Thanks for joining me this Friday the 25th July, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is your weekly market update.

This weekly wrap explores what we are expecting on a broad scale from August’s reporting season. As July draws to a close, we turn our focus to the eagerly awaited August reporting season. This pivotal time will shed light on key trends, offering valuable insights into the stability of Australia’s economy, identifying sectors that have outperformed or underperformed, and providing guidance for investment opportunities as we head into the new financial year.

Investors are selling off financial stocks ahead of earnings season, with all four major banks under pressure due to overvaluation. CBA (ASX:CBA), which recently hit $190 per share, has dropped to $173 as investors take profits and shift to growth sectors. At $190, CBA was the world’s most expensive bank, trading at a PE of over 33x, well above the sector’s 19x average. This overvaluation was driven by passive exposure, safe-haven demand, and higher interest rates, but as these factors fade, the banks face increased scrutiny. For this earnings season, watch CBA’s Net Interest Margin, provisions, and guidance to see if the bull run has peaked.

During uncertain times, investors flock to staple stocks like Woolworths (ASX:WOW) and Coles (ASX:COL), pushing their prices up. However, with modest earnings growth recently, these stocks may see sell-offs as investors take profits during the reporting season.

Tech stock valuations are high, and earnings will be closely watched to ensure growth matches these prices. For example, despite Netflix beating expectations, its stock fell 3%, highlighting the importance of growth potential for tech firms like TechnologyOne (ASX:TNE), recently downgraded due to valuation concerns.

Retailers have remained strong, but rising interest rates and reduced spending are now taking their toll. Companies like Accent Group (ASX:AX1) and Adairs (ASX:ADH) have issued profit warnings, and low single-digit earnings growth is expected this season.

China’s stimulus has yet to boost demand for Australian commodities, with subdued demand and weaker prices impacting miners like BHP (ASX:BHP) and Rio (ASX:RIO). However, their green energy diversification may offset some of the pressure.

Healthcare results have been mixed, but companies like ResMed (ASX:RMD) are standing out with strong earnings and strategic partnerships in the sleep apnoea market.

Expect low single-digit earnings growth overall, with a focus on margins and cost control. Companies managing capital well in tough conditions may stand out.

The materials sector could see wins, particularly for copper producers benefiting from the green energy shift, while iron ore demand remains weak.

Aussie tech stocks might surprise to the upside, driven by global demand for cloud, cybersecurity, and digital payments, especially for companies with international exposure.

Despite headwinds, discretionary stocks, especially online retailers with low inventory and strong cost control, could outperform due to resilient consumer sentiment and low unemployment.

Key risks to watch out for this reporting season include inflationary pressures, with rising costs and interest rates potentially weighing on earnings, especially for sectors with high operating costs. Global supply chain disruptions, particularly in tech and retail, could affect profitability, while any slowdown in China’s economy may impact mining exports, given Australia’s strong trade ties with China. Companies exposed to US tariffs might also reveal the financial impact of these taxes, which investors should be mindful of. Additionally, if companies that previously issued guidance fail to do so this season, it could signal uncertainty, and investors are likely to respond negatively. We’ll be covering the Australian reporting season throughout August, with videos every Wednesday and Friday.

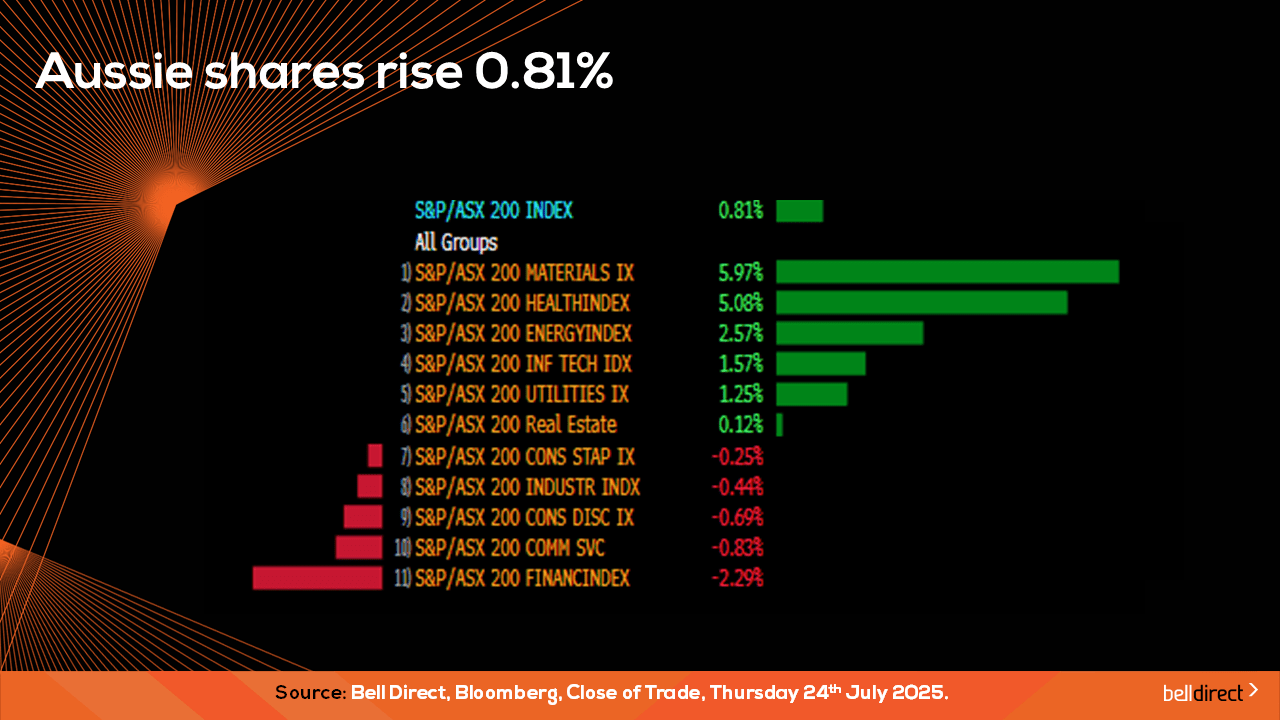

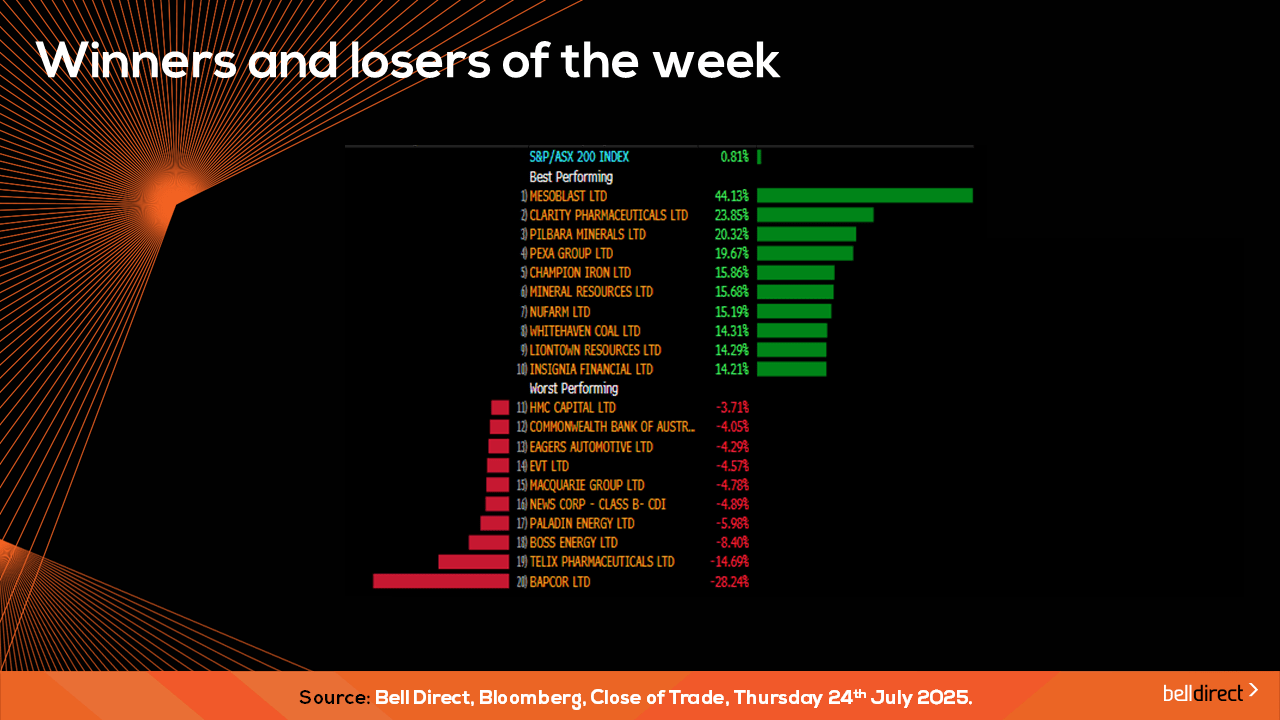

Locally from Monday to Thursday the ASX200 posted a 0.81% rise as a 5% surge in materials and healthcare stocks offset weakness among financials and consumer services stocks.

For the week, the broader market index posted a 1% as a 42% surge for Calix (ASX:CXL) offset Imugene’s (ASX:IMU) more than 22% slide.

The most traded stocks by Bell Direct clients this week were CBA (ASX:CBA), BHP (ASX:BHP), Neuren Pharmaceuticals (ASX:NEU), Fortescue (ASX:FMG), Pilbara Minerals (ASX:PLS), and Mesoblast (ASX:MSB). Clients also bought into CSL (ASX:CSL) and Telix (ASX:TLX) while taking profits from DroneShield (ASX:DRO) and Macquarie (ASX:MQG).

And the most traded ETFs by our clients were led by Vanguard Australian Shares Index ETF (ASX:VAS), Vanguard US Total Market Shares Index AUD ETF (ASX:VTS) and Vanguard Australian Shares High Yield ETF (ASX:VHY).

On the economic calendar next week we may see investors react to key US jobs data out on Tuesday while the Fed’s latest interest is announced next Thursday where markets are expecting the Fed to hold again as tariff implications on inflation remain unclear.

And that’s all for this Friday, we hope you have a wonderful weekend and happy investing.