Transcript: Weekly Wrap 3 November

Thank you for joining me this Friday the 3rd November, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market wrap.

Volatility in global markets continued into the last trading week of October, however, so far November has started on a green note across the key trading regions on the back of the Fed maintaining the US cash rate for another term, eurozone inflation data coming in at a 2-year low for October, and Australian quarterly results showing resilience across some sectors.

While geopolitical tensions are driving global market volatility and China’s imminent recovery post pandemic is yet to have a material impact on economic growth, there is one key theme that has had little impact from macro noise, and that is the world pushing ahead on the green energy transition front.

This week, infrastructure investment company Infratil (ASX:IFT) rallied 1.2% after announcing that construction at the company’s major US solar farm is underway.

Governments are also pressing forward with the transition to green energy. China’s investment in solar power generation rose 232.7% in 2022 to 286.6bn yuan, with the world’s second largest economy aiming to source around 33% of power from renewable sources by 2050. The U.S. increased its energy transition investment by 11% YoY to US$141bn in 2022, while renewables and natural gas have grown from a combined 43% of total U.S. power generation to 62% in a decade. Over in Europe, the Nordic countries are leading the way according to the World Bank, all 5 Nordic Countries being Denmark, Finland, Iceland, Norway and Sweden, are among the top 20 countries in terms of renewable energy production per capita. Denmark exports wind energy technology and is a country powered 50% by wind and solar energy, 20% by renewable biomass and biofuels and the rest from fossil fuels. Sweden is also leading the charge with 75% of the country’s electricity production coming from hydroelectric supplies, nuclear power, and 16% comes from wind power.

And in Australia, with a firm commitment to transition to net zero by 2050, the government has spent over $1.4bn in reliable renewable generation and storage to date. The investment includes supporting a high-tech expansion of the Snowy Hydro Scheme, and the development of Marinus Link, the second Bass Straight interconnector needed to turn Tasmania’s battery of the nation vision to reality.

The key commodities that play a vital role in the energy transition include lithium, rare earths, nickel, copper, hydrogen, and uranium.

Copper plays a vital role in sustainable energy initiatives especially in the adoption of wind and solar power because it is a highly efficient conduit. Copper is used in renewable energy systems to generate power from solar, hydro, thermal and wind energy across the world. It helps to reduce CO2 emissions and lowers the amount of energy needed to produce electricity. With an undersupply of copper expected over the coming years, the outlook for copper remains strong for years to come.

While some miners are making big investments in the hydrogen space like Fortescue Metals Group (ASX:FMG) into its Fortescue Future Industries division, other mining giants are expanding their portfolio into lithium assets like Gina Rinehart through her recent buy-up of shares in Liontown Resources (ASX:LTR).

Hydrogen has a very positive outlook for decarbonising hard-to-electrify sectors like heavy machine industries and transportation, however, the hydrogen industry both at home and overseas is still far from mature. Australia’s Federal Government announced a $2bn Hydrogen Headstart program in the most recent budget, taking up half of the budgets’ $4bn spend on renewable energy. When investing in hydrogen stocks, be wary of the early-stage nature of companies operating in this new green energy space given that these business are usually yet to establish consistent cashflows.

Lithium remains a key green commodity in the energy transition and despite recent lulls in the price of the commodity, the outlook remains strong for the key EV battery component moving forward.

So, while sectors and stocks remain volatile amid movements in macro news and events, the green energy transition charges on with strong outlook for FY24 and beyond.

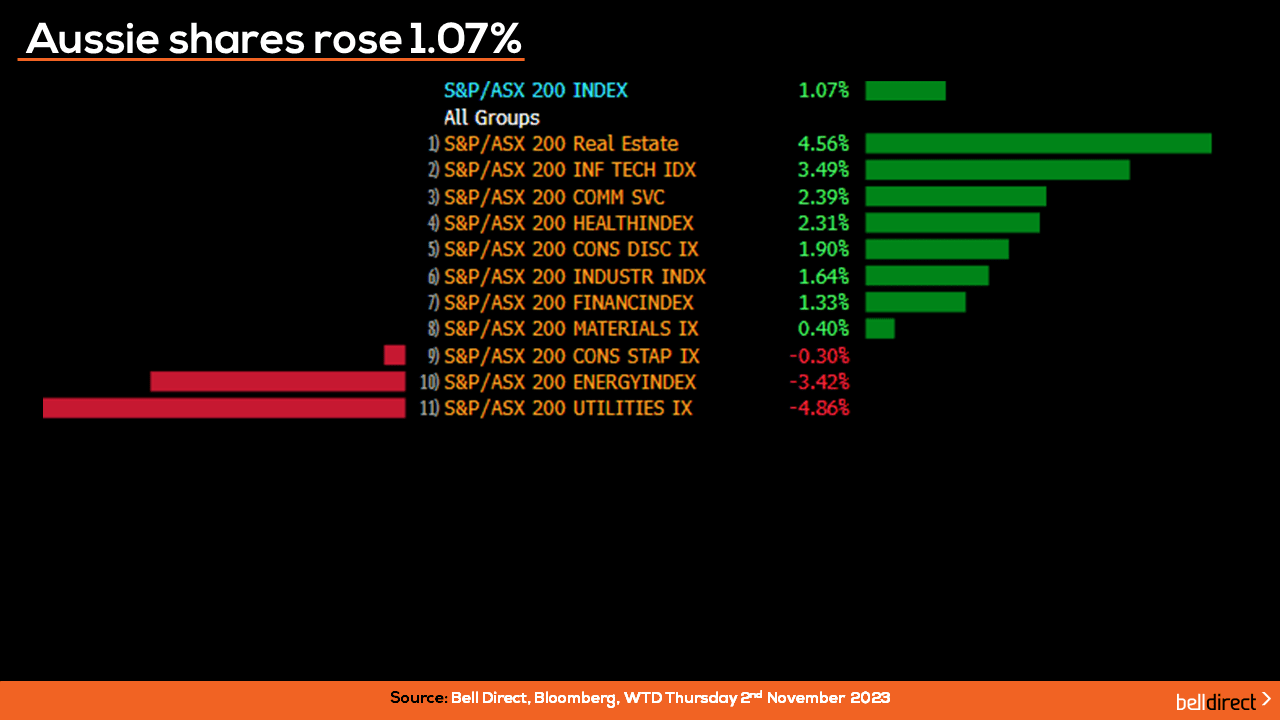

Locally from Monday to Thursday the ASX200 rose 1.07% to start the new trading month in the green led by real estate stocks jumping over 4.5% to regain some ground following the sell-off in the sector over the year so far. Tech stocks also rebounded to rise 3.5% over the trading week.

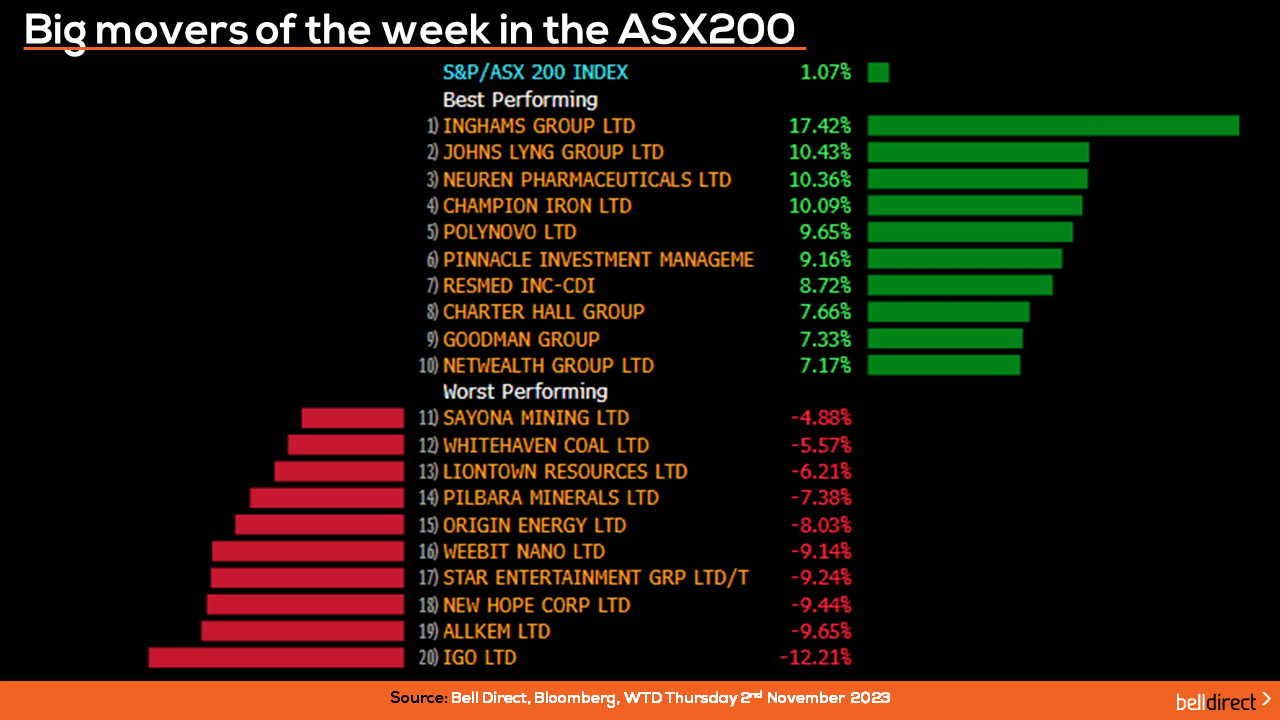

The winning stocks on the ASX200 this week were led by Ingham’s Group (ASX:ING) soaring 17.4% after Australia’s leading poultry producer released a strong first half trading update. Johns Lyng Group (ASX:JLG) jumped 10.43% over the four trading days, and Neuren Pharmaceuticals (ASX:NEU) added 10.36%.

On the losing end, IGO (ASX:IGO) fell 12.21%, Allkem (ASX:AKE) lost 9.65% and New Hope Corp (ASX:NHC) fell 9.44%.

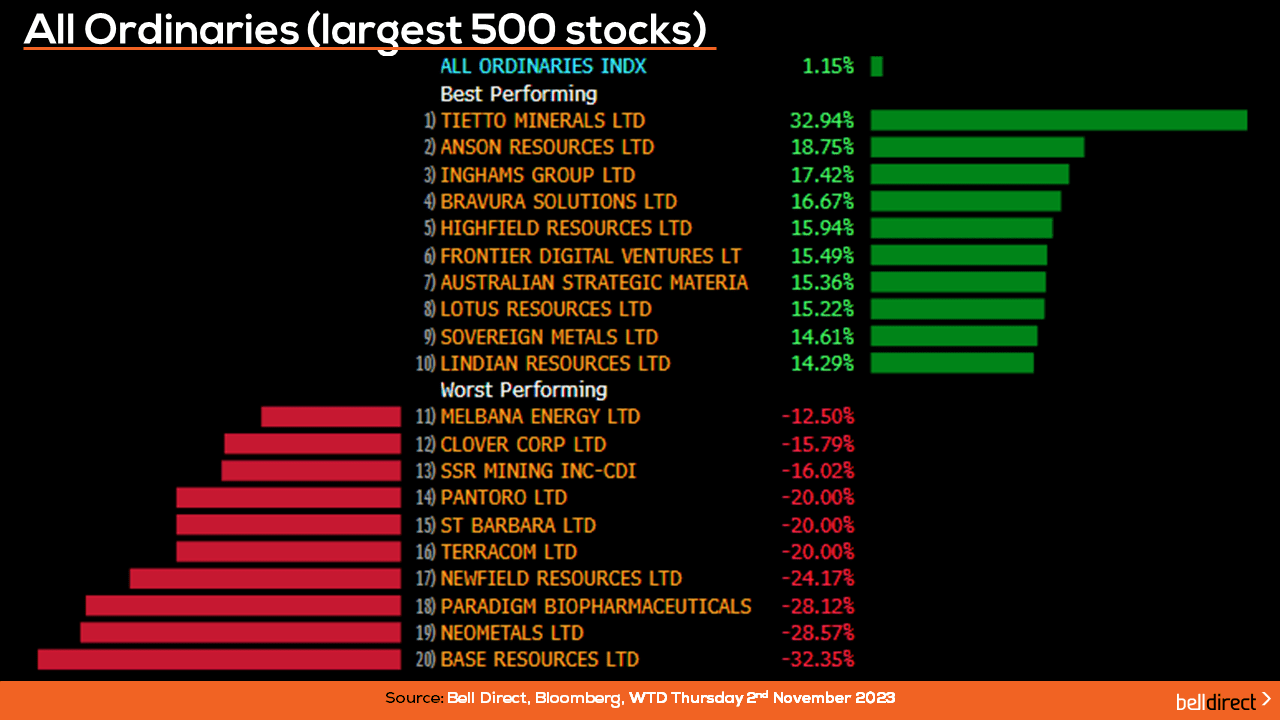

Taking a look at the broader index, the All Ords rose 1.15% buoyed by Tietto Minerals (ASX:TIE) soaring 33% following the receipt of a takeover offer, while Anson Resources (ASX:ASN) rallied 18.75% this week. Base Resources (ASX:BSE) weighed on the All Ords, falling 32.35% after the company confirmed its Kwale Operations will end at the conclusion of 2024.

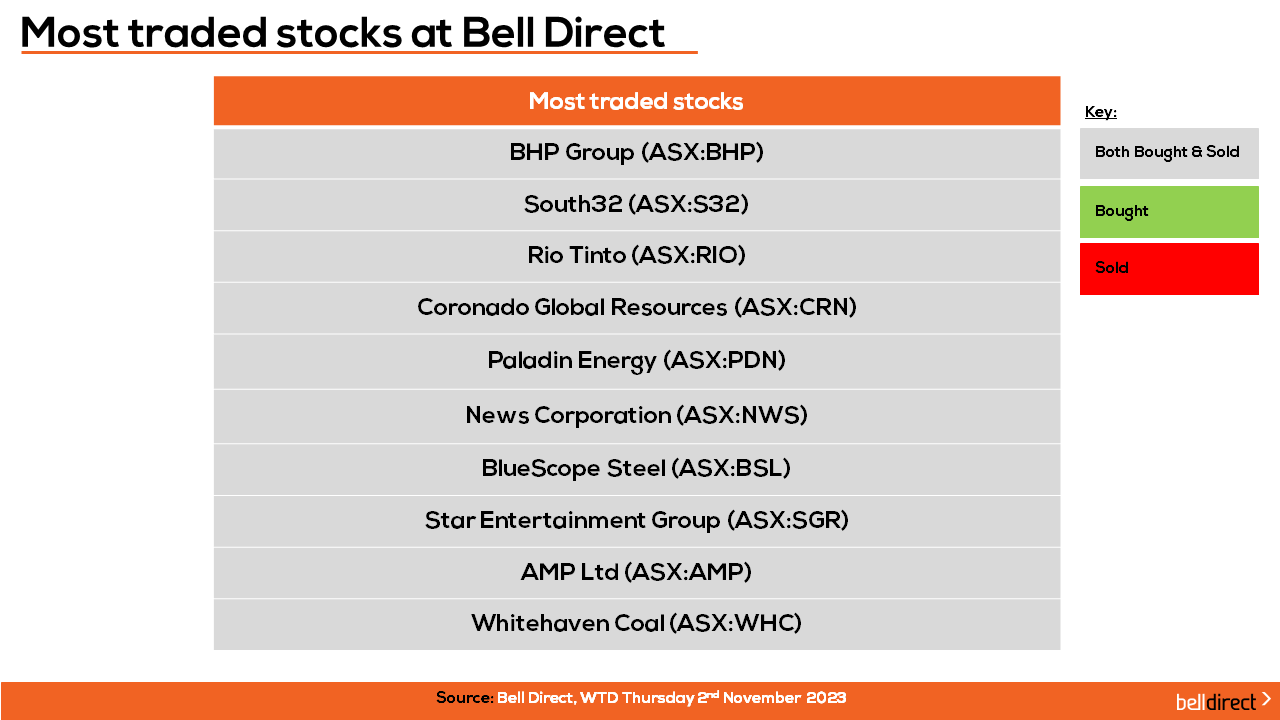

The most traded stocks by Bell Direct clients this week were BHP (ASX:BHP), South 32 (ASX:S32), Rio Tinto (ASX:RIO), Coronado Global Resources (ASX:CRN), Paladin Energy (ASX:PDN), News Corporation (ASX:NWS), BlueScope Steel (ASX:BSL), Star Entertainment Group (ASX:SGR), AMP (ASX:AMP) and Whitehaven Coal (ASX:WHC).

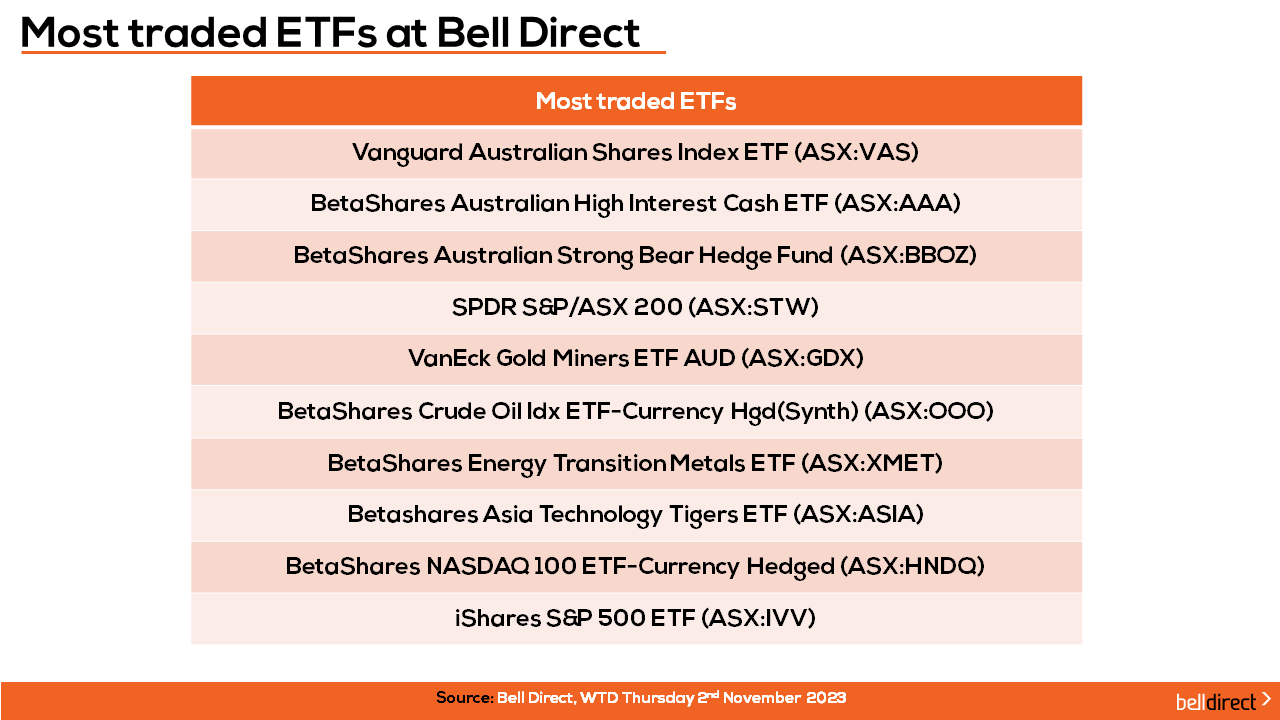

The most traded ETFs were led by Vanguard Australia Shares Index ETF, Betashares Australian High Interest Cash ETF and BetaShares Australia Strong Bear Hedge Fund.

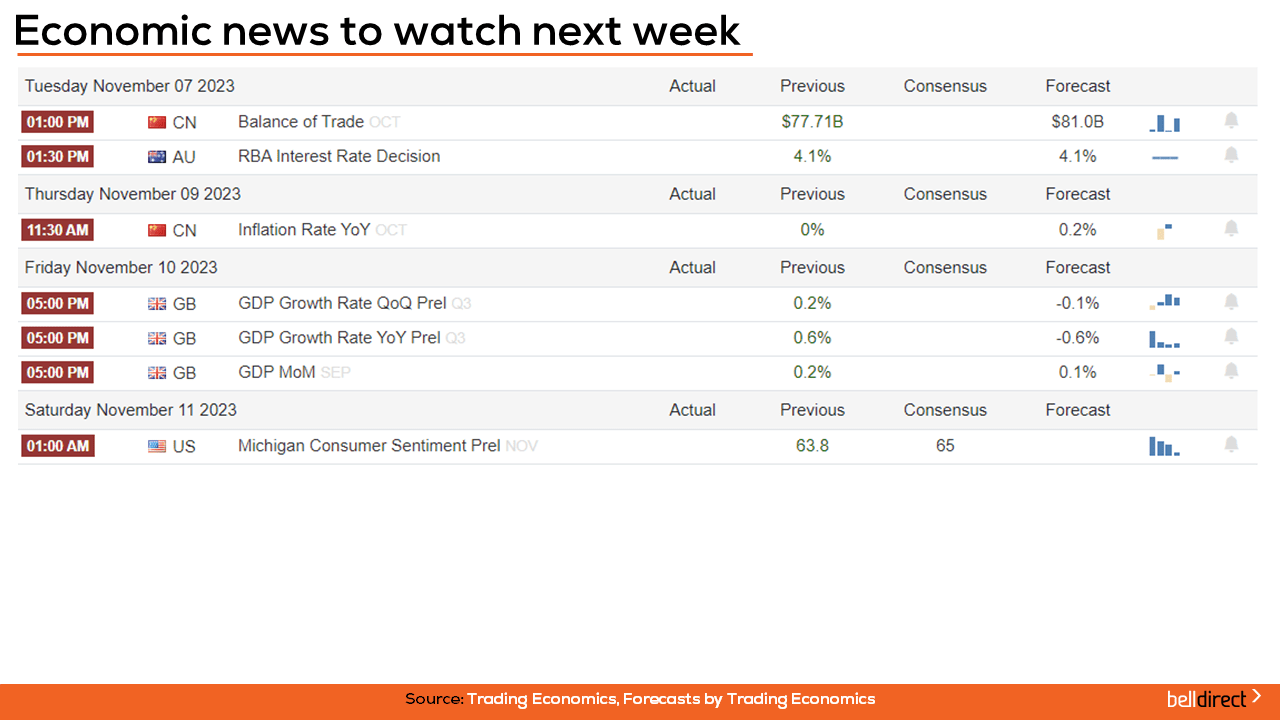

Looking to the week ahead, China’s trade balance and inflation rate data will provide key insight into how well the world’s second largest economy is recovering post pandemic. Locally, the highly anticipated RBA interest rate decision is announced on Tuesday with all four big banks expecting the RBA to raise the nation’s cash rate by 25-basis points. Over in the UK, GDP data is out later next week with the expectation of economic contraction across all readings.

And that’s the markets for this week and the green energy transition theme overview. I hope you have a wonderful weekend and as always, happy investing!