Thanks for joining us this Friday 28 November. I’m Sophia Mavridis, a market analyst with Bell Direct and this is the weekly market update.

If you’ve been watching the US markets lately, you may be asking: Is this rally sustainable, or is it running on fumes?

Well, the Q3 2025 reporting season has ended strong, with companies delivering on strong profits. This solid earnings performance is acting as a safety net for the US equity market right now.

In the third quarter, a massive 83% of S&P 500 companies beat their earnings forecasts. Before the season started, analysts expected earnings growth of about 7.9%. The reality was that growth surged to 13.4%. Because of this, analysts are now upgrading their profit forecasts for the rest of 2025 and into 2026. However, we’re also seeing that valuations are high meaning the market is expensive, and investors are being selective.

This brings us to Artificial Intelligence. Big Tech is spending historic amounts of money on AI, while the market is starting to ask: ‘Where is the return?’

Amazon rallied after showing their AI spending is making money through their cloud business. Nvidia also crushed expectations, proving the demand for chips is nowhere near slowing down. On the flip side, Meta and Microsoft declined because they are spending billions on AI infrastructure, but investors aren’t seeing the immediate revenue boost to justify the cost.

The Financial sector has been a standout performer this quarter. Banks like Morgan Stanley and Goldman Sachs posted results that beat expectations, driven by a resurgence in dealmaking and investment banking fees.Bell Potter remains constructive on the medium term. They believe the AI productivity boom will support earnings for years to come. However, watch out for short-term volatility. The Federal Reserve’s interest rate decisions are still causing market jitters. If we get a market correction or a dip, the strategy is to view it as a buying.

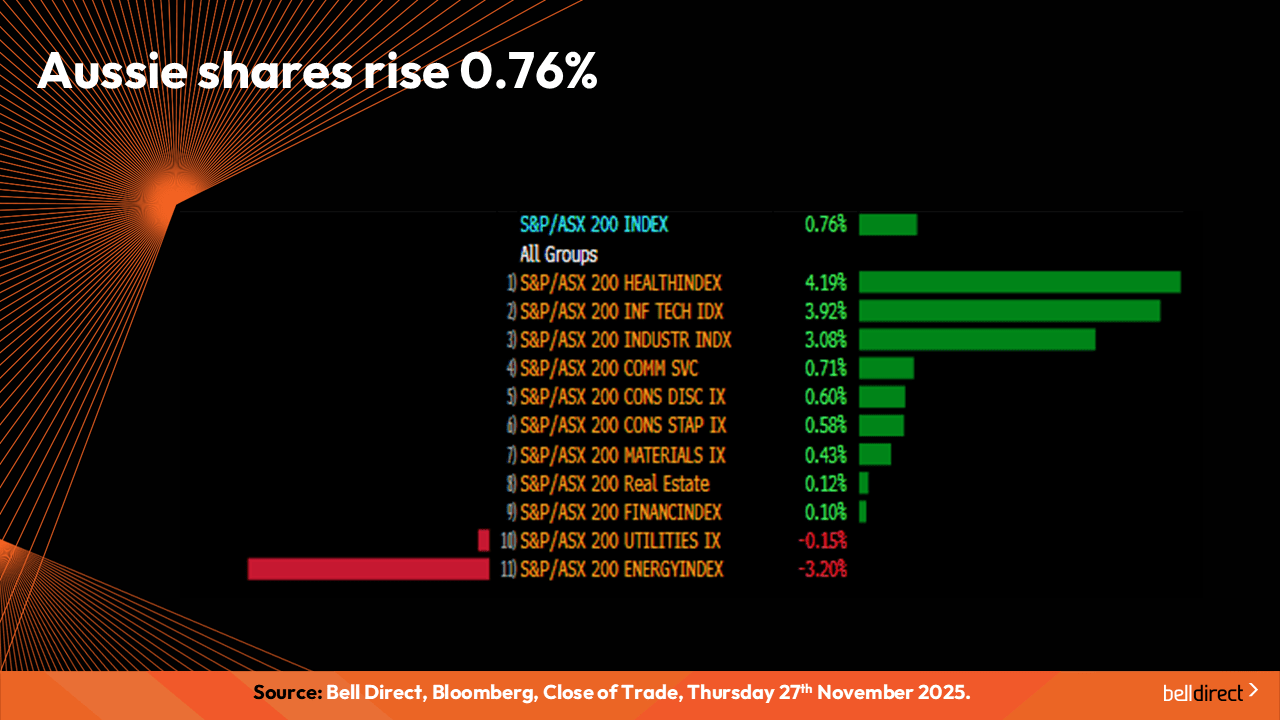

Now looking at our local markets performance this week so far, the ASX200 gained 0.76% Monday to Thursday, with healthcare and technology in the lead, advancing 4.19% and 3.92% respectively. Meanwhile, the energy sector was down the most, 3.2% in the red.

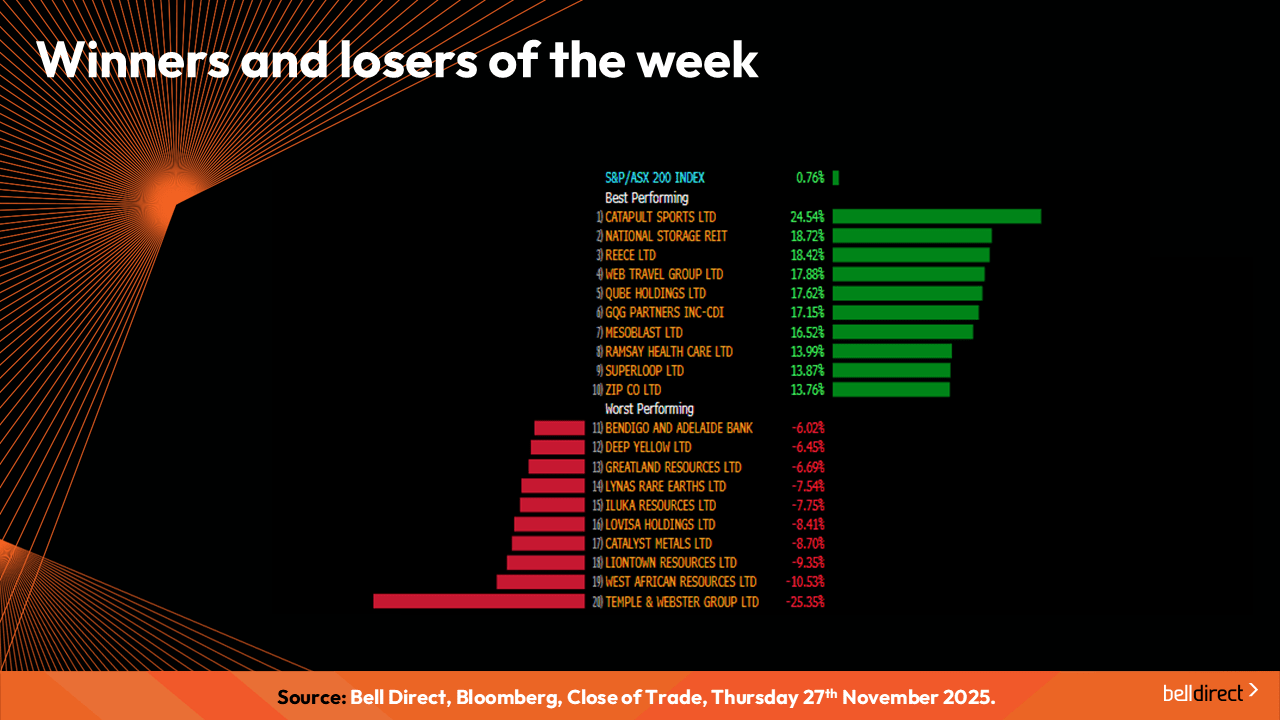

On the ASX200 leaderboard, Catapult Sports (ASX:CAT) advanced the most. Bell Potter this week retained their buy rating on this sports technology company’s shares with a lowered price target of $6.50. They said that Catapult released its half year results last week and delivered earnings ahead of both guidance and Bell Potter’s expectations. This was driven by a higher-than-expected margin. Bell Potter sees potential for strong double-digit growth in the core business and believes it will be augmented by the cross-sell opportunities.

Meanwhile Temple and Webster (ASX:TPW) declined the most, down 25.35% this week so far following a FY26 trading update.

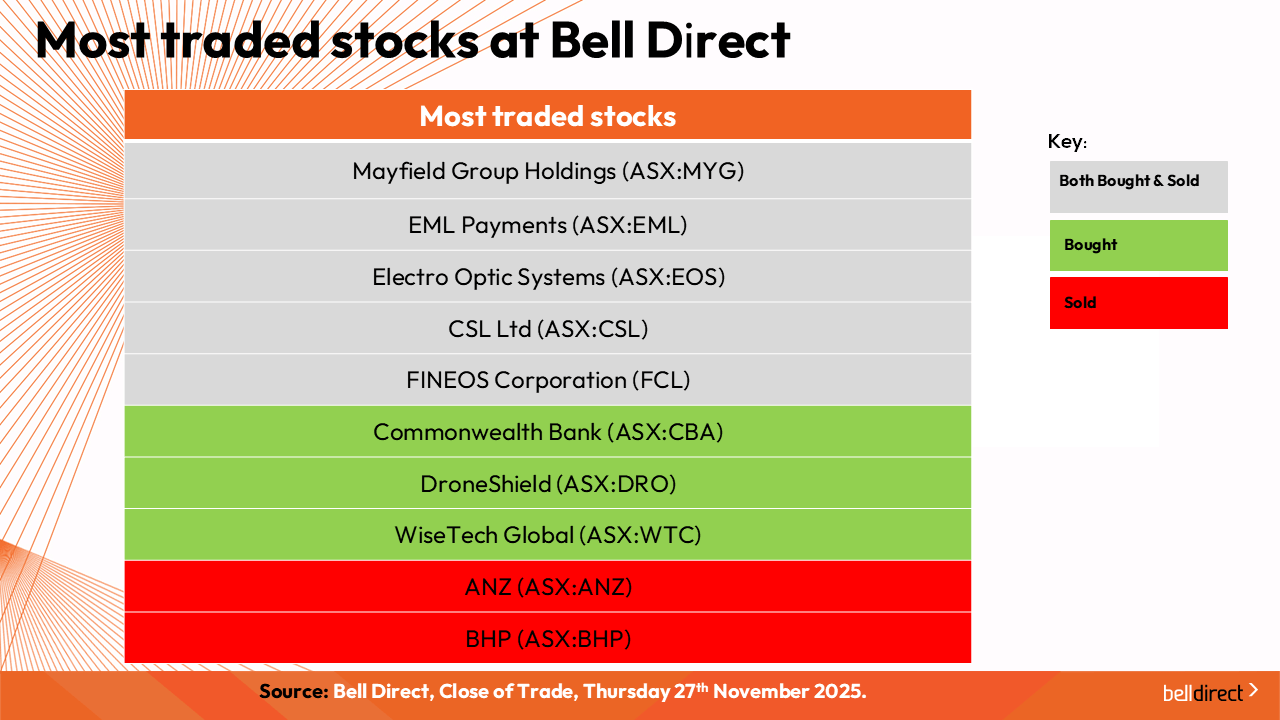

As for the most traded stocks by Bell Direct clients, these were Mayfield Group Holdings (ASX:MYG), EML Payments (ASX:EML), Electro Optic Systems (ASX:EOS), CSL Limited (ASX:CSL) and FINEOS Corporation (ASX:FCL).

Clients also bought into Commonwealth Bank (ASS:CBA), Droneshield (ASX:DRO) and WiseTech Global (ASX:WTC). While took profits from ANZ Group (ASX:ANZ) and BHP Group (ASX:BHP).

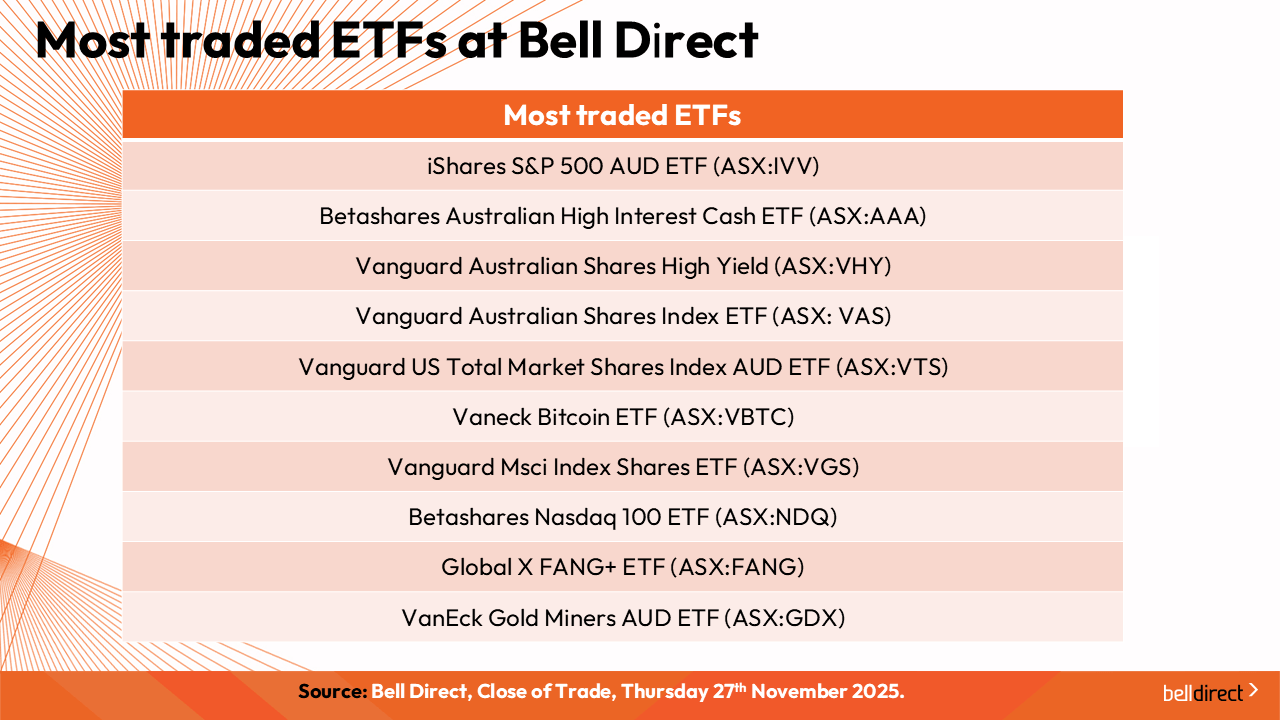

And the most traded ETFs were iShares S&P 500 ETF (ASX:IVV), the Betashares Australian High Interest Cash ETF (ASX:AAA) and the Vanguard Australian Shares High Yield ETF (ASX:VHY).

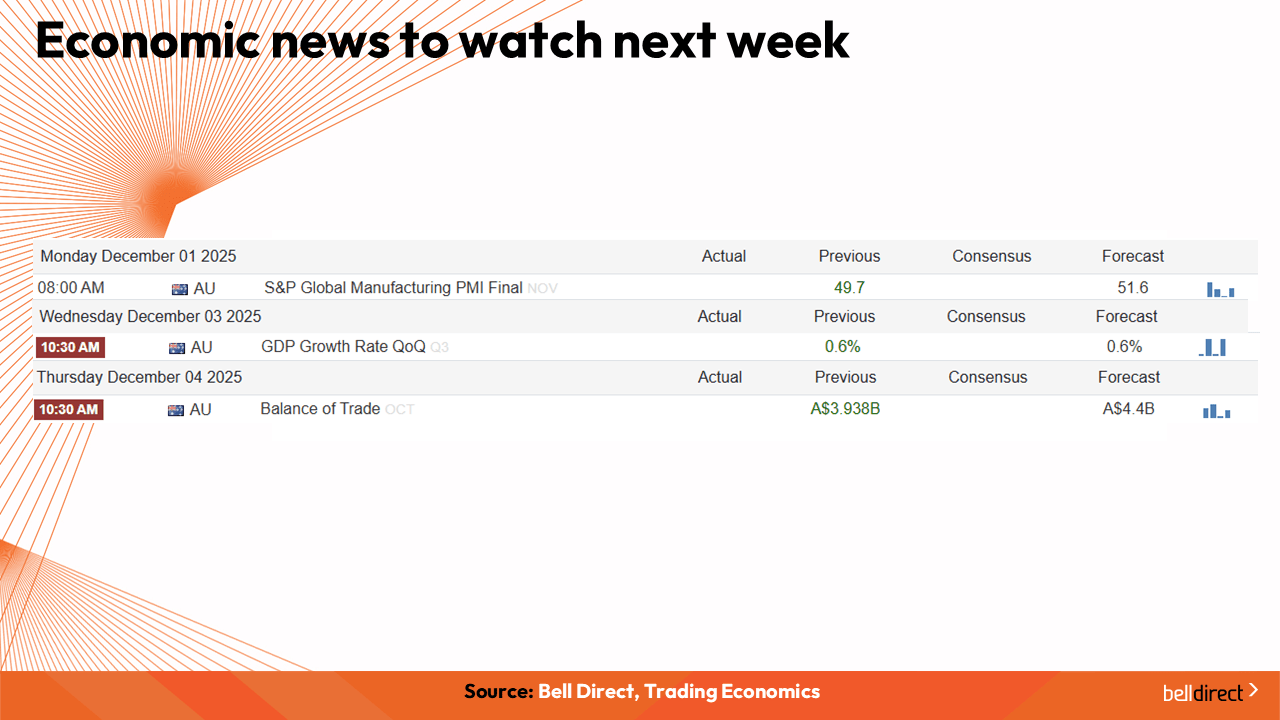

And to end on some economic news items to watch next week,

On Monday, the S&P Global Manufacturing final PMI for November will be released and is expected to show an expansion from the month prior. On Wednesday the GDP growth rate will be released for Q3 and on Friday, balance of trade data for October.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great day and happy trading.

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.