Transcript: Weekly Wrap 8 March

The stock market, driven by investor sentiment, can be regarded as a barometer for the economic health of the global economy and the geopolitical climate. With this in mind, let’s consider the geopolitical tensions concerning markets, and assess the risks involved.

While it’s undeniable that geopolitical tensions can sway the stock market in the short term, reacting impulsively to these fluctuations can often lead to suboptimal outcomes for investors. It’s important for investors to maintain a focus on their long-term wealth-building strategies. By implementing a strategic investment approach, investors can mitigate the effects of geopolitical volatility and position themselves for sustained growth over time. Ultimately, the key to success lies in patience and diversification across asset classes and industry sectors.

Some of the top geopolitical risks of 2024 include the ongoing Israel-Gaza war, the Russia-Ukraine conflict, increasing competitive tension between the US and China, as well as escalating cyber-attacks.

Cyber-attacks are receiving increasing market attention as they disrupt critical and digital infrastructure. Any company relying heavily on digital systems or that handles sensitive data, is vulnerable to the impacts of cyber-attacks and this can heavily impact their stock prices. As cyber treats continue to evolve, investors may like to consider the cybersecurity strategies of companies in their investment portfolios and monitor how those companies plan to respond to a potential incident.

The relationship between the US and China has become more complicated in recent years, in the areas of trade and supply chains, which has impacted liquid natural gas imports, the US trade deficit with China and the US energy sector. We’ve also seen the US blacklist some of China’s tech companies, and China has threated to sell off US Treasury bonds. Such headlines have caused disruption in global financial markets and commodity prices.

The energy sector is one to watch this year, as energy resources are crucial to economic development. The Ukraine war sees Europe at risk of having limited access to Russian gas. European energy security is under threat and this places upward pressure on Euro gas prices.

The extent the stock market will react to geopolitical tensions can vary depending on the perceived impact on economic stability and the level of uncertainty. Investors are bracing for some short-term volatility in certain sectors and commodities. It’s important for investors to stay informed, avoid impulsive investment decisions, consider safe-haven assets, monitor exposure to risk and maintain a diversified portfolio.

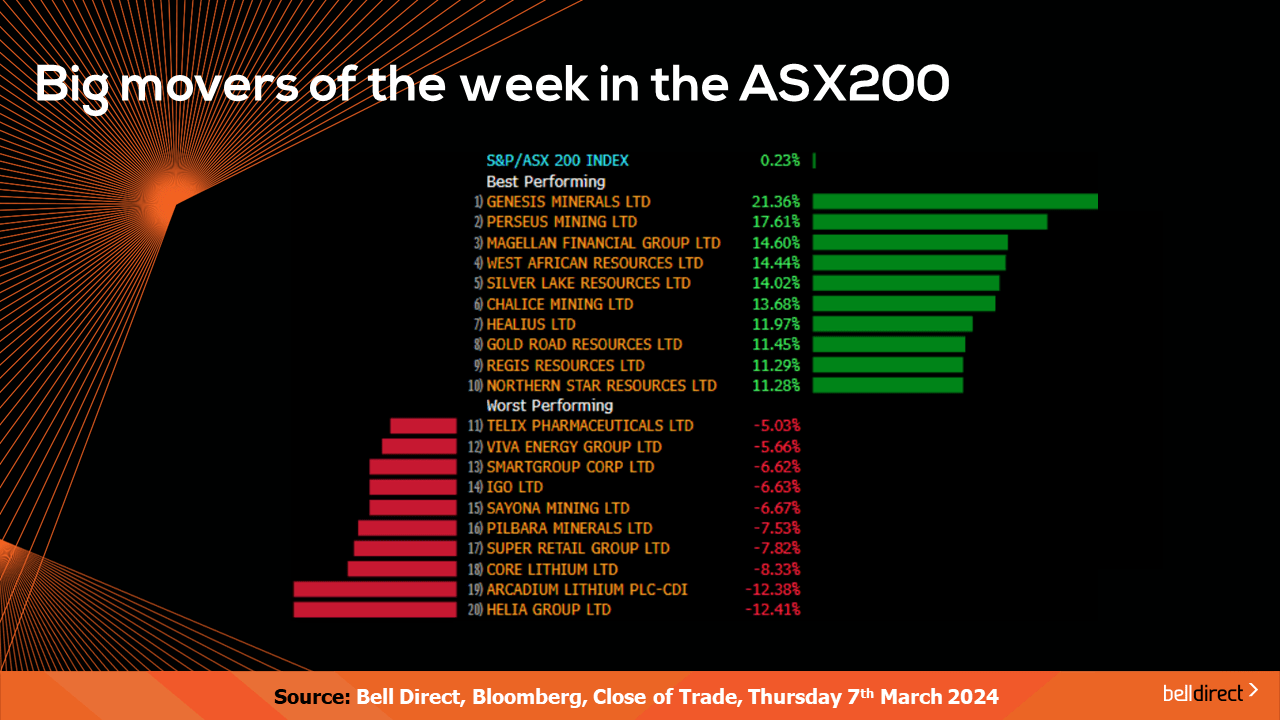

On the ASX200 leaderboard, Genesis Minerals (ASX:GMD) was the best performing stock this week, rising an impressive 21%, closely followed by Perseus Mining (ASX:PRU) up 18%. On the other hand, Helia group (ASX:HLI), Arcadium Lihtium (ASX:LTM) and Core Lithium (ASX:CXO) declined the most, as lithium stocks suffered major share price falls this week.

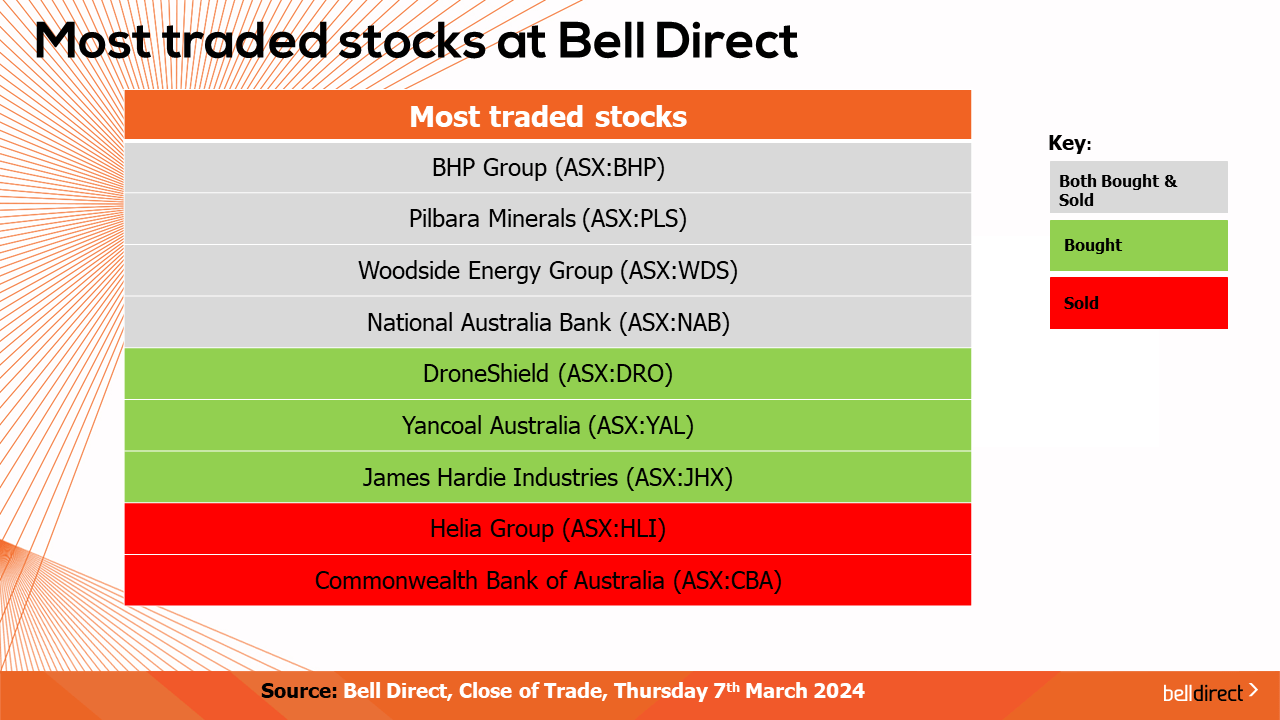

The most traded stocks by Bell Direct clients this week were BHP (ASX:BHP), Fortescue Metals (ASX:FMG), Pilbara Minerals (ASX:PLS), Woodside Energy (ASX:WDS) and NAB (ASX:NAB). Clients also bought into Droneshield (ASX:DRO), Yancoal (ASX:YAL)and James Hardie Industries (ASX:JHX). While took profits from Helia Group and the Commonwealth Bank.

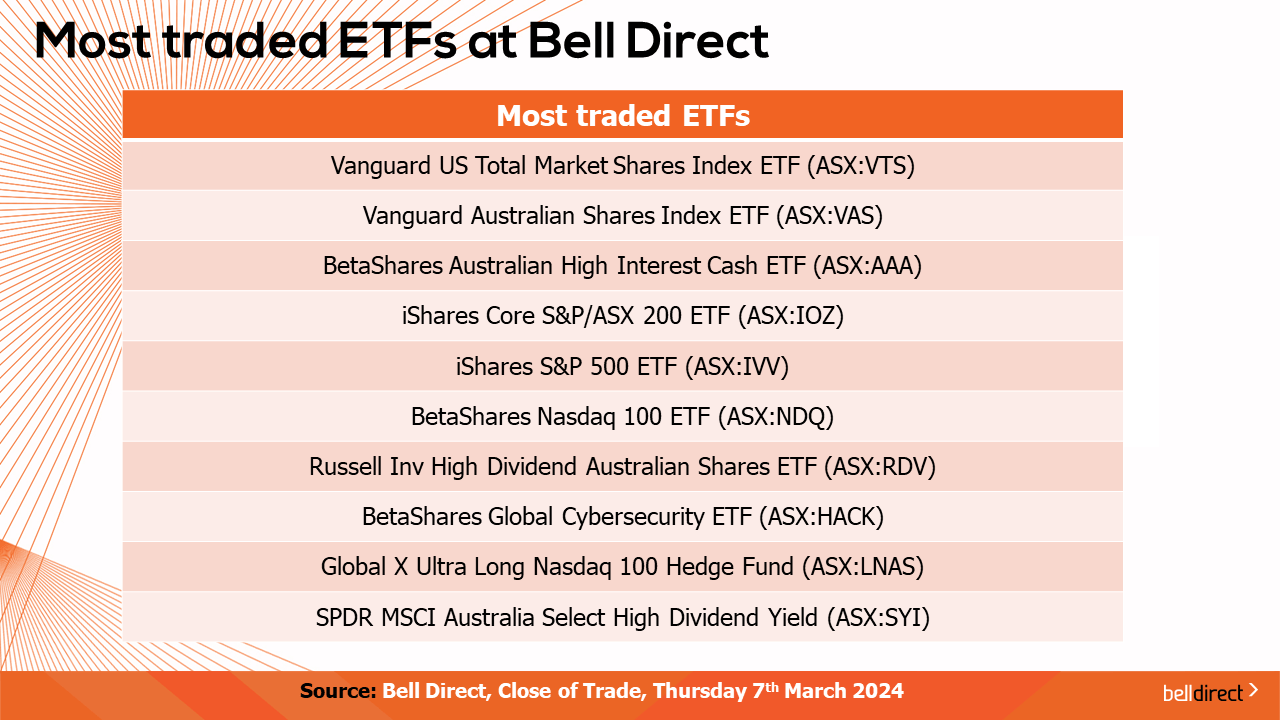

And the most traded ETFs by Bell Direct clients were the Vanguard US Total Market Shares Index ETF (ASX:VTS), the Vanguard Australian Shares Index ETF (ASX:VAS) and the BetaShares Australian High Interest Cash ETF (ASX:AAA).

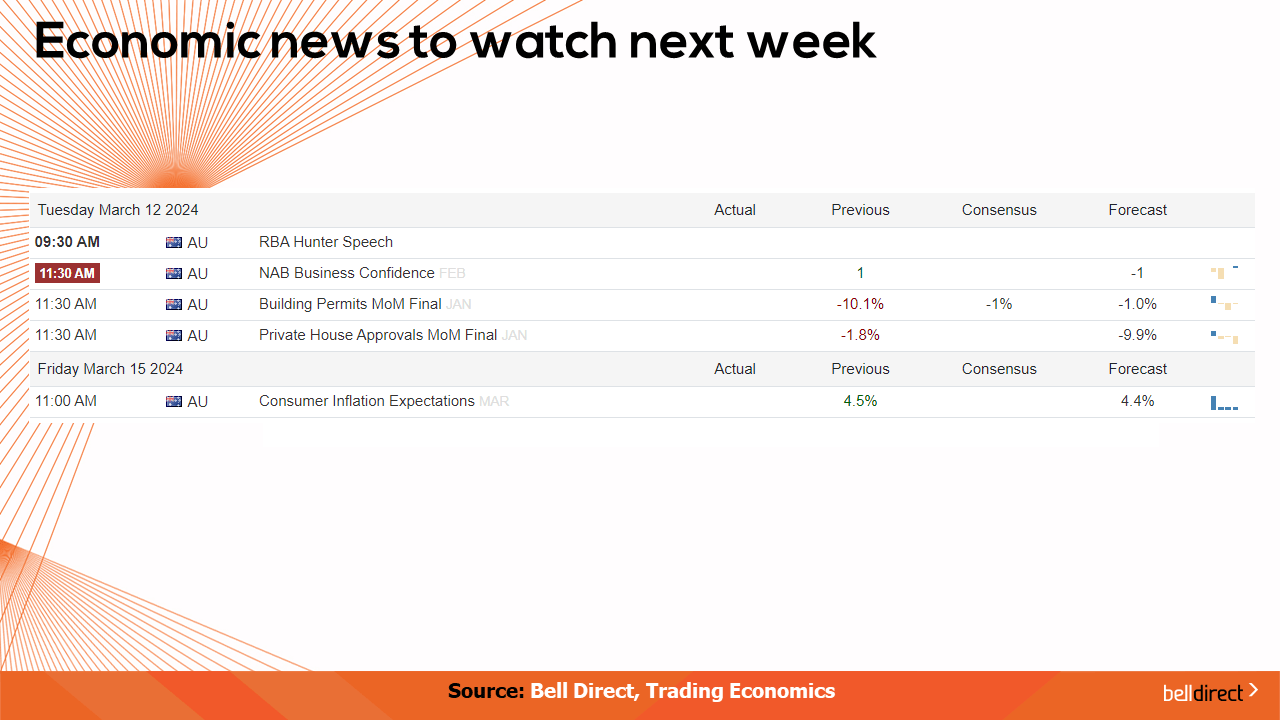

And to end, economic data to watch next week.

NAB’s business confidence data for February and Building Permits data for January will be out on Tuesday, and consumer inflation expectations for March will be released on Friday.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great Friday and as always, happy investing.