There are many things you can control in life. A global health pandemic is not one of them, however the asset allocation and diversification of your portfolio is.

The benefits of a diversified portfolio shouldn’t be underestimated. Why? Because share markets are fast paced, meaning it can be difficult for investors to stay updated with market movements and make decisions on the best performing individual investments.

One way to navigate this pain point and simplify the decision-making process is to incorporate exchange traded funds (ETFs) into your investment portfolio.

Each ETF typically invests in a basket of shares that track an index, such as the S&P/ASX200, which represents the 200 largest companies on the Australian Securities Exchange (ASX). ETFs provide a simple way to achieve diversification by offering access to a vast range of markets and asset classes.

It’s important to note that it is perfectly normal for the Australian share market to fall about one in every five years. One of the biggest impacts on your overall portfolio return is your asset allocation. Diversification across different asset classes reduces the risks associated with the performance of the Australian share market and diversification can offer some protection when shocks such as COVID-19 or the global financial crisis occur.

For example, when returns from one asset class are low, returns from another may be high, smoothing out the overall performance of your portfolio. The good news is that markets go up over the long term.

It’s important to note that the risk of investing can never be fully eliminated, but it can be greatly reduced through diversification efforts.

If incorporated mindfully, ETFs can provide several layers of portfolio diversification, such as:

- Asset class diversification

- Market diversification

- Sector diversification

Asset class diversification

Through a few strategic ETF trades, you can easily build a fully diversified portfolio with exposure to the four main asset classes: equities (both local and international), fixed income, property, and cash.

Equities and property are traditionally considered growth assets, meaning they will grow your investment over time. In saying this, they are also high-risk, high reward and are more susceptible to market volatility. Volatility is simply the extent to which an investment rises and falls in value over a period of time.

On the other hand, fixed income and cash are considered income or defensive assets. Defensive assets tend to be less volatile than growth assets that deliver reliable, stable income.

Consider your risk appetite before choosing which asset classes to include in your portfolio when aligning your portfolio with your investment goals.

Market diversification

ASX research has concerningly shown that self-directed investor portfolios tend to be too focused on just the Australian share market. Considering the Australian market represents less than 3% of the world’s investable assets, local investors are missing out on diversification opportunities globally.

For example, Vanguard’s ETF (ASX:VGS) tracks the performance of 20 global developed markets including the US, Japan, UK, France and Canada. In one ASX trade investors can access over 1,500 companies. The largest companies include Apple, Microsoft, Facebook, VISA, Johnson & Johnson and Nestle.

In more recent times, each country across the globe has been affected differently by the pandemic, meaning share markets in differing regions had unique reactions and fluctuations. This will also mean their economic recovery will be different, giving diversified global investors the opportunity for upside as overseas markets rebound.

Sector diversification

Most Australian investors hold a number of blue-chip shares in their portfolio, such as Commonwealth Bank of Australia (ASX:CBA) and Rio Tinto (ASX:RIO). However, with a concentration on financials and materials (which comprise over 45% of the market), many investors don’t have adequate exposure to other sectors.

The technology sector was one of the best performing sectors in 2020. There are only a handful of technology stocks available on the Australian Securities Exchange, meaning investors need to consider looking globally to access this theme. For example, the BetaShares ETF (ASX: NDQ) tracks the performance of 100 technology stocks listed on the NASDAQ, including Apple, Amazon, Alphabet, Intel and Cisco Systems.

Bringing it all together

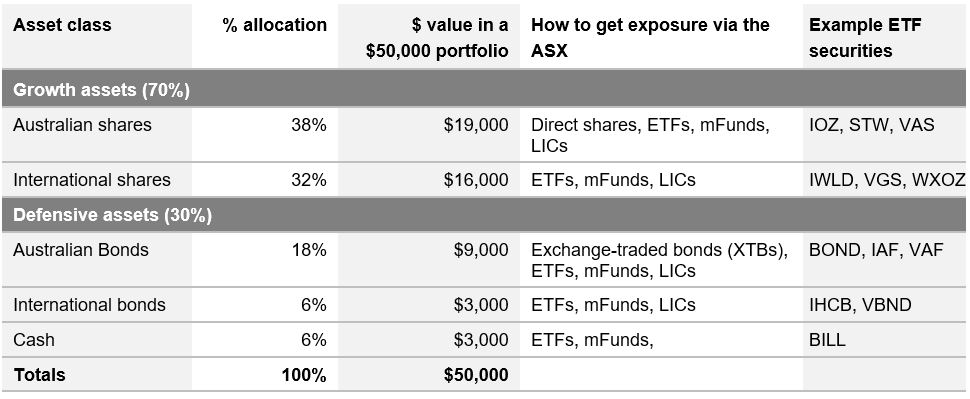

Here’s an example of an asset allocation from BlackRock, the world’s largest fund manager. A typical growth portfolio has about 70% of its assets in growth assets and 30% in income assets. A financial adviser can help define an asset allocation that is right for you.

Want an easy way to compare?

With over 260 ETFs available through the Australian share market, this is an unrealistic number to easily compare and can often be a pain point for investors.

As a Bell Direct client, you can access the Bell Direct ETF Filter which enables you to easily compare ETFs by performance, fees, asset class, sector, issuer and ICR, in order to help you build a diversified portfolio.