Thanks for joining me this Friday the 18th July, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is your weekly market update.

The defence sector has been running hot over the last 12-months amid rising geopolitical tensions, countries reviewing and renewing their spend on the defence front, and technology advancements driving enhancements in the way defence strategies are comprised. Bell Potter’s team brought out a defence sector note recently so let’s dive into the highlights and opportunities in the market for you to gain exposure to this high-growth thematic.

In 2024, global military expenditure reached a record high of $2.718 trillion USD, marking the largest year-on-year increase since the Cold War, with a 9.4% rise. Military spending grew across all regions, with Europe and the Middle East seeing the most notable surges. NATO members collectively boosted their budgets, with 18 out of 32 members now dedicating at least 5% of GDP to defence, up from 11 in 2023. This trend is expected to persist as NATO and other nations commit to further increases in military spending.

Geopolitical risks remain high despite fragile ceasefires in the Middle East and ongoing diplomacy in Europe. Tensions between Israel and Iran persist, and the war in Ukraine, since Russia’s 2022 invasion, continues with heavy casualties and limited progress. Europe’s defence budgets are strained, and rising tensions in the Indo-Pacific, especially between the US and China, are increasing military spending, particularly in Australia. These uncertainties suggest global defence spending will stay a key focus.

In 2024, NATO members significantly increased defence spending, reflecting heightened geopolitical risks, including ongoing conflicts in Ukraine and the Middle East. As a result, NATO’s commitment to defence spending is expected to continue growing in the near future, acting as another tailwind to the sectors expansion outlook.

While there are serious growth opportunities, Bell Potter’s research team also sees some risks facing the sector including changes in government policies, and de-escalating geopolitical tensions. Competition, supply chain disruptions, and infrastructure access can impact operations, while delays in product development and contract performance may affect financial outcomes. Additionally, funding and capital management risks, including securing finance and managing debt, are key concerns.

Some investors may feel they have missed the rally train as many of the defence stocks have run hot in the last 12-months, but there are many ways to invest in the sector including direct and indirect exposure.

Direct exposure can be through direct equities like DroneShield (ASX:DRO) which provides counter-drone technology hardware and software. I spoke with DroneShield CEO, Oleg Vornik this week about his optimism, insights and outlook for the next 12-months which indicate the high growth potential of earnings for the company highlighted here. To see the full interview follow the link in the description.

You can also gain exposure to the defence theme through ETFs like Vaneck Global Defence ETF (ASX:DFND), and Betashares Global Defence ETF (ASX:ARMR). ETFs offer a diverse range of defence related holdings and offer a lower risk opportunity to gain exposure to the sector than a direct investment in a defence company, but lower reward with lower returns for the amount of risk taken on.

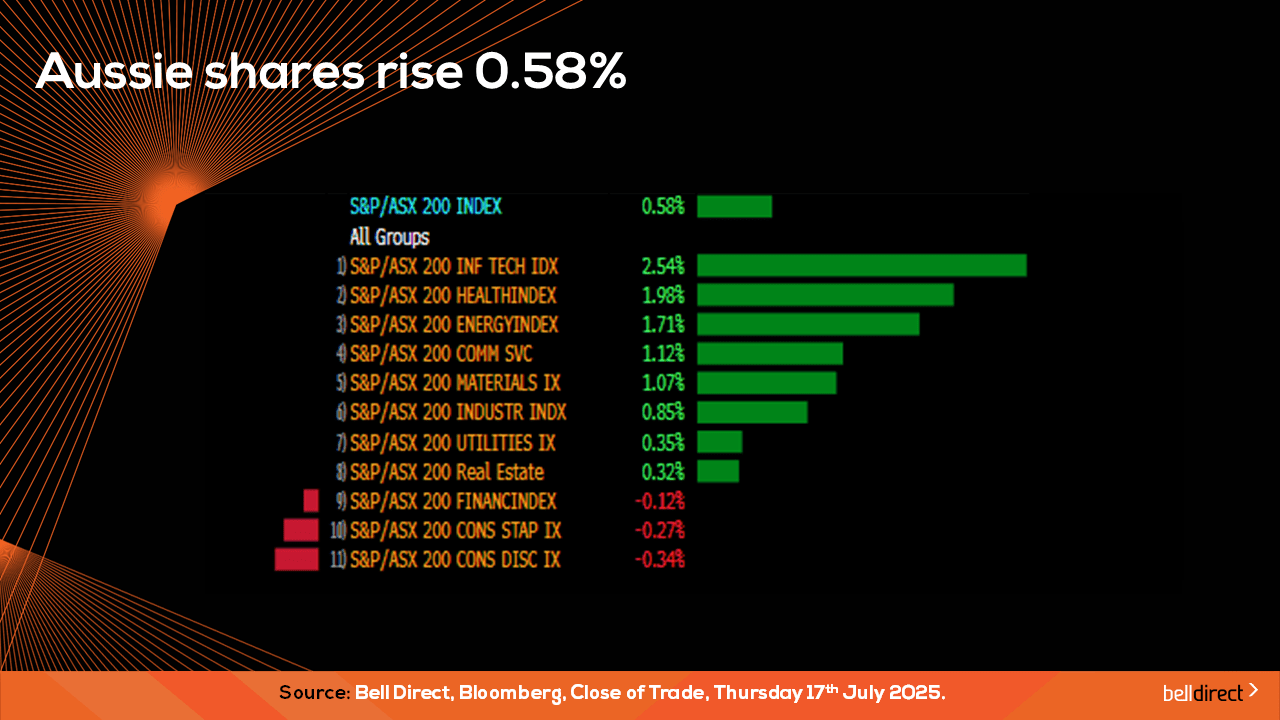

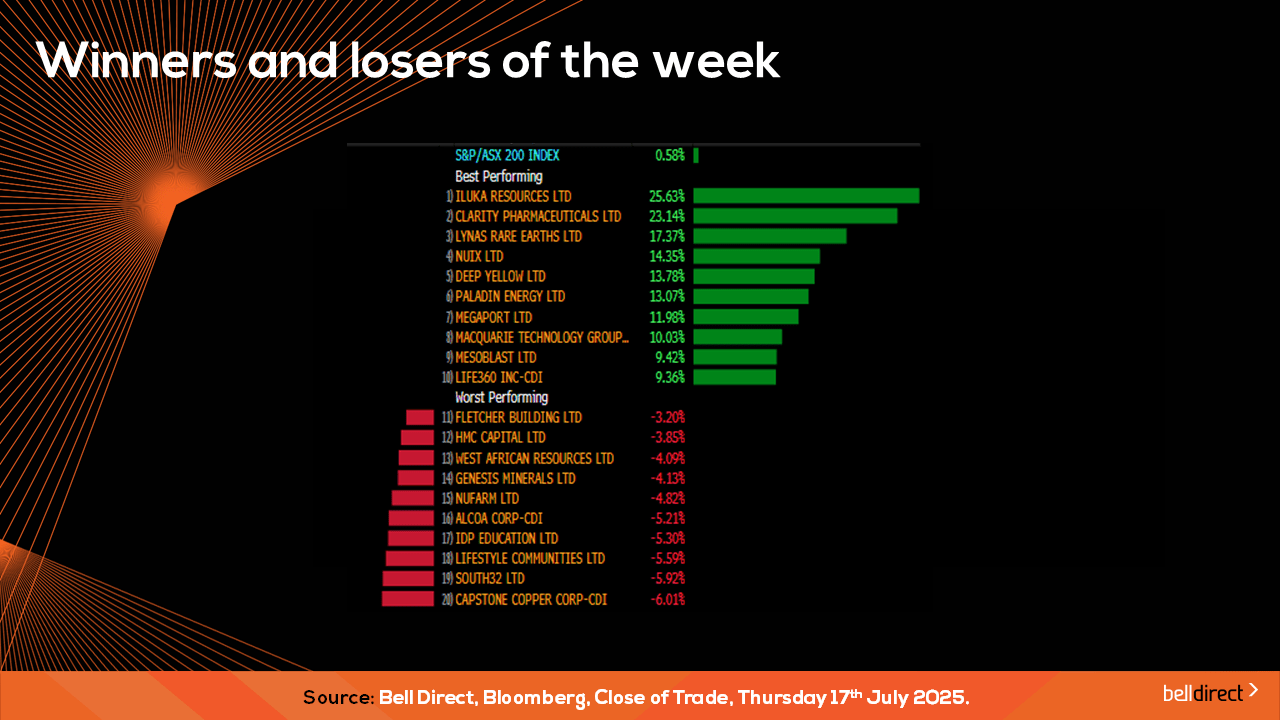

Locally from Monday to Thursday the ASX200 posted a 0.58% gain as the key index reset its record high for a third time this financial year already earlier in the week before retreating on trade war concerns. The tech and healthcare sectors led the charge this week with gains of 2.54% and 1.98% respectively, while discretionary and staples stocks posted losses of 0.34% and 0.27% respectively.

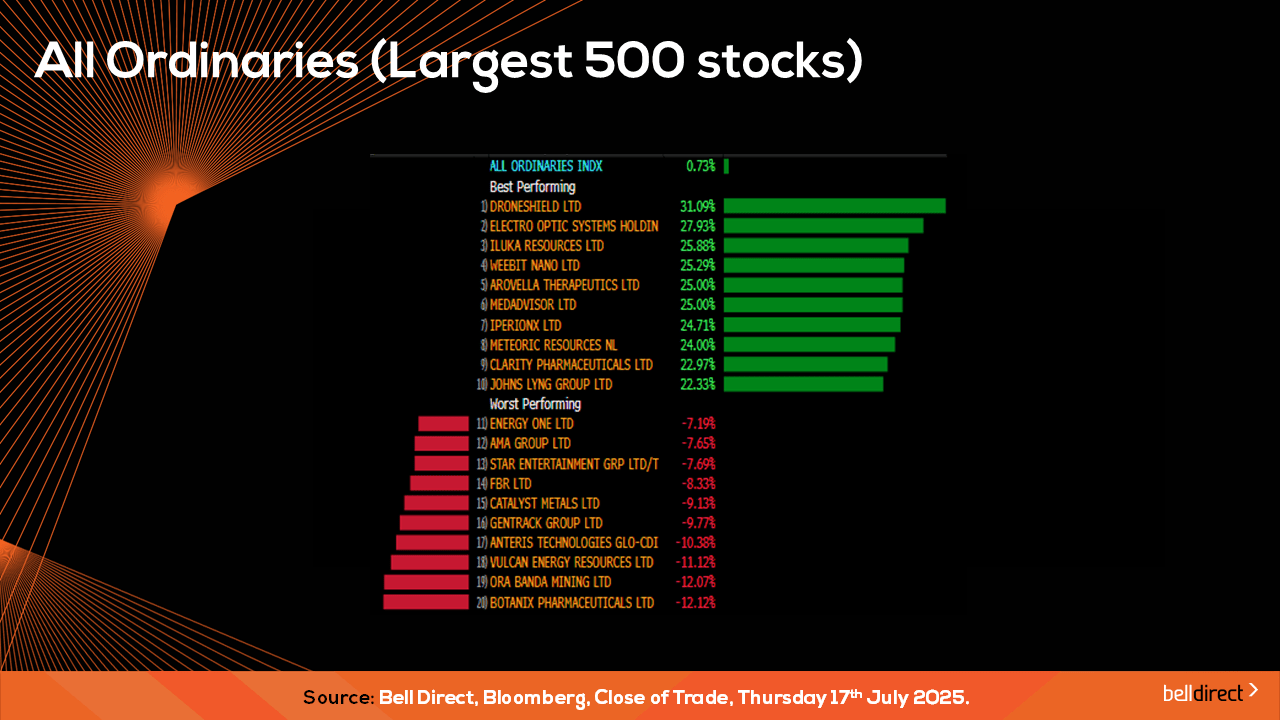

On the broader market index, the All Ords posted a 0.73% gain as DroneShield (ASX:DRO) soared 31% on the announcement of enhanced R&D spend and expansion of its Sydney-based production facility, while Botanix Pharmaceuticals (ASX:BOT) at the other end of the market tumbled 12%.

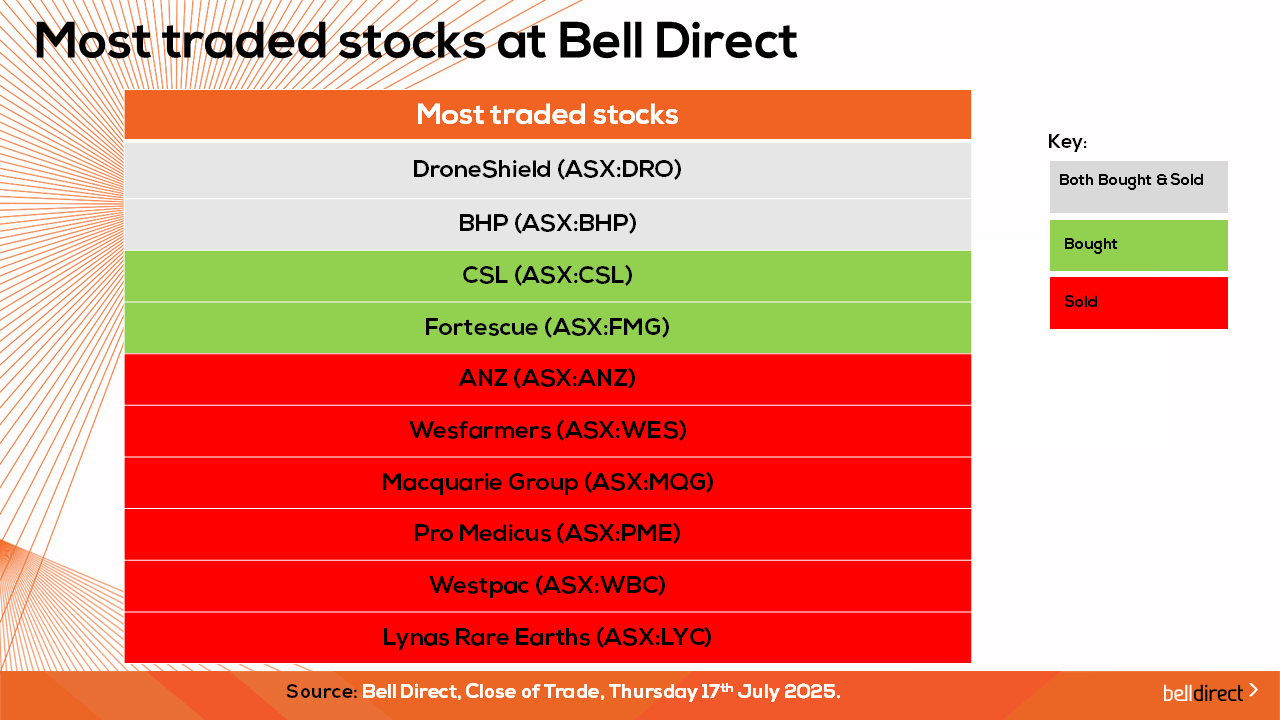

The most traded stocks by Bell Direct clients this week were DroneShield (ASX:DRO), and BHP (ASX:BHP). Clients also bought into CSL (ASX:CSL), and Fortescue (ASX:FMG), while taking profits from ANZ (ASX:ANZ), Wesfarmers (ASX:WES), Macquarie Group (ASX:MQG), Pro Medicus (ASX:PME), Westpac (ASX:WBC) and Lynas Rare Earths (ASX:LYC).

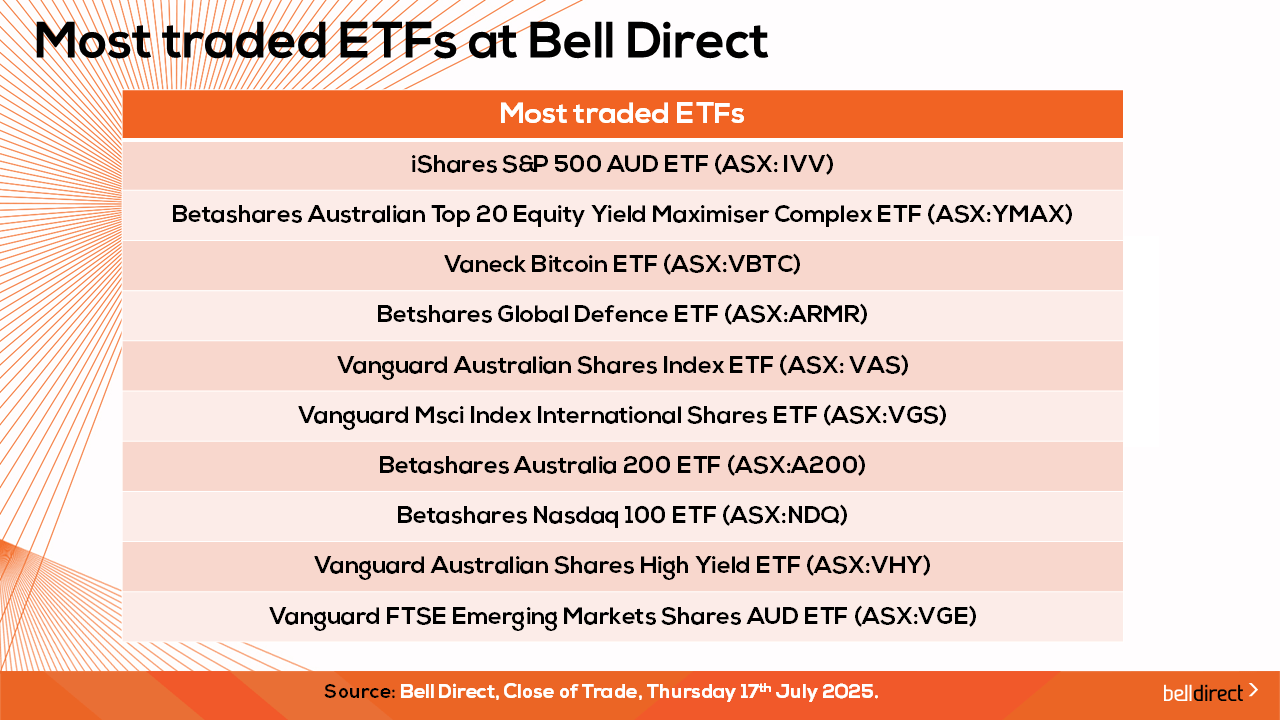

And the most traded ETFs were led by iShares S&P 500 AUD ETF (ASX:IVV), YieldMax Universe Fund of Option Income ETFs and Vaneck Bitcoin ETF (ASX:VBTC).

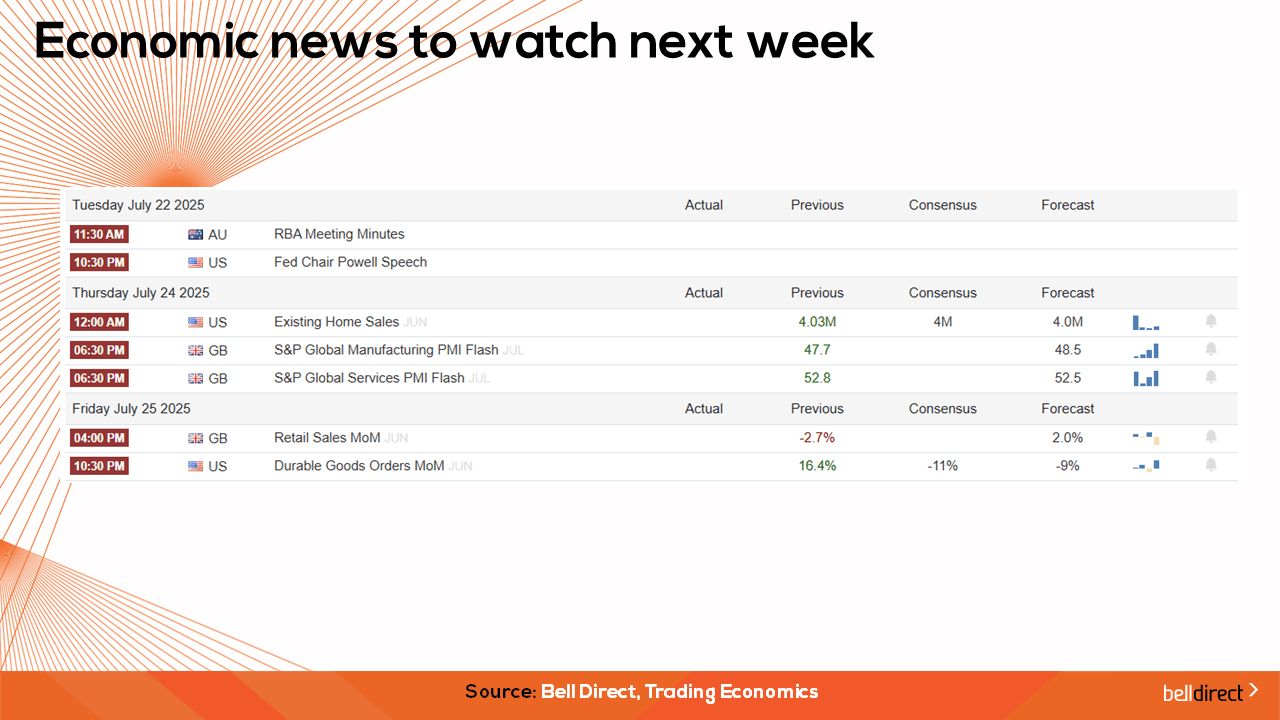

Next week on the economic calendar front, we may see investors react to the latest RBA meeting minutes following the shock hold of Australia’s cash rate last meeting. Overseas, Fed Chair Jerome Powell will speak early in the week and US durable goods orders are out later in the week, while British Manufacturing PMI is out midweek.

And that’s all for this week, have a wonderful weekend and happy investing.