Author: Chris Fox is the Head of Product at Bell Potter Captial

Borrowing funds (margin lending) to increase your investing capacity can be a powerful wealth creation tool. Margin lending is a gearing strategy that may suit informed and experienced investors seeking to accelerate portfolio growth and magnify potential returns.

KEY TAKEAWAYS ON MARGIN LENDING

- A margin loan is an ongoing line of credit that lets you borrow funds to buy lender-approved securities, using existing approved securities as collateral.

- Margin lending can enable greater portfolio diversification, and its flexibility lets you quickly take advantage of investment opportunities when they arise.

- Loan interest expenses may be tax deductible, and pre-paying interest before the end of the financial year can give cash flow certainty and potentially accelerate tax deductions.

- Like all forms of gearing, margin lending can potentially grow your wealth faster, but it can also increase the risk and magnitude of capital losses.

- If your portfolio’s value falls below a certain point your lender may make a ‘margin call’ and require you to provide additional security, repay some of your loan, or sell part of your portfolio – usually within 24 hours.

The power of gearing

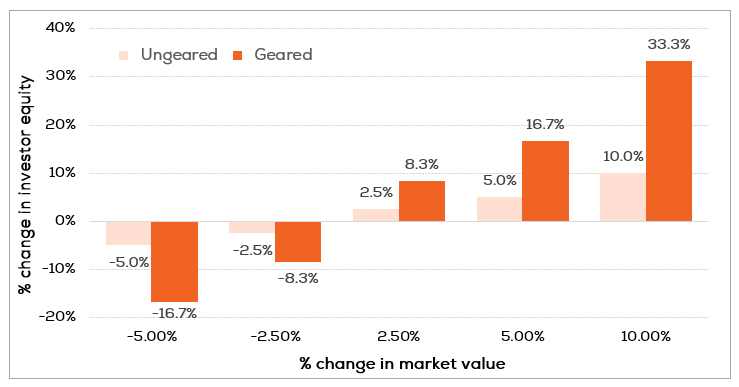

The chart below is a simplified example comparing a geared with an ungeared investment. It shows how gearing magnifies the impact of changes in investment market values – both positive and negative – on the value of an investor’s equity (their own funds, excluding any borrowed amount).

The above chart is based on an initial equity contribution of $30,000 geared at 70% (i.e. an investment amount of $100,000). This example is to demonstrate the impact of rising and falling prices and does not take into account any dividends, interest expenses or taxation effects.

For example, as the chart shows, a 10% increase in the portfolio’s market value gives the geared investor a 33.3% increase on their initial equity. Conversely, a 5% fall in market value means a 16.7% loss of equity for a geared investor.

How does a margin loan work?

A margin loan is an ongoing credit facility that allows you to borrow against approved securities such as shares and managed funds to create capacity to buy additional securities, within the limits of the facility.

Margin lending can therefore support a more flexible and dynamic approach than a one-off investment, and allows you to potentially grow wealth faster because you can invest larger amounts than you could otherwise.

The steps below describe the basic mechanics of how a margin loan operates once an application is approved:

- The lender allocates you a credit limit depending on your financial situation and ability to pay the interest on the loan.1

- You provide some of your own money, or your existing investments (if approved by the lender), or both, as security for your loan.

- You borrow money to buy more investments which then also form part of the security for your loan. You can buy (or sell) investments to add to your portfolio at any time, providing you have sufficient borrowing capacity and your loan balance doesn’t exceed your credit limit.

- Interest is accrued against any drawn loan balance. You can choose to make ongoing interest payments or have the interest added to your loan. Interest rates can be fixed or variable – if variable, your payments will fluctuate when your loan balance changes or if lending interest rates change.

- If the value of your portfolio falls sufficiently you may be subject to a margin call (see below).

1 Some margin loan facilities have no minimum loan balance requirement, meaning you’re not obliged to draw down on your loan facility and can maintain a zero balance for periods if you want to.

Margin lending in action

Your portfolio’s ‘geared value’ (your borrowing capacity) is based on the market value of your investments and their approved gearing ratio. As the market value of your investments fluctuates, you need to be aware of the changes to your borrowing capacity relative to your loan balance.

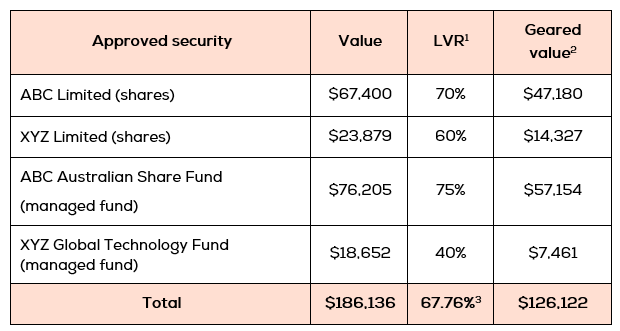

Below is a hypothetical snapshot of some of the information typically provided to a borrower in their monthly margin lending statement, with explanations of the key features.

Margin loan monthly statement

Portfolio summary as at 31 December 2023

Loan facility summary

1 The loan to value ratio (‘LVR’ or ‘gearing ratio’) is the maximum you can borrow against each approved security. Lenders can change LVRs at any time.

2 Your geared value (or borrowing capacity) is the amount the lender is willing to lend you against each security.

3 The lender applies an LVR to the market value of each holding and then arrives at a single aggregated LVR for your combined portfolio (rounded to two decimal places in this example).

4 Your portfolio’s value will fluctuate in line with investment markets and any transactions on your account.

5 The amount you’ve currently borrowed.

6 You can use this amount to buy additional securities, which will also form part of your secured portfolio. Provided you buy securities on your lender’s approved securities list, the securities themselves can be geared.

7 A buffer is in place to reduce the likelihood of a margin call from small market fluctuations, and also to give you the opportunity to reduce your gearing levels before a margin call is triggered. In this example the buffer is 10% of the portfolio geared value. See below for more about margin calls.

The information above is a hypothetical example to illustrate the components of a margin loan and isn’t intended to be any form of recommendation. Margin loan terminology and some calculations may differ across lenders, but the underlying concepts remain the same.

The benefits of margin lending

A key benefit of margin lending, as with any geared investment, is that it gives access to more investment capital and may therefore accelerate returns. Other benefits may include:

- Funding flexibility that allows you take advantage of investment opportunities when they arise.

- Being able to invest in additional securities can allow for greater portfolio diversification and spreading of investment risk.

- Greater potential access to dividends including franking credits and deferred tax benefits.

- You can unlock the value of an existing portfolio without having to trigger a capital gains tax event.

- Loan interest expenses may be tax deductible.

- Prepaying interest can provide cash flow certainty and potentially accelerate tax deductions.

The risks of margin lending

As with any form of gearing, a key risk with margin lending is that it can increase the risk and magnitude of capital losses. Other risks to consider include:

- Margin loans are ‘full recourse’ loans, meaning you’re providing a guarantee to pay back the amount owing to the lender.

- You pay interest on the outstanding loan balance, and your borrowing costs may rise if interest rates increase.

- The facility may be subject to a margin call (see below). To satisfy this margin call, you may need to sell a security in your portfolio at a time which does not suit your circumstances.

- Tax laws may change resulting in an adverse impact to your after-tax position.

What is a margin call?

A margin call is triggered if your portfolio value falls to the point where your loan balance exceeds your geared value (your borrowing capacity) plus the buffer. The lender will issue a margin call notice that requires you to either sell part of your portfolio, provide additional security or repay part of your loan, usually within 24 hours.

If you don’t take the required action to satisfy the margin call or if your lender can’t contact you, they’ll sell some or all of your investments they’re holding as security to repay part or all of your loan balance.

Margin loan case study

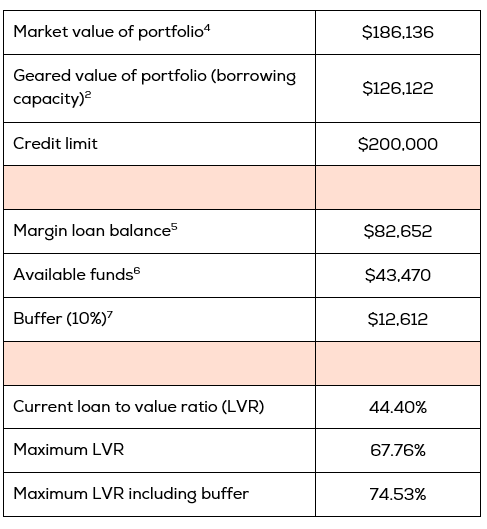

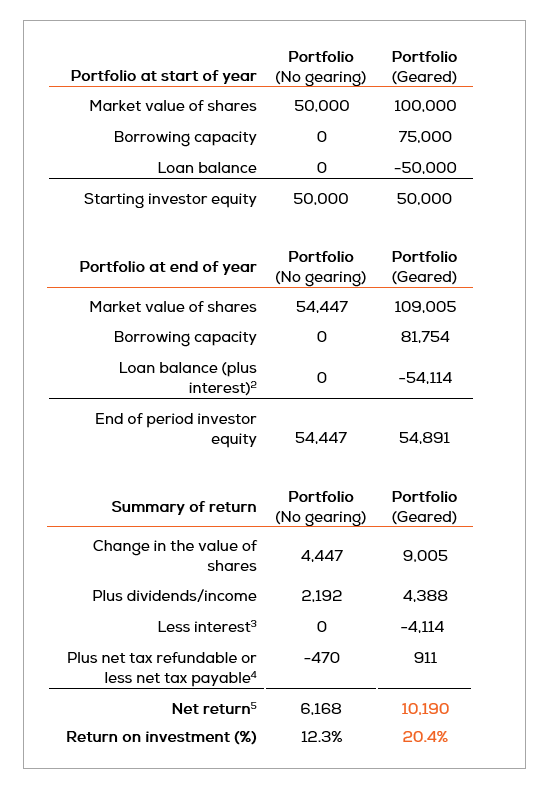

To illustrate the potential benefits of gearing, the following example compares two scenarios for someone who buys Commonwealth Bank of Australia (CBA) shares. In the first scenario they buy the shares without a margin loan (ungeared) and in the second they use a margin loan facility (geared).

The investor had $50,000 to invest on 1 January 2023 and held the shares for the calendar year. For the margin loan, they borrowed an additional $50,000, meaning their investment was moderately geared at 50%. This gave the investor capacity to manage any market volatility (i.e. reduce the risk of a margin call) or for further investment as opportunities arose.

During the 12-month investment period:

- CBA’s share price1 increased from $102.55 to $111.80 (a 9.02% increase).

- CBA paid two ordinary dividends totaling $4.50 per share.

- The margin loan lender’s LVR for CBA shares was 75%.

- The investor’s margin loan facility wasn’t subject to a margin call.

The tables below show the investor’s position at the start and end of the 12 months, and compares the net return for both geared and ungeared scenarios.

1 CBA share price is based on market open, and the transaction excludes any brokerage.

2 Variable interest rate of 8.00% p.a. with interest accrued daily and capitalised to the loan balance monthly (in arrears).

3 This is the total interest amount that was accrued and capitalised to the loan balance for the period ($4,114).

4 Taxation assumptions include an individual on a marginal tax rate of 45%, franking credits can be used to offset tax payable and interest expense is tax deductible.

5 This investment return is for illustrative purposes and has not considered any other circumstances of the investor or the applicable treatment across the two financial years.

Summary of results after one year

- The ungeared portfolio showed a net return on investment of 12.3%.

- The geared (margin loan) portfolio showed a net return of 20.4%.

- The geared portfolio therefore outperformed the ungeared portfolio by about 8.1%.

The use of gearing has magnified the benefits of the increase in the CBA share price, the value of dividends received and the potential for tax benefits (including interest deductibility).

Please note, we advise that you seek your own taxation advice when considering prepaying interest.

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.

Our Direct Margin Lending product is issued by Bell Potter Capital ABN 54 085 797 735 AFSL No. 360 457. You can also access our Margin Lending PDS, Margin Lending T&Cs and the at-call investment PDS to find out more about our DML offering. The at-call investment Target Market Determination (TMD) is available free of charge by contacting Bell Potter Capital Ltd on 1800 061 327 or by clicking on this link. Previous versions of the TMD are available by calling 1800 061 327.