Thank you for joining us this Friday 22nd September, I’m Sophia Mavridis, a Market Analyst with Bell Direct and this is the weekly market update.

Well, there’s been a lot of talk about uranium this week, so let’s review what happened, as well as consider some investment opportunities in the industry.

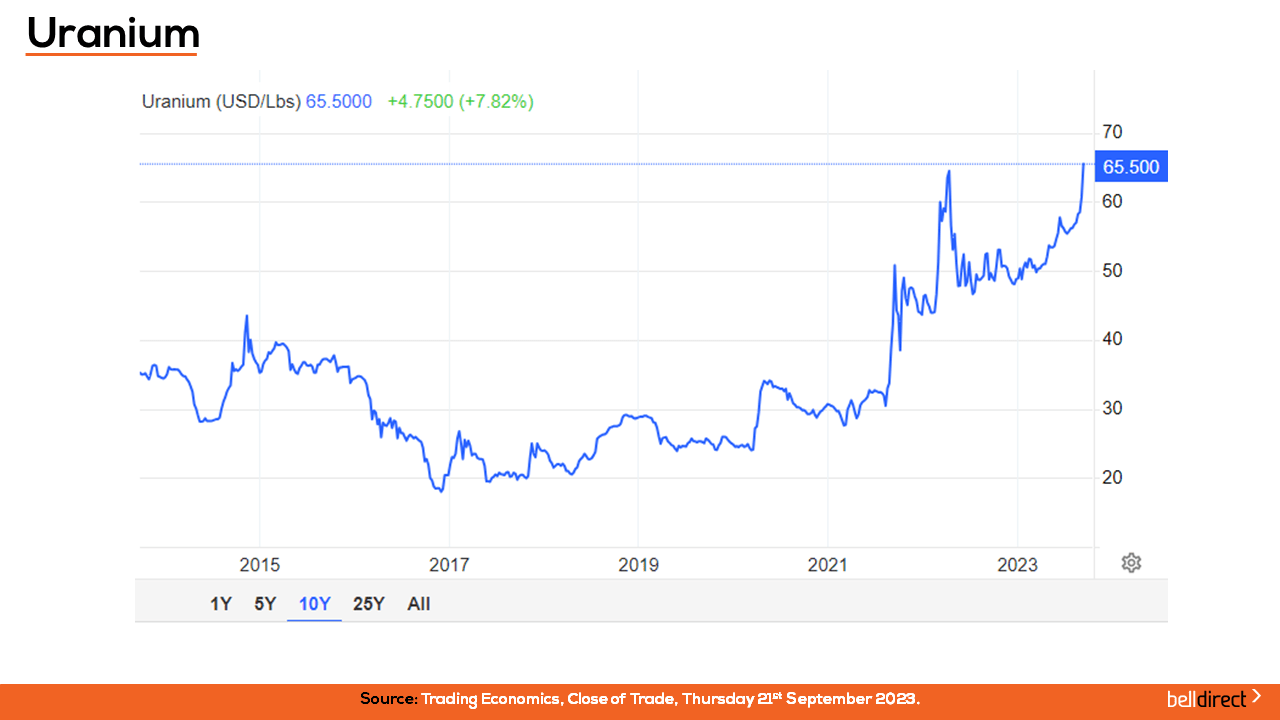

The share prices for uranium miners will be closely watched over the coming months given the price of uranium has advanced to over US$65 a pound in September, extending gains for the 10th consecutive week.

As we can see from the chart, the price has reached its highest level since the Fukushima nuclear accident in 2011. The higher uranium price is supported by bets from fund managers and is also signalling an increase in demand for nuclear fuel. The Sprott Physical Uranium Trust assisted the price increases when it started buying up secondary supply in 2021. A strategy paying well for Sprott now.

Another factor to note is decarbonisation and the increasing prices of fossil fuel energy, provoking economies to bet on nuclear power production to help them meet clean energy targets. One example of this is China, who are looking to build 32 additional nuclear reactors by the end of the decade. Meanwhile, Japan plan to restart several nuclear plants, as well as begin to build new facilities. This coincides with worries of low supply, after the world’s second-largest uranium miner, Canada’s Cameco Corporation, reduced its production guidance for this year.

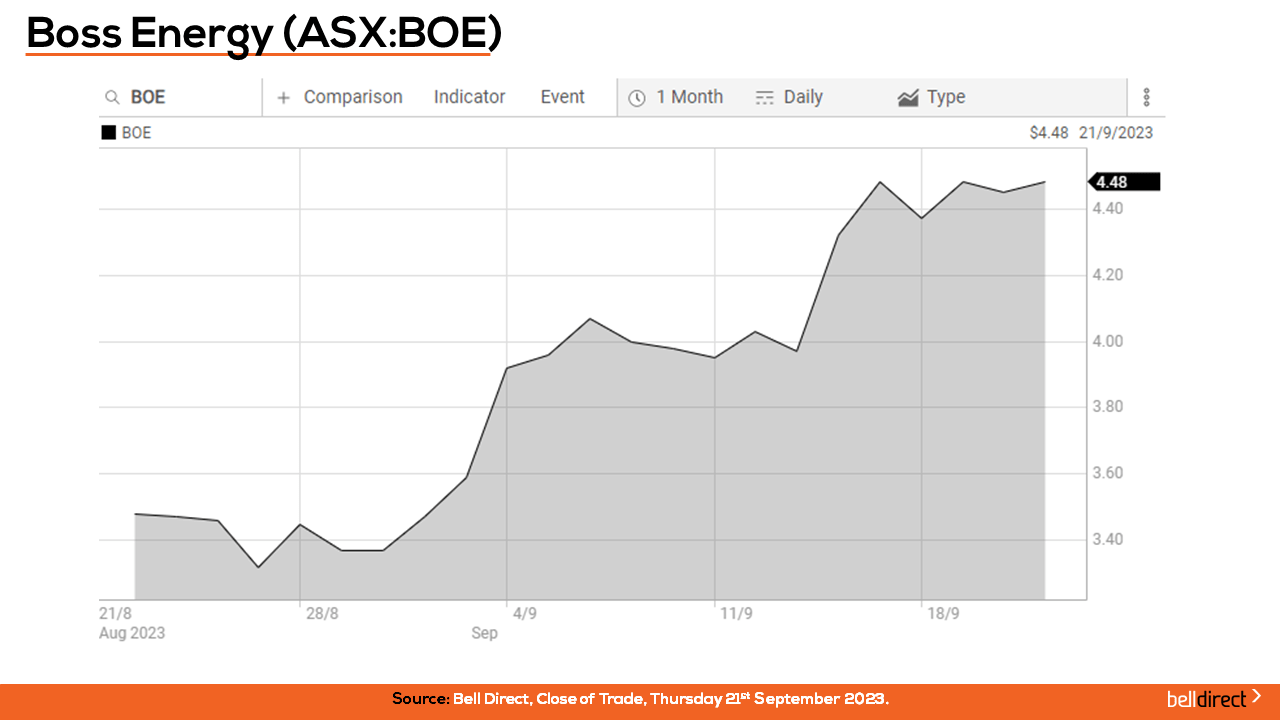

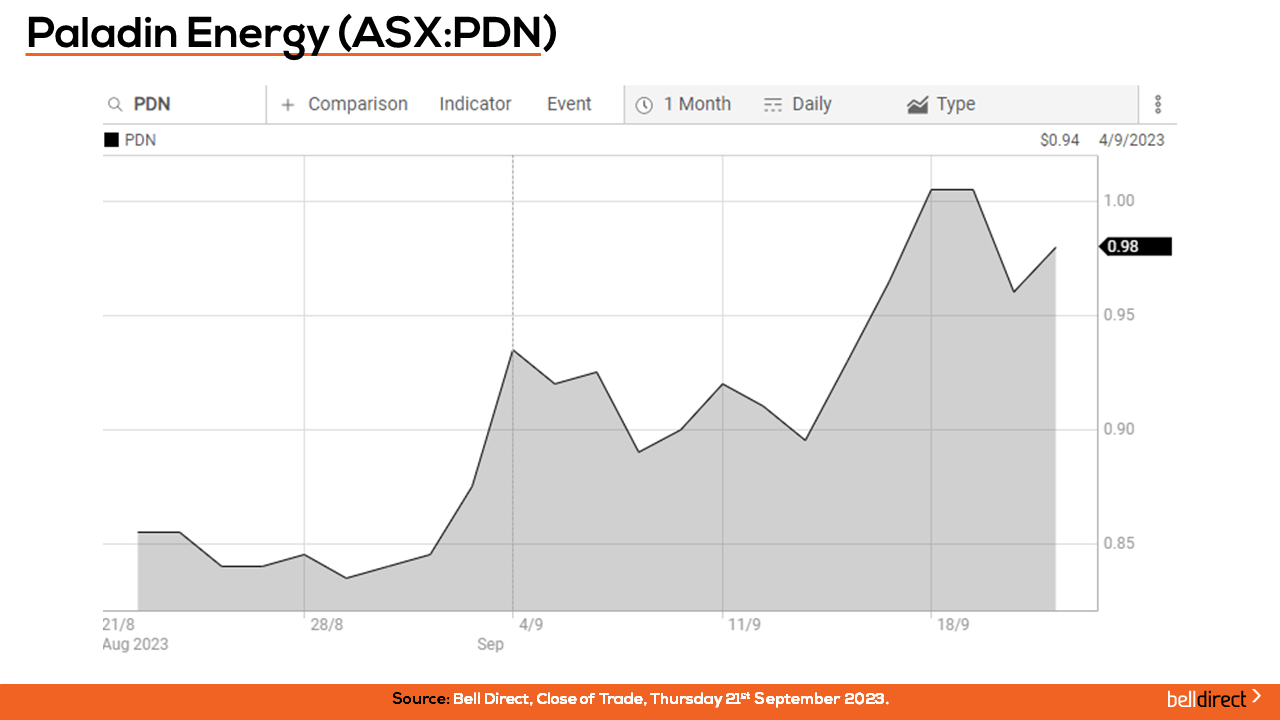

This news shines a light on locally listed uranium stocks, including Boss Energy (ASX:BOE) and Paladin Energy (ASX:PDN), with Boss Energy preparing for first production in just a few months at a time when the price of uranium may see continued upside. Bell Potter currently has a Speculative Hold recommendation on the company and has increased its valuation to $3.90.

Boss Energy (ASX:BOE) is an energy company primarily focused on the development of its 100%-owned Honeymoon Uranium Project in South Australia. Australia is a Tier 1 mining jurisdiction, providing diversification and low supply risk for uranium fuel buyers. BOE has released further results on its infill drilling program at Goulds Dam, a satellite deposit approximately 80 kms north-west from the central Honeymoon site. The results should help further define the opportunity at Goulds Dam to extend the production life and increase annual production. Bell Potter have previously assessed two upside scenarios for BOE, the first included an increase in production up 36% over the initial 11-year mine-life at Honeymoon and the second being an extension to mine life for a further 3 years.

So, in just over 4-months Boss Energy is anticipating to restart production from its Honeymoon uranium project in South Australia and will become Australia’s third uranium producer (and first in the last decade).

Another Bell Potter uranium pick is Paladin Energy (ASX:PDN), maintaining a Speculative Buy rating and a valuation of $1.12. The company’s strategic focus is the development of its 75% owned Langer Heinrich Mine (LHM) located in Namibia. The mine was placed into care and maintenance in 2018 following a prolonged period of depressed uranium prices. Prior to this the mine produced 43 million pounds of Tri uranium octoxide at a C1 cash cost of US$26 a pound. More recently, the business has progressed through a recapitalisation, paying down debt and strengthening the balance sheet.

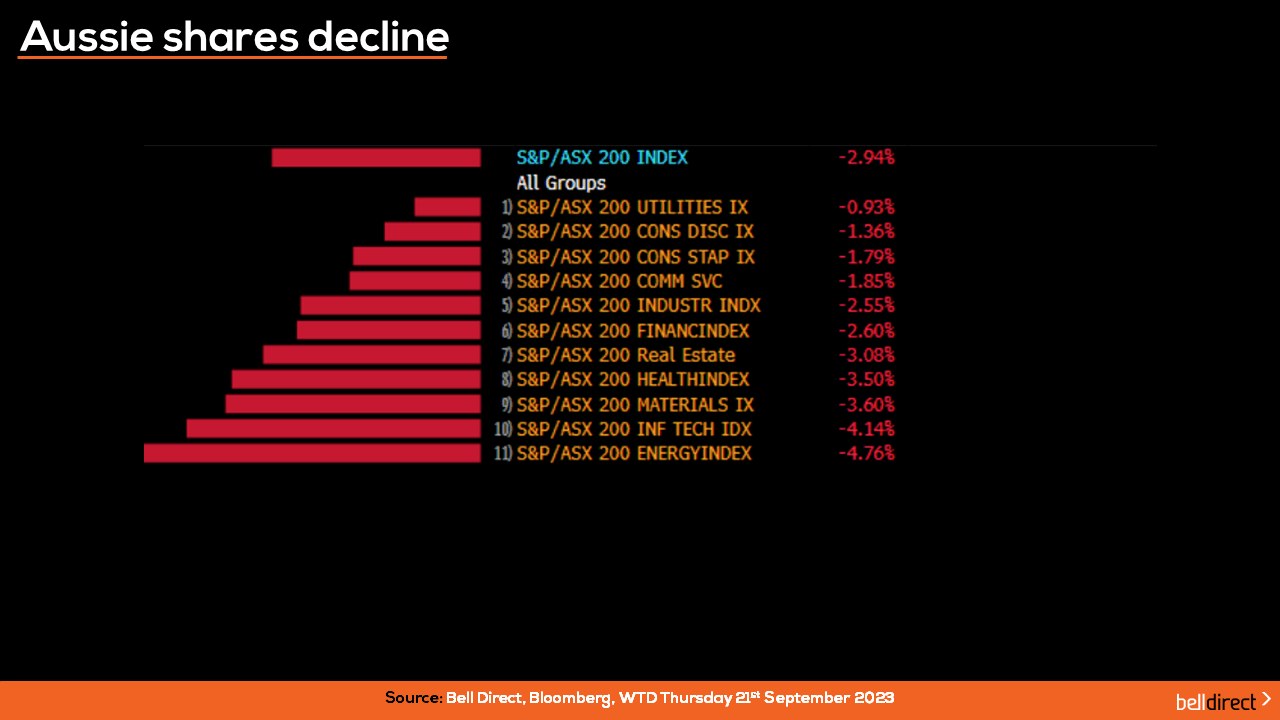

Looking now at the market’s performance this week so far,

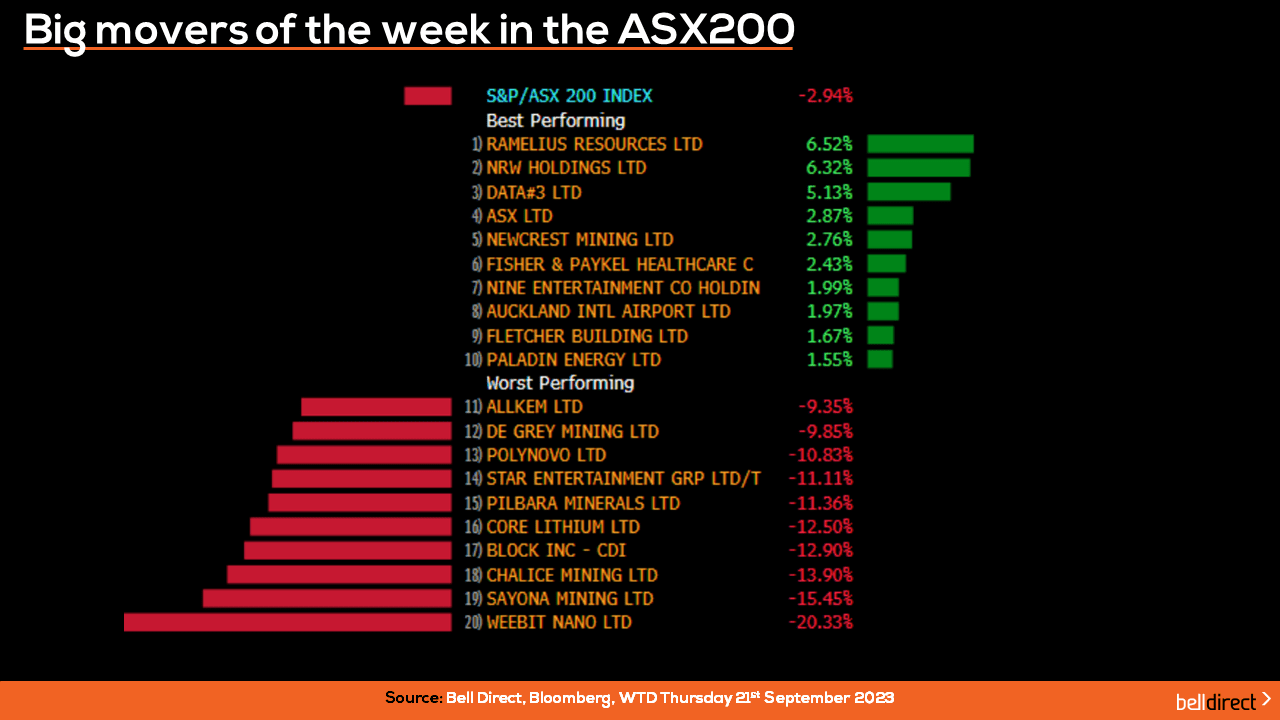

Week-to-date, the Australian share market has suffered a decline of 2.94% Monday to Thursday, with all industry sectors in negative territory. The energy sector has taken the biggest hit, declining 4.8%, following by information technology and materials.

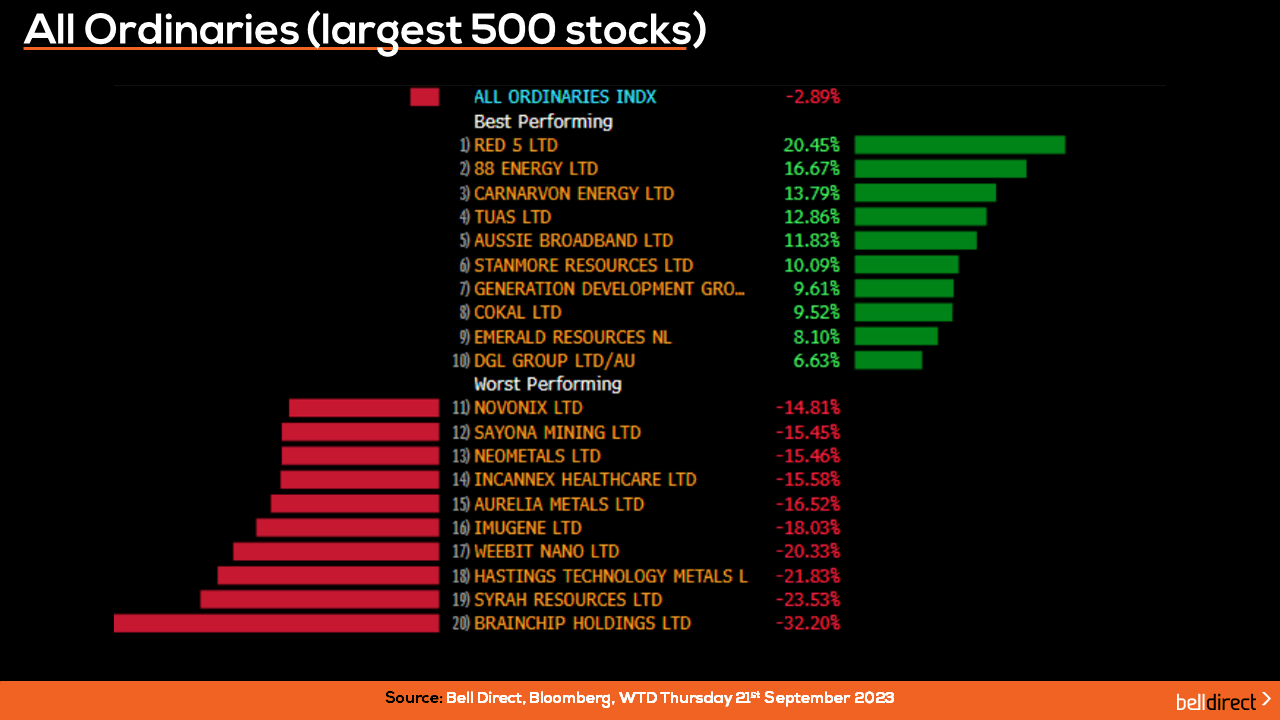

Looking at the ASX200 leaderboard, the biggest gainers this week so far are Ramelius Resources (ASX:RMS) and NRW Holdings (ASX:NWH), while stocks that declined the most were Weebit Nano (ASX:WBT) which tumbled more than 20%, and Sayona Mining (ASX:SYA) down more than 15%, as investors sell the lithium miner, following concerns that lithium prices could continue to fall over the next 12 months.

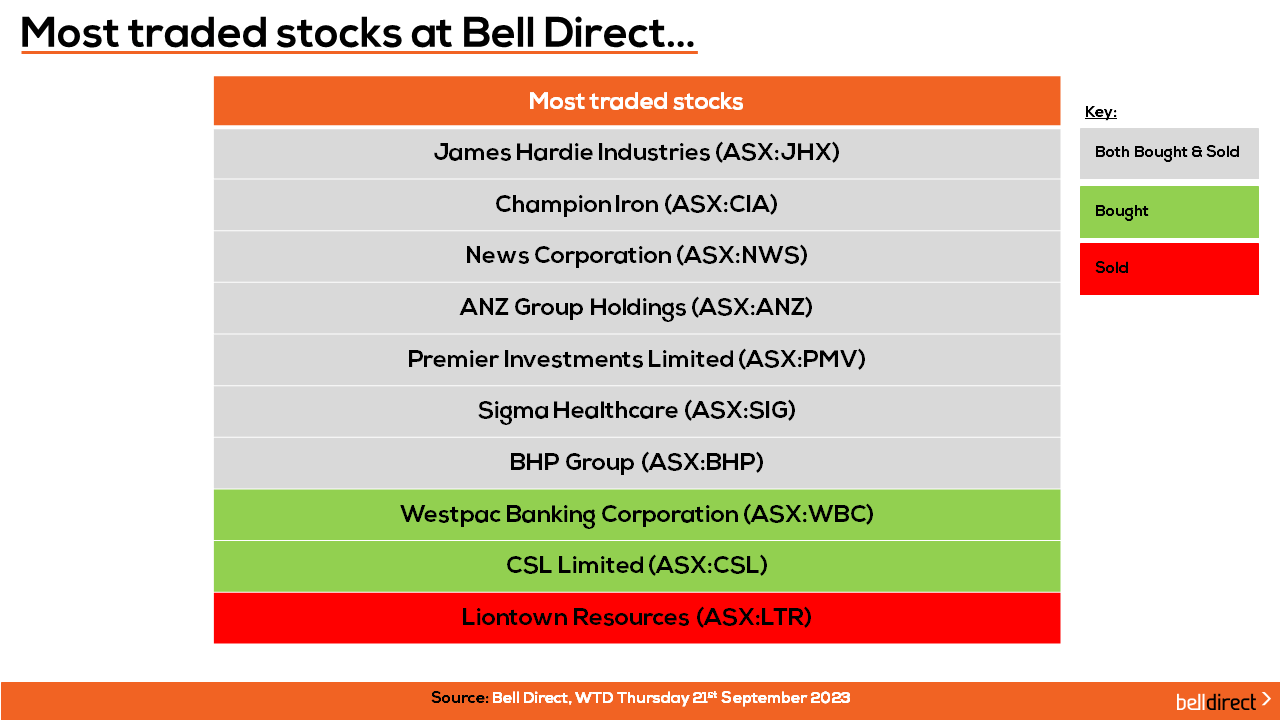

And the most traded stocks by Bell Direct clients this week were James Hardie Industries (ASX:JHX), Champion Iron (ASX:CIA), News Corp (ASX:NWS), ANZ, Premier Investments (ASX:PMV), Sigma Healthcare (ASX:SIG) and BHP Group.

Clients also bought into Westpac (ASX:WBC) and CSL, while took profits from Liontown Resources (ASX:LTR).

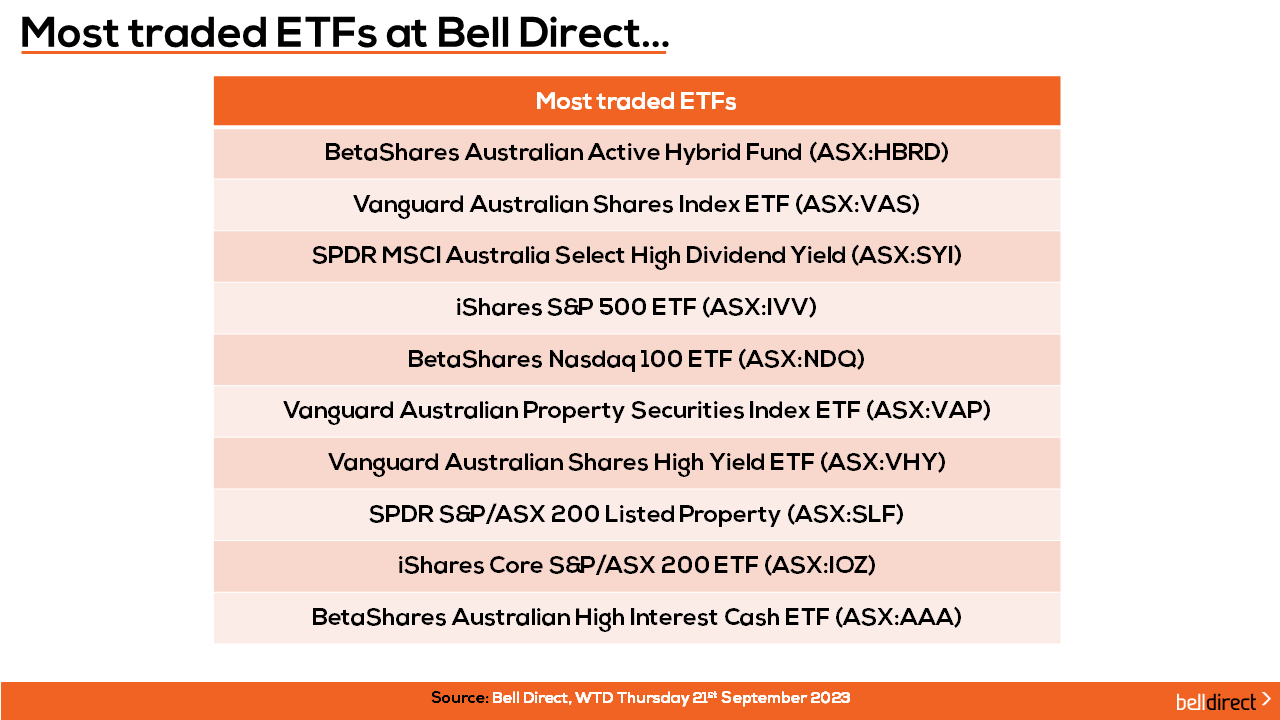

And the most traded ETFs were the BetaShare Australian Active Hybrid Fund (ASX:HBRD) and the Vanguard Australian Shares ETF (ASX:VAS).

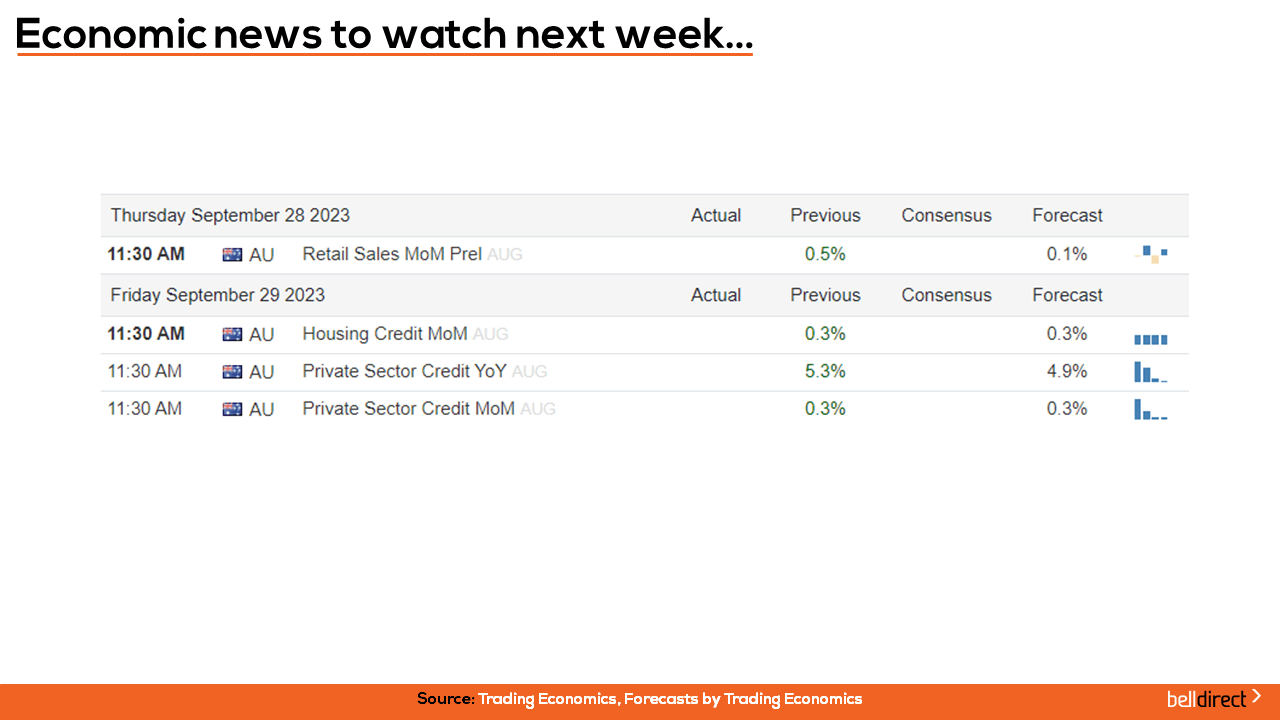

And to end on economic data out next week, look out for Retail Sales data for August out on Thursday and Housing and Prive Sector Credit for August out on Friday.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great day and happy trading.