Thanks for joining me this Friday the 11th July, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is our weekly market update.

In its July meeting, the Reserve Bank of Australia (RBA) kept the cash rate on hold, surprising markets that had priced in an over 95% chance of a rate cut. Bell Potter’s expectation was more balanced, given the board’s preference to wait for quarterly CPI data and the still-tight labour market. We now anticipate a rate cut at the August meeting after the inflation data release. Bell Potter’s base case remains four rate cuts for the year, based on several factors: moderating inflation, a softening labour market with limited wage pressures, below-trend economic growth, and the lagged effects of previous tightening. Additionally, weaker global growth supports the RBA’s easing bias. We expect the RBA to adopt a measured, data-dependent approach, opting for gradual, rather than aggressive, rate cuts, as we have already seen with the surprise hold this week and RBA governor Michele Bullock saying the RBA is set to ‘nail’ inflation before cutting again to ensure another fight against inflation doesn’t arise.

Overseas this week, we had the end of Trump’s tariff waiver on July 9, and the President was out to set the tariff narrative straight; no more delays, August 1 is the start date and countries that don’t have a trade deal with the US by then will face elevated tariffs on imports into the world’s largest economy. Markets reacted negative earlier in the week, however, moderated later in the week as hopes of trade deals being done boosted investor optimism. This week the US President sent over 15 letters to countries indicating new tariff terms and amounts that will come into play. The common theme on a global scale is resistance of central banks to make any drastic changes to interest rates as the world waits to see the final impact of Trump’s tariffs on near-term and forecast inflation levels.

Trump’s latest tariff threats came this week in the form of a 50% tariff on copper imports and a 200% tariff on drug imports into the US. The price of copper has been on a run over the last year primarily driven by the undersupply outlook for the commodity and its vital role in the green energy transition driving demand outlook. Copper traders are rushing to reroute shipments to Hawaii and Puerto Rico to cut delivery times as Trump’s 50% tariff plan threatens to disrupt a profitable arbitrage trade. New York futures surged 25% above international prices, prompting traders to deliver copper to the US before tariffs take effect, risking huge profits or losses.

This shift follows Trump’s February tariff announcement, triggering a surge in US copper stockpiles while squeezing global supplies. Though shipments have slowed recently, large volumes are still heading to US ports, with inventories expected to reach 500,000 tonnes, mainly in New Orleans and Panama City. Traders are working around the clock to decide how to handle these shipments amid the uncertainty.

And for healthcare producers outside of the US, at a Cabinet meeting, Trump announced that his administration plans to reveal a proposal soon regarding pharmaceutical tariffs, which could impose a 200% tariff on imported drugs. Companies would have about a year to relocate their manufacturing to the U.S. before the tariffs are enforced. Although pharmaceuticals are currently exempt from Trump’s broader “Liberation Day” tariffs, he had previously hinted at potential new tariffs on the sector. If implemented, the pharmaceutical tariff could affect the $212 billion in imports the U.S. received in 2024, making it the fifth-largest imported product. Additionally, Trump revealed a 50% tariff on copper imports and hinted at further tariffs on items like semiconductor chips.

CSL (ASX:CSL), Australia’s heavyweight pharmaceutical company, has called on the Trump administration to target hostile nations that could weaponize pharmaceutical supplies, instead of imposing blanket tariffs on medicines. The company supported Trump’s concerns but urged a focus on specific non-allied countries rather than broad tariffs of up to 200%.

Another week, another tariff threat update. Stay tuned for any latest updates next week but we look forward to seeing the end of tariff news headlines and negotiations.

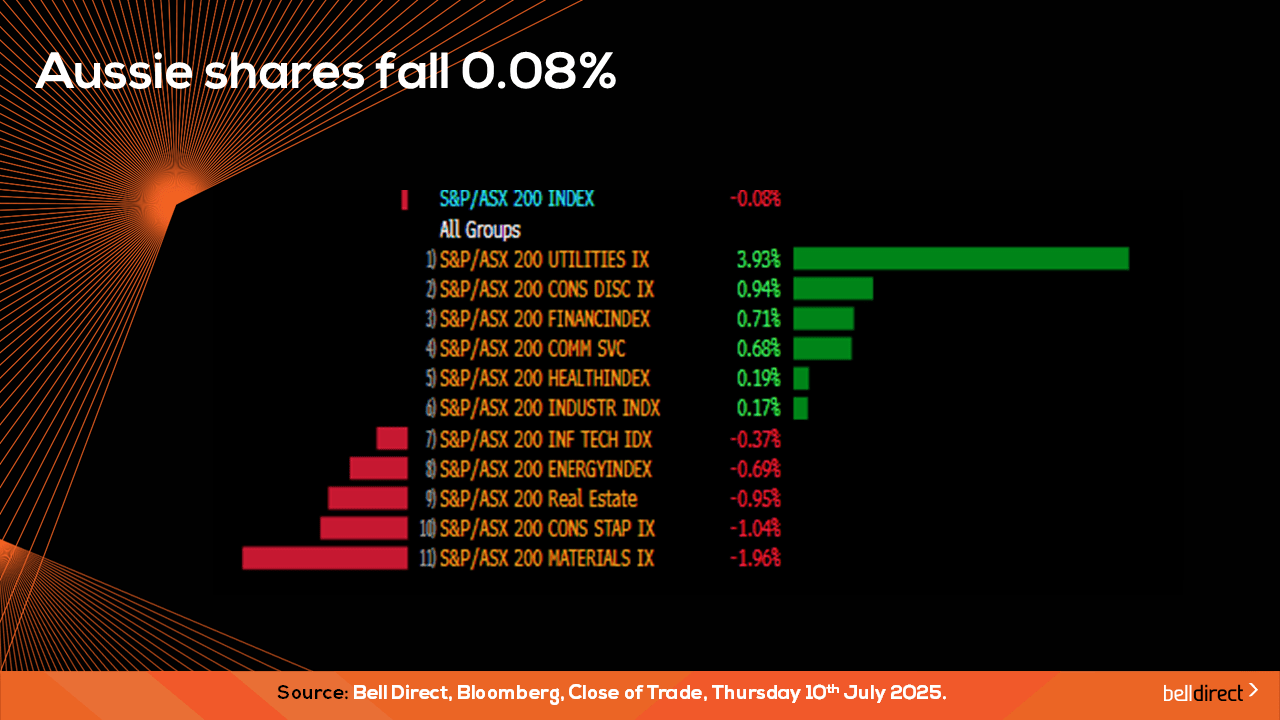

Locally from Monday to Thursday the ASX 200 posted a mere 0.08% loss over the 4-trading days as a near 4% surge in utilities stocks offset weakness among staples, materials and REIT stocks.

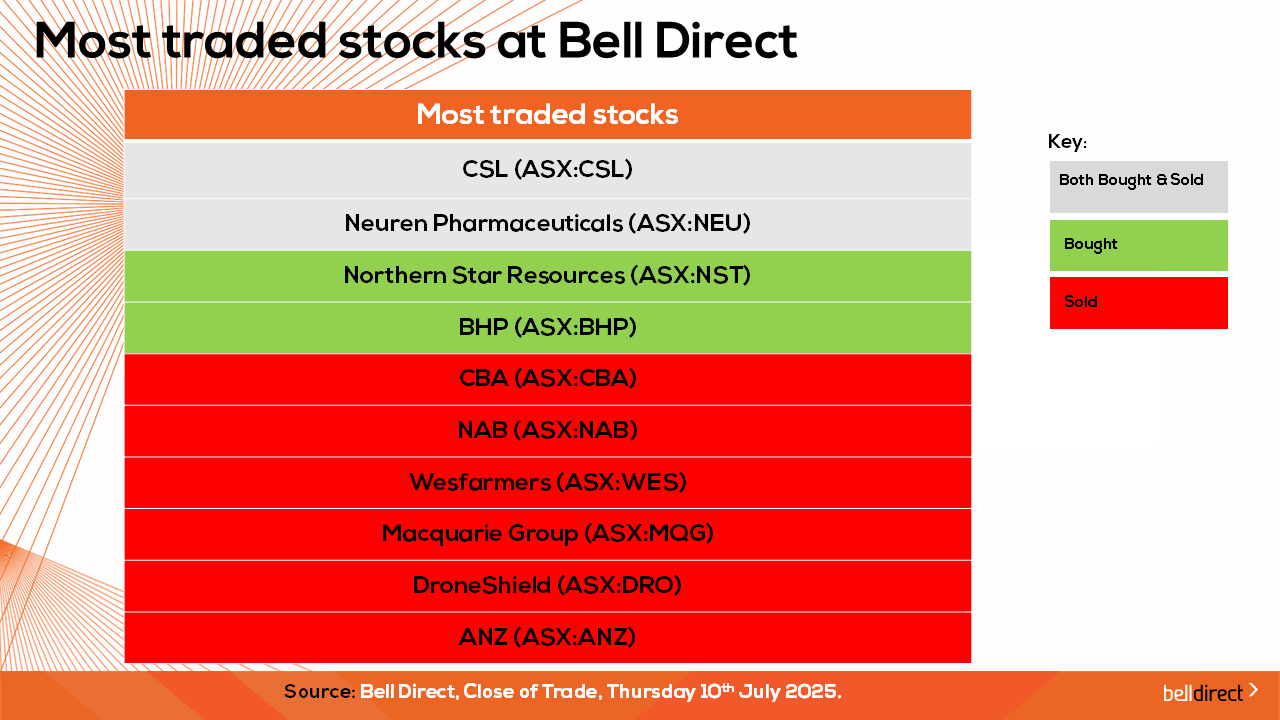

The most traded stocks by Bell Direct clients this week were CSL (ASX:CSL), and Neuren Pharmaceuticals (ASX:NEU). Clients also bought into Northern Star Resources (ASX:NST), and BHP (ASX:BHP) while taking profits from CBA (ASX:CBA), NAB (ASX:NAB), Wesfarmers (ASX:WES), Macquarie Group (ASX:MQG), DroneShield (ASX:DRO) and ANZ (ASX:ANZ).

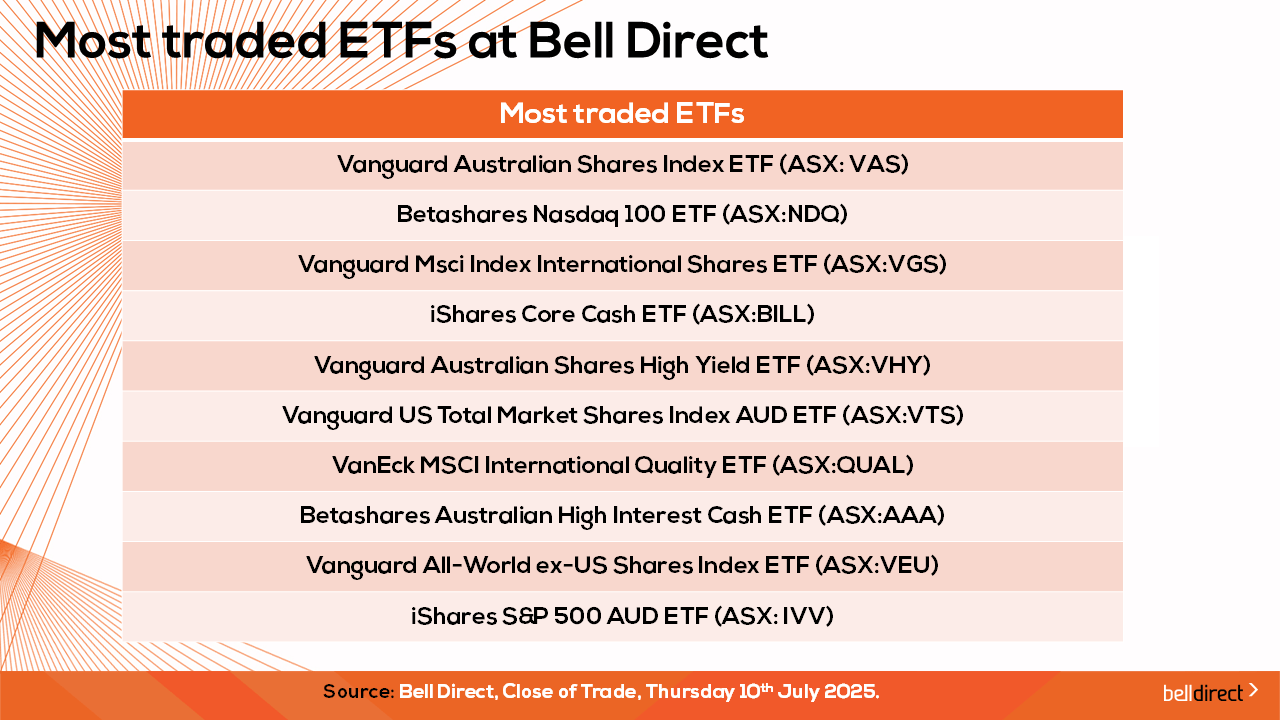

And the most traded ETFs by our clients this week were led by Vanguard Australian Shares Index ETF, Betashares Nasdaq 100 ETF and Vanguard Msci Index International Shares ETF.

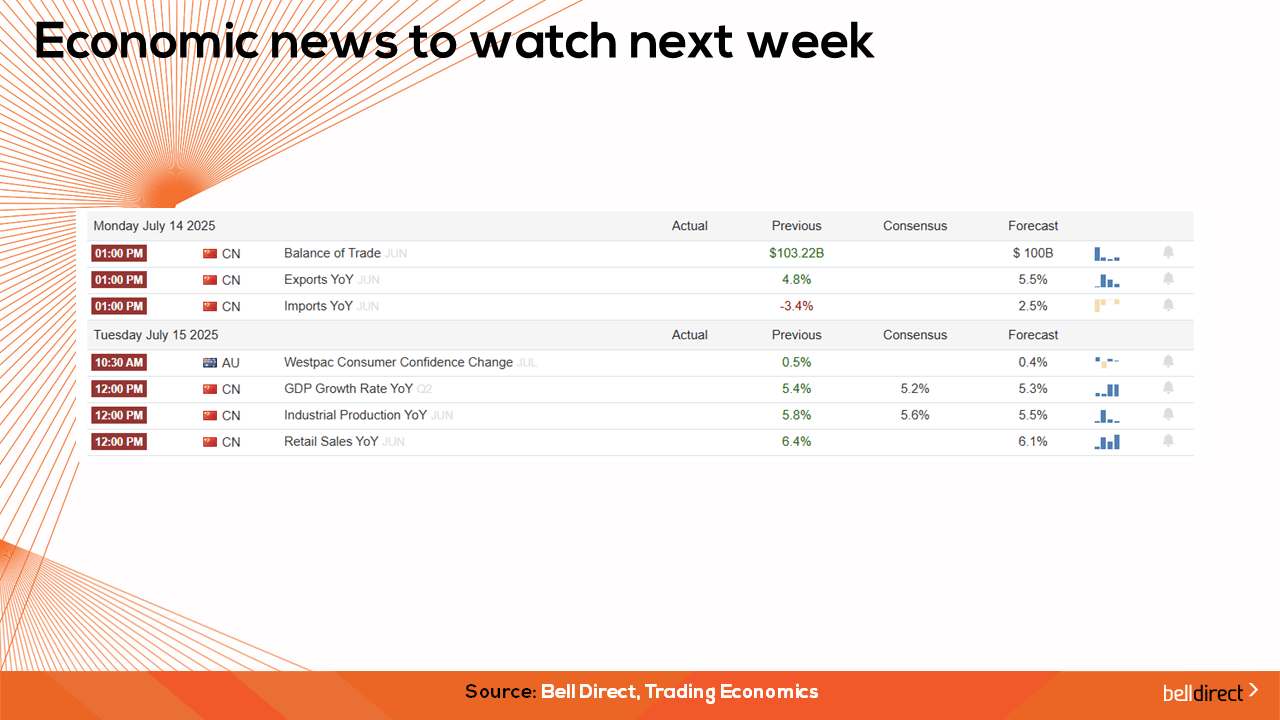

On the economic calendar next week, we may see investors react to Westpac consumer confidence data for July out on Tursday while overseas, China’s latest economic readings will give an insight into the recovery of the world’s second-largest economy. On Tuesday, China’s GDP growth rate, Industrial Production, and retail sales will be released with the market forecasting a decline in all three readings.

And that’s all for this week, have a wonderful weekend and happy investing.