Bell Direct’s Market Analyst Grady Wulff talks about what the second half has in store for investors and how investors can pay geopolitics and recession themes.

It’s been a busy first half of 2023, with the collapse of US and European banks, the debt ceiling drama, and rate hikes from central banks around the world.

However, the S&P 500 is up by 15% so far this year and the tech-heavy Nasdaq has surged over 30%.

Locally, the ASX 200 has also advanced, with the Tech sector in the lead, while Telecommunications Services and Utilities up 9% and 7% respectively.

What is ahead for the second half?

A major theme for the second half will be the continuing war between Russia and Ukraine and tensions in the Asia Pacific. Investors are looking at how countries are responding to rising geopolitical tensions, and how their defence spending strategies are going. A lot of these countries are reassessing their capabilities and many are looking into AL capabilities.

That has put companies like DroneShield (ASX:DRO) on the map.

DroneShield is making waves in the capital goods industry through the use of artificial intelligence and machine learning. The company is an Australian defence manufacturer specialising in counter-drone technology, servicing military and intelligence, law enforcement, critical infrastructure and commercial parties globally.

Some investors believe that investing in war theme stocks actually encourages war, but DroneShield’s technology actually protects lives by taking down autonomous drones that threaten lives. DroneShield’s AI-powered anti-drone systems is used to detect and destroy enemy drones or other unmanned aerial vehicles. It’s an exciting time for the company, which is one of the opportunities we see in the geopolitical tension area.

You can watch our recent interview with DroneShield’s Managing Direct & CEO, Oleg Vornik here.

Focusing on income investing

As interest rates increase, investors are shifting their portfolio towards income assets, i.e. stocks that provide a steady dividend.

Income investing is about consistency; in other words, investors must be careful to chose those stocks that pay a consistent and growing dividend. It’s really important not to get fooled by companies that are paying a higher dividend in one year, but then no dividends at all the next.

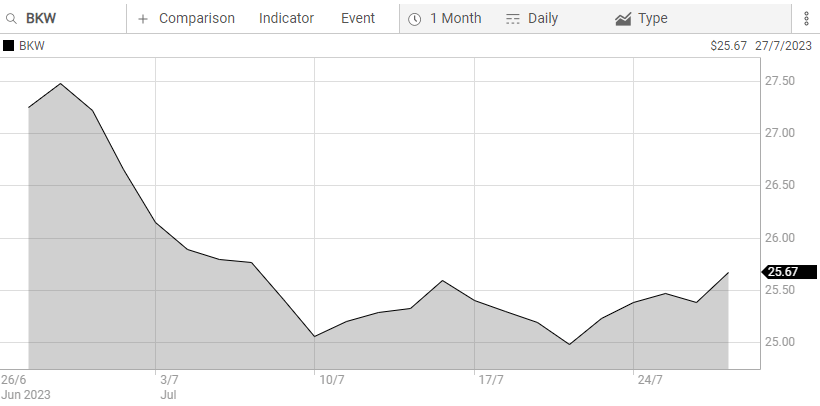

Brickworks (ASX:BKW) is a company that Bell Potter has recently initiated a coverage and has a Buy recommendation on.

Brickworks has a really good track record of paying dividends, it hasn’t cut dividends since the late 1980s.

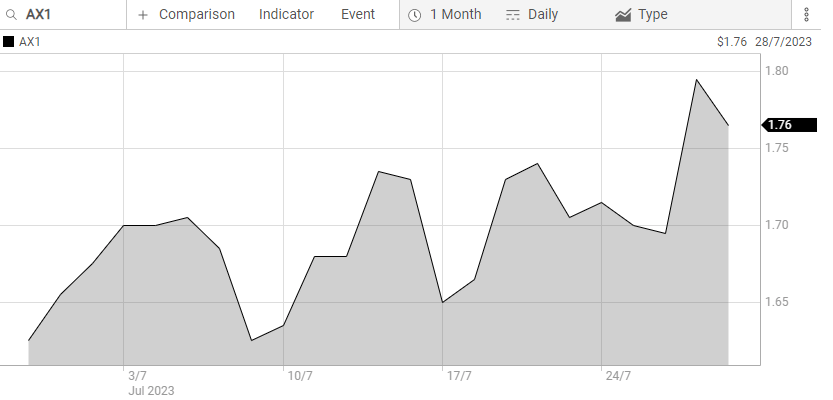

Another dividend stock that Bell Potter likes is shoes retailer Accent Group (ASX:AX1). Accent is part of the sector (discretionary) that has been sold off but the company pays growing dividends.

Accent Groups’s dividend grew from 2.5 cents per share last financial year to 12.5 cents per share in the first half of this financial year.

Artificial intelligence causing market movements

Artificial intelligence (AI) is driving a lot of the market moves, particularly in the US. A lot of investors think that investing in technology is just AI, but AI has capabilities and expansion into every sector on the ASX. Big miners are investing in AI companies to monitor drilling and enhance their capabilities.

In healthcare, companies are also investing in AI to predict the outcome of clinical trials.

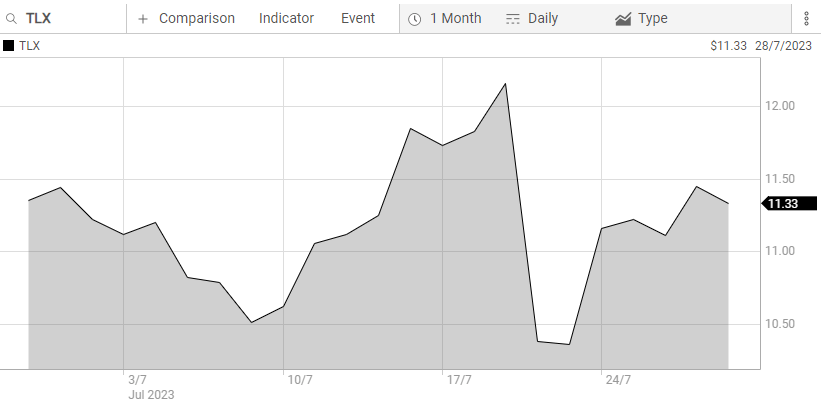

One ASX healthcare company on Bell Potter’s buy list is Telix Pharma (ASX:TLX), which recently acquired an AI company, Dedicaid GmbH, to accelerate its clinical programs.

It just goes to show that AI is the way to go in 2023 and beyond. Companies that aren’t investing in it are falling behind. When investing in the tech sector, to always remember to consider profitability, AI investment and debt levels before adding the stock to your portfolio.

Tech companies with high debt levels are falling out of favour with investors this year because rate hikes mean their debts are more expensive to repay.

Understand that in the tech space, investors are really wary of investing in companies that have high debt levels, those which have AI tech but aren’t actually sure how to use it, and those that have low annual recurring revenue.

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.