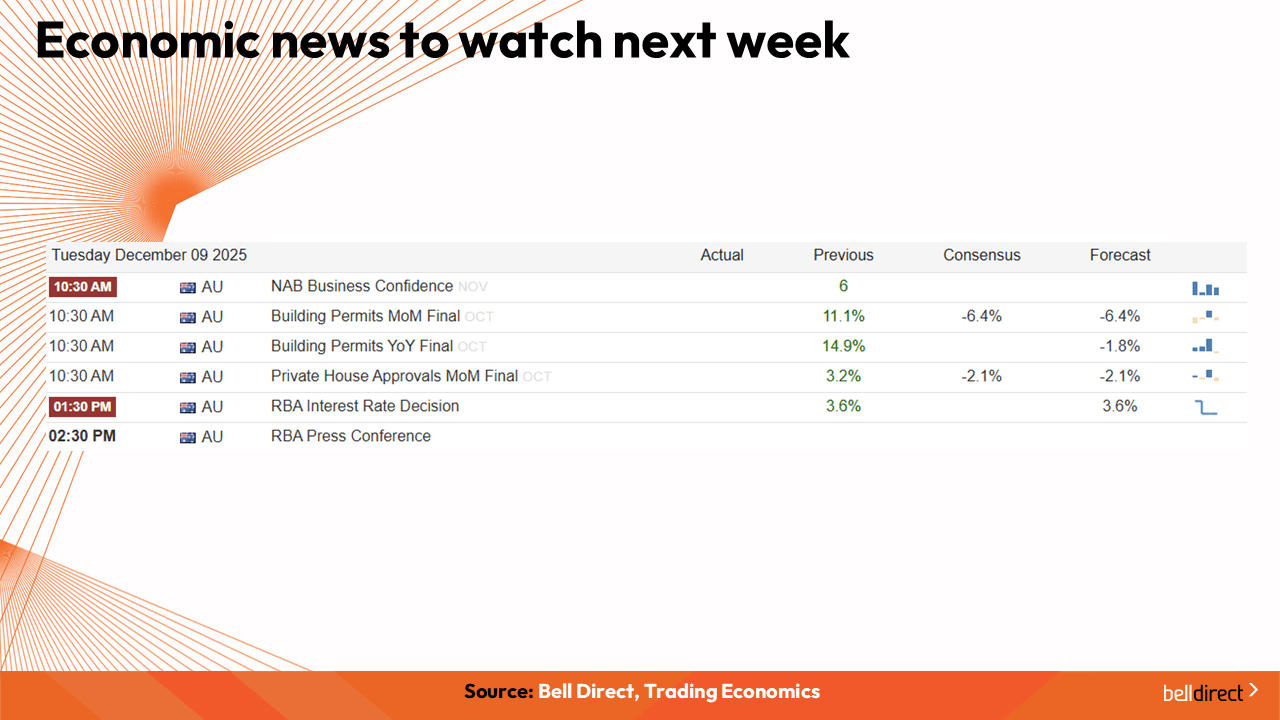

And to end on economic news items to watch out for, on Tuesday NAB’s business confidence data for November will be out at 11:30am AEDT and at 2:30pm, the RBA will announce its next interest rate decision.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great day and happy trading.