Transcript: Weekly Wrap 21 July

Thank you for joining me this Friday the 21st July, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update. In recent times, Environmental, Social, and Governance (ESG) goals have become increasingly important for corporations worldwide, including in Australia. Companies are setting ESG targets to enhance long-term shareholder value and attract specific investors who are focused on the six ESG investing methods, such as exclusion and best-in-class strategies.

Environmental targets, like achieving net-zero emissions by 2050, are being pursued by companies such as AGL Energy. While we are still in the early stages of ESG implementation, companies that are genuinely committed to ESG principles are creating long-term value for both shareholders and stakeholders.

Let’s dive into some of the companies kicking goals on the ESG front in recent times.

Chalice Mining (ASX:CHN) has been focusing on social and governance aspects by appointing female directors to its board and maintaining a workforce where 48% are females.Woolworths (ASX:WOW), the supermarket giant, has taken significant ESG actions, such as the demerger of its alcohol and tobacco assets into the newly listed Endeavour Group in 2021, replacing its petrol-fuelled delivery fleet with electric vehicles to reduce carbon emissions, and introducing Mini Woolies, a program supporting the education and skills of young Australians with disabilities.

Perpetual (ASX:PPT) is a global asset manager that has received a buy rating from Bell Potter analysts with a price target of $26.50/share. The company operates an ESG Australian Share Fund, investing predominantly in Australian shares that meet Perpetual’s ESG criteria, by excluding companies involved in gambling, fossil fuels, uranium, animal cruelty, or the manufacturing or sale of alcohol and tobacco.

When investing in ESG it’s important to remember there is still minimal governance and reporting requirements for companies investing in sustainability however with an outlook of building shareholder value and long-term sustainability, companies are prioritising ESG targets as part of their strategies in 2023.

This week also marks the all-important earnings season, offering insight into how companies have performed in the high-interest rate, high-inflation environment. US big banks have reported stronger-than-expected results, while locally, Australian companies like big miners and healthcare firms have released their quarterly and full-year results.

Results included Bank of America shares rising 4.2% after it reported earnings above expectations for the second quarter thanks to higher interest rates, while Morgan Stanley added 6.2% after a better-than-expected report on both revenue and adjusted earnings per share.

Locally, we are seeing fourth quarter results being released from the big miners while some healthcare companies have released full year results. Telix Pharmaceuticals fell 16% on Thursday after releasing a Q2 trading update including cash disbursements increasing by 18% compared to Q1FY23, which the market punished, despite the company also reporting a 20.6% rise in revenue and increased expansion of its core Illucix product in global markets., while BHP rallied after announcing Q4 results that met guidance expectations.

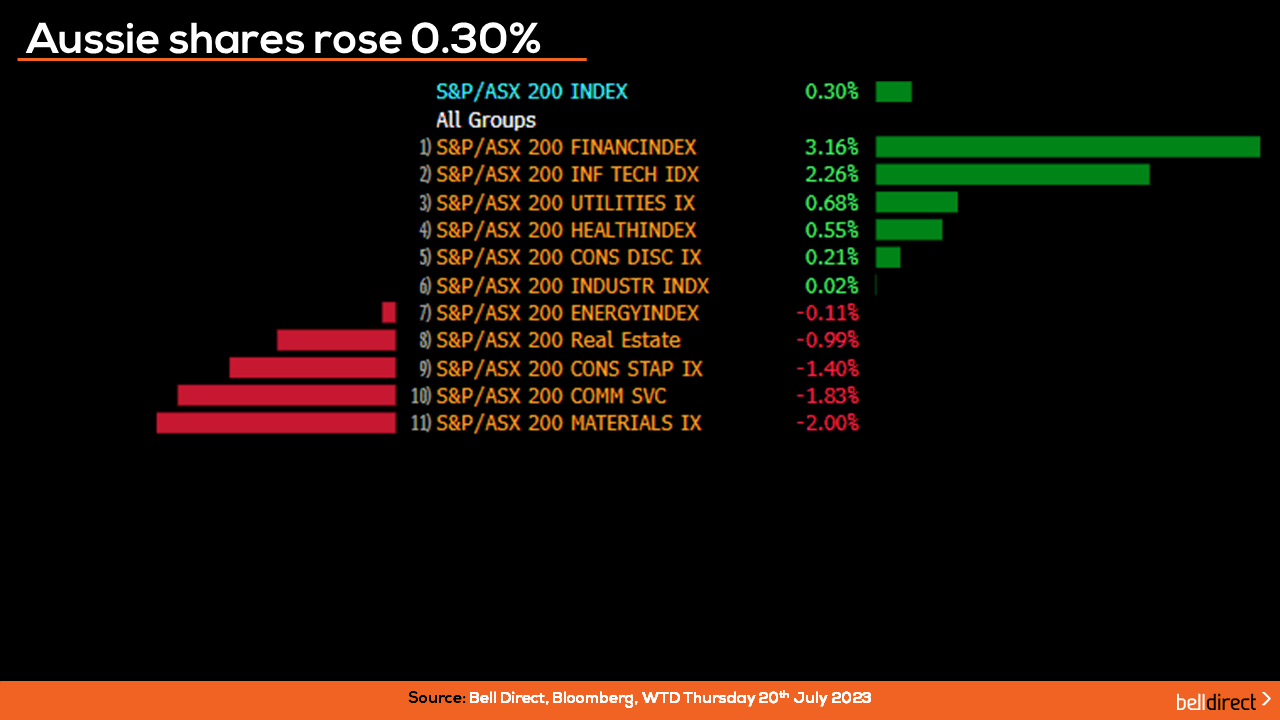

Locally from Monday to Thursday, the ASX200 rose 0.3% amid strong earnings results out of the US and positive investor sentiment around the world. Financial stocks rose 3.16% this week while technology added 2.26%.

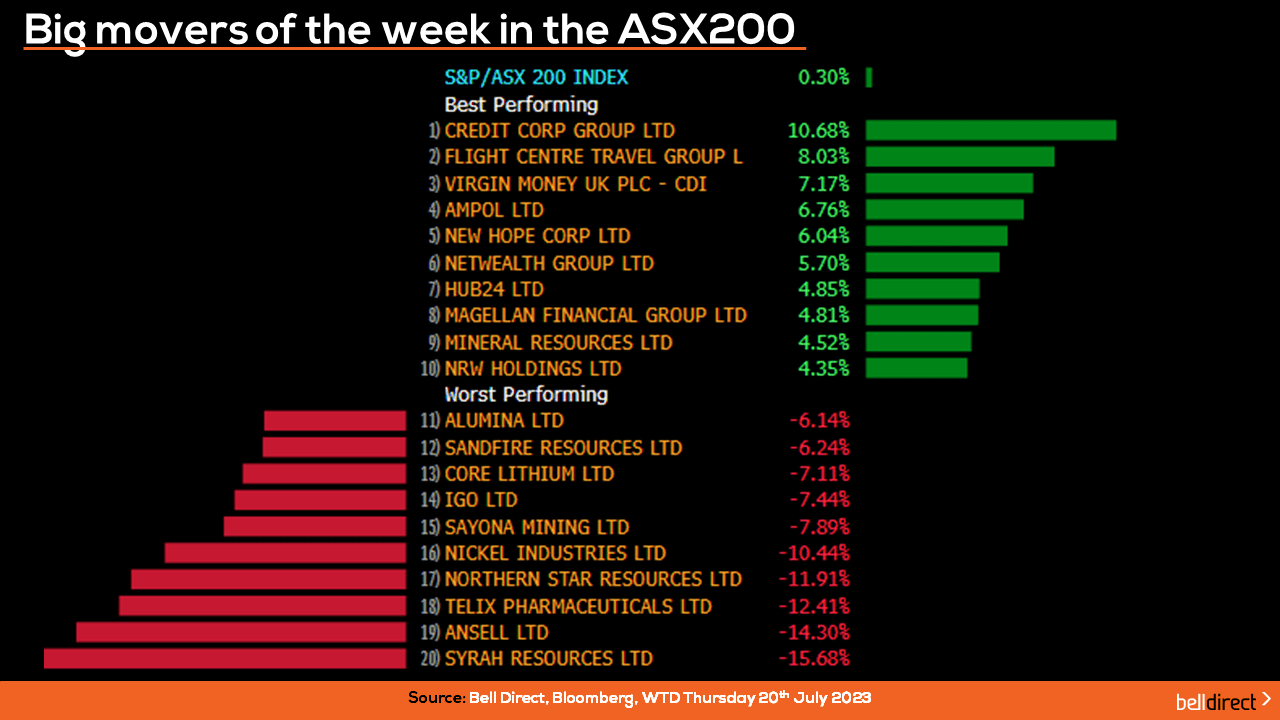

The winning stocks on the ASX200 were led by Credit Corp Group rallying 10.68%, while Flight Centre added over 8% on the company boosting its underlying EBITDA forecast for the 12-months to June 30, to between $295m to $305m from the previous guidance of $270m to $290m.

On the losing end Syrah Resources fell 15.68% this week, Ansell lost 14.30% on higher costs expected over FY24 and Telix Pharmaceuticals dropped 12.41% from Monday to Thursday.

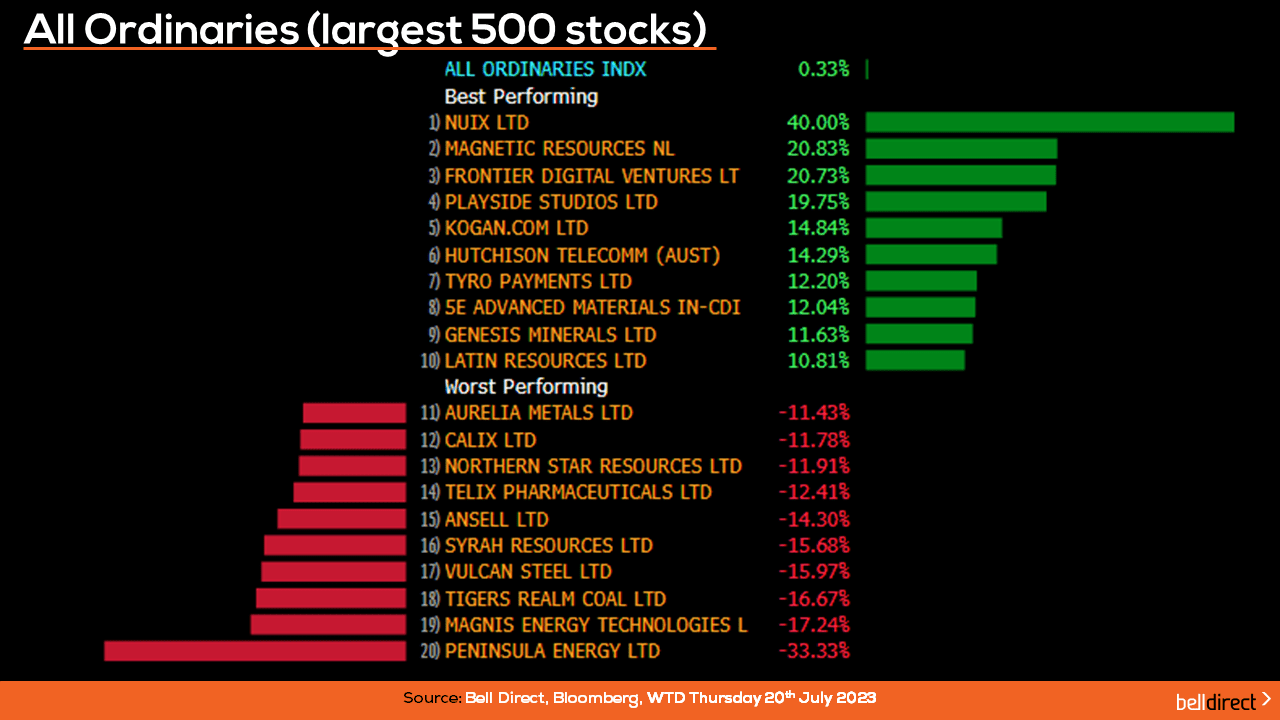

On the broader market, the All Ords added 0.33% from Monday to Thursday led by Nuix soaring 40% after the investigative software company announced its annualised contract value was expected to come in between $184m and $186m. Magnetic Resources added 20.83% over this week and Frontier Digital Ventures rose 20.73%.

On the losing end of the All Ords, Peninsula Energy fell 33.33% after releasing a disappointing update regarding the termination of its agreement to treat loaded resins and produce dry yellowcake from the Lance ISR Projects.

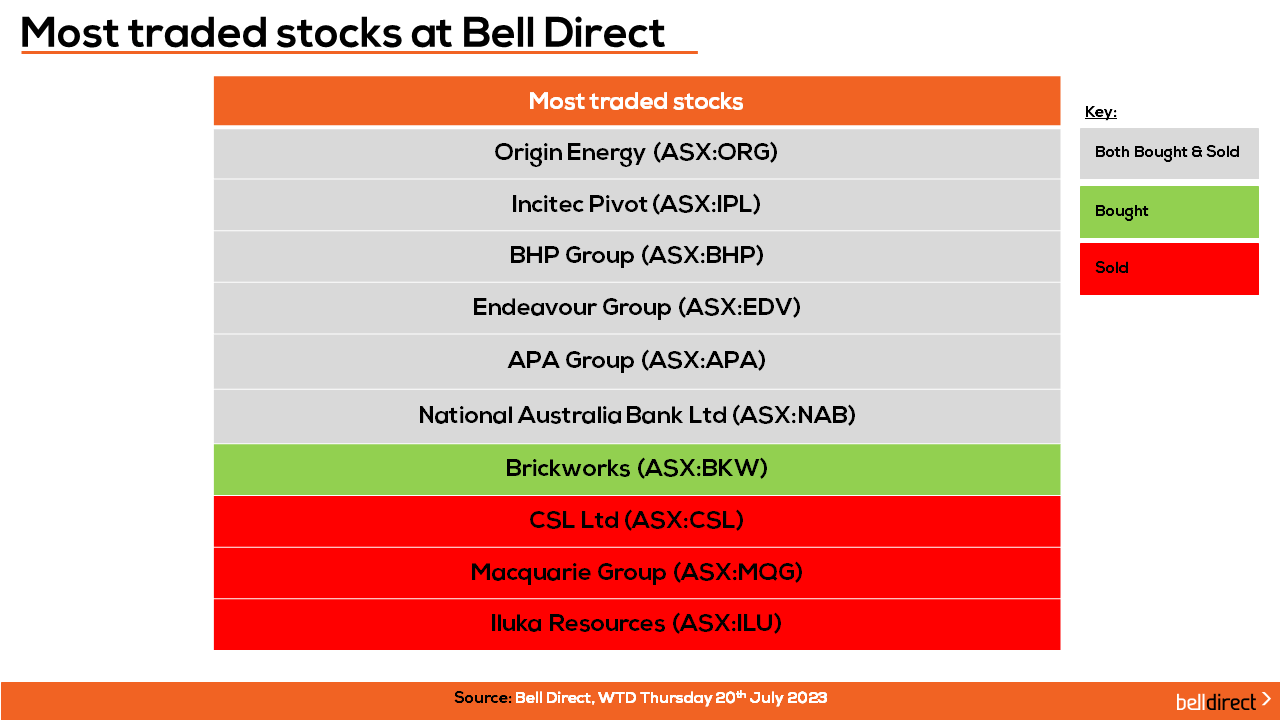

The most traded stocks by Bell Direct clients from Monday to Thursday were Origin Energy, Incitec Pivot, BHP Group, Endeavour Group, APA Group, and NAB.

Clients also bought into Brickworks while taking profit from CSL, Macquarie Group, and Iluka Resources.

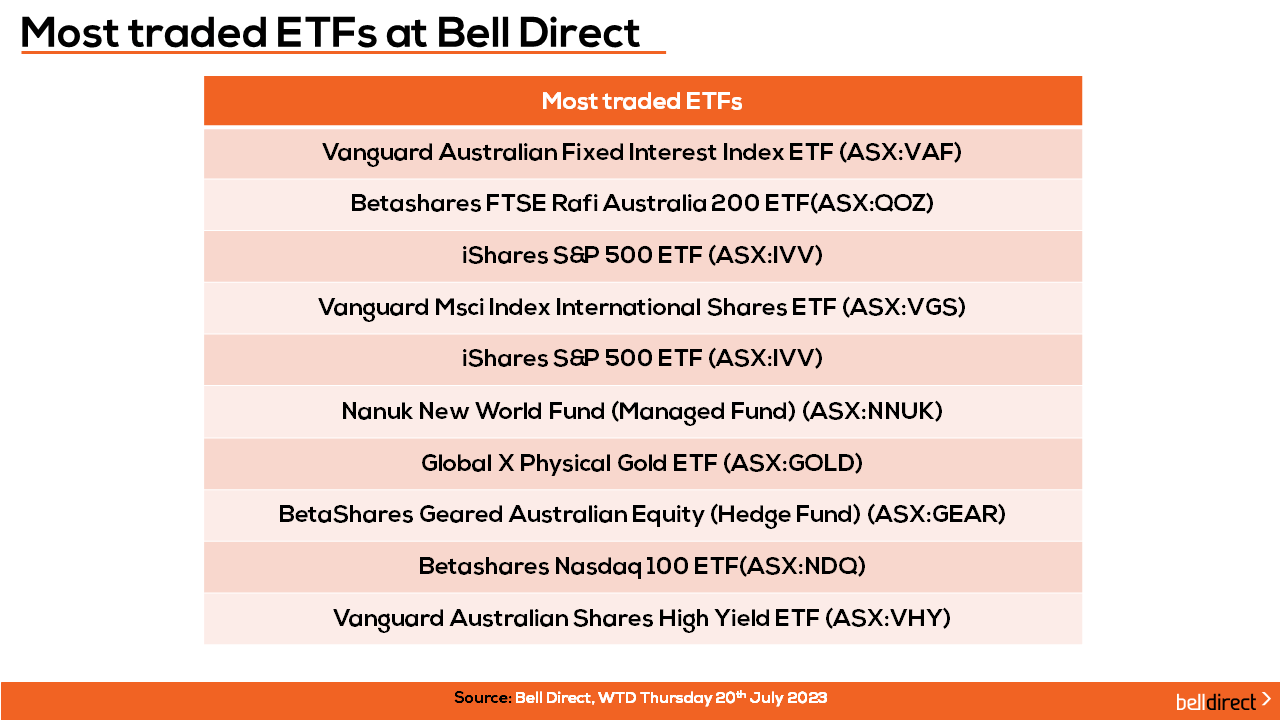

On the diversification front, the most traded ETFs by Bell Direct clients this week were Vanguard Australian Fixed Interest Index ETF, BetaShares FTSE Rafi Australia 200 ETF and iShares S&P 500 ETF.

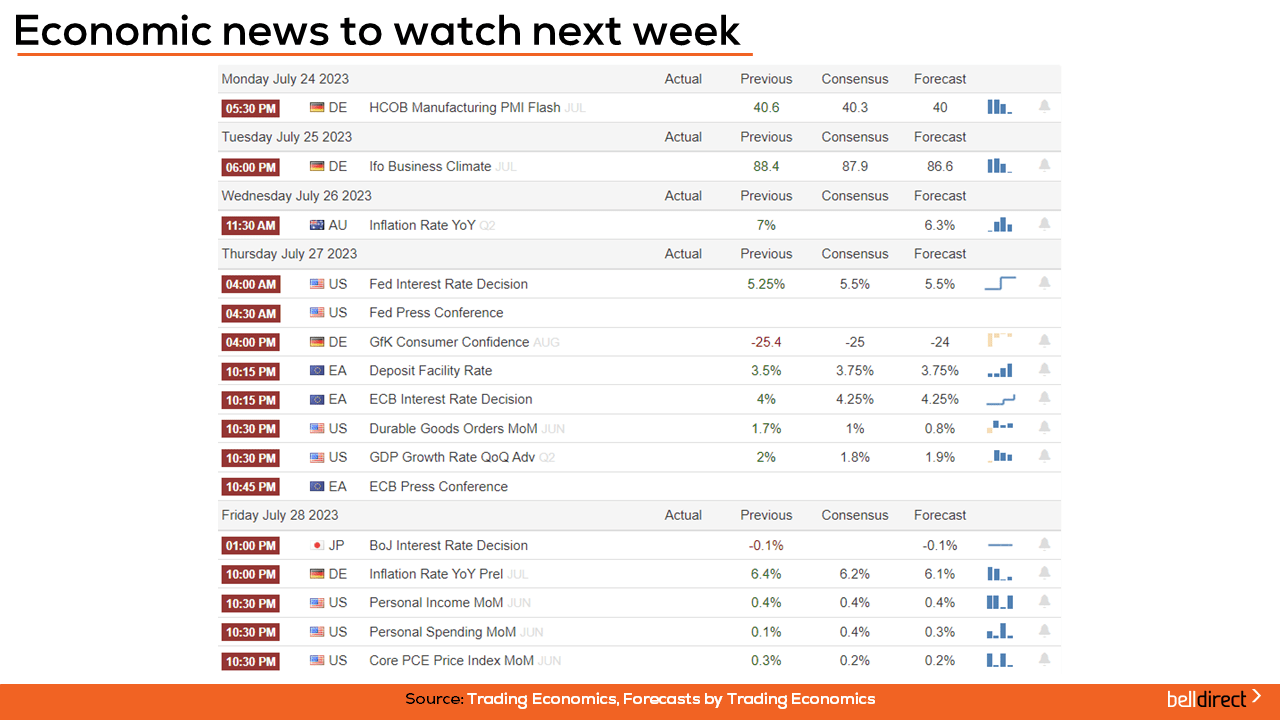

Taking a look at the week ahead, Australia’s annual inflation rate data for Q2 is out on Wednesday with the forecast for a decline to 6.3% from 7% in Q1.

Overseas, the US interest rate decision is out on Thursday with consensus expecting a 25-basis point rate hike for the month ahead despite inflation cooling in the region.

The bank of Japan interest decision is out next Friday with the expectation of a hold at -0.1%.

And that’s all for this week, have a wonderful weekend and as always, happy investing.