Managed funds are beginning to play an important complementary role in direct share-dominated portfolios. Bell Direct Chief Executive Arnie Selvarajah explains why.

Smart investing is an art and a skill. Pick the right stock at the right time and investment returns quickly flourish.

Now broaden that investment palette and apply the same principles. Investment returns not only flourish, but the ride becomes smoother.

Welcome to a new world of access beyond direct shares.

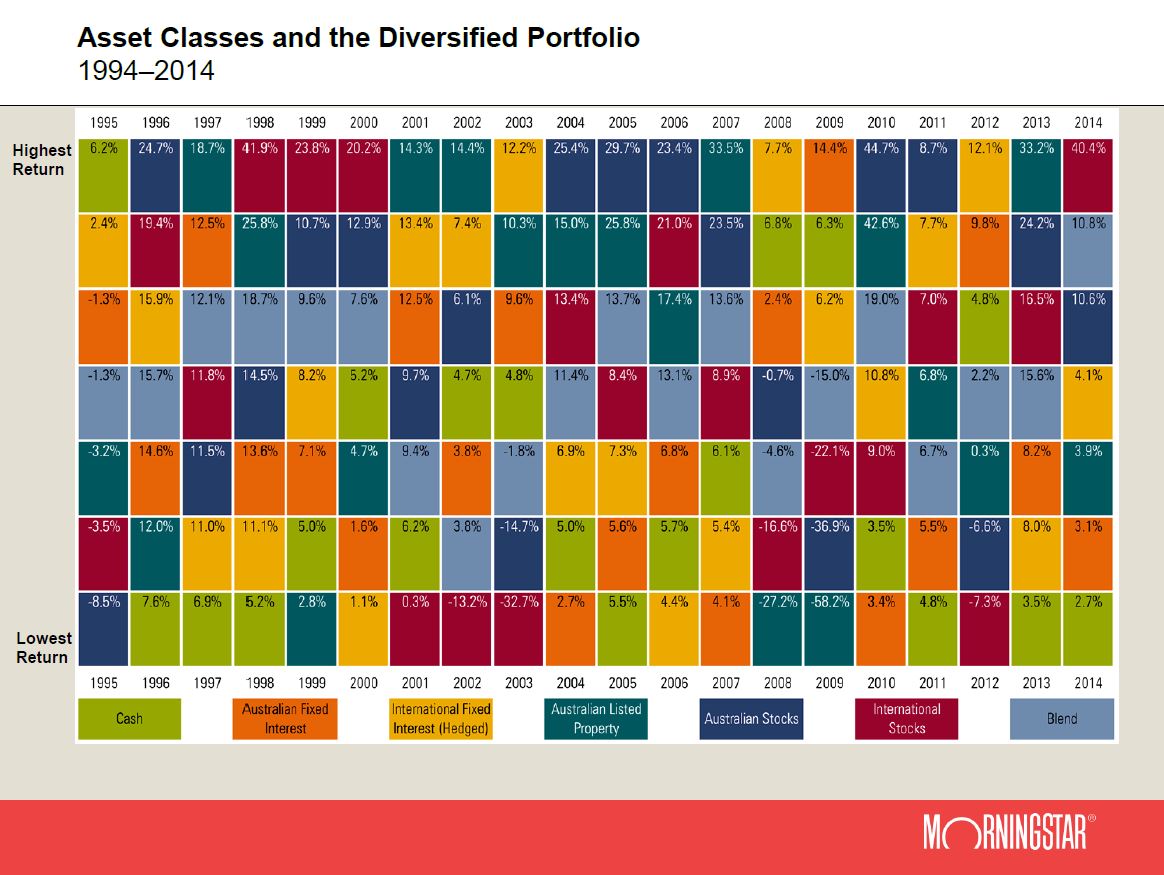

It is a trend being driven by Australian share investors who also want the benefits of holding a range of different asset classes – global equities, as well as property and bonds – because they rise and fall at different times.

That access comes in a surprisingly different wrapping – managed funds – but the investment goals remain the same.

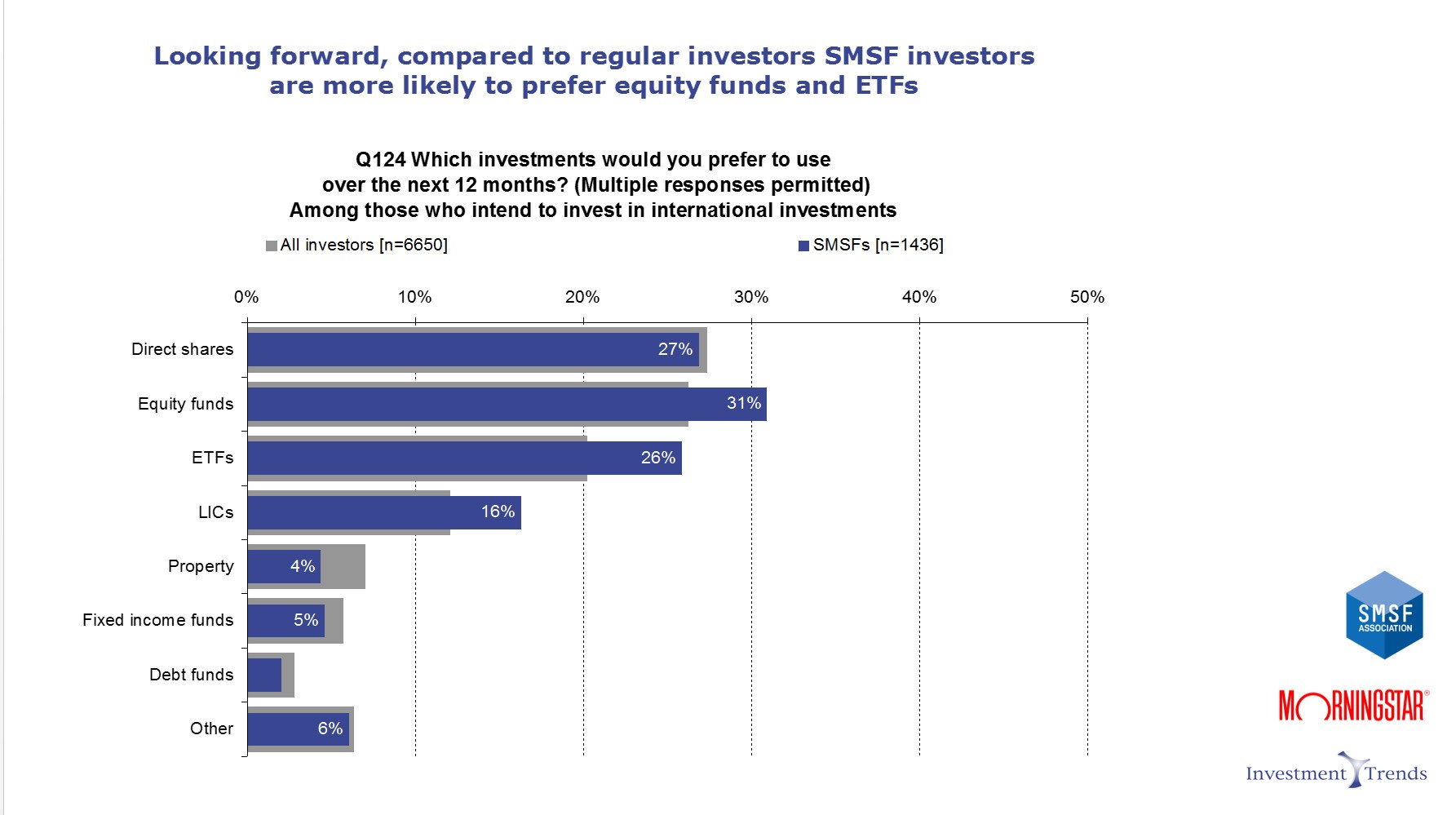

Almost one-third of self-managed super fund (SMSF) trustees who are considering investing in global equities now prefer managed funds, according to a new report by research house Investment Trends. That’s higher than direct shares, exchange-traded funds (ETFs) and listed investment companies (LICs).

It suggests there is a sea-change occurring among SMSFs which have, historically, shown a preference for concentrated direct share portfolios, residential property and bank deposits.

The ASX mFund Settlement Service, which was launched last year to allow investors to trade unlisted managed funds via their broker, is now a central pathway for access to a range of asset classes. It is a low-cost, efficient platform, which makes buying units in an unlisted managed fund as simple as buying shares in a blue-chip stock.

International equities

A Financial Services Council survey last year found 15 per cent of SMSFs are considering investing in international shares. It’s a trend I’m also seeing among Bell Direct clients.

Why?

While investors have enjoyed strong recent gains from the Australian sharemarket – including a spectacular start to 2015 – they’re also concerned that it may be slightly over-valued amid a weakening economy.

By way of contrast, the US economy is recovering strongly and, combined with the declining Australian dollar, is making global equities a compelling proposition.

Direct international shares can have a place in a portfolio but also come with caveats.

Global stocks are often trading while we’re asleep, limiting local investors to either end-of-day or start-of-day prices. Intra-day price movements naturally become a greater risk.

Managing both offshore stock prices and foreign exchange movements at the same time is more difficult while extra costs are often hidden in foreign exchange spreads when buying and selling.

An Australian-dollar denominated managed fund, managed by a team of professional fund managers, can alleviate many of these concerns, including related issues such as withholding tax and IRS forms.

Australian shares

Australian equities often play a dominant role in portfolios. That home bias has paid off well for investors with Australian shares delivering 11.8 per cent a year between 1980 and 2014, according to research house Morningstar.

While almost 6 million Australians own direct shares according to the ASX, a growing number of investors are also using ‘core-satellite’ approaches to tilt their direct share portfolios. It opens up access to a range of new investment styles and techniques which can be too costly for an investor to undertake alone.

For example, an investor may tilt their portfolio towards value stocks by replacing some of their direct shareholdings with a small allocation to a value manager when markets appear over-valued.

Conversely yield-focused investors may consider buy-write strategies, where a fund manager uses options to generate higher levels of quarterly income.

Property

Commercial property is often ignored by Australian investors who typically count residential property as one of their largest assets.

However, actively-managed commercial property funds tend to produce better yields of 6-8 per cent – more than double the levels of typical residential investments (which tend to produce better capital gains).

Commercial property funds hold a wider range of properties, backed by long-term tenants, across a range of sectors such as industrial and office, which further reduces risk.

Managed funds also have the benefit of allowing partial lots of units to be sold as needed whereas residential property is far less liquid.

Bonds

Bank-held deposits remain particularly popular among SMSF investors although concerns are rising about falling interest rates.

While declining interest rates typically provide a boost to bond funds, many investors continue to harbor concerns about the eventual negative impact of rising rates.

While rates are expected to rise in the US this year, active bond managers can shift their allocations to regions less affected, such as Europe, or decrease a bond portfolio’s sensitivity to rising rates by investing in shorter-term or floating rate securities.

While many sovereign bonds issued by governments are now offering low to negative yields, a number of high quality corporates – including blue-chip Australian companies – continue to issue attractively priced bonds which an active fund manager can invest in.

Such forecasts rely on historic asset class return and volatility data but the concept of portfolio diversification has been soundly tested over decades and continues to be successfully employed by professional investors.

mFund: a personal view

Like many investors, my SMSF consists predominately of direct shares, as well as ETFs and LICs. After a recent review, I decided that a higher exposure to commercial property would likely boost my portfolio’s long-term returns.

But rather than buy a specific listed property security or ETF, I decided to invest in my first unlisted asset: a managed fund.

Up until now, such a move would have cost me a significant amount of personal time filling in paperwork and then manually updating my SMSF administrator with the value of my investment.

Instead, I saw it as an opportunity to test the ASX’s mFund Settlement Service.

I was able to use the cash in my Bell Direct account – which is linked to my SMSF administrator – to buy the property managed fund units online. No new client forms, paperwork, cheques, or waiting for weeks for processing.

The transaction was confirmed online and the value of units in my new property fund automatically flowed through to my SMSF administrator.

While listed assets are still likely to form the core of my SMSF, I now have the ability to strengthen it with a range of new, professionally-managed asset classes through mFund.

It has created a new pathway to asset classes which were once the preserve of large investors, bringing with it the opportunity for higher returns through active management and lower risk through greater diversification.

The opportunity is now there for investors to embrace those options.

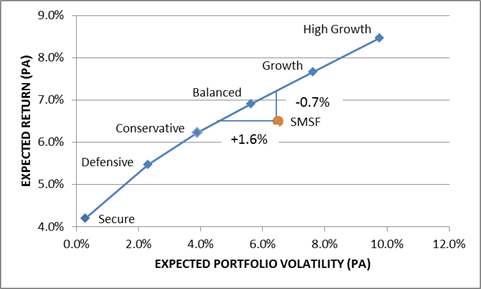

Improved access to a range of new asset classes provides the foundation for portfolio diversification. A well-diversified portfolio can produce more efficient returns for the same level of risk.

Take a typical SMSF portfolio, comprised of 50 per cent Australian equities, 49 per cent cash and just 1 per cent global equities.

Adding a range of asset classes (emerging market equities, property, global listed infrastructure, alternative assets, and bonds) produces a 0.7 per cent a year higher expected return (an 11 per cent increase) at similar volatility levels, according to an analysis by actuaries Milliman Australia.

Similarly, a more risk-averse investor could construct a more diversified portfolio to deliver similar returns as their initial portfolio but with 1.6 per cent lower volatility (a 24 per cent decrease in risk).