Transcript: Weekly Wrap 11 August

Thank you for joining me this Friday the 11th August, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

Reporting season ramped up this week, with investors very reactive to both good and bad news out on names spanning the market cap spectrum.

CBA’s results were the highlight of Wednesday’s trading session with the bank announcing a record cash profit of $10.16bn boosted by higher interest rates, net interest margin up 17 basis points, and dividends per share of $4.50 in FY23, up 17% on FY22. Investors responded positively to the results with the CBA share price rising 2.6% on Wednesday.

Over in the cement department, a new leader was all it took for Boral (ASX:BLD) to post a material improvement in results for FY23. The leading integrated Australian materials company reported revenue up 17% to $3.46bn, underlying NPAT soared over 300% to $142.7m, cash increased to $658.1m after the company reduced debts by $629m and operating cash flow increased 66%, under the helm of new CEO Vik Bansal. Bansal, the former CEO of Cleanaway Waste Management focused on cost cutting, pricing and volumes in a bid to turn around the cement maker’s profitability struggles. The results spoke for themselves in showing a material improvement across most metrics, which investors agreed with as the company’s share price jumped 8.35% on release of the report.

Shifting focus to the luxury online fashion market and Cettire (ASX:CTT) rocketed 21% on Thursday after surprising investors with strong FY23 results despite the slowing consumer spend environment. Gross revenue rose 87% to $539.2m, sales revenue increased 98% to $416.2m, active customers rose 63% to 423k, and the company provided qualitative outlook expecting the positive trading momentum to continue into FY24. This result shocked the market given the high interest rate environment impacting consumer spending in the retail space. Bell Potter has a buy rating on Cettire with a 12-month price target of $3.90.

Downer (ASX:DOW) dampened trading on Thursday though as investors responded to the integrated services company’s FY23 results including a swing to a loss of $385.7m and a decline in dividend from 12cps to 8cps. Downer said it expects external market conditions to remain challenging in FY24 due to ongoing cost escalation, labour market availability, and productivity issues.

So, what has this week told us about reporting season so far? Consumer spend in the luxury sector remains strong, the banks are profiting on higher interest rates, investors are quick to sell underperformers especially from companies who provide weak outlook, and that new executives have delivered some material turnarounds in FY23.

Looking ahead to next week on the reporting calendar, we will be keeping an eye on results out of miners like Beach Energy (ASX:BPT), Allkem (ASX:AKE), and Evolution Mining (ASX:EVN), FMCG companies like Endeavour Group (ASX:EDV), and Treasury Wine (ASX:TWE), healthcare companies like Sonic Healthcare (ASX:SHL) and CSL (ASX:CSL), and financials including Bendigo & Adelaide Bank (ASX:BEN) among others. We will gauge more of an insight into the strength of results over the next week as the number of companies reporting increases.

On a global scale, markets moved this week on the release of inflation data out of the US which came in line with consensus expectations of a slight month-on-month growth by 0.2% while the annual inflation rate rose to 3.2% from 3% in June. While the reading shows inflation rising in the region, this was expected and the reading was not as high as the market was expecting on an annual basis. China’s annual inflation rate was also released this week and came in at a reading of minus 0.3% year on year in July, the first decrease since February 2021. Investors took the US inflation data as a sign inflation remains sticky in the world’s largest economy, sparking concerns over possible further rate hikes to come out of the Fed. On the other hand, China’s reading was taken as a further sign that the Chinese Government needs to introduce further stimulus to reignite growth in the region.

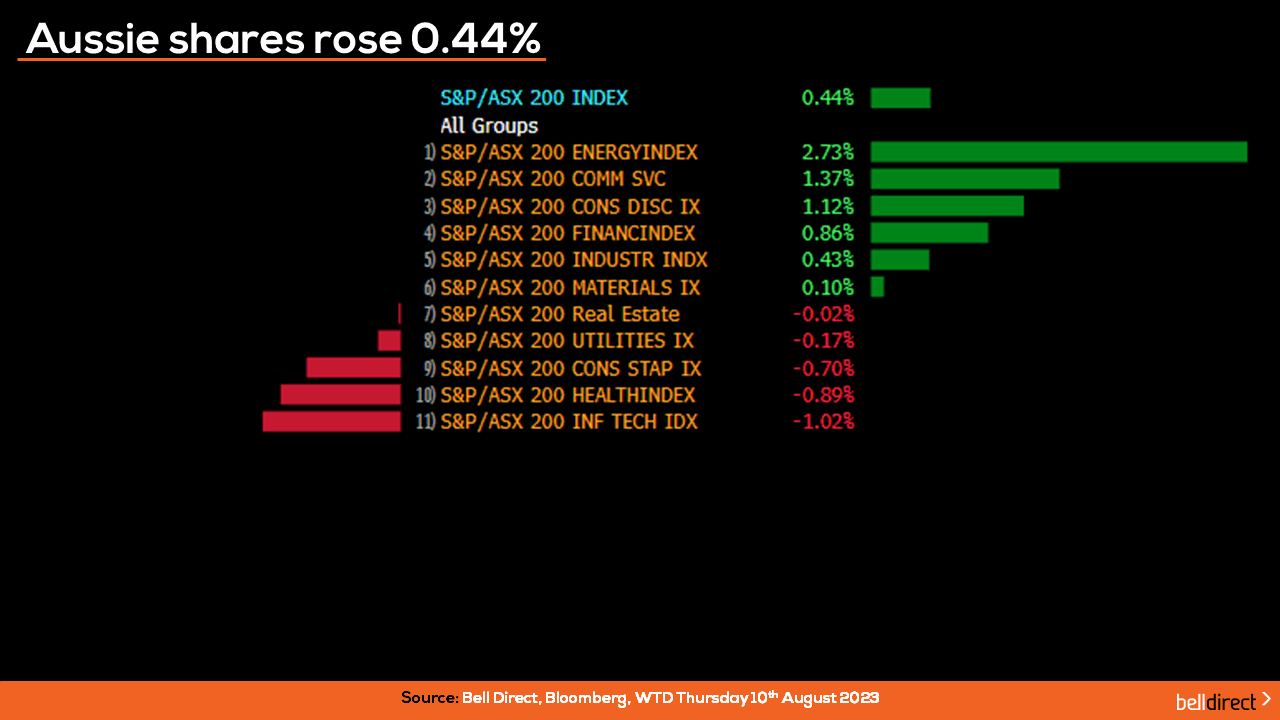

Locally from Monday to Thursday the ASX200 rose 0.44% as a 2.73% gain for the energy sector offset losses in the tech and healthcare sectors.

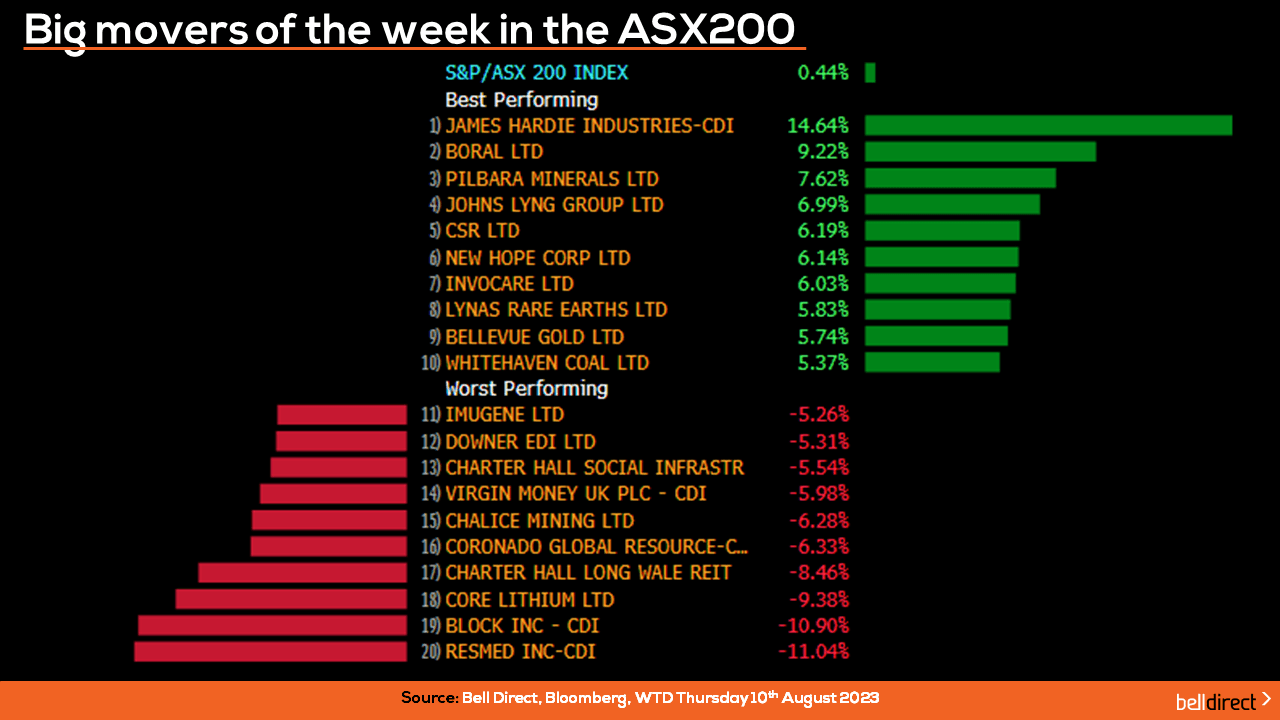

Looking at the winning stocks on the ASX200 over the four trading days, James Hardie Industries (ASX:JHX) jumped 14.64% on the back of strong results that beat consensus expectations and included outlook for Q2 FY24. Boral also added over 9% this week and Pilbara Minerals (ASX:PLS) rose 7.62%.

On the losing end, ResMed (ASX:RMD) continued to decline this week, falling 11% over the four days, following the release of disappointing results last week. Block Inc and Core Lithium also each lost 10.9% and 9.38% respectively.

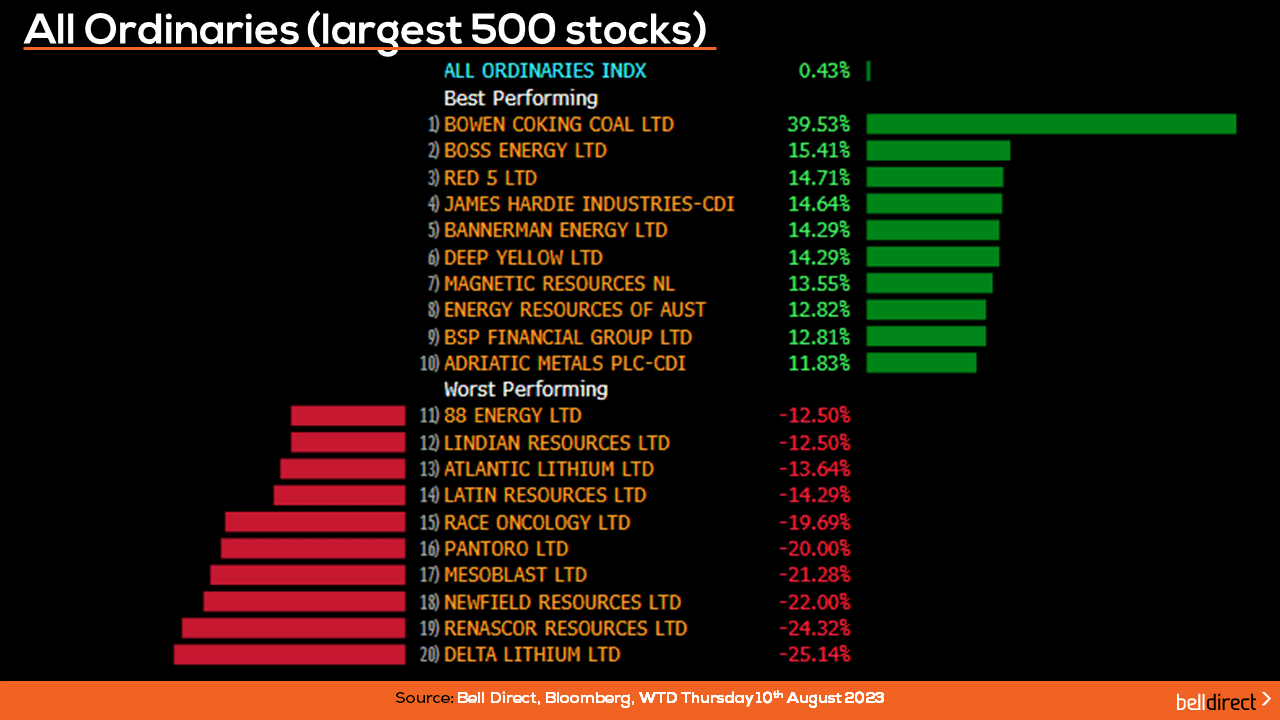

On the broader market, the All Ords rose 0.43% this week led by Bowen Coking Coal (ASX:BCB) soaring 39.50% after the company reported strong shipping performance achieved in July, while Boss Energy (ASX:BOE) rose 15% and Red 5 lifted 14.71%.

Delta Lithium (ASX:DLI) weighed on the All Ords this week with the lithium explorer falling 25%, while Renascor Resources (ASX:RNU) and Newfield Resources (ASX:NWF) fell 24% and 22% respectively.

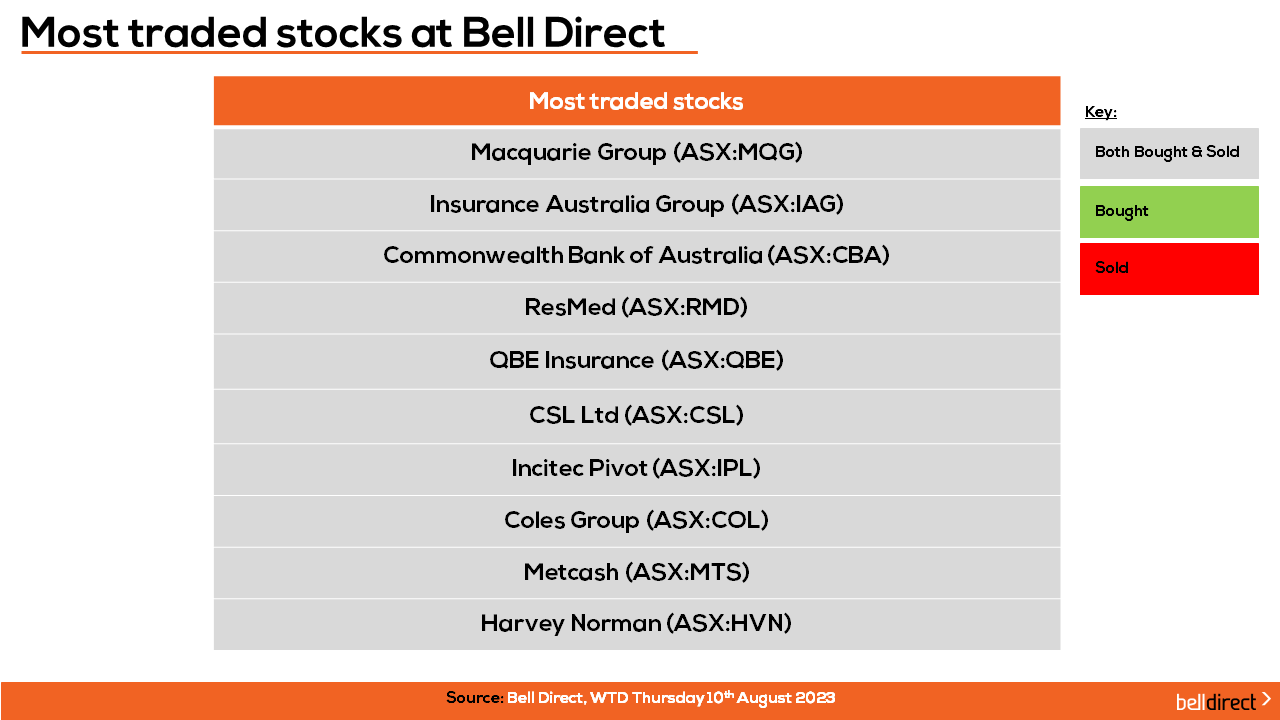

The most traded stocks by Bell Direct clients from Monday to Thursday were Macquarie Group (ASX:MQG), Insurance Australia Group (ASX:IAG), CBA (ASX:CBA), ResMed (ASX:RMD), QBE Insurance (ASX:QBE), CSL (ASX:CSL), Incitec Pivot (ASX:IPL), Coles Group (ASX:COL), Metcash (ASX:MTS) and Harvey Norman (ASX:HVN).

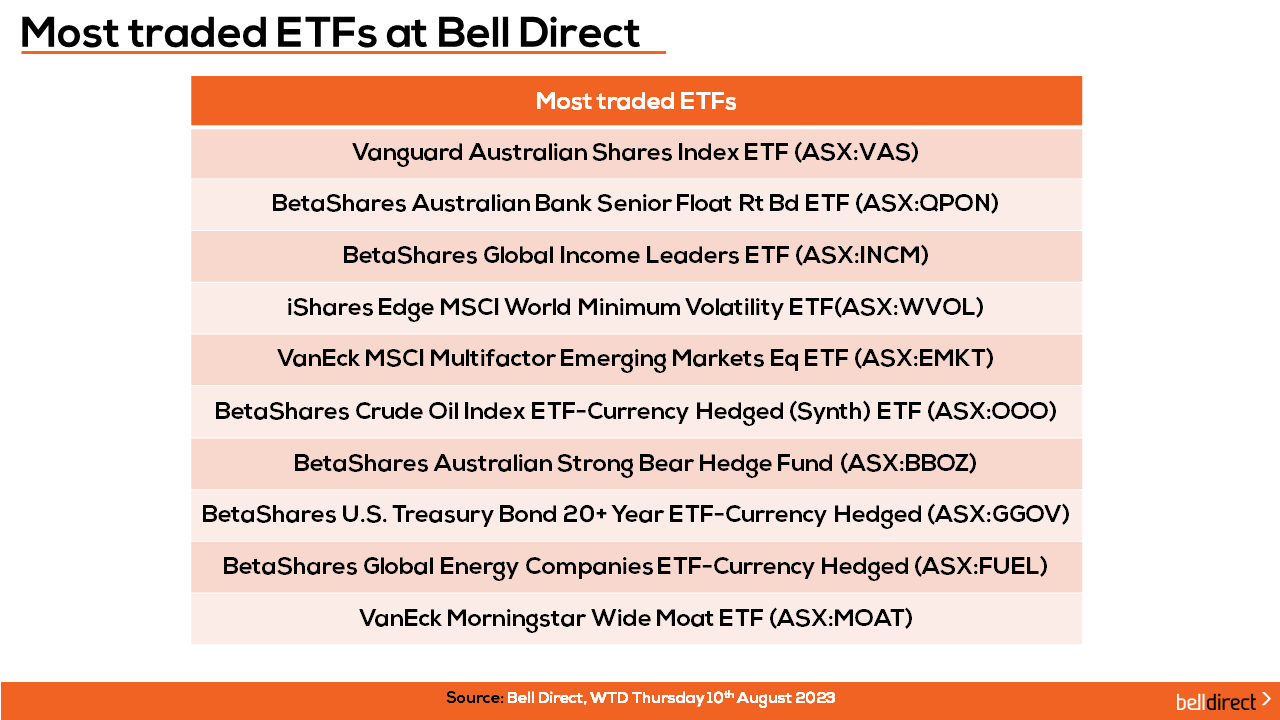

On the diversification front, the most traded ETFs by Bell Direct clients from Monday to Thursday were led by Vanguard Australian Shares Index ETF, Betashares Australian Bank Senior Float Rate Bade ETF, and Betashares Global Income Leaders ETF.

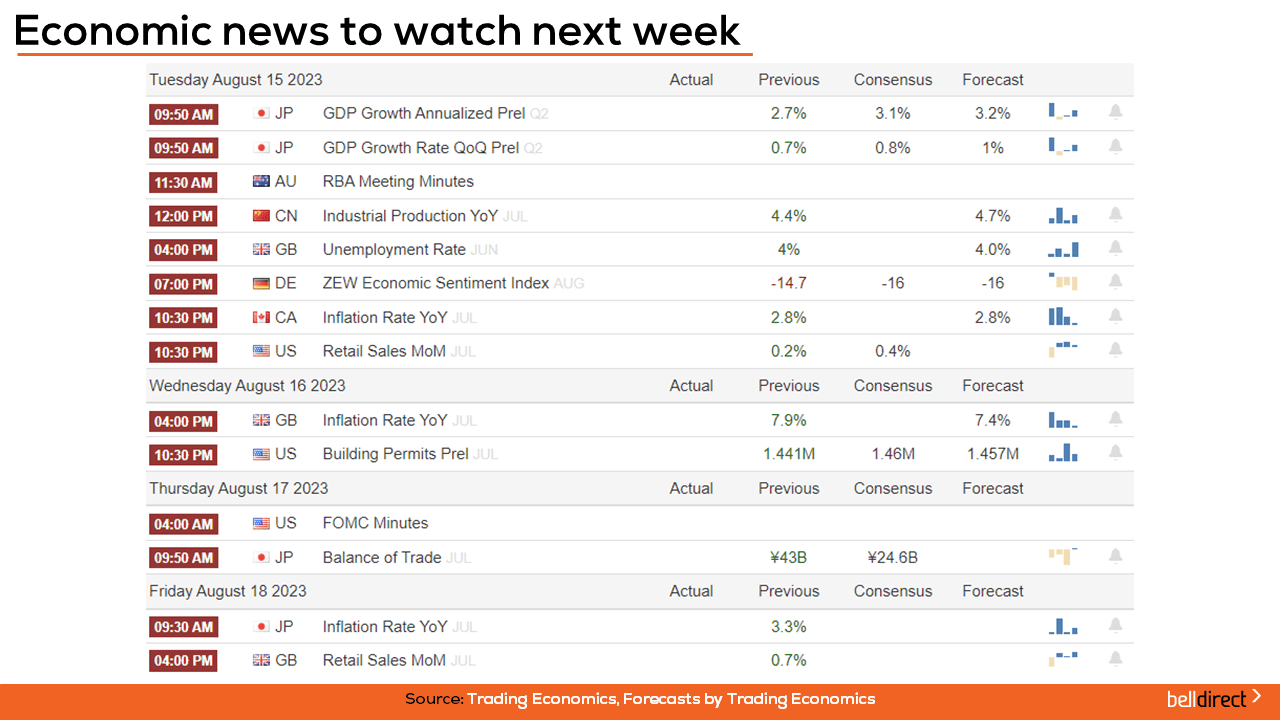

Taking a look at the week ahead, locally, the RBA releases the latest meeting minutes on Tuesday which will give investors an insight into the rate outlook for this cycle.

Overseas, Chinese industrial production, retail sales and unemployment data is all out on Tuesday which will provide further insight into how contractionary the world’s second largest economy is post-pandemic.

In the US, retail sales and building permits data are out later in the week alongside the release of the FOMC meeting minutes which will also provide investors with outlook for further potential rate hikes out of the Fed.

And that’s all for this week, have a wonderful Friday and weekend, and as always, happy investing.