Transcript: Weekly Wrap 4 August

Thank you for joining me this Friday the 4th August, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

Reporting season kicked off this week with a small list of key names releasing results, while overseas was possibly the busiest results week in Europe and the US earnings season. Other key events driving markets were the Fitch Ratings downgrade on the US, China’s stimulus policy and Australia’s RBA rate pause.

The week started on a slightly higher note from the Chinese economy’s perspective following the release of the highly anticipated policy document outlining stimulus measures the Chinese government will introduce to reignite growth in the region. The world’s second largest economy released PMI index data for July that indicated the manufacturing sector uptick in output was just 0.3 points from the prior month to 49.3 points. The PMI data was further supporting evidence that the economy’s recovery post-pandemic is struggling to gain momentum, after GDP in the region only grew 0.8% in Q2 down from 2.2% growth in Q1. The new policy document announced 20 measures aimed at increasing consumption in the region in addition to fuelling economic growth including the building of more EV charging facilities, encouraging local governments to host food, music and sports festivals to attract tourism, a two-year plan to boost the ‘light industry’ encompassing goods, sports and leisure. The policy document was a start, however analysts around the world are still expecting more concrete stimulus to reignite growth in the region over the coming weeks.

On a global market scale some big names released results this week that had a significant impact on market movements. Qualcomm shares dipped over 2% on Wednesday after the semiconductor released Q3 results that beat Wall St expectations but revenue and guidance for Q4 fell short of expectations. The chipmaker reported slumping sales in the smartphone industry is set to impact Q4 results, partially due to the slow recovery in China. Coffee giant Starbucks topped Wall St expectations for the latest quarterly results however same-store sales fell short of expectations. JetBlue on the other hand cut forecast on a shift to international travel and the end of a partnership with American Airlines, this sent shares in JetBlue tumbling 8% on Tuesday. Creative social media platform Pinterest announced expenses rose 11% during Q2 to US$781m, which hurt the company’s share price on Tuesday. Taco Bell owner Yum Brands also reported this week, announcing second-quarter earnings per share that beat Wall St estimates, but revenue fell short of expectations at US$1.69bn vs the expected US$1.75bn. The company’s KFC stores experienced same-store sales increasing 13% fuelled by returning demand in China.

Wall St was shaken midweek though by the announcement that Fitch Ratings had downgraded the US credit rating to AA+ from AAA, with the company citing “expected fiscal deterioration over the next three years” as the reason for the downgrade. This caused Wall St to tumble on Wednesday as investor risk-fears resurfaced and sparked a shift out of growth stocks like technology, with the Nasdaq falling over 2% in its worst session since February. Analysts and economists believe the downgrade fall-out will be short-lived though and will have no material impact on the economy or markets.

Locally, the ASX rallied, with Aussies taking a deep sigh of relief after the RBA held the nation’s cash rate at 4.1% for the month ahead for a second consecutive month in a bid to see how the economy is responding to the 12-rate hikes since May 2022. Consumer discretionary and REIT stocks rallied on the back of the announcement as these are two sectors that wear the full brunt of interest rate hikes, while technology, the winning sector of 2023 so far, also surged on the rate pause.

Next week we dive headfirst into Australia’s reporting season which will be a key indicator of how locally listed companies both big and small have fared during the high interest rate, high inflation environment.

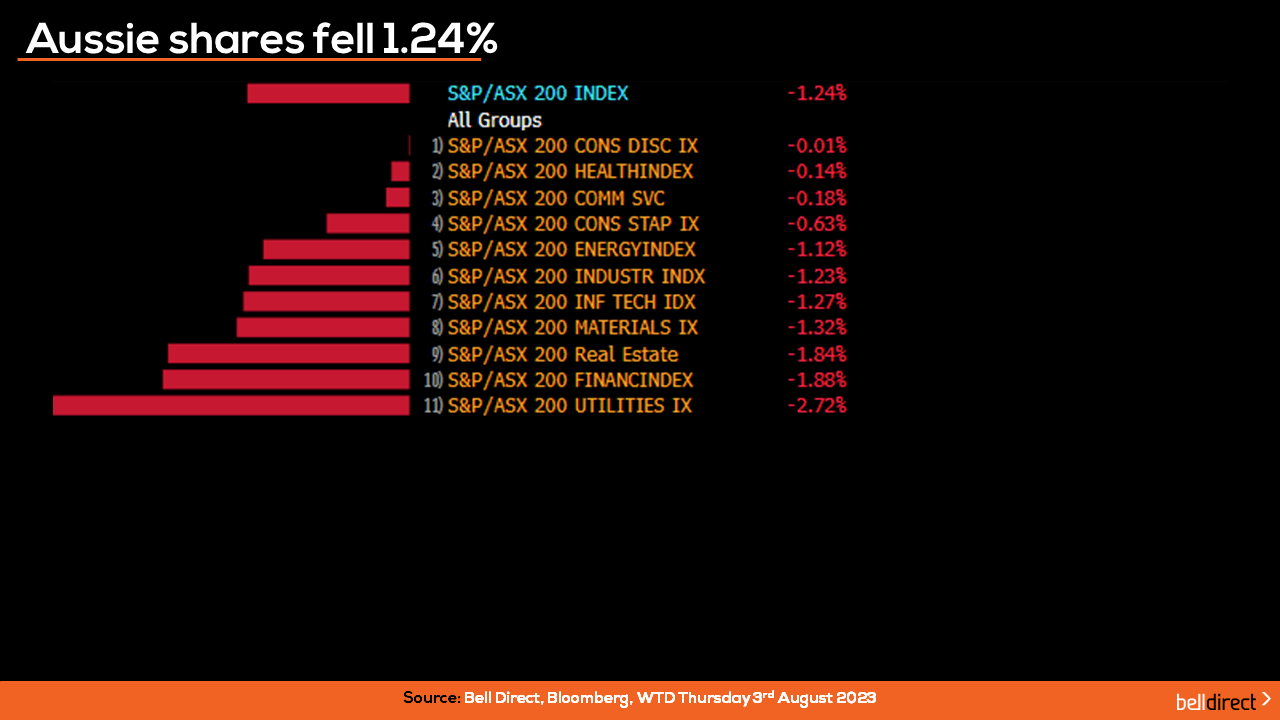

Locally from Monday to Thursday the ASX200 fell 1.24% as the local market took lead from the global market sell-off. The utilities sector took the biggest hit dropping 2.72%, followed by financials losing 1.88% and REIT stocks dropping 1.84%.

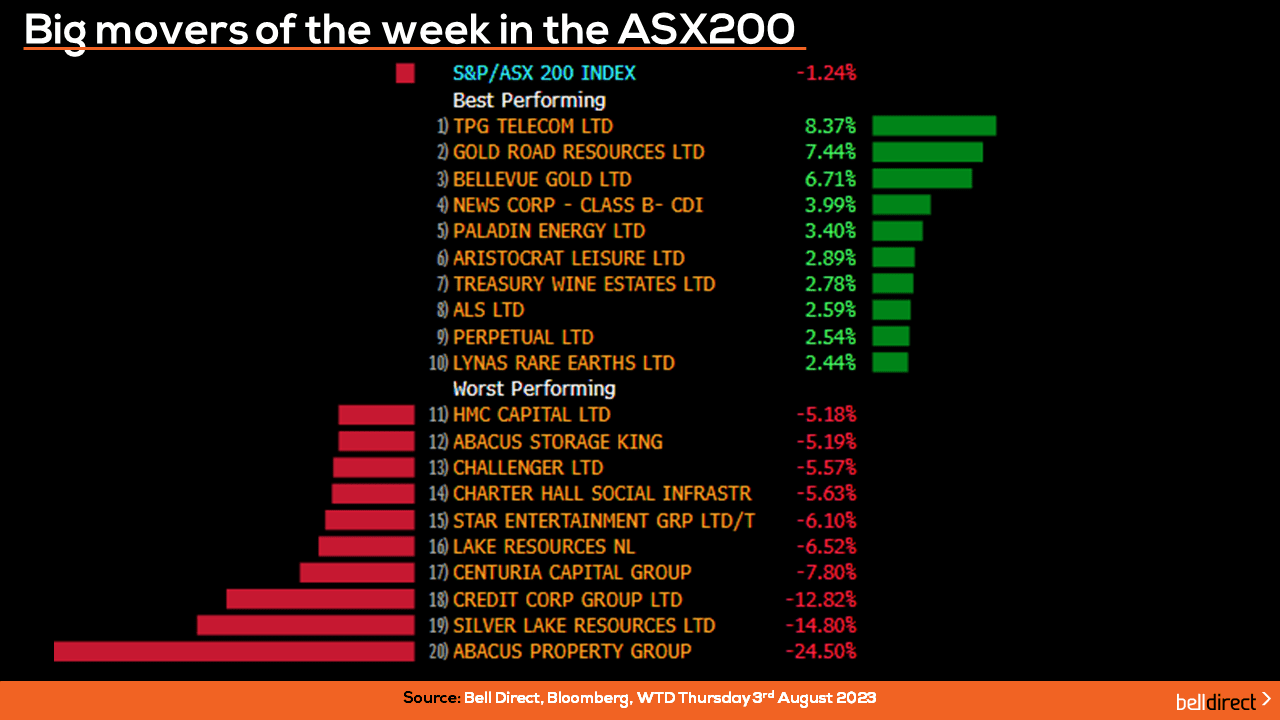

The winning stocks on the ASX200 over the four trading days were led by TPG Telecom (ASX:TPG) adding 8.37%, Gold Road Resources (ASX:GOR) lifting 7.44% and Bellevue Gold (ASX:BGL) rallying 6.71%.

On the losing end, Abacus Property Group (ASX:ABP) tumbled 24.5%, Silver Lake Resources (ASX:SLR) fell 14.8% and Credit Corp Group (ASX:CCP) dropped 12.82% after these companies released their FY23 results.

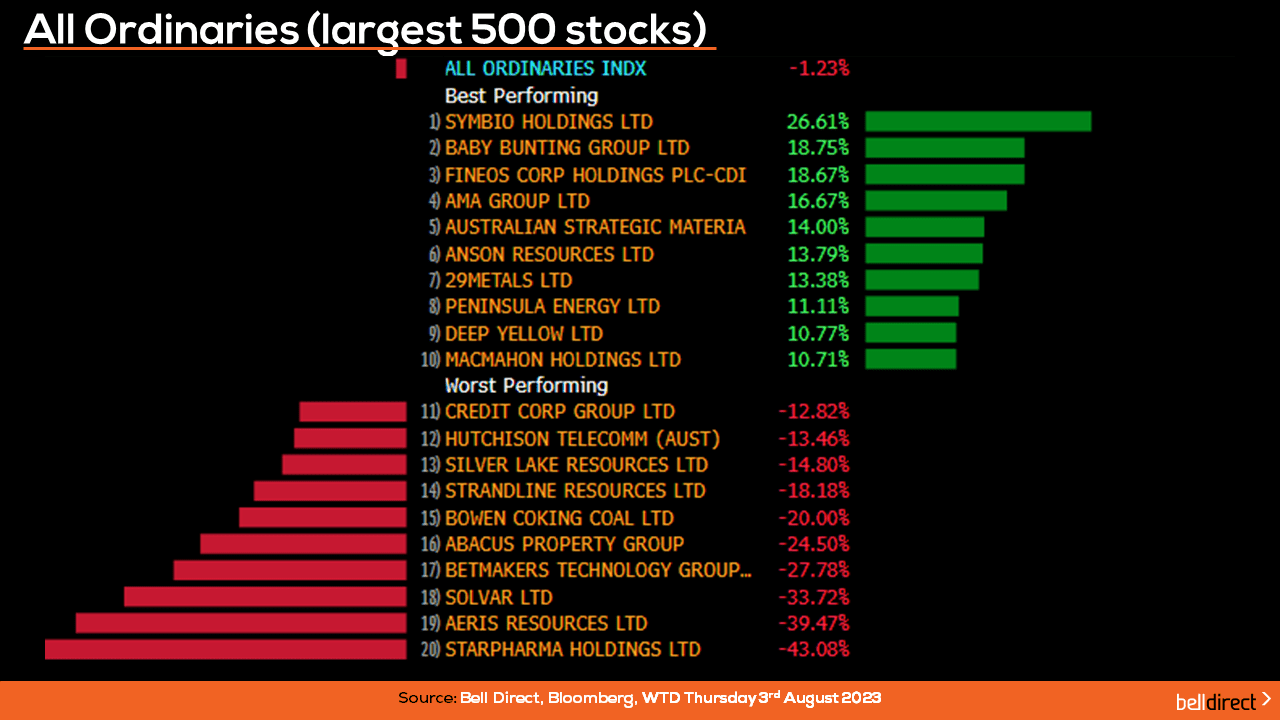

On the broader index the All Ords fell 1.23% over the week weighed down by Starpharma (ASX:SPL) tanking 43% after AstraZeneca pulled out of the partnership development with Starpharma for AZD0466 following a small number of asymptomatic adverse events. Aeris Resources (ASX:AIS) lost almost 40% over the week and Solvar (ASX:SVR) fell 33.72%.

Symbio Holdings (ASX:SYM) rose 26.61% though from Monday to Thursday and Baby Bunting (ASX:BBN) rallied 18.75% to offset some of the heavy losses on the All Ords index from Monday to Thursday.

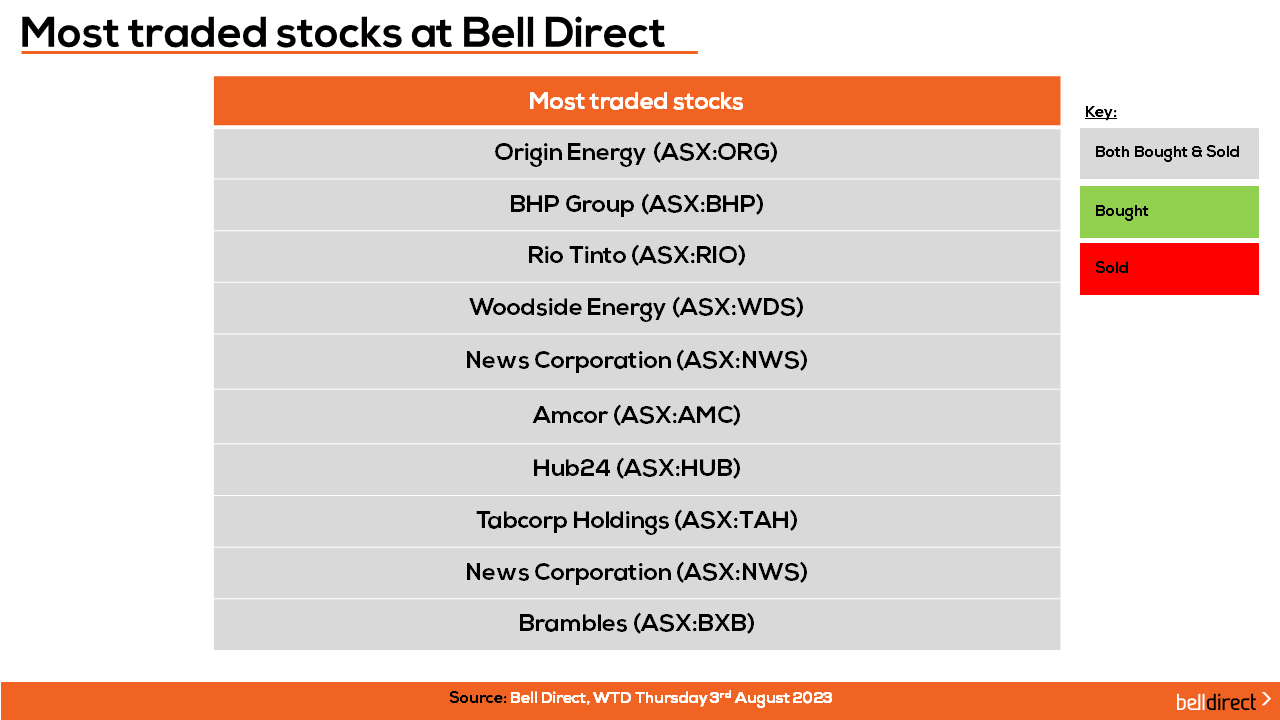

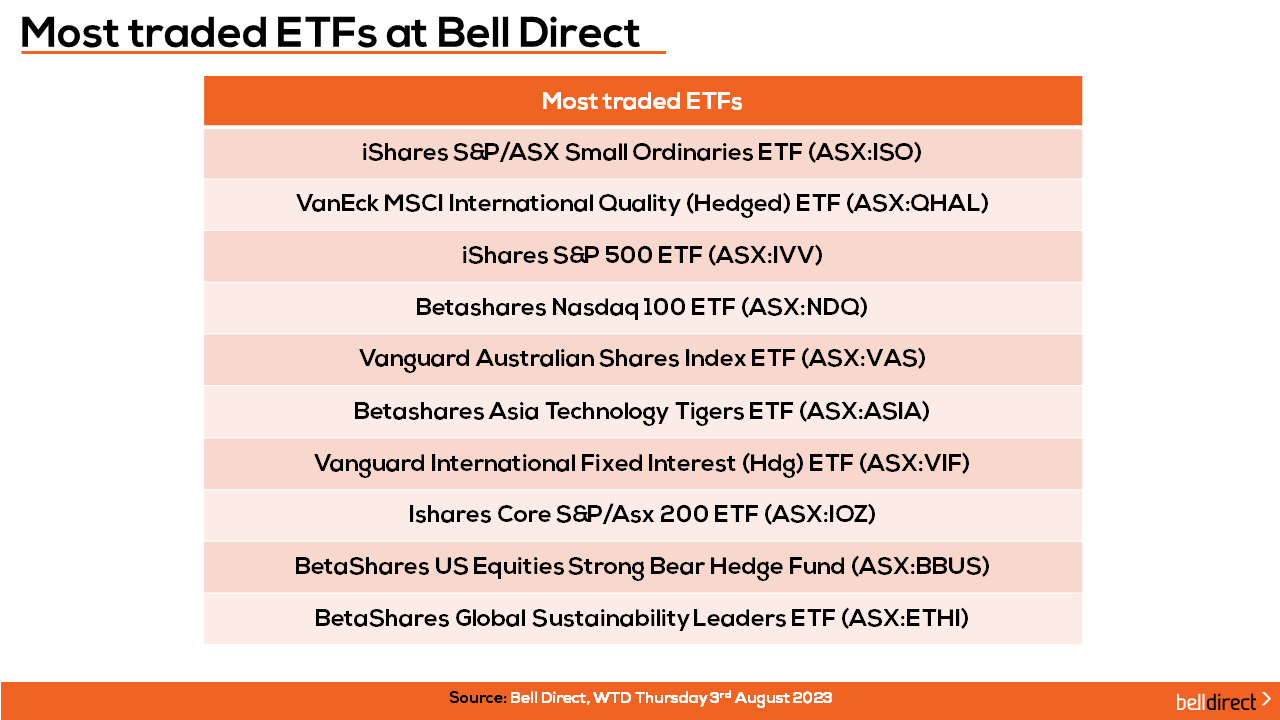

And on the diversification front, the most traded ETFs by Bell Direct clients this week were iShares S&P/ASX Small Ordinaries ETF, VanEck MSCI International Quality (Hedged) ETF and iShares S&P 500 ETF.

Taking a look at the week ahead, on the local economic calendar we may see some market movements following the release of the Westpac Consumer Confidence data for August and NAB Business Confidence Data for July which are both out on Tuesday and will indicate consumer and business sentiment in current market conditions.

Overseas, the all important inflation rate data out of China is released on Wednesday with the market expecting deflation of 0.3% which will provide a further sign that the world’s second largest economy is struggling to regain growth in the post-pandemic environment.

In the US, key inflation data is out on Thursday with consensus expecting core inflation to decline to 4.7% year-on-year to July from 4.8% in June, and the overall inflation to decline to 2.8% from 3% over the month.

Over in the UK, GDP data is out on Friday and US PPI data is also out next Friday.

And that’s all for today, have a wonderful Friday and weekend, and as always, happy investing!