Thanks for joining me this Friday the 1st August, happy reporting season and welcome to our weekly market wrap. I’m Grady Wulff, Senior Market Analyst with Bell Direct.

As we kick off the all-important earnings season for August 2025, we have had some key insights into sector performance and what can be expected from specific sectors over the next few weeks as companies release results. In this weekly wrap we will dive into the materials sector which has been out-of-favour with investors until just recently amid a lull in commodity prices due to China’s weak economic recovery post-pandemic.

This week, Rio Tinto (ASX:RIO) kicked off the earnings period with mixed results that painted a clear picture of outlook for costs, iron ore price recovery and dividends to be expected out of the blue chips this reporting season.

Rio Tinto’s H1 2025 results included underlying earnings falling 16% YoY to US $4.81B, driven by weak iron ore prices, weather events and operational disruptions. Iron ore saw a 13% price drop and cyclone-related challenges led to a 24% EBITDA decline in the segment. Despite this, copper and aluminium performance helped offset some of the losses. Shares dropped just 1% after the results were released, suggesting the market expected what was delivered. Going forward, iron ore shipments are forecast at the lower end of guidance, though analysts predict a price rebound by year-end. Rio’s strategic shift towards lithium and copper, including the US $6.7B lithium acquisition of Arcadium Lithium, positions it for future growth, with a new CEO potentially accelerating diversification efforts. A key low light of the results though was the 16% drop in the company’s interim dividend to US$1.48/share, which may be a sign of the sector dividend outlook for this reporting season as other key players in the iron ore space like Fortescue (ASX:FMG) faced similar challenges during 1H25.

Elsewhere in the iron ore market, Champion Iron (ASX:CIA) reported this week as Q1 FY26 results missed expectations, with EBITDA of C$57.8M, 34% below consensus, and net income of C$23.8M, 28% below forecasts. Revenue was slightly below target, while C1 cash costs of C$81.9/t were 6% higher than expected. The average realized iron ore price dropped 14% QoQ and 26% YoY, with production of 3.5M wmt affected by ore hardness and plant issues. Despite these challenges, sales hit a record 3.8M dmt. On the project side, the DRPF is set for commissioning in December 2025, and the Kami mine sell-down is expected in two stages, starting in 2025.

Fellow blue chip iron ore miners in BHP (ASX:BHP) and FMG report on Tuesday 19 August and Monday 25th August respectively so stay tuned to see the impact of weaker iron ore prices on dividends and growth outlook from these two big names this reporting season.

BHP’s results will likely show a different picture to Rio’s though as BHP’s aggressive expansion into copper, which accounts for 30% of its earnings now and growing, will offset the weakness of its iron ore division results this reporting season.

Elsewhere in materials, Pilbara Minerals (ASX:PLS) released its June quarter results this week proving why it is a leader of the lithium market despite a prolonged period of headwinds associated with the depreciated commodity price. Pilbara Minerals had a strong Q4, exceeding FY25 guidance with a 77% QoQ increase in spodumene production and a 72% rise in sales. Its focus on cost efficiency saw unit costs drop 10% QoQ to A$619/t, boosting cash flow to $85M. With $974M in cash and $1.6B in liquidity, PLS is well-positioned for future growth. For FY26, it aims to reduce costs further (A$560-600/t) and lower capex ($300-330M). As a low-cost, high-grade producer, PLS is set to benefit from long-term lithium demand.

So, while iron ore remains weak due to depleted demand from China, diversification of the big miners into commodities associated with the green energy transition like copper, rare earths, zinc and aluminium will prove beneficial over FY26. Be sure to keep an eye on grades, dividends, capex and cost per unit of production and guidance this reporting season when assessing the results of materials companies.

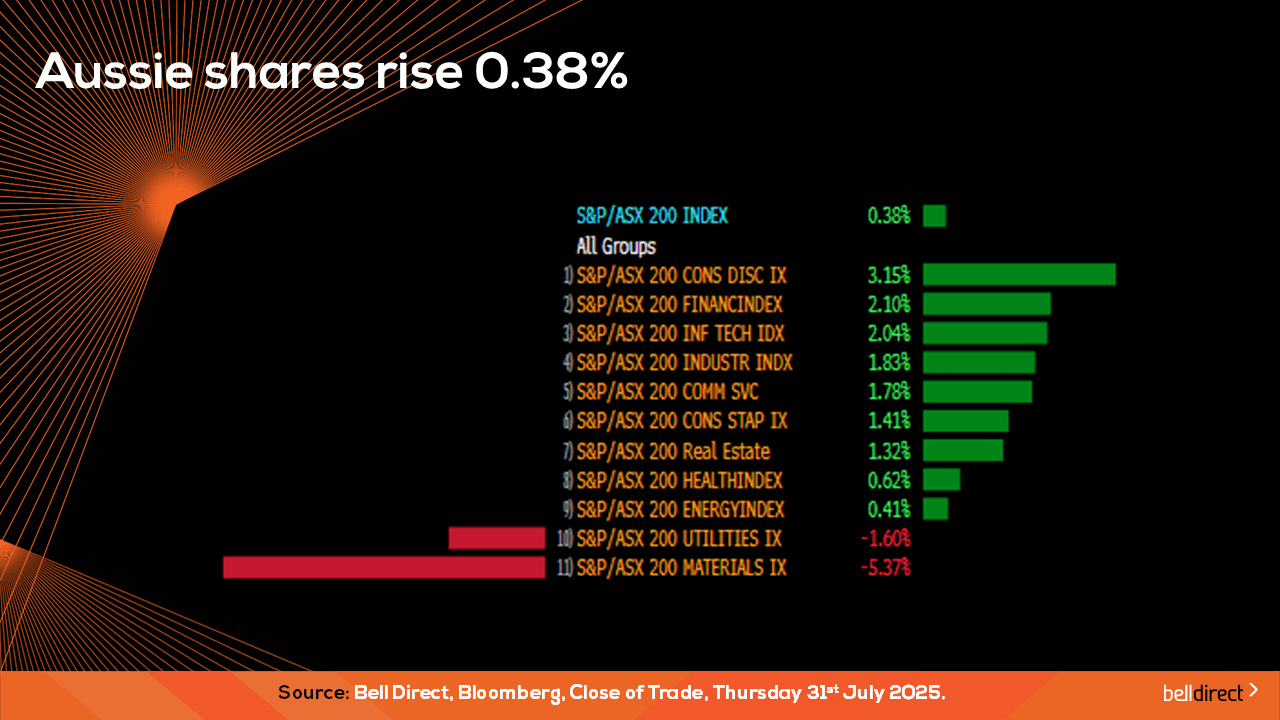

Locally from Monday to Thursday the ASX200 posted a 0.38% rise on favourable CPI data out locally boosting investor hopes of a rate cut come August, and a on the back of a solid start to earnings season. Materials and utilities stocks were the only sectors that came under pressure over the trading week.

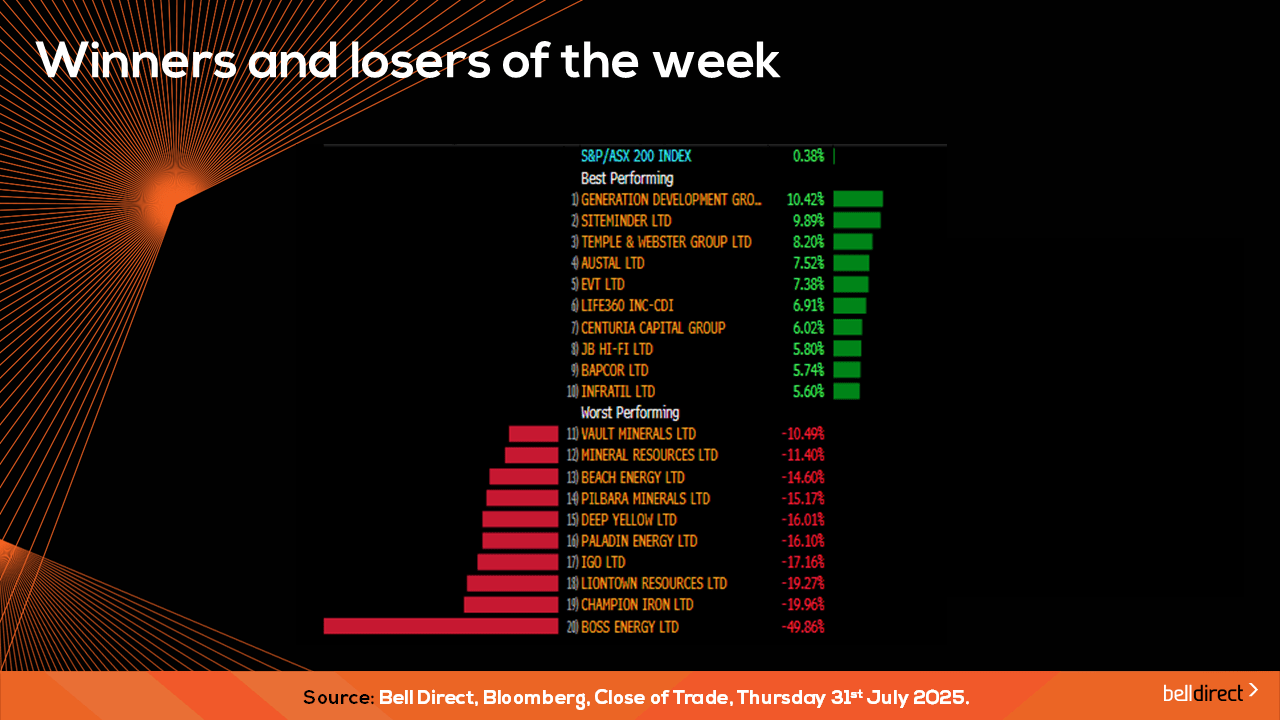

The winning stocks on the ASX200 were led by Generation Development Group (ASX:GDG) rising 10.42% while Siteminder (ASX:SDR) added 9.9% and Temple & Webster (ASX:TPW) added 8.2% over the 4-trading days while Boss Energy (ASX:BOE) tanked almost 50% on a trading update.

The most traded stocks by Bell Direct clients were Boss Energy (ASX:BOE), and DroneShield (ASX:DRO). Clients also bought into BHP (ASX:BHP), Pilbara Minerals (ASX:PLS), Woodside (ASX:WDS) and Fortescue (ASX:FMG) while taking profits from CBA (ASX:CBA), ANZ (ASX:ANZ), Mesoblast (ASX:MSB) and Macquarie Group (ASX:MQG).

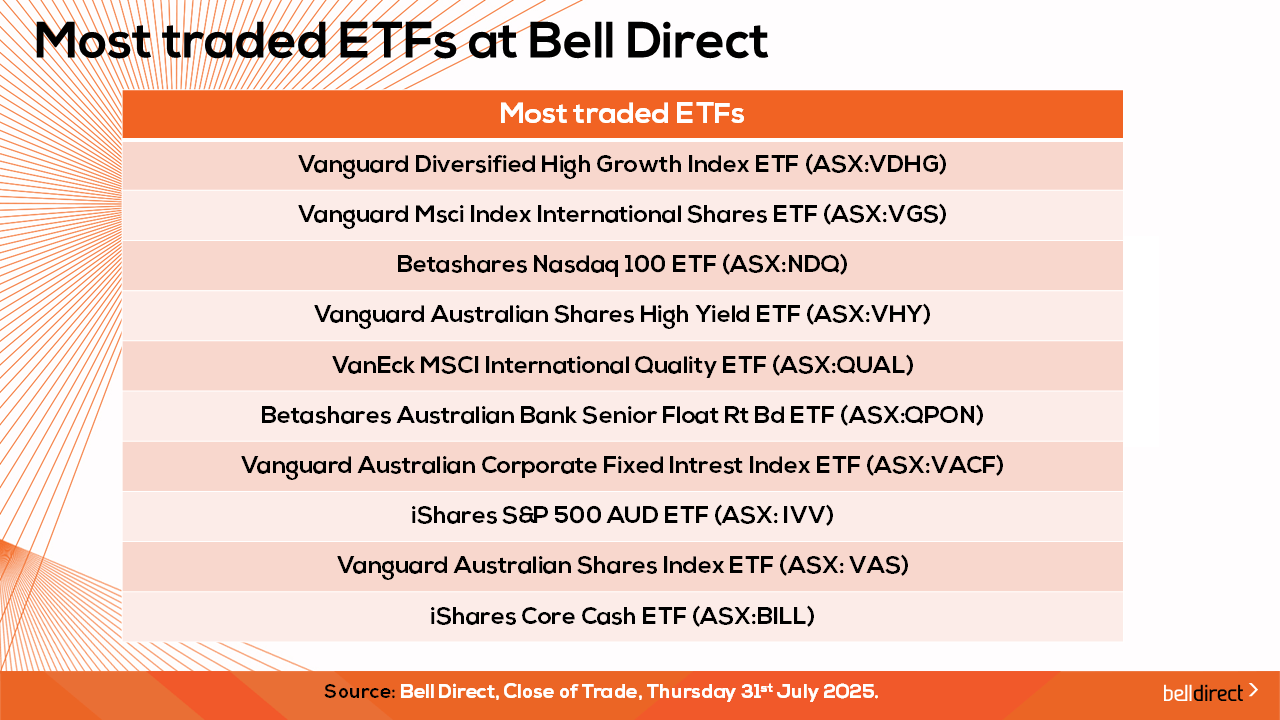

And the most traded ETFs by our clients this week were led by Vanguard Diversified High Growth Index ETF (ASX:VDHG), Vanguard Msci Index International Shares ETF (ASX:VGS) and Betashares Nasdaq 100 ETF (ASX:NDQ).

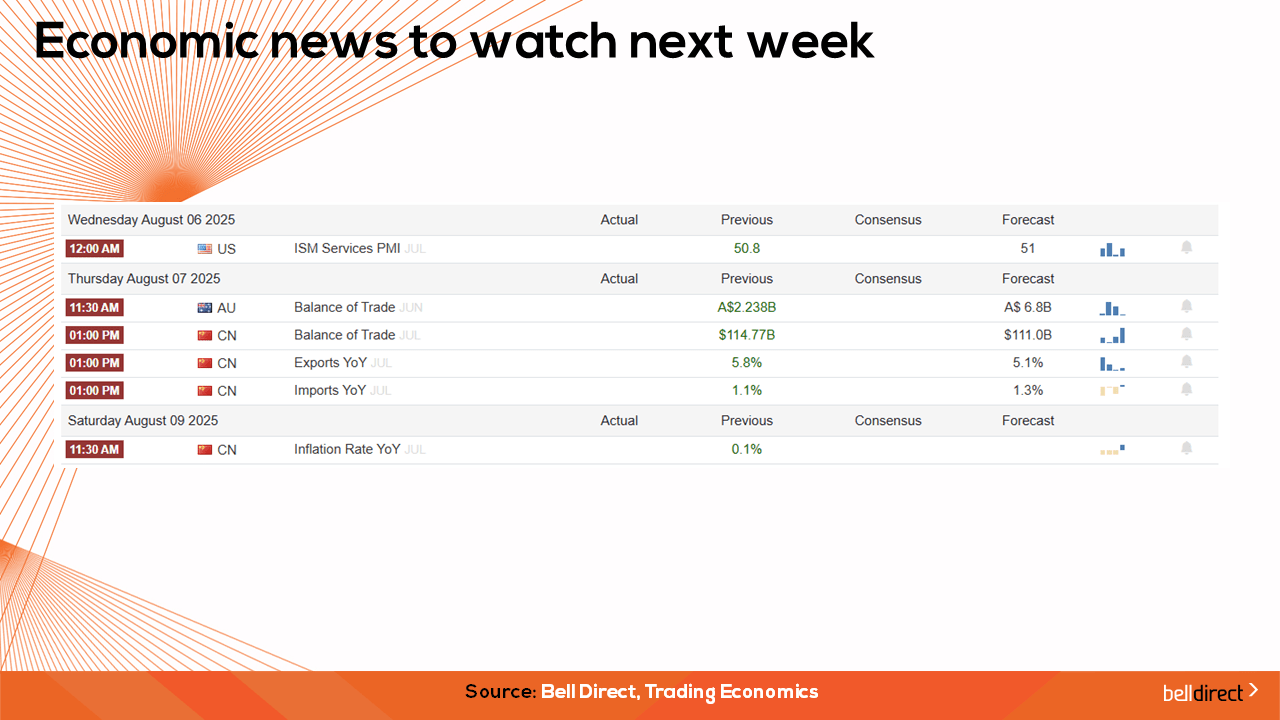

On the economic calendar next week, we may see investors respond to Australia’s latest trade balance data out on Thursday next week, while overseas the latest slew of China’s economic readings are out later in the week with trade balance and inflation rate readings due out which will give the next insight into recovery of the world’s second largest economy.

And on the earnings season calendar next week we will see results out of News Corporation (ASX:NWS), Centuria Industrial REIT (ASX:CIP), REA Group (ASX:REA), TPG Telecom (ASX:TPG), Block Inc (ASX:XYZ), AMP (ASX:AMP), QBE Insurance (ASX:QBE) and Carsales.com (ASX:CAR).

And that’s all for this Friday, have a wonderful weekend and happy investing.