When it comes to investing, many Australians have a significant bias towards big Australian shares, despite the benefits offered by diversifying to different sectors and regions. Naturally, investors are more comfortable investing in domestic companies that are well known in the local market as opposed to investing in international companies in less familiar offshore markets.

If we’ve learnt anything in the last 12 months, it’s that having a diversified portfolio is a crucial tool to help mitigate the risk of any losses from unexpected market falls. One way to do this is through diversification into international markets using Exchange Traded Funds (ETFs).

To recap, ETFs are managed funds that are traded on an exchange, similar to individual shares. Each ETF typically invests in a basket of shares that track an index, such as the S&P/ASX200, which represents the 200 largest companies on the Australian Securities Exchange (ASX).

The home bias of local investors is unsurprising, given Australia’s swift and effective response to containing and managing the pandemic and the policy measures from the government and the RBA, which were deployed quickly and aggressively. Despite this, the local market was sluggish to return to pre-COVID-19 levels. This shows the dislocation that can occur between share markets and economies, underscoring the importance of taking a diversified approach to investing.

Widen your investing horizons

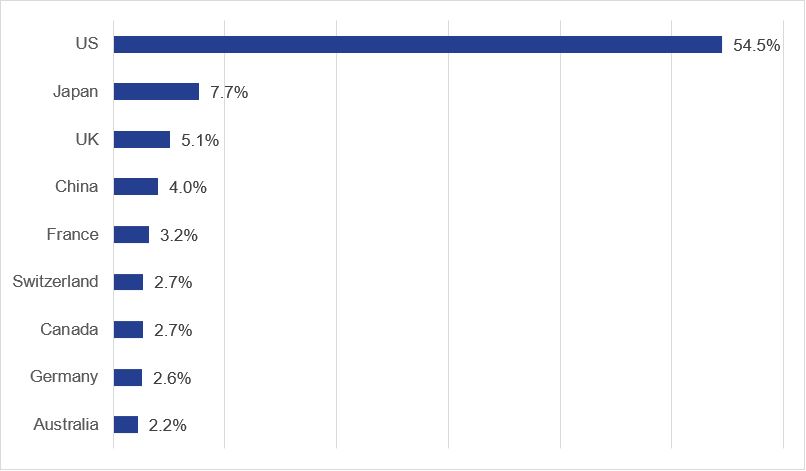

As shown in the following chart, when looking at the combined value of all global stock markets, the Australian market is dwarfed by the U.S. (which makes up over half), along with Japan, the UK and China.

Countries with the largest share markets worldwide (June 2021)

Alongside having a small global market share, Australia’s marketplace has largely remained the same over the last decade. With the ASX300 comprising primarily of financial organisations and resources companies.

Looking offshore therefore allows investors to diversify geographically as well as across asset classes to construct a well-rounded portfolio.

A popular way to do this is via ETFs, which offer a simple and easy way to invest in a portfolio of international shares.

An international ETF gives you access to tens, hundreds or thousands of stocks in one ASX trade. Investors can invest in a specific country, such as the U.S., Japan or the UK, via dedicated ETFs which track the respective local share market. Another option is to invest in a fully diversified global ETF which doesn’t include Australia, such as the SPDR S&P World ex Australia Fund (ASX:WXOZ).

Tap into specific countries, regions and sectors

Investors can use ETFs to diversify into a specific country, such as the US, Japan or the UK. In doing so they can take advantage of the relative strength of a particular economy and mitigate the risk of having all their capital tied to the success of the Australian economy. For instance, you can invest in an ETF which follows the top 100 shares traded on the London Stock Exchange such as the BetaShares FTSE100 ETF (ASX:F100).

Additionally, consider diversifying into different sectors, such as technology.

The Morningstar Global Technology ETF (ASX:TECH) holds global tech darlings such as Microsoft, Salesforce, and Uber. Similarly, the BetaShares Nasdaq 100 ETF (ASX: NDQ) tracks the largest 100 stocks on the US NASDAQ exchange, which includes companies such as Tesla, Amazon and Apple.

It’s also worth looking into Asia’s growing tech sector. Consider the Vanguard FTSE Asia (ex-Japan) ETF (ASX:VAE) and the BetaShares Asia Technology Tigers ETF (ASX:ASIA) to tap into this market.

The technology sector is now so big that investors can also invest in specific subsectors that tap into megatrends, such as cybersecurity, artificial intelligence and robotics. Take a look at BetaShares’ dedicated ETFs which cover these emerging investment themes: (ASX:HACK), (ASX:RBTZ) and (ASX:ROBO).

Alongside technology, the global healthcare sector attracted attention during the race for a COVID-19 vaccine and has remained in the limelight as the world grapples with ongoing health implications. The sector is also benefiting from longer term trends, which include the growth of the telehealth sector in the US, an ageing global population and the emerging middle class in Asia. Some examples of ETFs that target this space are BetaShares’ BetaShares Global Healthcare ETF (ASX:DRUG) and the iShares Global Healthcare ETF (ASX:IXJ).

Investors cannot be blamed for wanting to stick by the familiarity of Australian equities over recent times. Particularly as Australia’s recovery is looking increasingly positive after bouncing back from a recession, starting to roll out a vaccine and seeing our share market hit record highs.

Yet, investors who wisely look further afield will be better placed than those taking comfort in their home bias. As the global economy continues to boom, a worldly approach to portfolio construction will capitalise on growth opportunities and ETFs are a simple and cost-effective way to gain exposure through a Bell Direct online investing account.