Different approaches to fixed income – absolute return and benchmark relative – solve different investment problems for investors.

The ability of fixed income to be used in different ways owes much to its diversity as an asset class, and the diversity of approaches employed. This is reflected in a range of factors including the type and quality of issuers, the degree of subordination of the security, the security type, maturity, coupon, individual covenants etc. It’s the combination of these characteristics that drive return and risk outcomes.

There are some main differences between absolute and benchmark relative fixed income approaches.

Differentiating absolute return approaches from more traditional approaches

Much of the current commentary focuses on the core defensive properties of traditional fixed income approaches, which emanates primarily from duration. These strategies are generally managed against a benchmark – typically in Australia the Bloomberg Composite 0+Yr – and range from passive (low tracking error) strategies to highly active with a broad investment universe (like core-plus approaches). The common structural characteristic is embedded duration, which makes this the most dominant driver of the total return and risk of these strategies over time. How well the benchmark reflects the defensive characteristics these strategies are trying to emulate is debatable.

In contrast to duration based/benchmark relative strategies, there is no unique definition of an absolute return fixed income strategy. The broad term describes fixed income approaches that are not benchmark aware and aim to generate returns in excess of cash, bank bills or Libor, utilising assets predominately from within the fixed income universe. While duration may be an alpha source, it is not typically structurally embedded in an absolute return strategy – an important point.

These strategies can vary considerably, but the common differentiating factors of absolute return fixed income strategies are based around:

- Breadth of the opportunity set – is currency in scope, high yield, emerging markets

- Investment approach – sector rotation, relative value

- Risk focus – volatility or downside risk focus

- Use of leverage – in gross and net terms

- Alpha target – typically +1% to +4%

- Investment horizon – usually 1 year for risk, but potentially longer for return.

The most fundamental difference between ‘absolute return’ focused strategies and more core, duration focused strategies is the absence of the embedded downside/deflation protection that comes from duration.

Absolute return strategies utilise the same underlying components, but are focused in their construction on delivering positive returns to investors over relatively short timeframes. They rely more on the skill of the manager to appropriately blend exposures and manage absolute risks.

Generalised performance characteristics

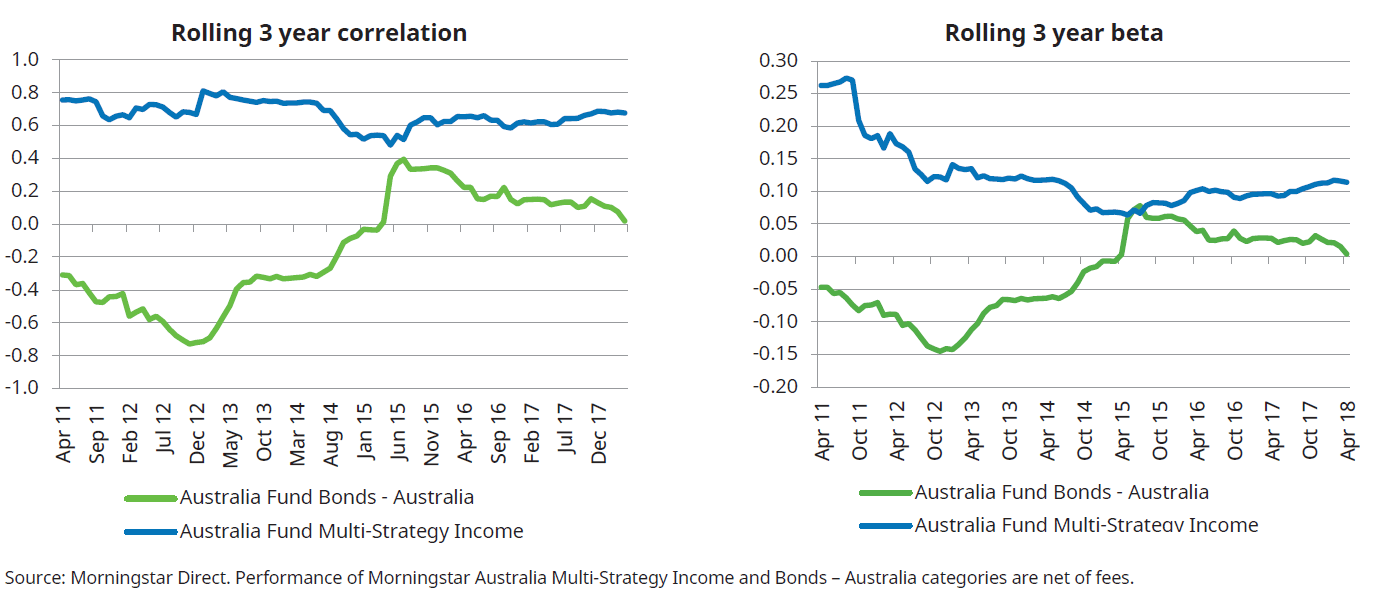

It is difficult to make general statements around performance for approaches within the absolute return category given the shorter track record and diversity of investment approaches that are employed. For now, the Morningstar Multi-Strategy Income category appears the best proxy for products employing more of an absolute return approach, and illustrates that the lower reliance on duration does result in a higher correlation to equity assets, although beta to equities remains low.

Figure 1: Rolling 3 year correlation and beta versus the S&P/ASX 200 index of managers in the Morningstar Australia Bonds and Multi-Strategy Income categories

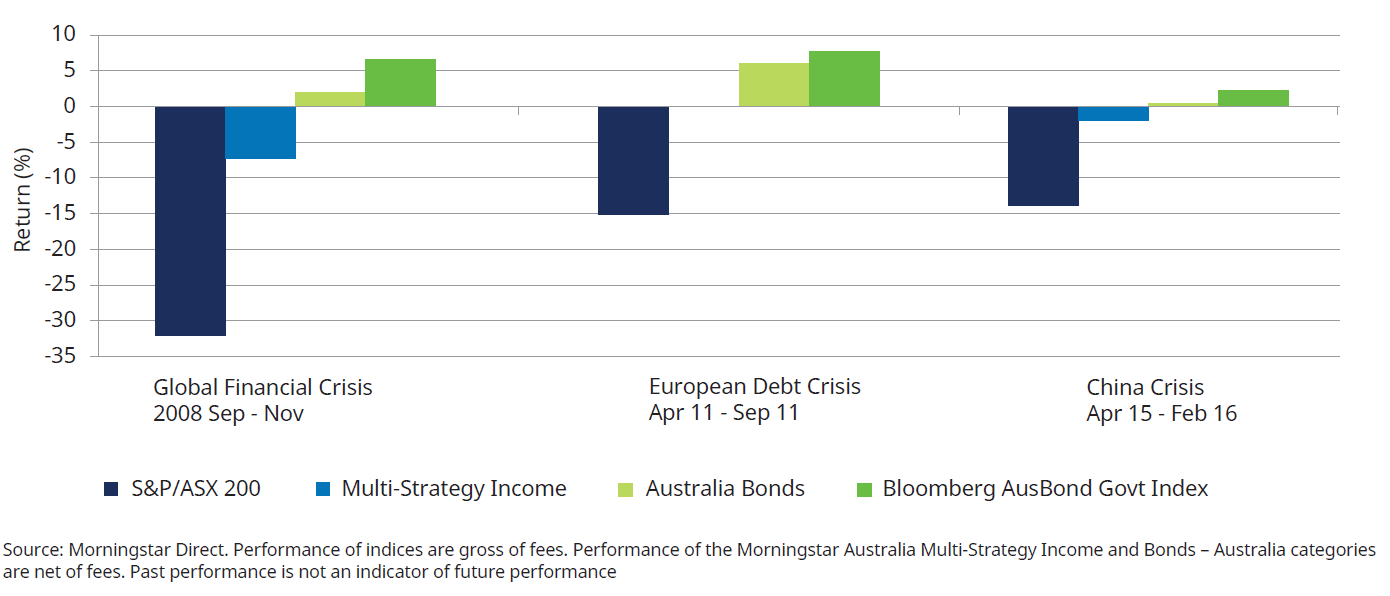

While correlation with equity assets may be higher, the low beta of absolute return relative to equities does still provide some diversification benefit even during periods of stress as shown in Figure 2 below.

While correlation with equity assets may be higher, the low beta of absolute return relative to equities does still provide some diversification benefit even during periods of stress as shown in Figure 2 below.

Figure 2: Performance of Absolute Return Fixed Income approaches during stress environments

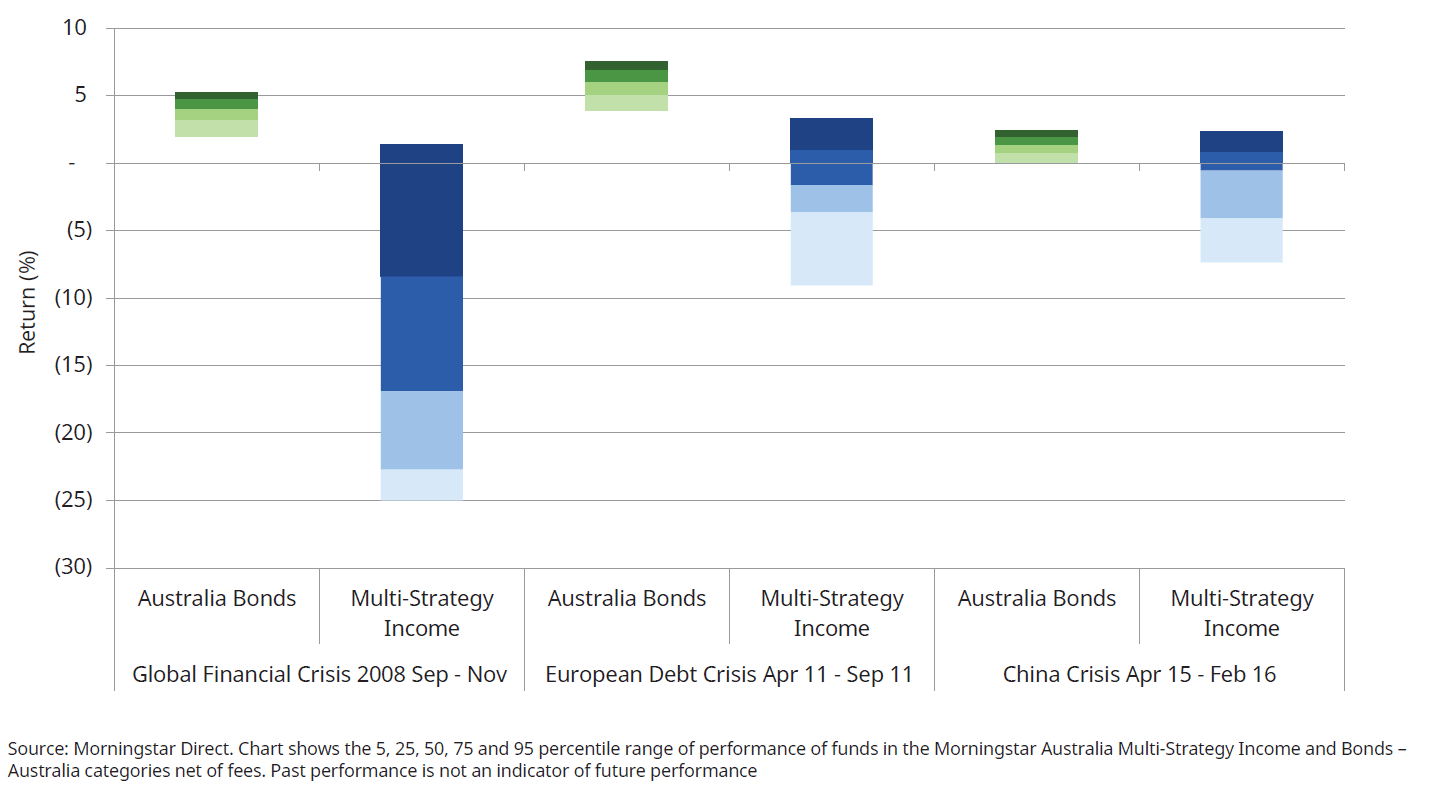

However, as figure 3 highlights, the range of outcomes for absolute return fixed income strategies varies considerably in times of stress, highlighting the heterogeneity of these approaches.

However, as figure 3 highlights, the range of outcomes for absolute return fixed income strategies varies considerably in times of stress, highlighting the heterogeneity of these approaches.

Figure 3: Range of Performance for fixed income approaches in stress environments

The factors above offer important context in thinking about their use in portfolios. Absolute return approaches, whether pure absolute return fixed income strategies or short duration alternatives (such as hedge funds, CTAs etc) can play a role at the total portfolio level as primarily lower risk growth/return-seeking strategies.

The factors above offer important context in thinking about their use in portfolios. Absolute return approaches, whether pure absolute return fixed income strategies or short duration alternatives (such as hedge funds, CTAs etc) can play a role at the total portfolio level as primarily lower risk growth/return-seeking strategies.

While they may also mitigate some of the volatility inherent in equity markets, they should not be viewed as a substitute for the deflationary benefits of duration, and can embed additional risks into the portfolio. Importantly, both more traditional, duration-anchored strategies and absolute return fixed income strategies can co-exist an complement each other in investor portfolios.

What role do these approaches have in a portfolio?

While more traditional and absolute return approaches can be used together in a portfolio, their roles are distinct.

- More traditional approaches are designed to provide investors with stable income, a return over time above cash, and a degree of protection against a downturn in risks assets and economic conditions/recession.

- This is achieved either through passive exposure to the benchmark, or via varying degrees of active management around the benchmark position. In particular, it is expected to produce solid returns – both in absolute and relative to other assets – in periods of economic weakness/recession, when risk assets are struggling and both inflation and monetary conditions are easing.

- Absolute return approaches are aimed at producing relatively stable returns at most stages of the cycle, but notwithstanding the alpha target of these strategies will typically lag equity returns in a bull market (see Figure 3), but also likely lag more traditional approaches (above) during bear markets.

- Their value comes through the provision of relatively stable income and consistent returns over time. We’d argue an exposure to an absolute return fixed income fund should be funded from a combination of equity, alternative and defensive risk budgets – as opposed to the defensive risk budget for traditional approaches – depending on the nature of the absolute return strategy itself.

You can get exposure to Fixed Income by investing in the Schroder Fixed Income Fund and the Schroder Absolute Return Income Fund.

Find out more here.

Important Information

Opinions, estimates and projections in this article constitute the current judgement of the author as of the date of this article. They do not necessarily reflect the opinions of Schroder Investment Management Australia Limited, ABN 22 000 443 274, AFS Licence 226473 (“Schroders”) or any member of the Schroders Group and are subject to change without notice. Investment in Schroder Funds may be made on an application form in the Product Disclosure Statement (PDS) which is available from Schroders. In preparing this document, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was otherwise reviewed by us.

Schroders does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this article. Except insofar as liability under any statute cannot be excluded, Schroders and its directors, employees, consultants or any company in the Schroders Group do not accept any liability (whether arising in contract, in tort or negligence or otherwise) for any error or omission in this article or for any resulting loss or damage (whether direct, indirect, consequential or otherwise) suffered by the recipient of this article or any other person.

This document does not contain, and should not be relied on as containing any investment, accounting, legal or tax advice. Past performance is not a reliable indicator of future performance. Unless otherwise stated the source for all graphs and tables contained in this document is Schroders.