Thank you for joining us this Friday 21st November, I’m Sophia Mavridis a market analyst with Bell Direct and this is the weekly market update.

This week, the Australian share market dropped to a near six- month low before rebounding. The benchmark ASX200, which had lost around $220 billion in cumulative market value over the last four weeks, found critical support after a week of global uncertainty.

The drop was driven by mounting concerns over lofty technology valuations and a general global “risk-off” mood ahead of key US earnings. Rate- sensitive sectors, especially Financials, led the slump, hitting a six- month low on margin pressure, alongside a sharp derating in Technology stocks. However, the mood shifted following a blowout earnings report from US chip giant Nvidia. The results eased global fears of an impending AI bubble pop and sparked a major relief rally, with the local tech sector soaring and the ASX200 bounding back significantly from its low.

While global tech drove the market’s swings, domestic economic data provide some reassurance this week regarding the labour market’s trajectory. The September quarter Wage Cost Index report suggested the labour market is not overly tight. The report showed overall wages rose by 3.4% over the year, while the private sector saw slightly softer annual growth at 3.2%. this easing aligns with the recent modest rise in the unemployment rate, from 3.7% to 4.3% since late 2023, confirming the classic Phillips curve correlation in Australia. Analysts suggest this 3.2% private sector wage growth should be consistent with underlying inflation hitting the RBA’s 2.5% target mid-point over the long run.

However, the clear challenge remains that unit labour costs grew by a chunky 5% over the year to end June, driven by currently weak productivity growth in just 0.1%. For the RBA, this means that while the private sector wage picture is encouraging, high unit labour costs prevent any significant shift in the immediate interest rate outlook.

Turning to the consumer sector, analysis at Bell potter have provided an overview of the sector, highlighting the key theme: the divergence between staples and discretionary stocks.

Following a pause in RBA interest rate cuts, the consumer discretionary index lagged, underperforming the staples index by 9%.

Staples stocks continue to show positive momentum. Key highlights include diary inflation lifting 2% YoY in September, reaching an 18-month high, and sustained strong supermarket spending from major players like Coles (ASX:COL) and Woolworths (ASX:WOW). New Zealand dollar weakness is also providing an FX tailwind for the A2 Milk Company (ASX:A2M).

The discretionary sector is showing some encouraging signs heading into the seasonal period, with non-food categories up around 5% YoY in September. The Westpac MI consumer Sentiment measure has risen above the 100 baselines for the first time since the tightening cycle began, which should be supportive for upcoming trading periods.

Therefore, Bell Potter analysts have made some rotations in their key picks, focusing on market leaders and exposure to a recovery in “out of home” consumption. They favour stocks exposed to out of home recovery, specially naming Bega Cheese (ASX:BGA), Woolworths (ASX:WOW) and Endeavour Group (ASX:EDV). They’re shifting their preference from Coles (ASX:COL) to Woolworths (ASX:WOW) and Endeavor Group (ASX:EDV), citing more favourable growth profiles and the cycling of softer comparative periods in the near term.

In discretionary retail, high-conviction ideas include Harvey Norman (ASX:HVN), Universal Store (ASX:UNI) and Accent Group (ASX:ABY), with ABY being added to the key stock picks list.

Lastly, in gaming, the presence is for Light and Wonder (ASX:LNW) over Aristocrat Leisure (ASX:ALL) due to a more compelling growth and value dynamic.

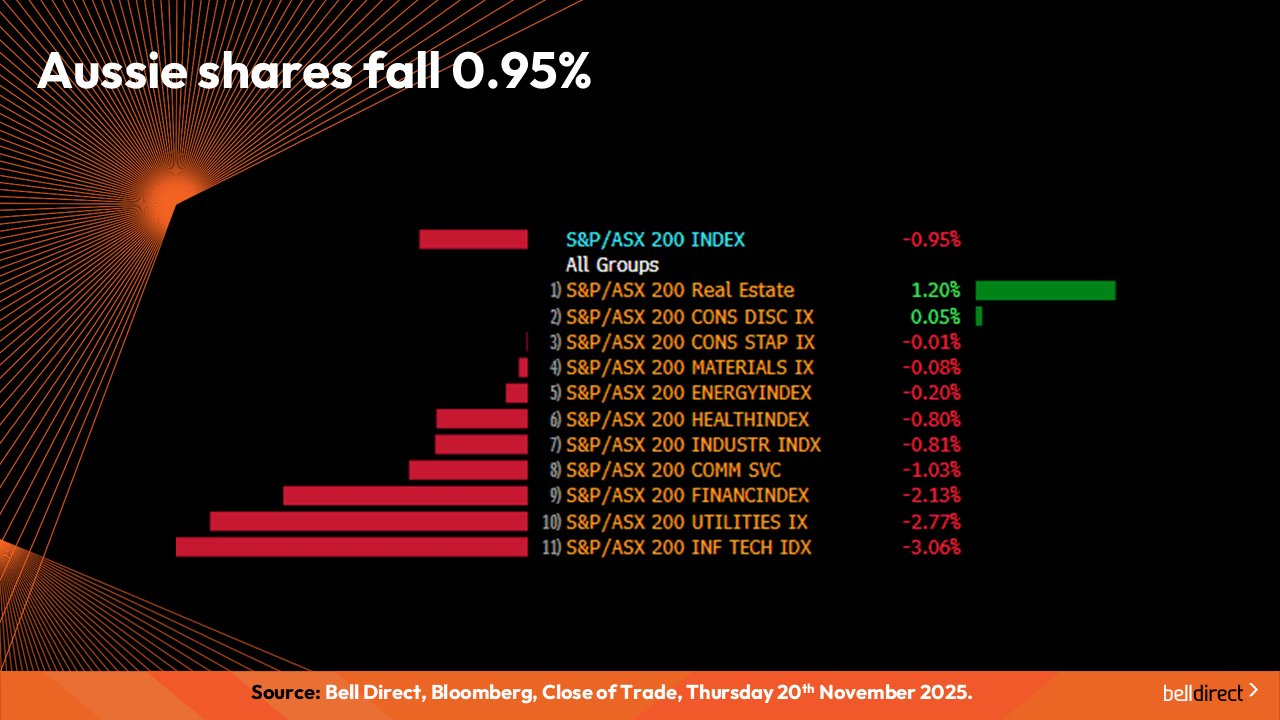

As for how the local market performed this week so far,

Monday to Thursday, the ASX200 declined 0.95% with technology, utilities and financials weighing down on the market the most, while real estate managed to gain 1.2%.

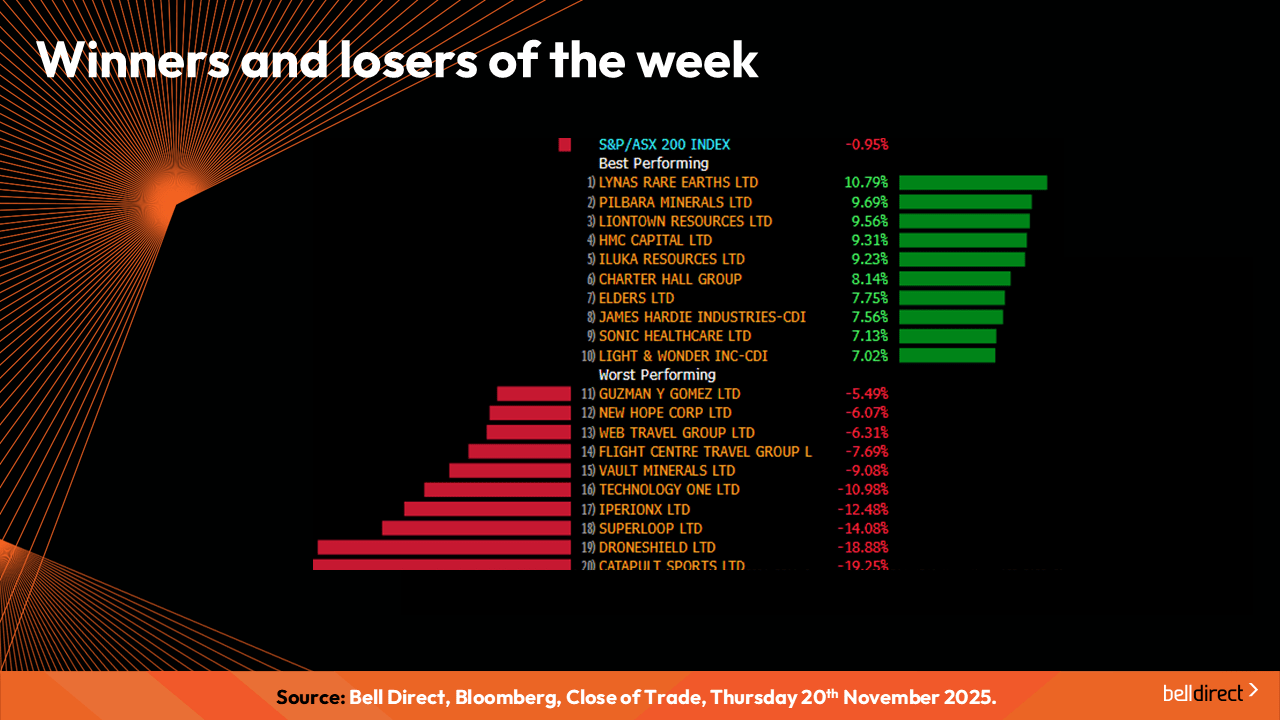

On the ASX200 leaderboard, the top performing stocks were Lynas Rare Earths (ASX:LYC), Pilbara Minerals (ASX:PLS) and Liontown Resources (ASX:LTR) all making impressive gains. Lynas Rare Earths advanced off the back of news this week of global demand for rare earths outside of China. Meanwhile, uranium stocks were higher after the US Department of Energy announced a US$1 billion loan to restart the Three Mile Island nuclear power plant, supported by President Trump to fuel AU data centre growth. This advanced the share price of Paladin Energy this week, as well as other uranium stocks. And Liontown Resources was boosted by the a 2-day gain in the gold price this week.

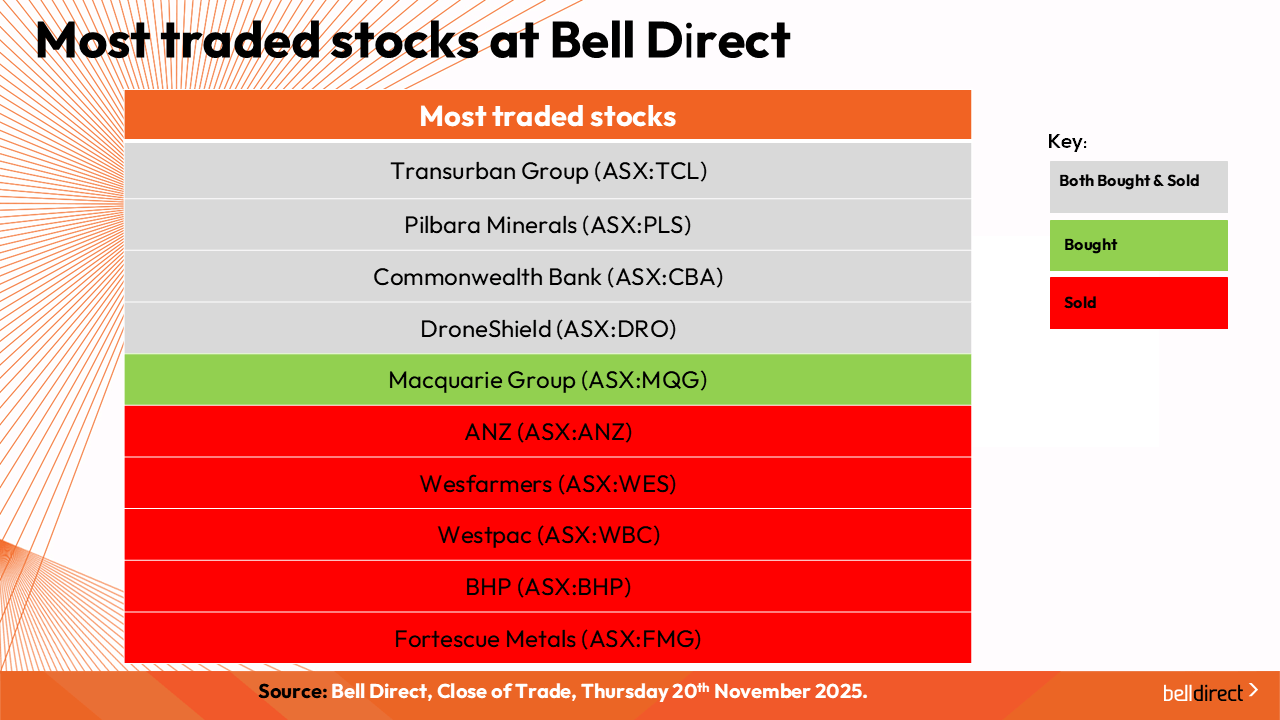

As for the most traded stocks by Bell Direct clients, these were Transurban Group (ASX:TCL), Pilbara Minerals (ASX:PLS), Commonwealth Bank (ASX:CBA) and Droneshield (ASX:DRO). Clients also bought into Macquarie Group (ASX:MQG), while took profits from ANZ Bank (ASX:ANZ), Wesfarmers (ASX:WES), Westpac (ASX:WBC), BHP Group (ASX:BHP) and Fortescue Metals (ASX:FMG).

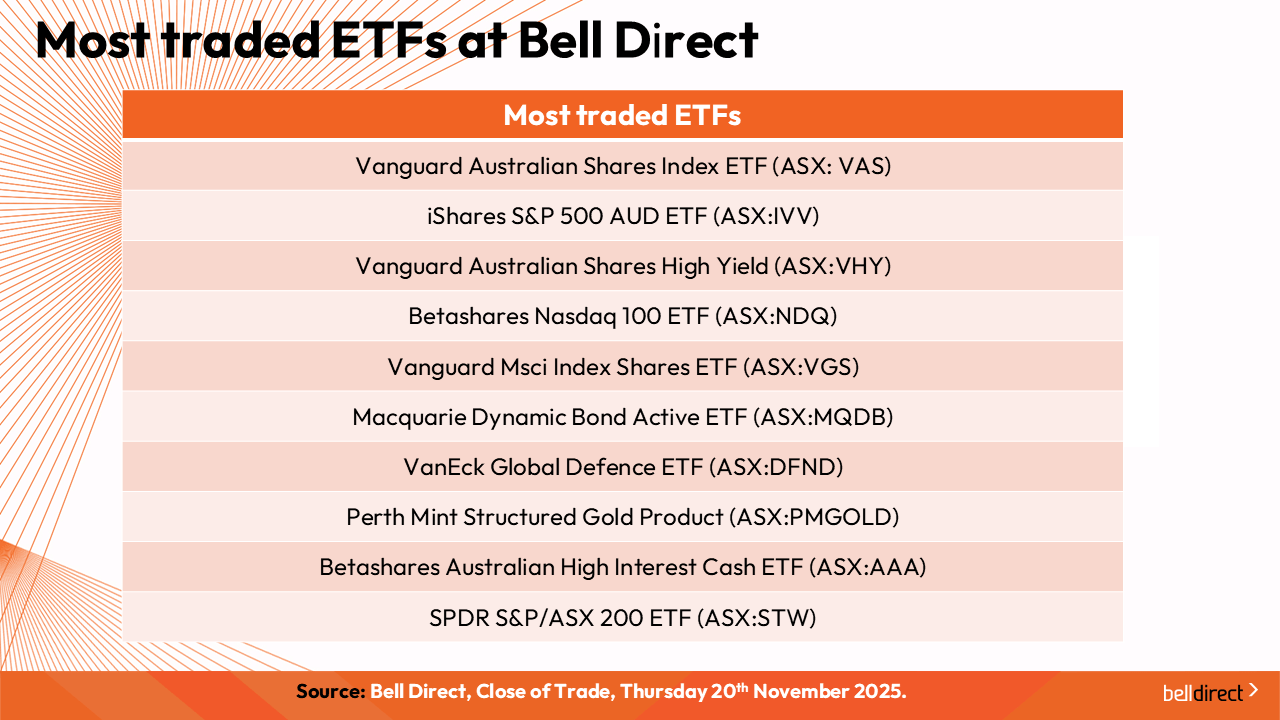

And the most traded ETFs by Bell Direct clients were the Vanguard Australian Shares ETF (ASX:VAS), the iShares S&P500 ETF (ASX:IVV) and the Vanguard Australian Shares High Yield ETF (ASX:VHY).

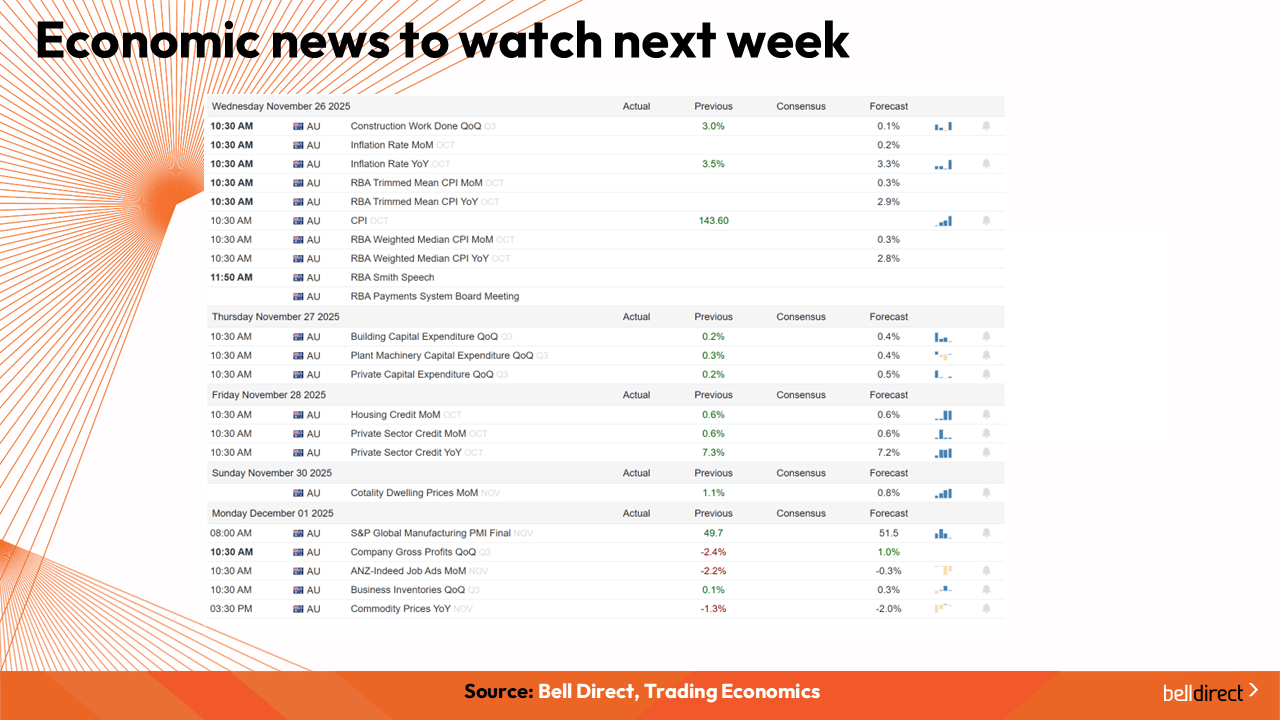

And to end on some economic news items to watch out for next week:

The latest inflation rate reading will be out at 10:30am AEDT on Wednesday, building and private capital expenditure data will be out on Thursday and housing and private sector credit data will be out on Friday.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great Friday and happy trading.