Thanks for joining us this Friday the 20th June, I’m Grady Wulff, Senior Market Analyst with Bell Direct and this is your weekly market update.

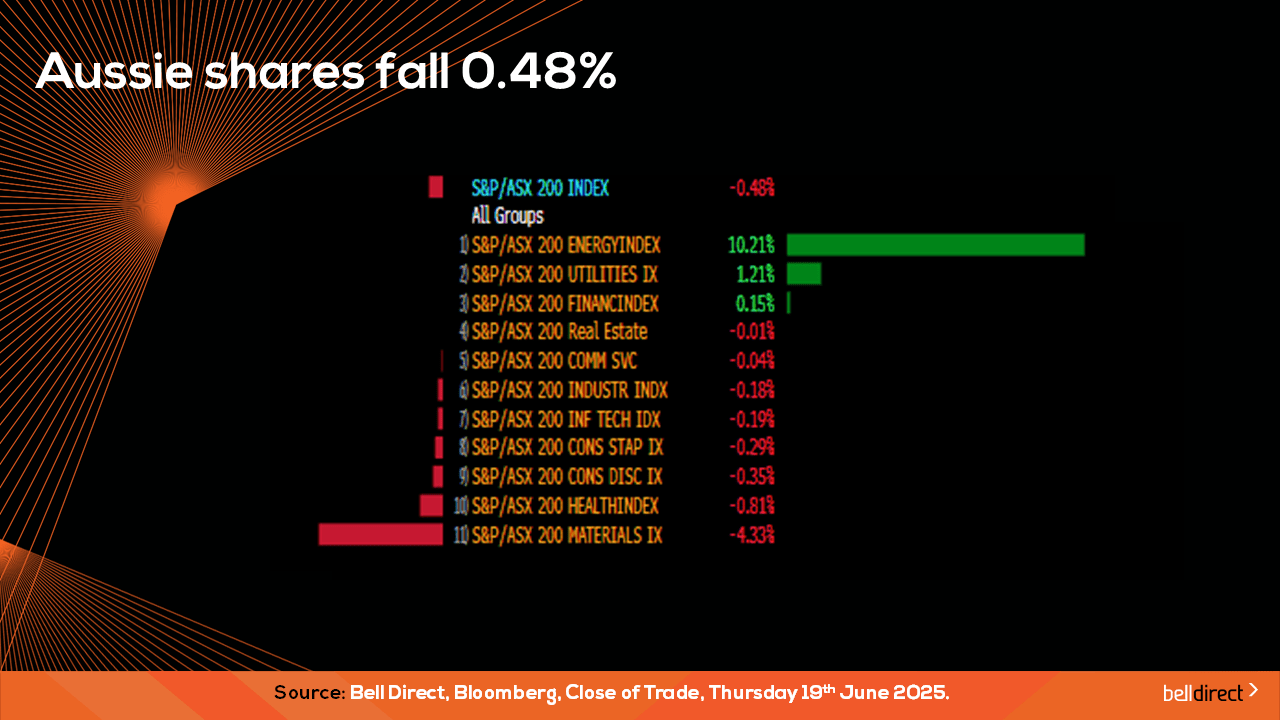

Well what a week that was on the markets in what can only be described as a lacklustre week really stumped investors as direction and clarity on a global scale was difficult to read thus resulting in the key index moving just 0.48% in the red direction.

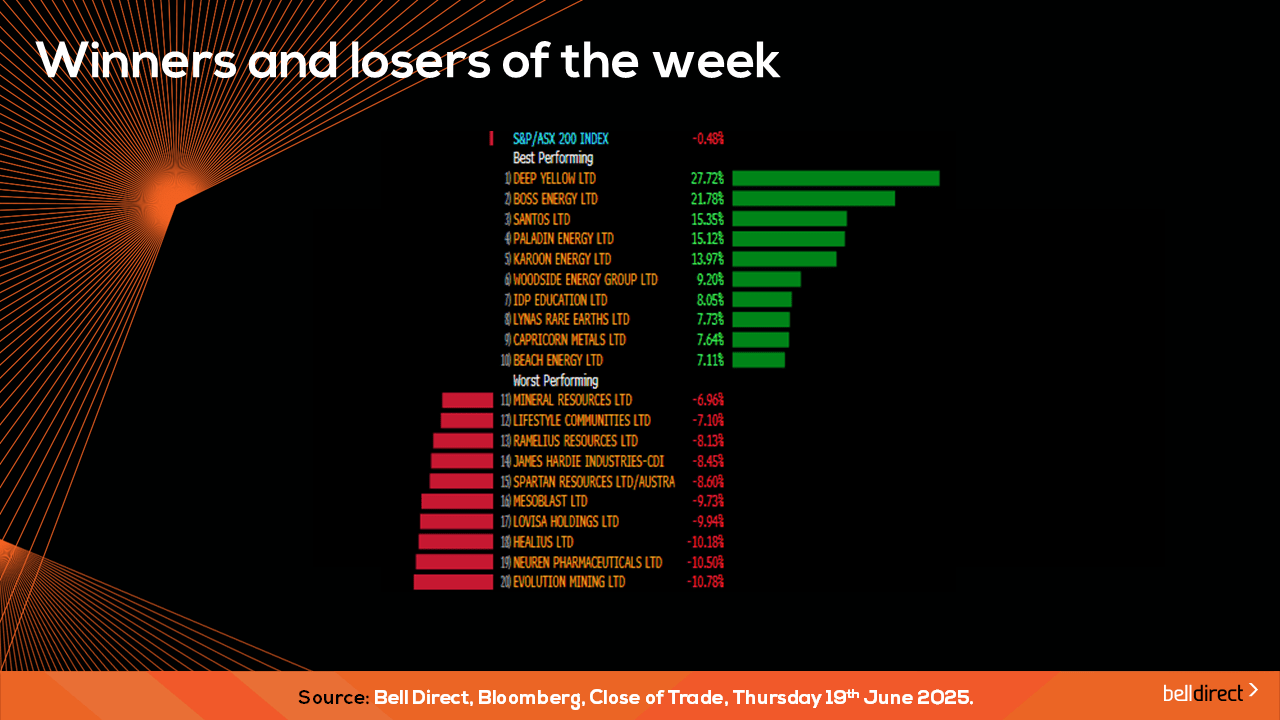

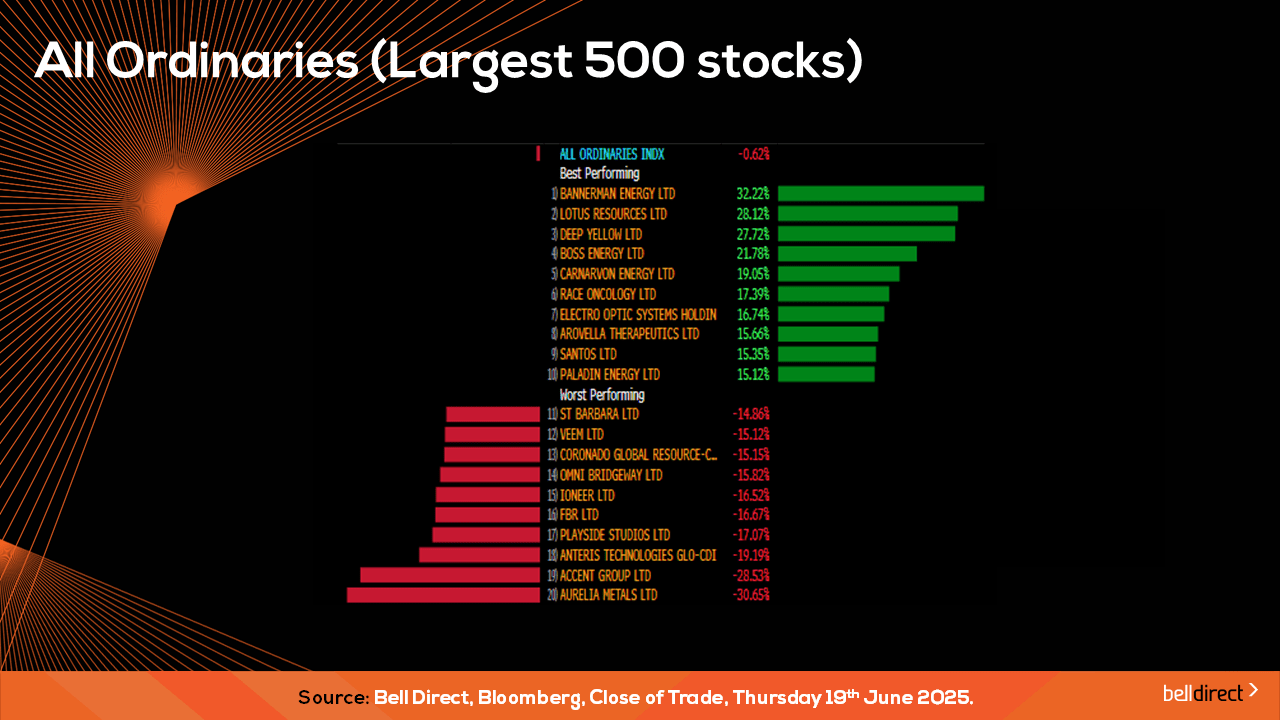

Middle East tensions rising dominated headlines throughout this week, causing President Trump to depart the G7 conference early to ‘deal with the situation’. The escalating attacks between Iran and Israel has surged the price of oil by over 10% this week alone due to supply concerns out of the major oil producing region, the Middle East. This has brought tailwinds for local energy stocks with the sector gaining over 10% this week. With so much noise and news in the markets, at a time where we have been hovering around record territory, investors have been reluctant to make any big moves with a more sit and wait attitude displayed throughout this trading week.

Retailers have faced a turbulent run of late with downgrades of FY25 earnings expectations, uncertain forecasting on consumer spend, uncertainty on the rate cuts front and tariff implications on outlook. We have seen investors flee retailers recently, especially those who downgrade guidance or have had to implement high levels of promotional activity to move inventory in a time where consumer spend has been easing. Headwinds that are mounting for our retailers are more delayed than the market had previously anticipated as consumer spend remained resilient for so long, until now, which we are seeing flow through to the downgrades and low single digit earnings being reported across the board. Cettire, Accent Group and many other retailers have been hit lately by trading updates reflecting poorer consumer spend conditions that will impact the final quarter of FY25, so any further delay in rate cuts will likely push out the recovery in spend for our listed retailers. KMD Brands, the owner of Rip Curl and Kathmandu became the latest retailer this week to issue a profit warning with sales down 0.5% in the first 10-months of FY25. There are still opportunities in the retail space that capitalise on growing market segments and thematics like JB Hi-Fi which is up 15% YTD due to the growing demand for AI-empowered technology.

Iron ore miners have also struggled through over 12-months of turbulence governed by China’s recovery and a volatile iron ore price. Trade deals may be going in the right direction between China and the US, however, China’s economic data remains concerning and weighs on the outlook for both the iron ore price and our big iron ore miners. The latest economic data out of the world’s second largest economy continues to show a mixed outlook for recovery in the region despite multiple stimulus package announcements over the past 2-years failing to make material growth and sustained recovery impact. China’s latest GDP data showed the economy grew by 5.4% year-on-year in Q1 2025, maintaining the same pace as Q4 2024 and exceeding market expectations, while industrial output, and retail sales are also showing signs of growth, but on the contrary, the country remains in deflation mode, and the property market continues to struggle. With such a mixed recovery picture, especially with the property front being a key indicator of steel demand, the iron ore miners continue to face mounting headwinds in 2025 which will likely flow through to reflect in FY25 results.

Locally from Monday to Thursday the ASX200 posted a 0.48% loss as investors were sitting on the sidelines amid renewed uncertainty and global volatility. Financial stocks rose almost 1% while materials stocks experienced a more than 4% sell-off.

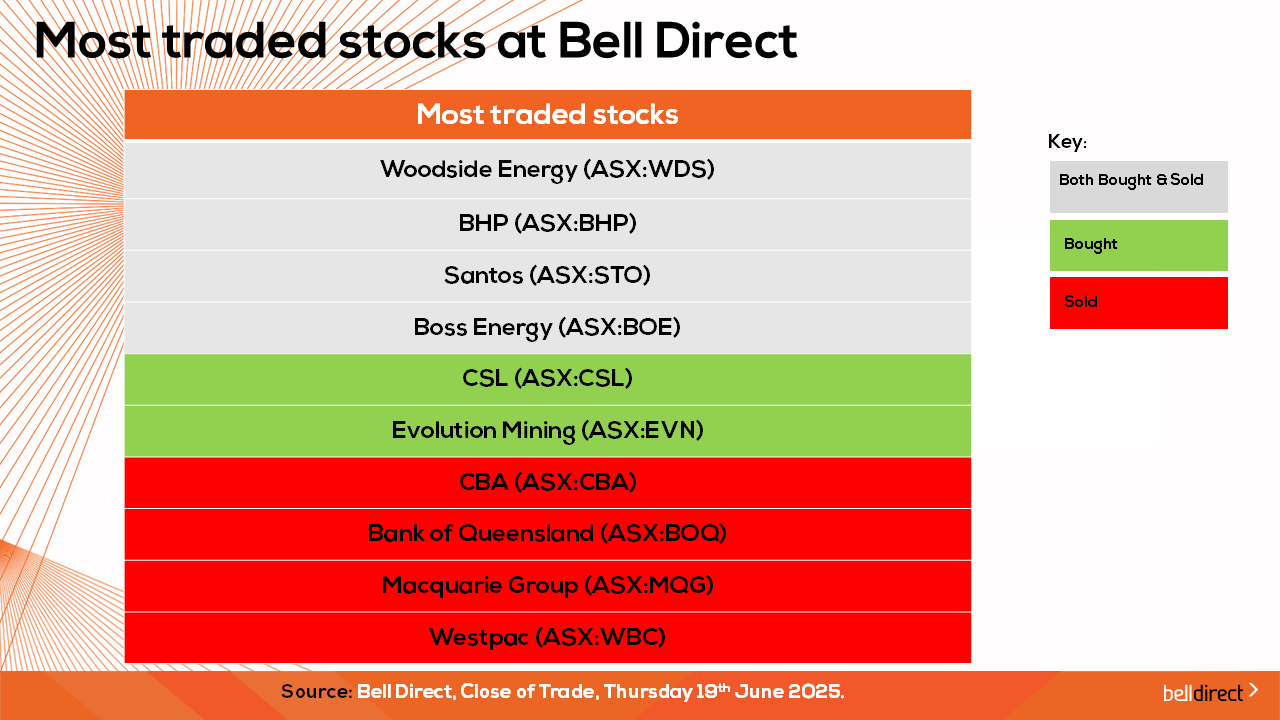

The most traded stocks by Bell Direct clients from Monday to Thursday were Woodside (ASX:WDS), BHP (ASX:BHP), Santos (ASX:STO), and Boss Energy (ASX;BOE). Clients also bought into CSL (ASX:CSL) and Evolution Mining (ASX:EVN) while taking profits from CBA (ASX:CBA), Bank of Queensland (ASX:BOQ), Macquarie (ASX:MQG) and Westpac (ASX:WBC).

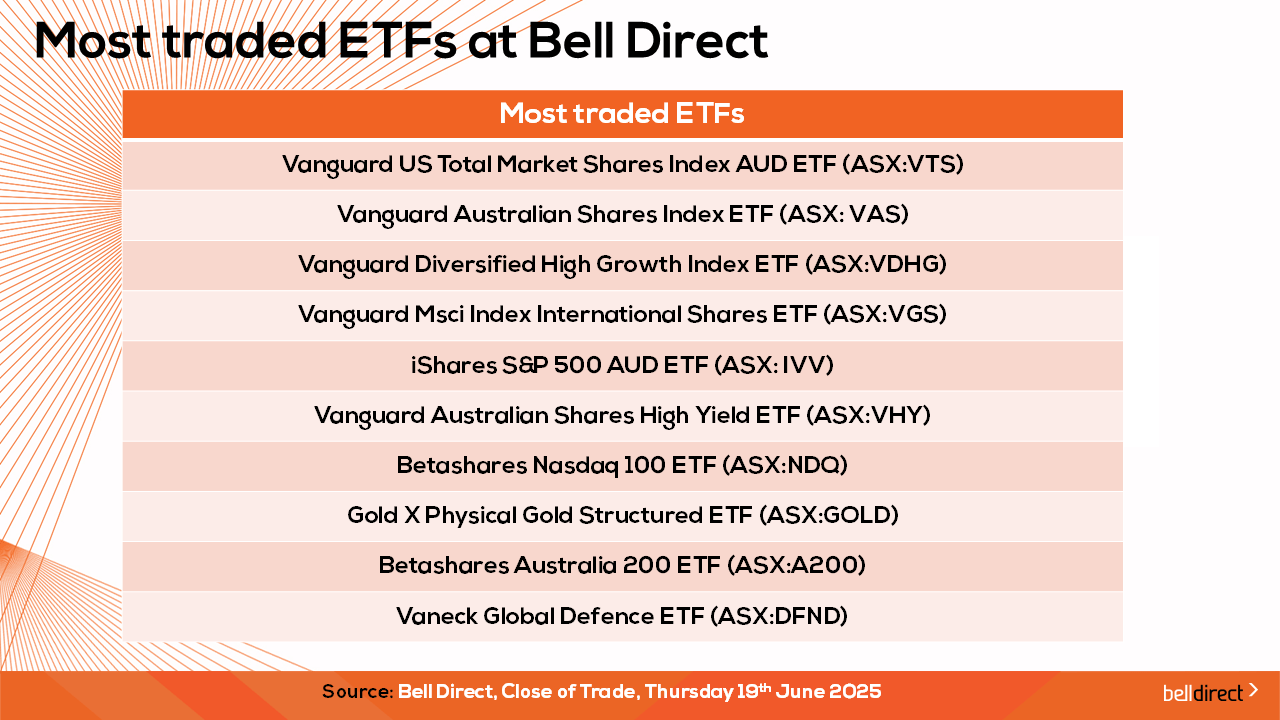

And the most traded ETFs by our clients were led by Vanguard US Total Market Shares Index AUD ETF, Vanguard Australian Shares Index ETF, and Vanguard Diversified High Growth Index ETF.

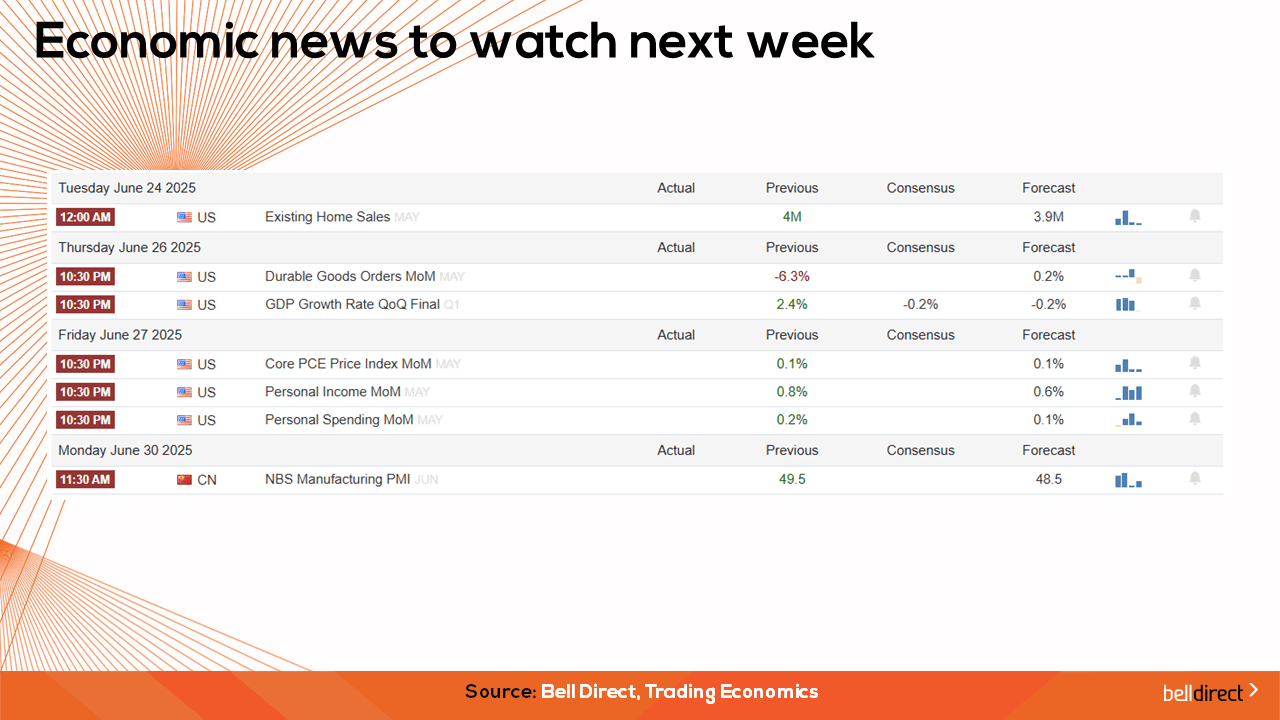

On the economic calendar front next week, we may see investors react to US durable goods orders, GDP growth rate data, personal income, personal spending and Core PCE Price Index data out throughout the week which will indicate the state of US consumer sentiment and inflationary journey in the wake of Trump tariffs and market volatility.

And that’s all for this Friday, have a wonderful day and happy investing.