Thanks for joining me this Friday the 13th June, I’m Grady Wulff, Market Analyst with Bell Direct and this is our weekly market update.

This week, we finally saw progress made between China and the US on the trade negotiations front as well as markets being moved by the first releases of economic data outlining the impact of Trump’s tariffs so far.

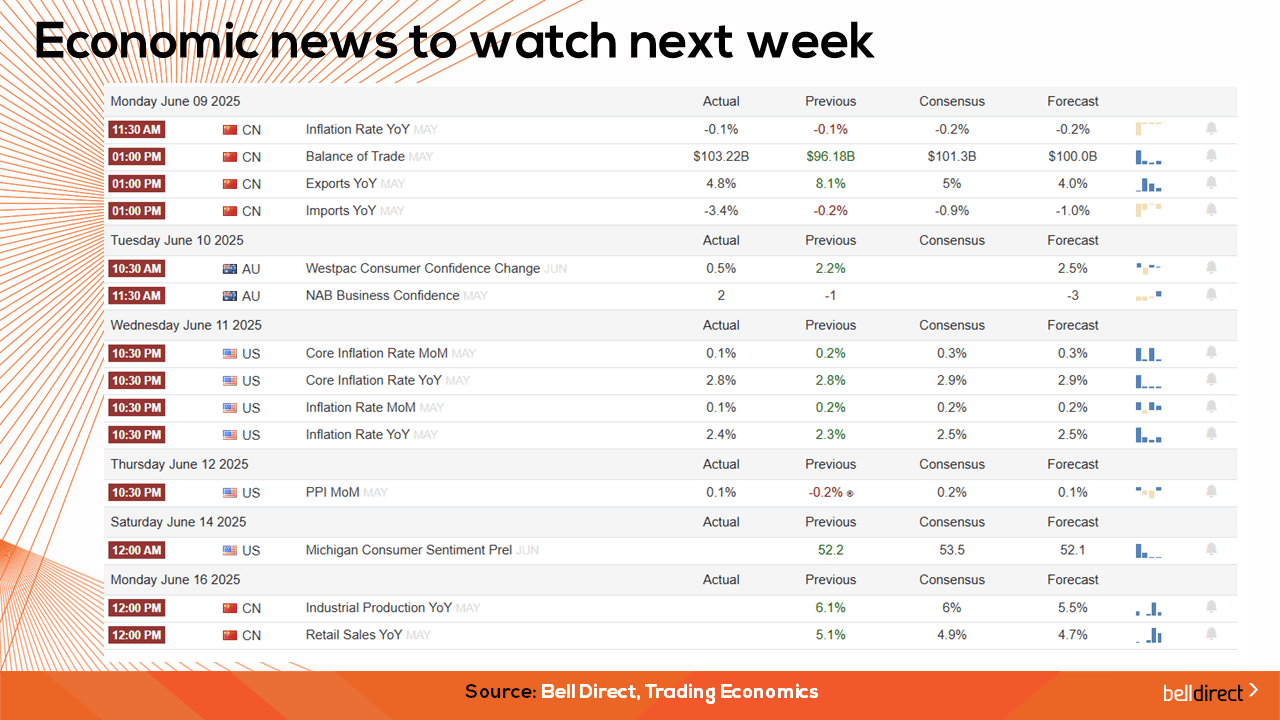

For the month of May, China’s exports to the US plunged 34.5% YoY in May in value terms representing the largest drop since February 2020, while total exports from the world’s second largest economy rose 4.8% YoY last month, easing from the 8.1% jump in April and missing economists’ expectations of a 5% rise. Producer and consumer price index readings for China were also out on Monday this week, further indicating deflationary pressures worsened last month. Consumer price inflation fell by 0.1% YoY in May which was lower than the 0.2% economists were expecting, while producer price index fell by 3.3%, marking the steepest contraction in almost 2-years. Retail sales in China also slowed last month due to increased job insecurity dampening consumer spend appetite. China’s struggles will hopefully turn around at the conclusion of trade talk negotiations with President Trump this week, with reports suggesting a deal is ‘done’ and the details of the deal are being finalised. We expect this will be outlined over the coming days and investors will likely react accordingly, with suggestions a 55% tariff on China will be held but nothing higher, watch this space.

In the US, we also received the first economic data read outs post the tariff imposition this week and as expected, the increased taxes on foreign goods have caused a rebound in inflation for the US but it wasn’t as bad as was expected. For the month of May, US CPI rose 2.4% YoY and 0.1% MoM, which fell short of the 2.9% and 0.3% economists were expecting. Weakness in energy prices helped offset some of the price increases incurred from the tariff outlay, while other areas that were expected to show a huge jump in price due to tariffs actually came down including vehicles and clothes. While this is just the first reading of its kind and many businesses held off price hikes to gain further clarity on the tariffs front, it is a welcome start for the US Fed on the inflation taming journey against the chaos caused by President Trump on the tariff and global trade front.

In Japan, business sentiment index for large firms slipped into negative territory over the April-June quarter which marks the first time it has slipped below 0 since Q1, 2024 indicating a growing number of businesses in the region are reporting deteriorating conditions. Sentiment dropped to -4.8 which is also the weakest reading in 5 quarters driven by sharp declines in the outlook for automotive, car parts and steel industries, the key areas of the Japanese market impacted by Trump’s tariffs. Currently, the USA has a 50% tariff on steel imports from Japan, a 25% tariff on all imported vehicles and parts, and a 24% tariff on all Japanese exports bound for the US is set to be imposed from July.

While tariff uncertainty remains high and the exact implications of tariffs on global operations is yet to be known, companies around the world are forecasting eased growth and impact on earnings based on the sweeping Trump tariffs for now, while the world bank sees US growth rate halving as tariffs slows growth on a global scale.

On local shores this week, investors fought to buy into Australia’s biggest bank, CBA (ASX:CBA), sending its share price to yet another record high over $183/share, making it the most expensive bank in world history. Several drivers are behind the CBA record run including many Australian superfunds holding CBA shares so many Aussies inadvertently hold shares in the big bank, and we have also seen investors using the banks in recent times as safe-havens amidst the global macro and market uncertainty. Subsequently of the CBA share price soar, Aussie industry superfunds have come under fire for distorting equity markets and inflating the company’s share price.

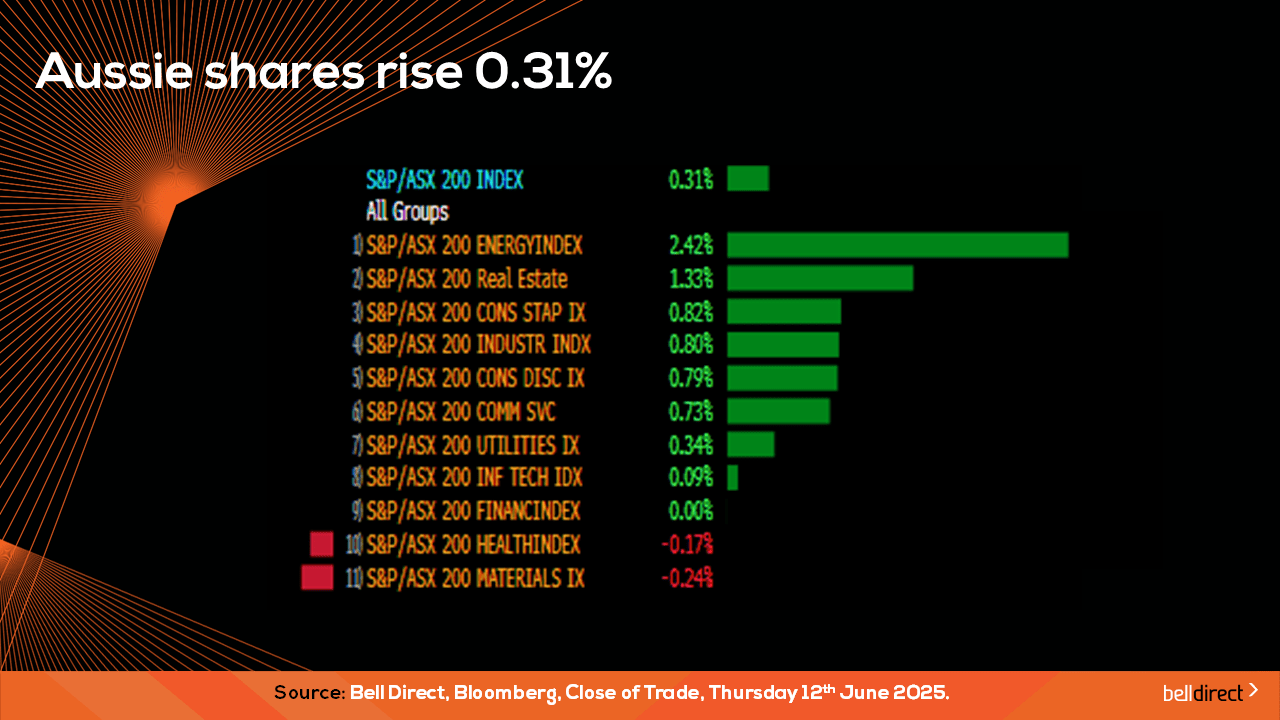

Locally from Monday to Thursday the ASX200 posted a 0.31% gain as 9 of the 11 sectors ended the trading week in the green led by energy stocks rising 2.42% on the rising price of oil early in the week.

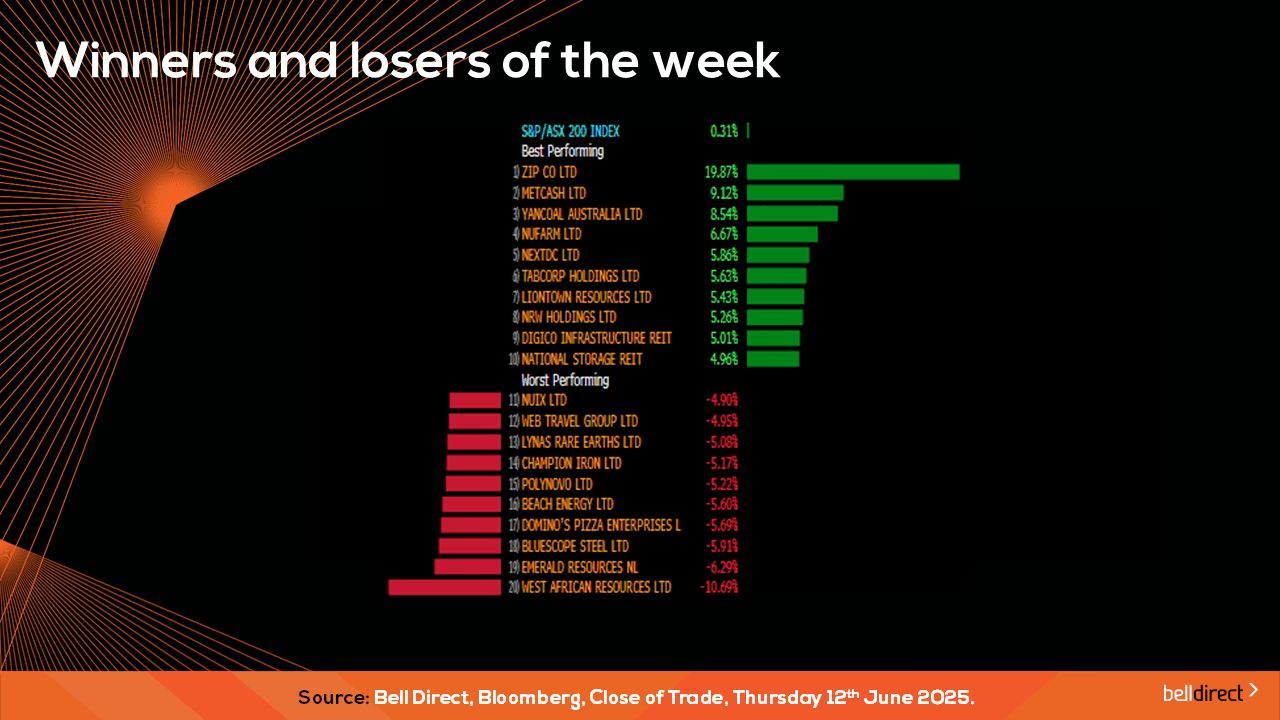

The winning stocks on the ASX200 were led by Zip Co (ASX:ZIP) soaring nearly 20% while Metcash (ASX:MTS) rose 9.12%, and Yancoal (ASX:YAL) added 8.54%.

On the losing end, West African Resources (ASX:WAF) fell 10.69%, Emerald Resources (ASX:EMR) dropped 6.3% and BlueScope Steel (ASX:BSL) ended the week down 5.91%.

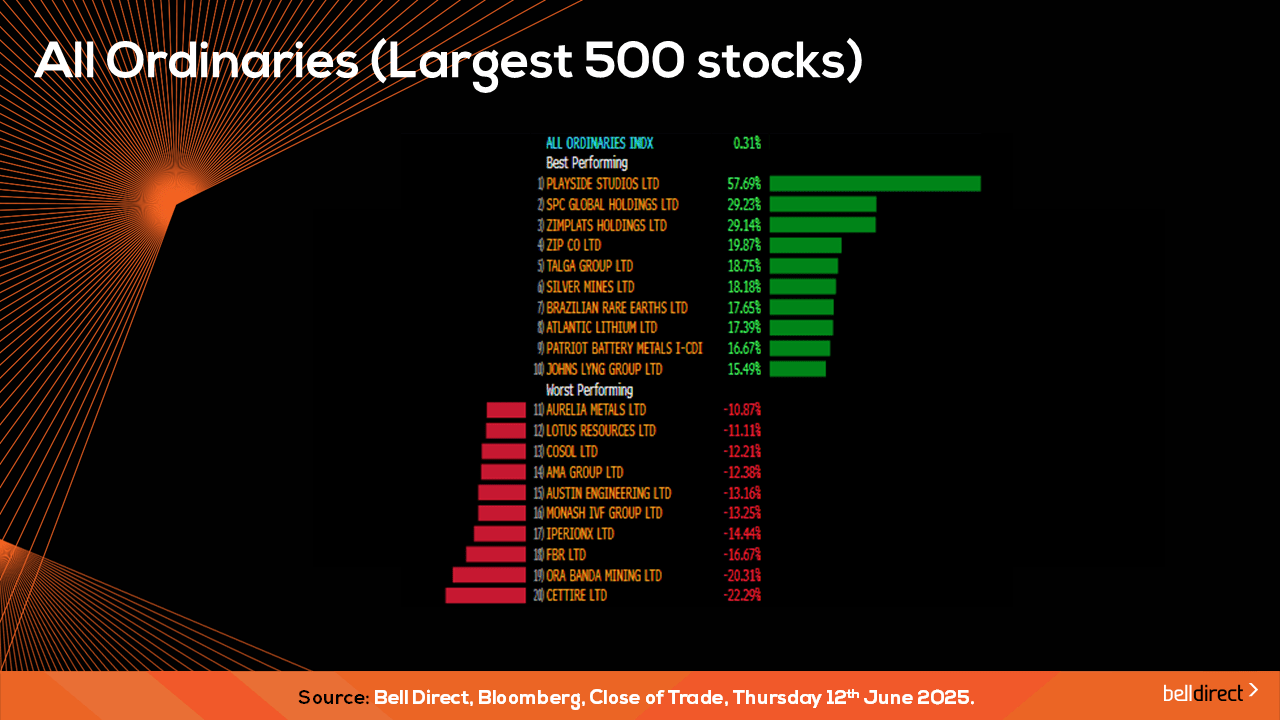

On the broader market index, the All Ords, rose 0.31% over the 4-trading days as a 58% surge for Playside Studios (ASX:PLY) offset more than 20% losses for Ora Banda (ASX:OBM) and Cettire (ASX:CTT).

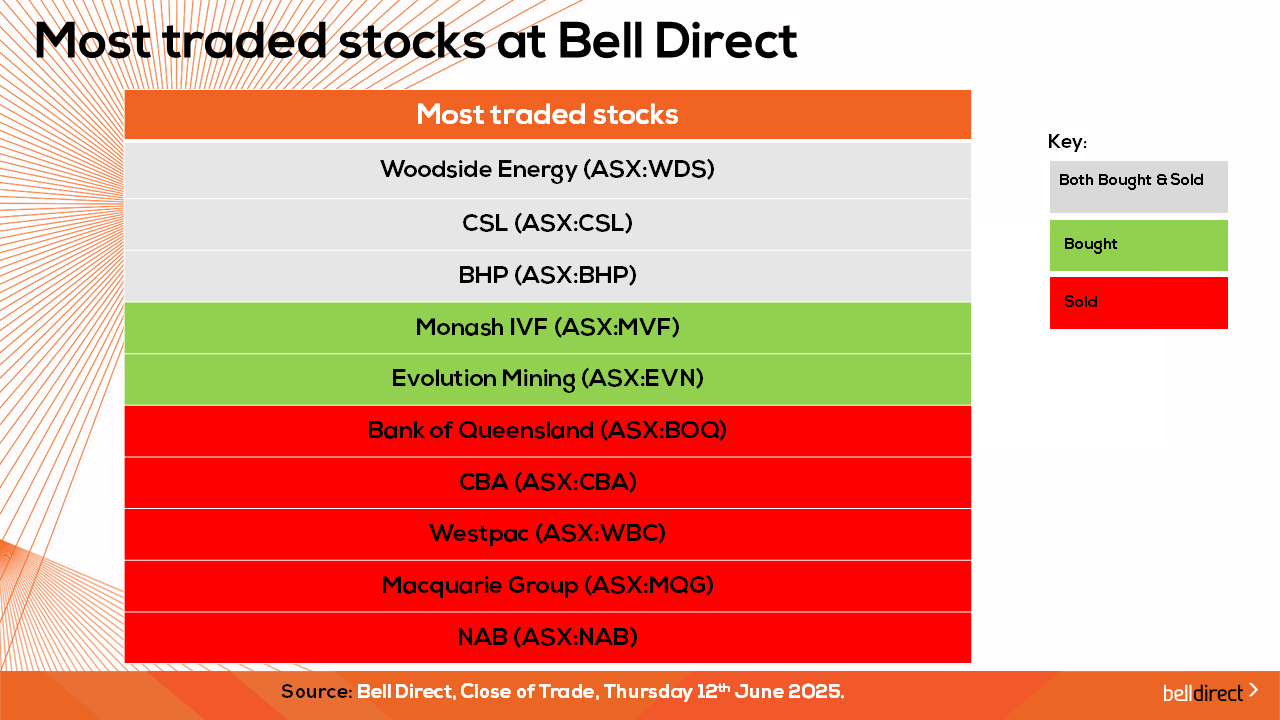

The most traded stocks by Bell Direct clients from Monday to Thursday were Woodside (ASX:WDS), CSL (ASX:CSL) and BHP (ASX:BHP). Clients also bought into MonashIVF (ASX:MVF) and Evolution Mining (ASX:EVN) while taking profits from Bank of Queensland (ASX:BOQ), CBA (ASX:CBA), Westpac (ASX:WBC), Macquarie Group (ASX:MQG) and NAB (ASX:NAB).

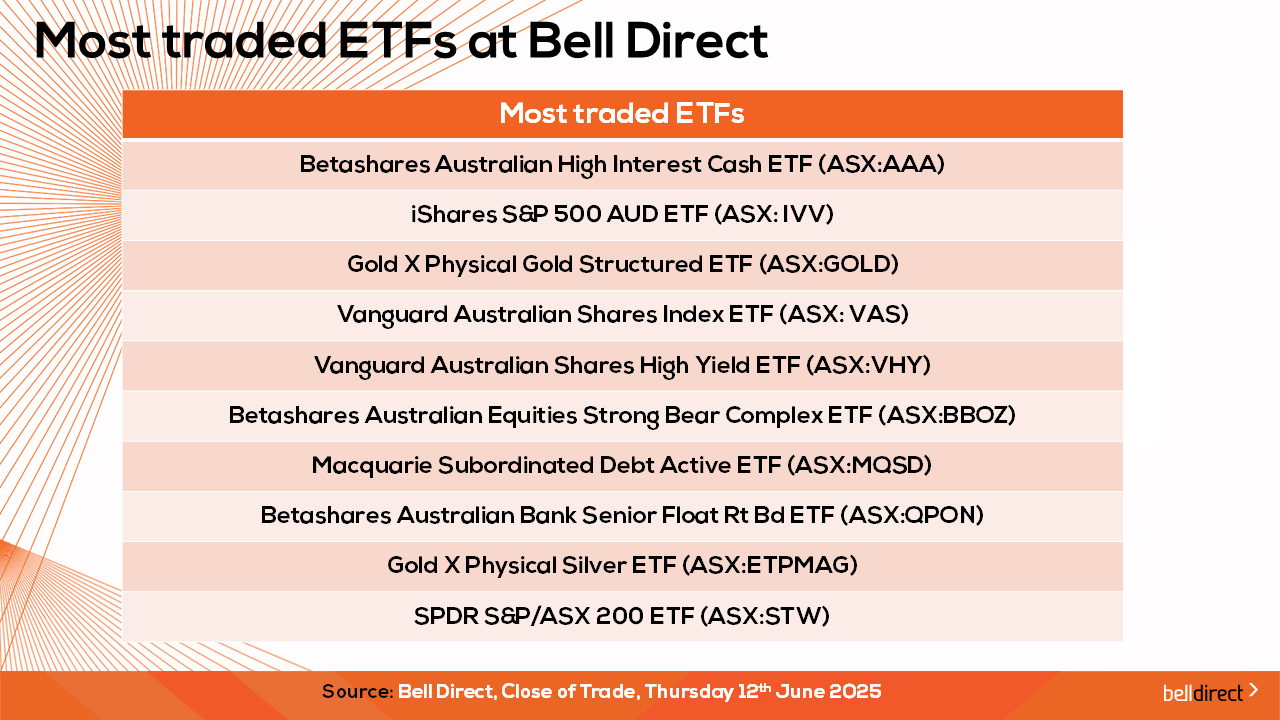

The most traded ETFs by Bell Direct clients this week were led by Betashares Australian High Interest Cash ETF, iShares S&P 500 AUD ETF and Global X Physical Gold Structured ETF.

On the economic calendar front next week, we may see investors react to China’s next slew of economic data out on Monday with industrial production and retail sales data for May being released, while in the US retail sales, building permits, and the Fed’s rate decision will also be released later next week.

And that’s all for this Friday, have a wonderful weekend and happy investing.