What this means for businesses and more specifically your portfolio is:

- Assess each company you are invested in to determine their level of debt – remember debt repayments increase with every interest rate hike.

- Analyse whether the company has had to absorb or has successfully passed on rising costs to customers over every rate hike to date.

- Consumer discretionary spend is likely to slide further as the basic cost of living continues to bite.

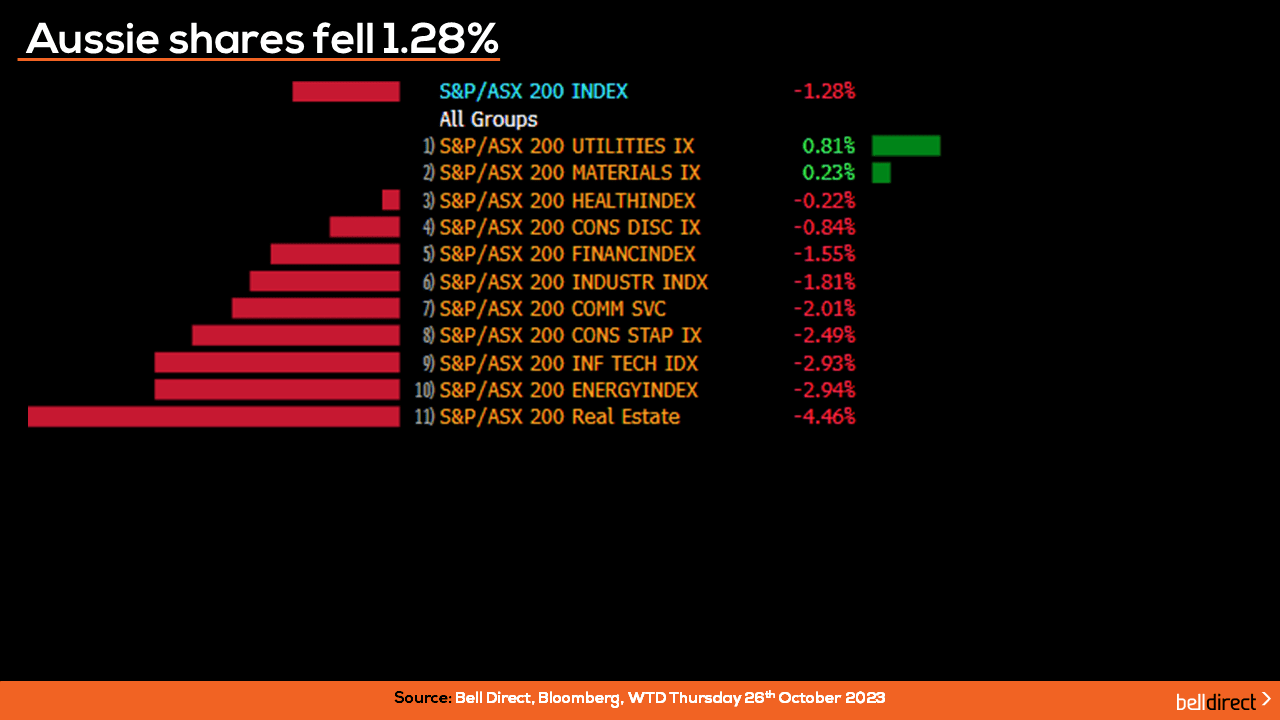

Locally from Monday to Thursday, the ASX200 fell 1.28%, weighed down by the REIT sector falling almost 4%, while energy stocks fell just shy of 3% on the retreating price of oil. Utilities stocks were the only sector to close in the green over the four trading days.

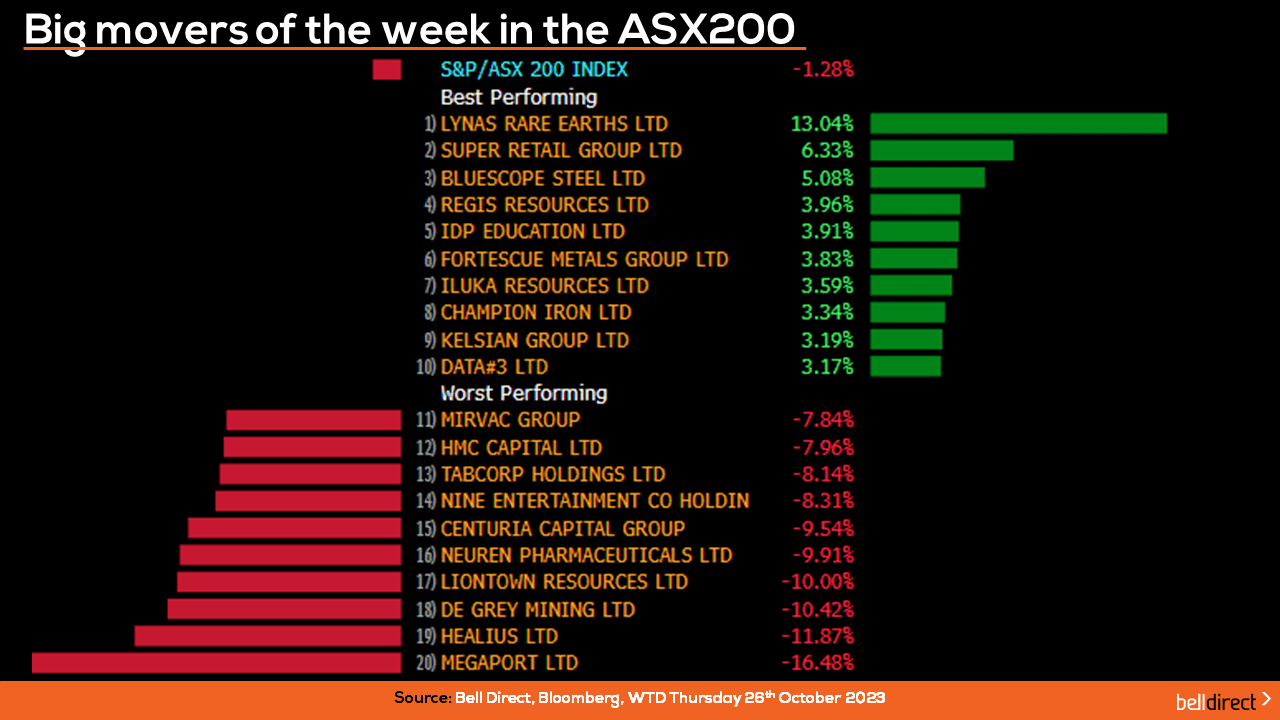

On a stock specific note, Lynas Rare Earths (ASX:LYC) topped the ASX200 this week, gaining over 13% after the rare earths producer provided an update on its Malaysian licence including an extension of importation of lanthanide to its Malaysian facilities from the Kalgoorlie operations. Super

Retail Group (ASX:SUL) rose 6.33% over the week, and Bluescope Steel (ASX:BSL) rallied 5.08%.

Megaport weighed down the ASX200 this week, falling 16.5% on the release of that first quarter trading update, while Healius (ASX:HLS) and De Grey Mining (ASX:DEG) lost 11.9% and 10.42% respectively.

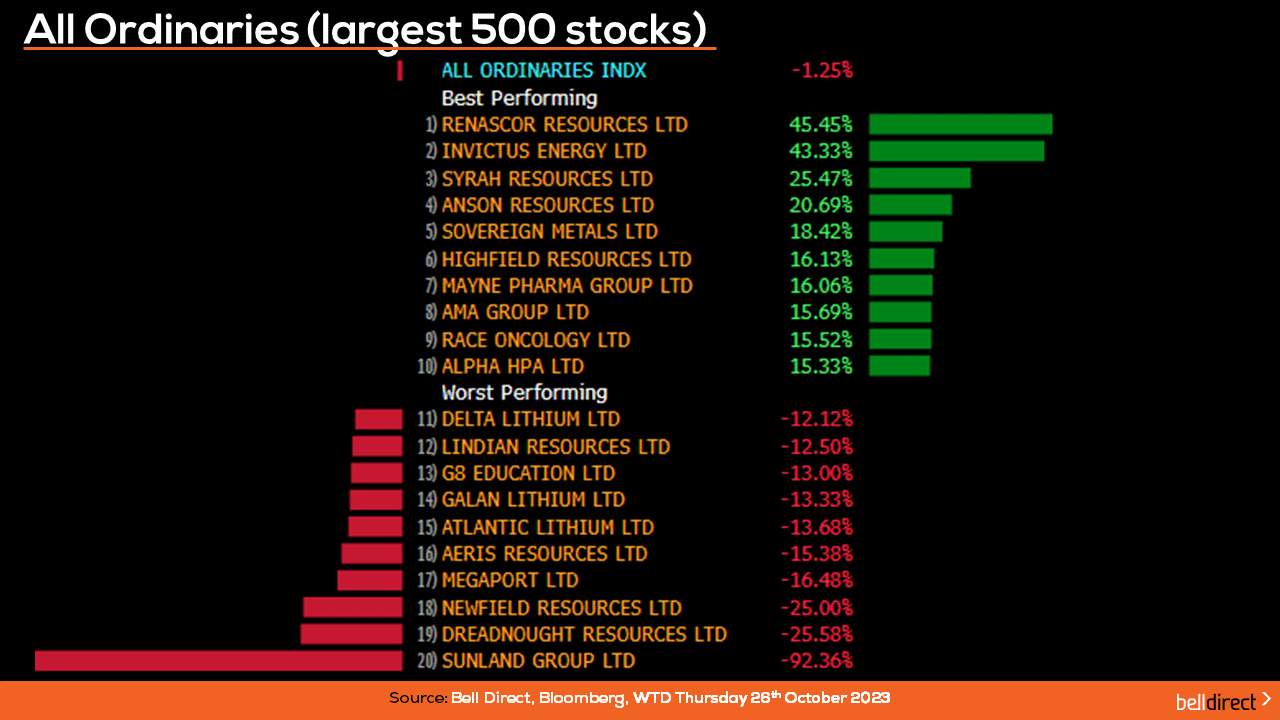

The All Ords fell 1.25% this week as Renascor Resources (ASX:RNU) soared 45.45% to offset some of the losses among the broader index. Sunland Group (ASX:SDG) tanked 92.36% over the four trading days though as the company’s shares traded ex-capital return, meaning the rights to an upcoming return are now settled in and new buyers of Sunland shares will not be entitled to it.

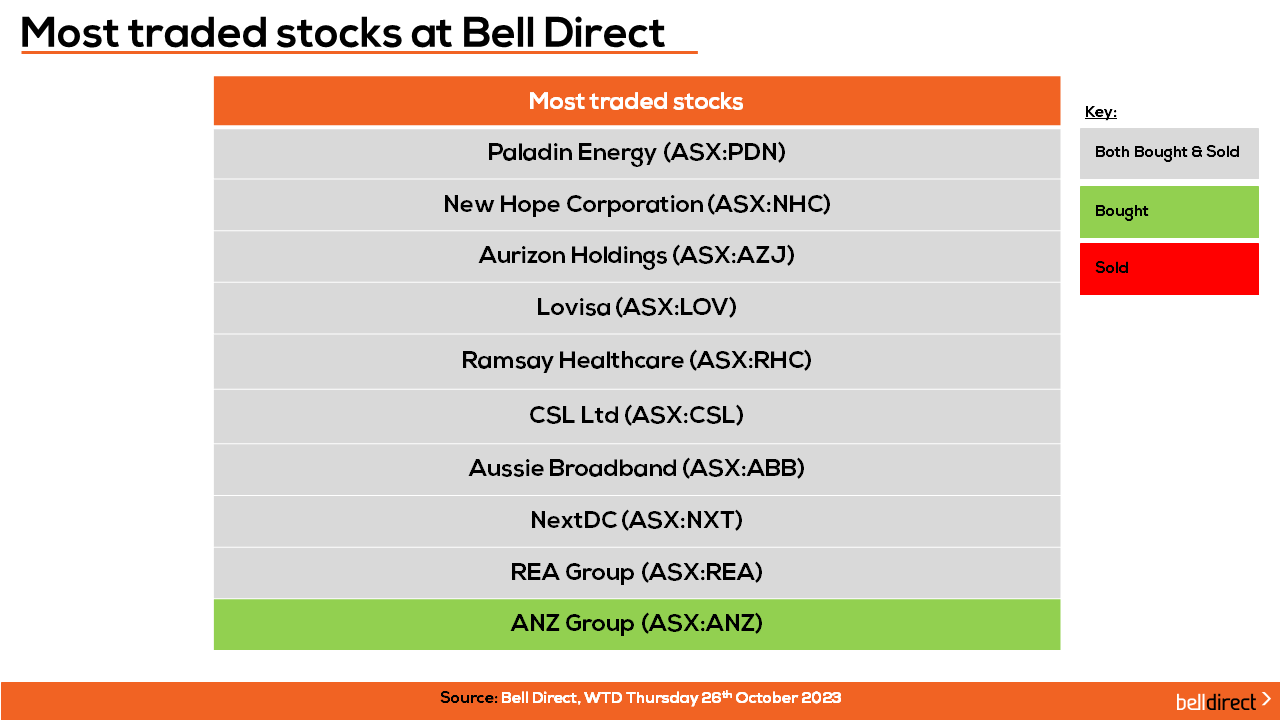

The most traded stocks by Bell Direct clients over the four trading days were, Paladin Energy (ASX:PDN), New Hope Corporation (ASX:NHC), Aurizon Holdings (ASX:AZJ), Lovisa (ASX:LOV), Ramsay Healthcare (ASX:RHC), CSL (ASX:CSL), Aussie Broadband (ASX:ABB), NextDC (ASX:NXT) and REA Group (ASX:REA).

Clients also bought into ANZ (ASX:ANZ) this trading week.

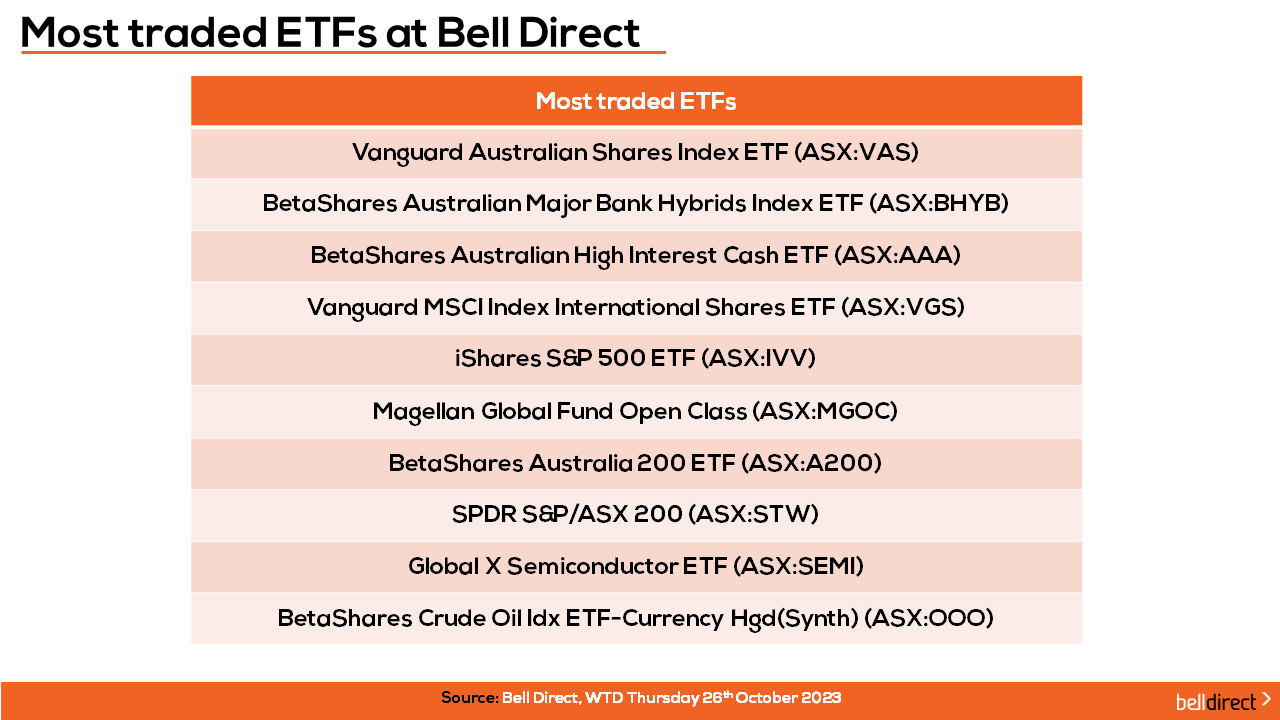

And the most traded ETFs were led by Vanguard Australian Shares Index ETF, BetaShares Australian Major Bank Hybrids Index ETF and BetaShares Australian High Interest Cash ETF.

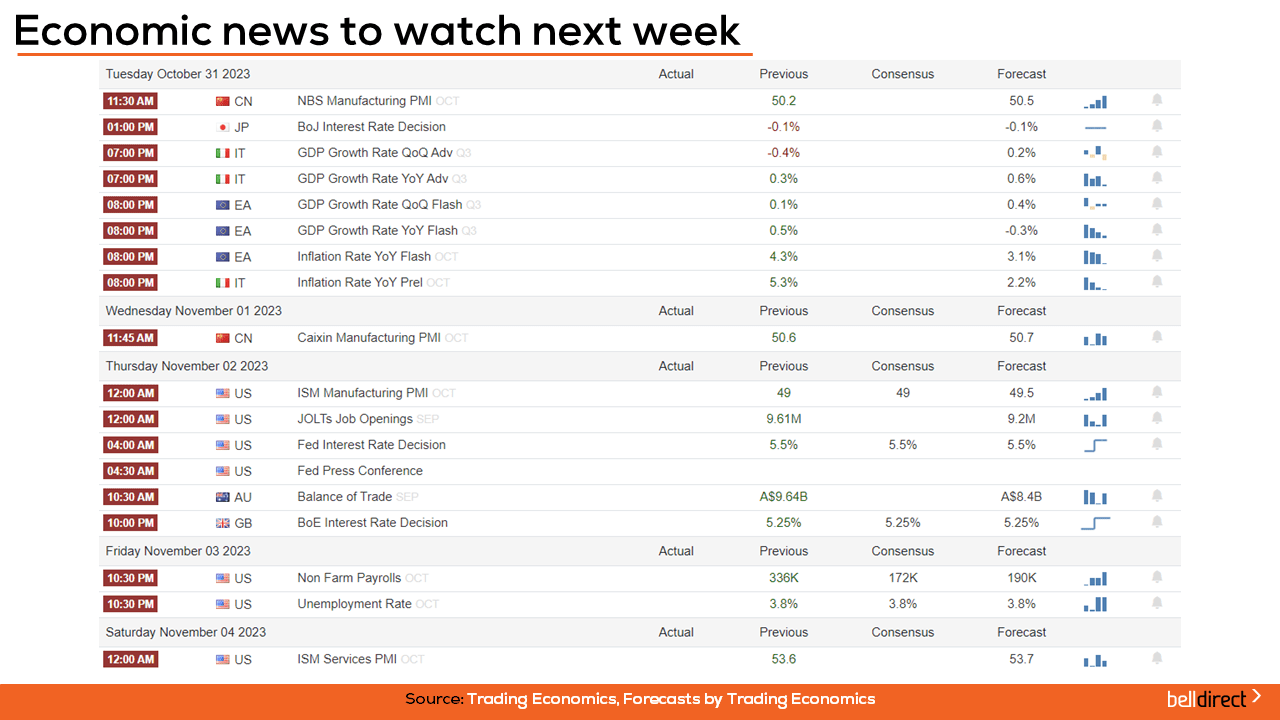

Looking at the week ahead, it’s a big week on the European calendar with Italy, Germany and the European region’s respective GDP growth rate readings out early in the week, while over in Japan, the Bank of Japan will hand down the latest interest rate decision on Tuesday with the market expecting the announcement of the -0.1% rate to be maintained for yet another month.

Locally, Australia’s balance of trade data is out later in the week with the expectation of a further decline in the country’s trade surplus to $8.4bn from $9.64bn in August, and over in the US, it’s a big week on the jobs front and the Fed will hand down the latest rate decision with the expectation of a hold.

So, a lot of exciting developments in markets this week, and much to watch out for next week. Have a wonderful weekend and as always, happy investing!