I’M READY

I’M THINKING ABOUT IT

Why track a single stock, when you can track a market?

ETFs continue to gather momentum in Australia and investors who use them say they like ETFs because they:

- are an easy way to access global markets

- give you diversification

- are low cost

ETF trading has never been easier. Join Bell Direct and get access to the industry’s most comprehensive ETF filter.

Access global markets with ETFs

We all know the Aussie share market makes up only a fraction of the global opportunities out there. And having all your shares in Australian companies probably doesn’t give you the diversification your portfolio deserves.

Easily access global markets by investing in ETFs.

There’s a bunch of ETFs that give you access to shares in markets around the globe. Or in a single country. Or region. Or sector. Or theme.

Whether you want to invest in stocks like Apple or the entire US market, there’s an ETF to suit you. You choose! (You can use our ETF comparison filter to help you choose by the way).

Start trading with Bell Direct

Comparing ETFs – made simple. Finally.

Whatever you’re looking for, there’s probably an ETF for you. You just need to find it.

Comparing ETFs is so much simpler now. It’s about ETF’ing time!

Use Bell Direct’s ETF comparison filter to compare the features of the ETFs in the market. This is only available to Bell Direct clients and not available with any other broker.

You can filter ETFs by: asset class, sector, provider and fees.

And you can access price information, fact sheets and performance.

The lowdown on ETFs

What are ETFs and why investors use them?

- ETFs (or Exchange Traded Funds) are a collection of investments within a fund that you can buy or sell on the ASX, similar to how you would buy or sell a share.

- They give you access to a vast range of markets, like global markets, fixed income markets and the Aussie sharemarket.

- In the early days, investing in ETFs gave you exposure to the full market index – such as the ASX 300 or the S&P 500. That’s some great diversification right there.

- With the growth of ETFs as a low-cost way to access diversification, you can now invest in ETFs that give you exposure to sectors, market themes and active portfolio management.

What are the benefits?

ETFs are so popular because they give you:

- Low cost – they tend to have low annual fees, usually cheaper than traditional managed funds or even index funds.

- Diversification – you can quickly and easily invest in an overall market or theme.

- Easy access – there is a huge range available, starting with a small minimum investment and they can be bought and sold like shares.

What are some of the pitfalls?

All investments have their risks and pitfalls. For ETFs, be aware that:

- Many ETFs give you exposure to a market index, where you don’t get the opportunity to perform better than the market. More recently you can access some active ETFs managed by professional managers if you wish.

- Different ETF providers use different methods to track the index, and some of these may add investment risk. Make sure you understand what you are buying and read the providers’ factsheets (you can find these in our ETF comparison filter).

How do we compare to the banks?

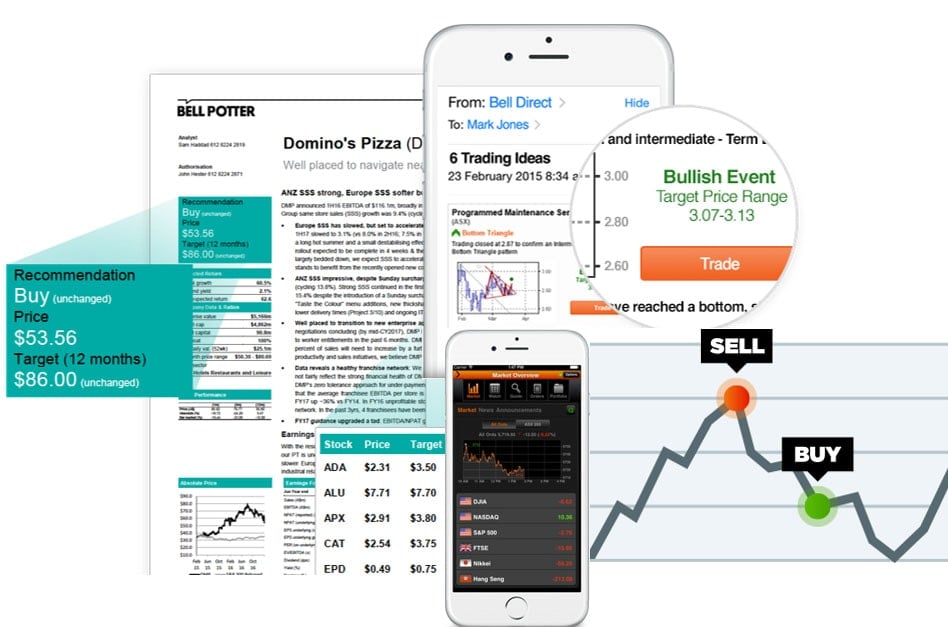

What you get with Bell Direct (more than just ETFs)

- Buy and sell ASX-listed securities, XTBs, international ETFs and mFunds

- Trades starting at $15 (compare our fees)

- Active trader benefits with cheaper brokerage and free live data (check the benefits)

- Daily trading ideas delivered to your inbox

- Free access to portfolio strategy, charting and stock filter tools

- Free access to Bell Potter research when you start trading

- Free conditional orders

- The ability to trade on your mobile

- Easy tax reporting

I’M READY

I’M THINKING ABOUT IT