Weekly Wrap Transcript 19 March

Looking at global markets from Monday to Thursday the central theme that caused investor jitters was driven by the Federal Reserve confirming the idea of ‘higher rates for longer’ on the back of robust economic data signalling inflation remains sticky in the world’s largest economy.

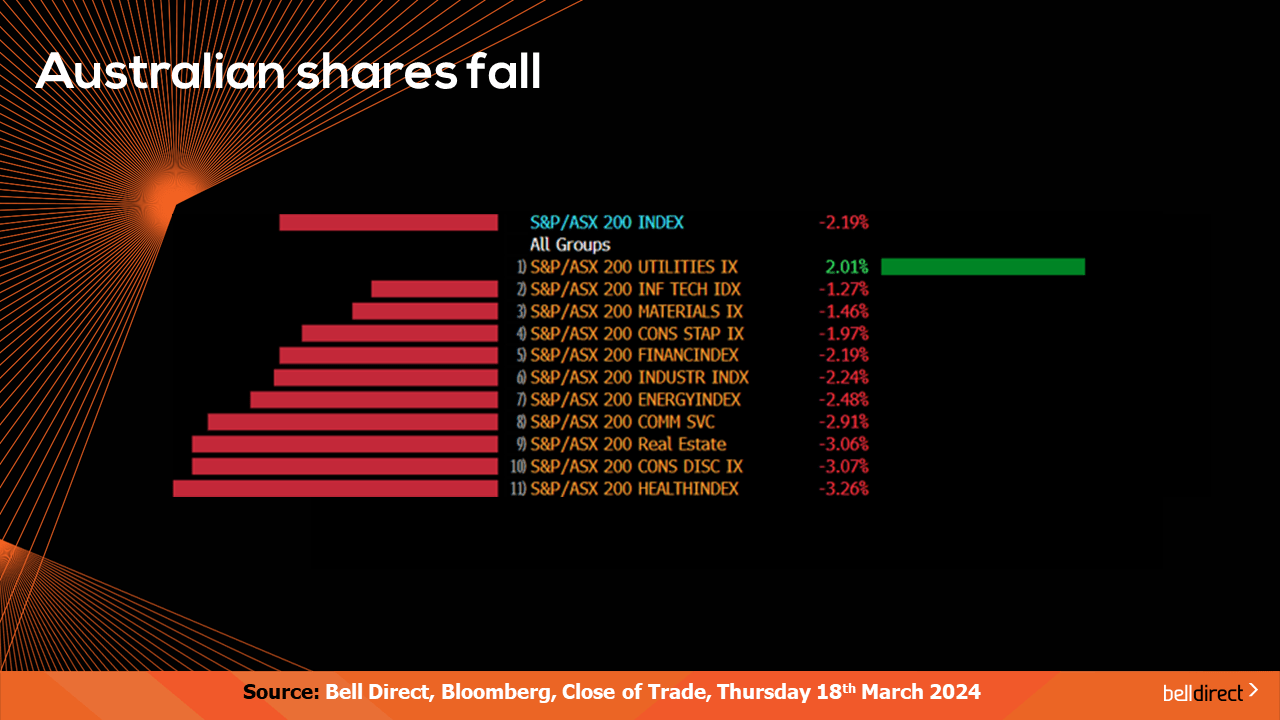

Locally, the ASX200 tumbled 2.19% as every sector aside from utilities stocks posted a more than 1% loss. Healthcare stocks were the heaviest hit this week with the sector falling 3.3%, while utilities bucked the sell-off trend to close 2.01% higher.

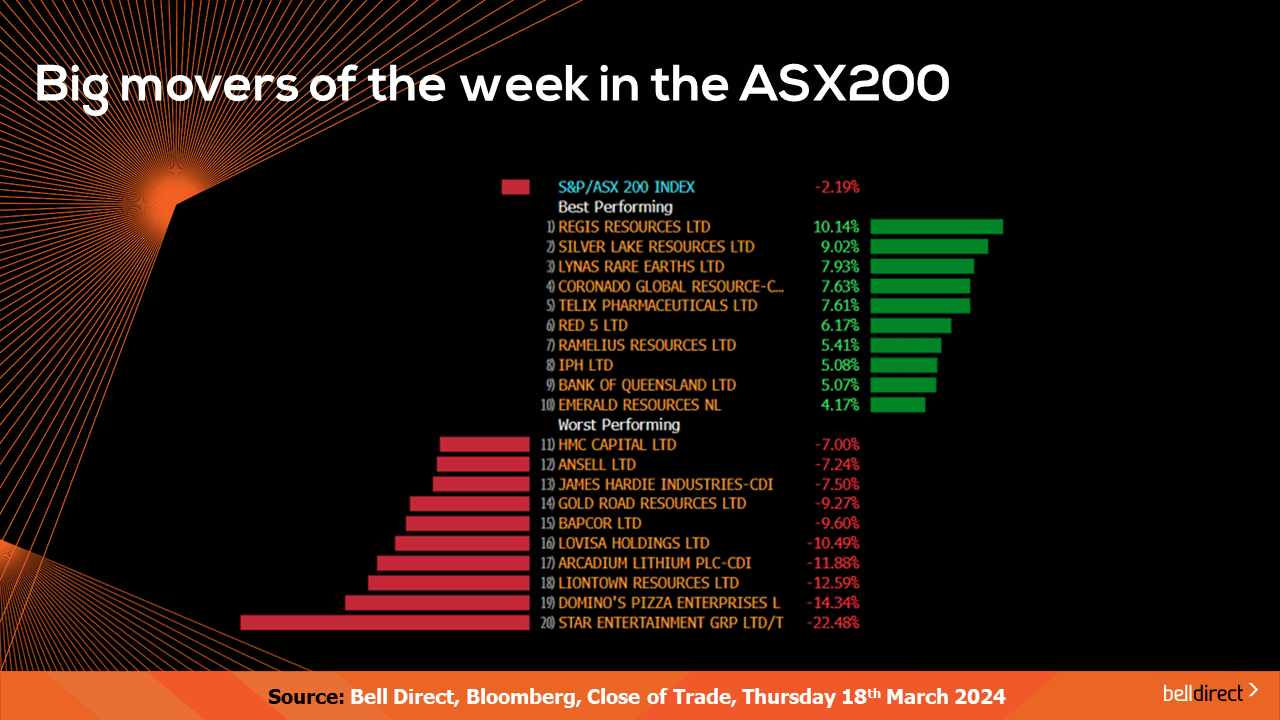

The winning stocks on the ASX200 from Monday to Thursday were led by Regis Resources (ASX:REG) jumping 10.14%, Silver Lake Resources (ASX:SLR) adding just over 9% and Lynas Rare Earths (ASX:LYC) rallying almost 8%.

And on the losing end Star Entertainment Group (ASX:SGR) tumbled 22.48% on a trading update and a second inquiry into the troubled casino, while Domino’s Pizza (ASX:DMP) and Liontown Resources (ASX:LTR) fell 14% and 13% respectively.

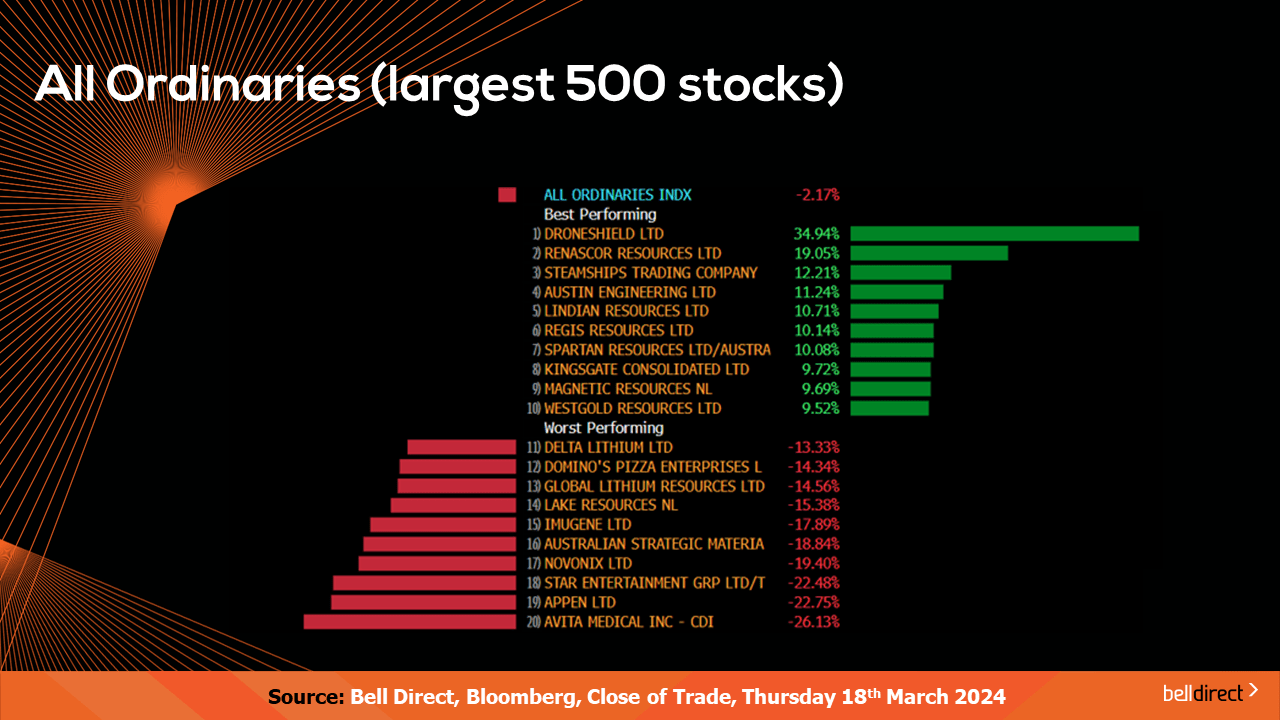

The All Ords, or the broader market index, fell 2.17% as Avita Medical (ASX:AVH) and Appen (ASX:APX) plunged 26% and 22.75% respectively while DroneShield (ASX:DRO) soared 35% on a trading update and contract win.

Key jobs data out in Australia at the later end of this week indicated the unemployment rate edged 0.1% higher in March to 3.8% which was in-line with market expectations. This result is below the RBA’s forecasts which expect unemployment to rise to 4.2% by June 30, indicating strength in our labour market YTD in 2024. Will we see rate cuts pushed back in Australia too like the US or have the RBA done a better job at taming inflation than the Fed? Watch this space…

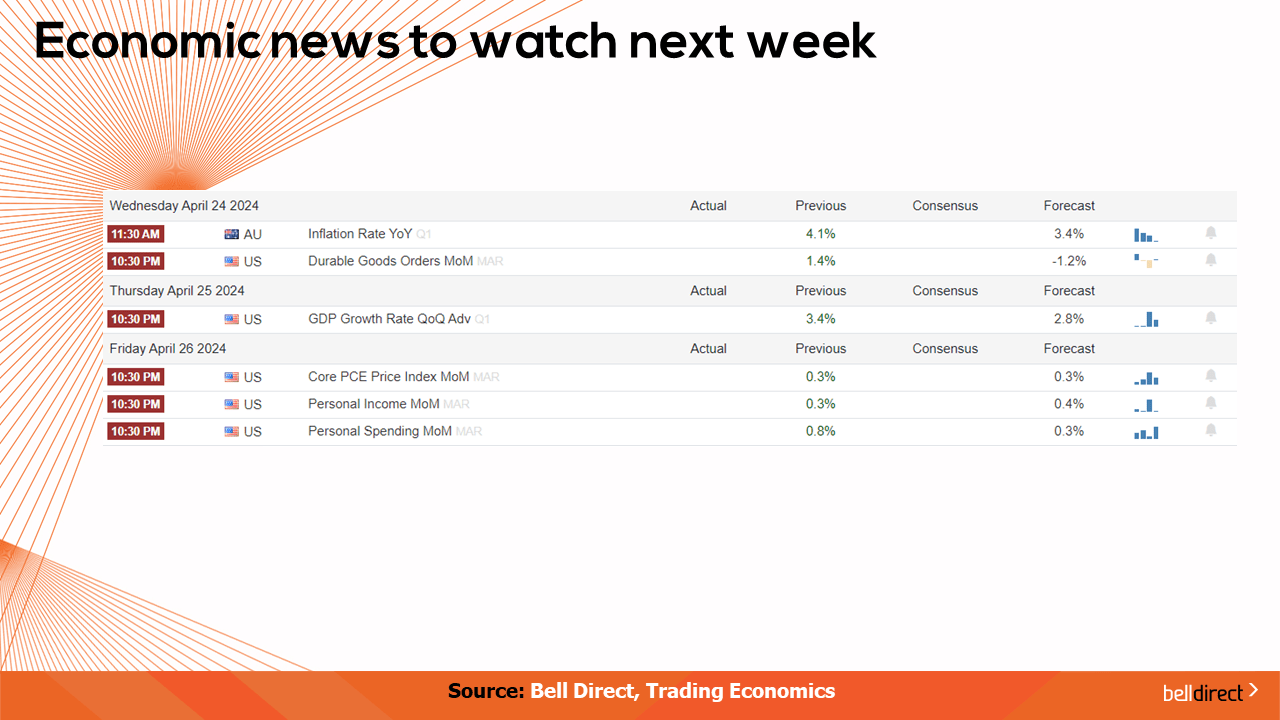

On the economic calendar for next week, investors are likely to respond to Australia’s inflation rate data out on Wednesday with economists expecting headline inflation to ease to an annual rate of 3.4% in Q1 FY24 from 4.1% in Q4 FY23, which would fall slightly short of RBA expectations and closer to the target range of 2-3%.

Overseas, US GDP growth rate data (advance estimate) is out on Thursday with the market expecting a decline to 2.8% in Q1 from 3.4% in Q4, while US Core PCE Index data is out on Friday which is the Fed’s preferred measure of inflation and has economists expecting a 0.3% rise for March.

The Bank of Japan will decide the interest rate for the month ahead on Friday which economists are predicting will remain at 0% for another month, following the shock move up to 0% from -0.1% in March.

That’s all for this week, we hope you have a wonderful weekend and we will see you on Monday for our regular market commentary.