Thanks for joining me this Friday the 23rd May, I’m Grady Wulff, Market Analyst with Bell Direct and this is our weekly market update.

The M&A market is gearing up for a strong rebound in the second half of 2025, driven by easing inflation, stabilising interest rates, readily available debt and equity financing, and a weakened Australian dollar. These conditions are setting the stage for a renewed surge in deal activity.

Mergers and acquisitions have been heating up in recent months, with a flurry of both small- and large-scale transactions taking place across various sectors. As companies sit on excess cash and chase ambitious growth targets, deal-making is firmly back on the agenda.

Despite recent market volatility causing some disruption, the appetite for M&A remains strong and the deal pipeline is expected to stay active well into 2025. In this update, we explore some of the most notable recent deals, what they signal for the market, and why they matter to you.

The big name and target that global private equity firms fought to buy earlier in the year was Insignia Financial (ASX:IFL). The deal is not yet done and is looking shaky as leading bidder, Bain Capital, walked away from the deal in the last week citing uncertainty caused by global market volatility in recent times for their decision to withdraw. Back in February, Brookfield Capital Partners, Bain Capital and CC Partners each bid for Insignia to gain market share of Australia’s estimated $4.1tn superannuation market which is considered to be the 4th largest in the world. By March, Brookfield pulled out of the running to buy Insignia and now Bain is out too, leaving just CC Capital on the table to make a binding offer so watch this space. Shares in Insignia are down 5% YTD.

On the blue-chip mining front, BHP (ASX:BHP) has gone hard in copper acquisitions buying up Oz Minerals (ASX:OZL) and Filo Corp (ASX:FLO), while Rio Tinto (ASX:RIO) is delving into the lithium space through acquiring Arcadium Lithium (ASX:LTM) in a deal worth US$6.7bn despite the prolonged depreciated price of the commodity. Both copper and lithium play a vital role in the global green energy transition, but the global supply and time to mine production of each varies significantly. Lithium prices have remained depreciated since the 2020 high due to oversupply, and eased demand leading to oversupply issues pressuring prices down. Copper on the other hand has an undersupply right now that is expected to escalate for years to come as a copper mine generally takes around 17-years to get into production, thus with an undersupply and growing demand, we are likely to continue seeing copper prices soar for some time to come. Such expansions by two of the biggest mining companies in the world suggests diversification of earnings is crucial amid China’s depreciated demand for iron ore, and the global transition to green energy driving growth opportunities for such miners.

Recently, amid the gold rush this year, we have seen some big name gold producers buying up juniors to expand their precious asset portfolios. Northern Star Resources (ASX:NST), one of Australia’s largest gold producers, acquired junior De Grey Mining (ASX:DEG) in a deal worth $6n to secure the long-life, tier one mine, the Hemi gold project to expand the high quality assets under the NST belt.

This week, we saw shares in Mayne Pharma (ASX:MYX) tumble over 30% on reports its US$672m takeover by US Pharmaceutical giant, Cosette, may be on the rocks. When Cosette first lobbed the takeover offer in February this year in a deal worth $672m, shares in Mayne soared over 40% but have fallen away in recent days after Cosette, a US pharmaceutical giant believed there had been a material adverse change in the company’s financial performance since the offer was first made in February including Mayne issuing weaker-than-expected earnings guidance and disclosed a potential US regulatory issue regarding its contraceptive pill.

Such events have sparked concern for Cosette which prompted the pharmaceutical giant to trigger a 10-day consultation period between the companies which means a watch and wait situation for all involved. The deal can get done but Cosette will be doing some serious due diligence and analysis to ensure they’re getting what they were promised back in February.

With rate cuts, easing inflation, stabilising macro conditions and recovery expected from China in 2H25, we may see an uptick in deals being done throughout the latter end of CY25 as companies have been holding cash ready for the perfect growth deal to arise.

So, why should M&A activity matter to you as an investor? There are several key reasons to keep it on your radar.

First, increased deal activity in a particular sector often signals strong growth prospects and confidence in that sector’s future, i.e. recent consolidation in the gold mining industry is a prime example. Second, a rise in M&A deals can reflect broader market stability, as companies are generally hesitant to pursue large transactions in uncertain or volatile conditions.

Finally, M&A activity can directly impact your portfolio. If you own shares in a company being acquired, you might receive shares in the acquiring company, assuming the deal includes a scrip component, giving you exposure to new businesses and potential growth opportunities.

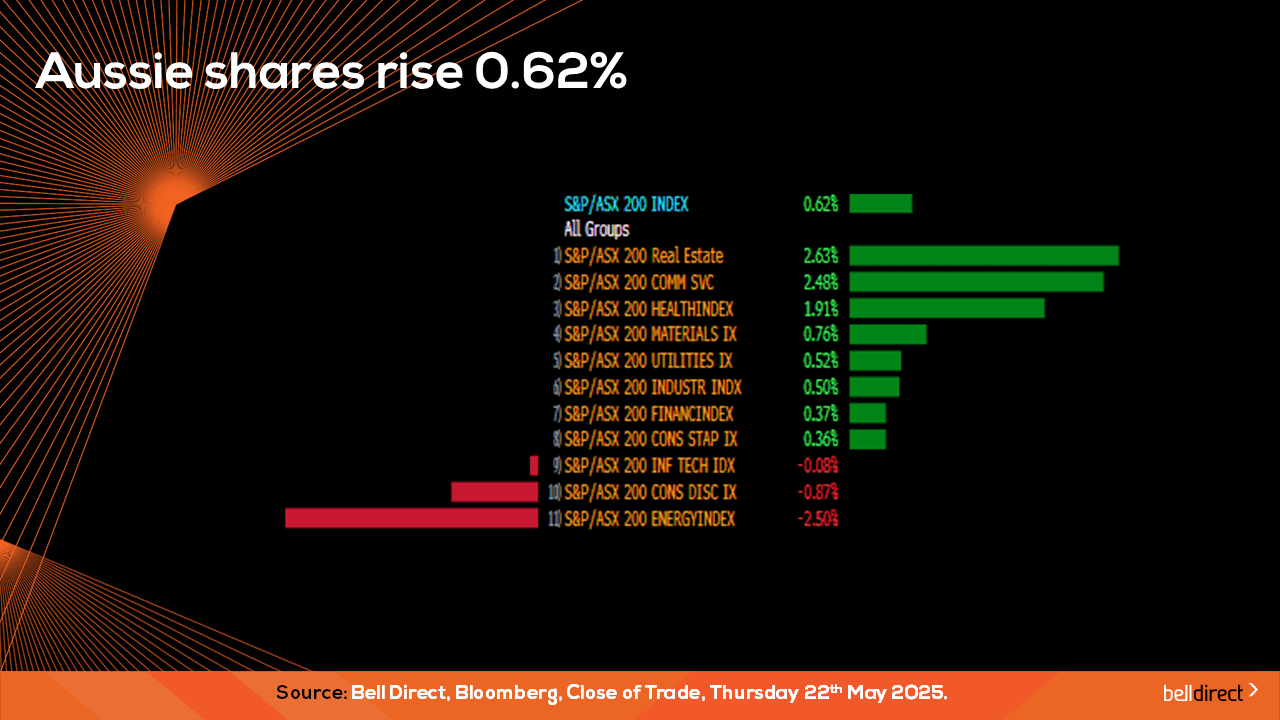

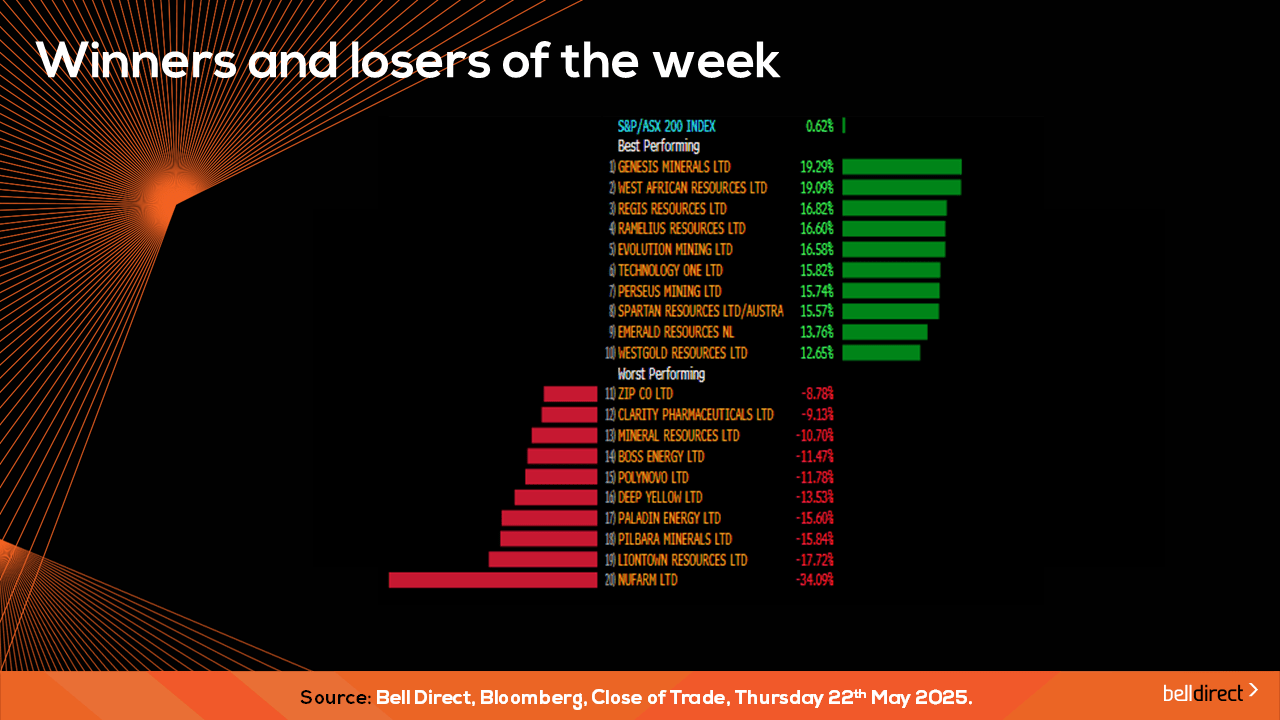

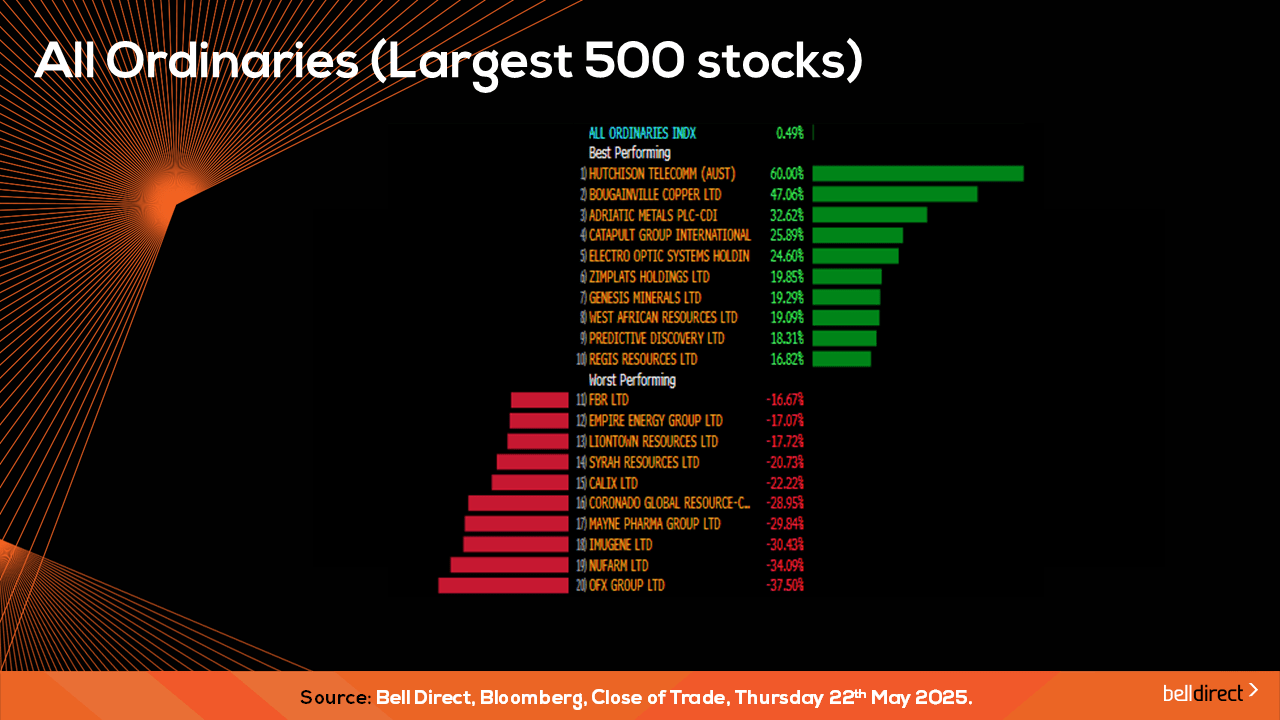

Locally from Monday to Thursday the ASX200 rose 0.62% buoyed by strength among real estate, communication services and healthcare stocks on the back of corporate earnings results, M&A deals and the RBA’s rate cut this week.

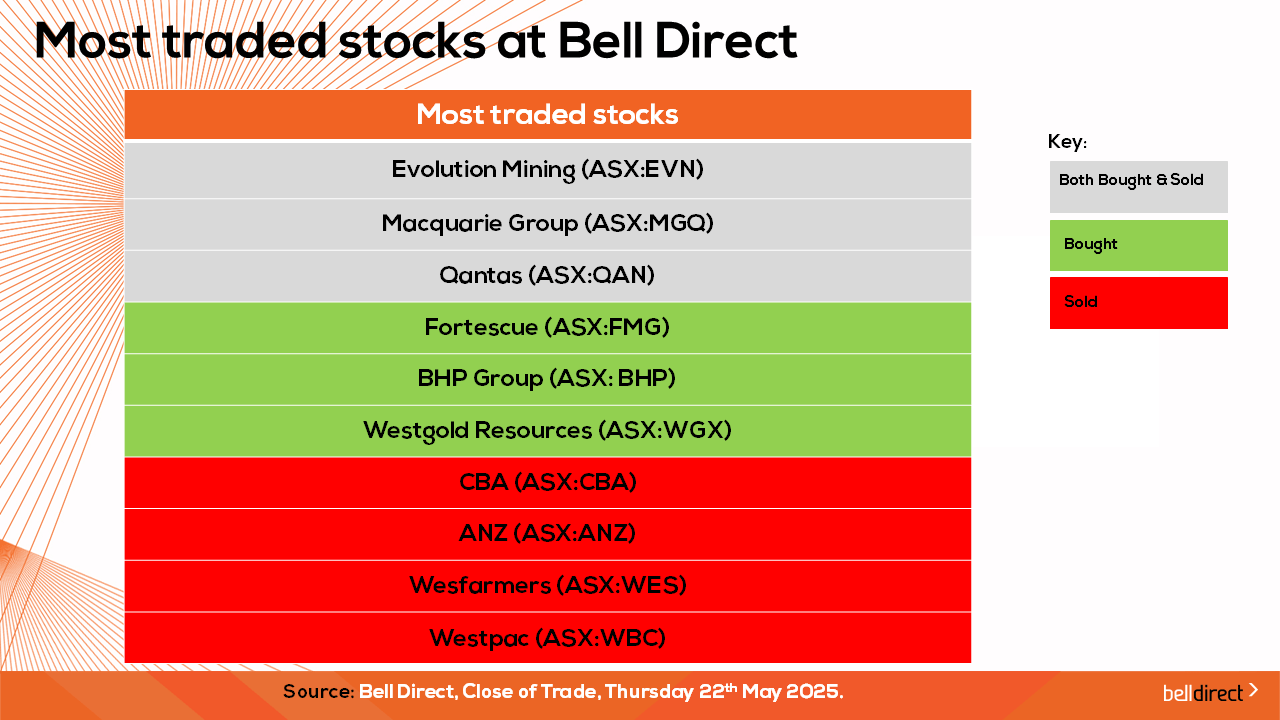

The most traded stocks by Bell Direct clients this week were Evolution Mining (ASX:EVN), Macquarie Group (ASX:MQG), and Qantas (ASX:QAN). Clients also bought into Fortescue (ASX:FMG), BHP (ASX:BHP), and Westgold Resources (ASX:WGX), while taking profits from CBA (ASX:CBA), ANZ (ASX:ANZ), Wesfarmers (ASX:WES) and Westpac (ASX:WBC).

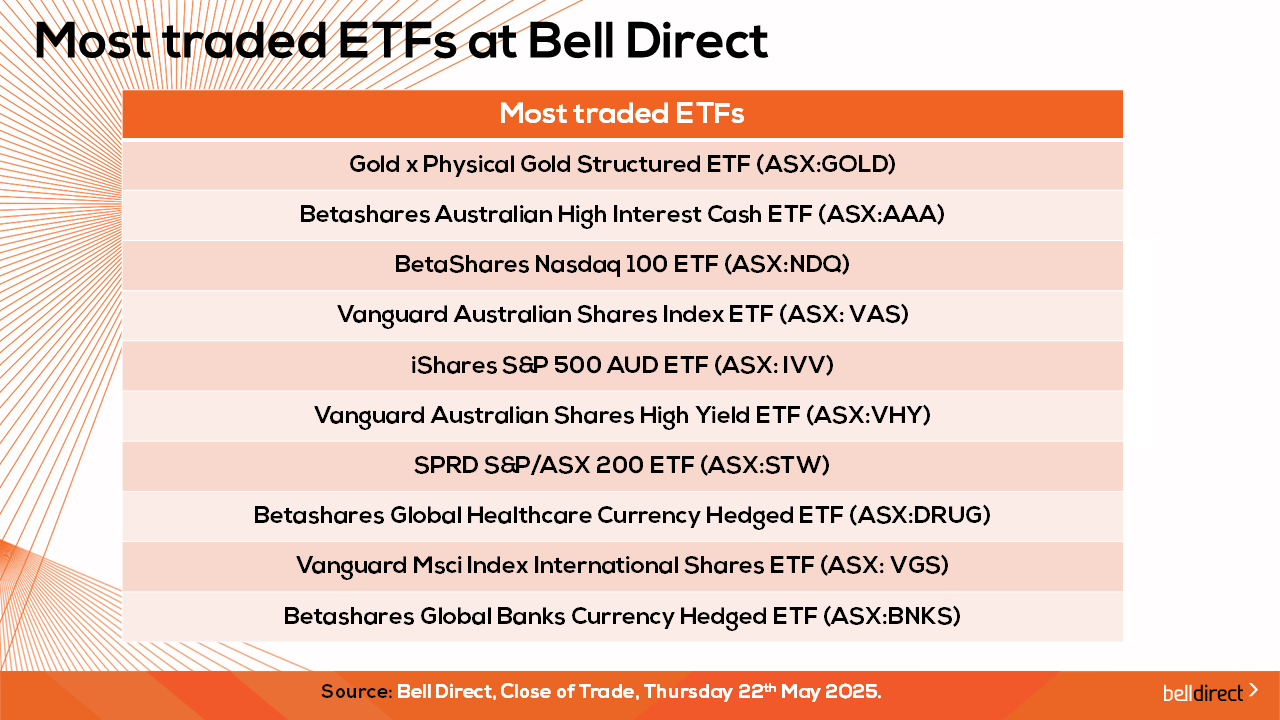

And the most traded ETFs were led by Global X Physical Gold Structured ETF (ASX:GOLD), Betashares Australian High Interest Cash ETF (ASX:AAA), and Betashares Nasdaq 100 ETF (ASX:NDQ).

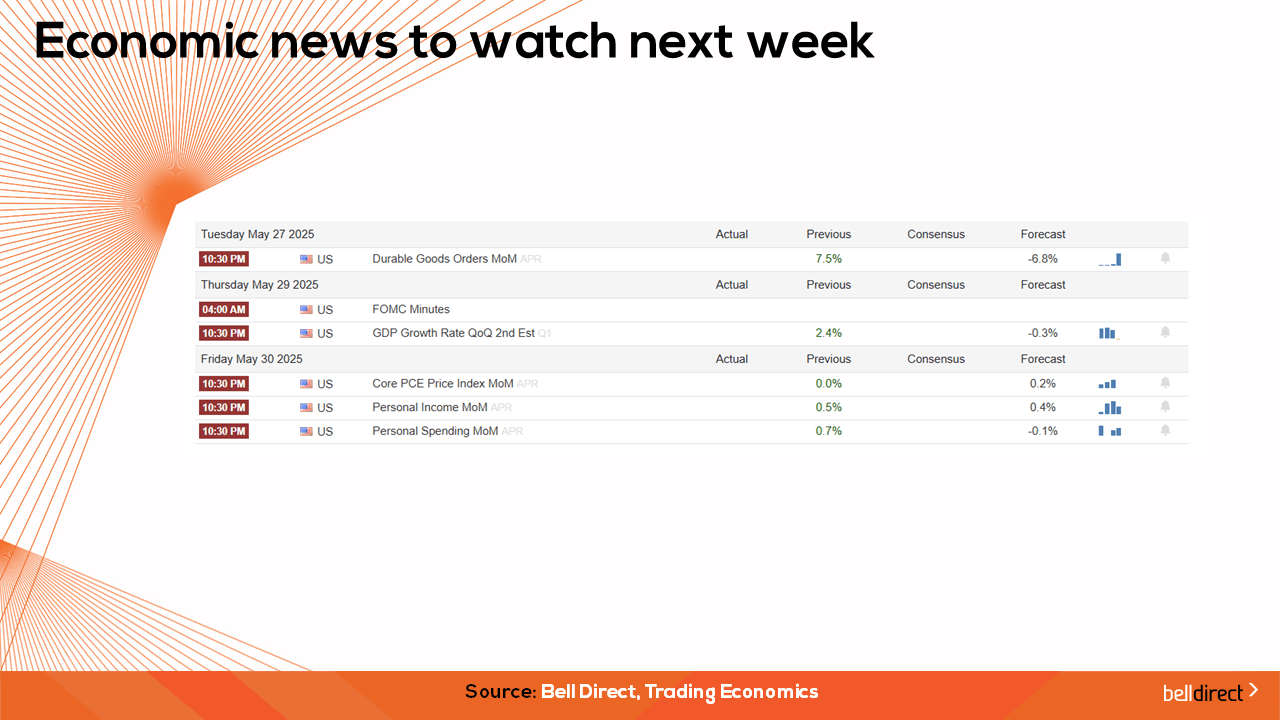

On the economic calendar front next week, we may see investors react to US durable goods orders for April, FOMC meeting minutes, US GDP growth rate for Q2, US core PCE price index for April and US personal spending, to paint a clearer picture on the US inflationary journey amid Trump’s tariff turmoil that has sparked uncertainty and volatility over recent months.

And that’s all for this Friday and week, have a wonderful weekend and happy investing.