While many Australians have taken advantage of the prolonged period of low interest rates, the party has been very one-sided. For TD investors there has been little to celebrate with rates continually falling to the current levels – the lowest since records began.

Deposits: Lowest rates ever BUT attracting more money than ever

Despite this constant decline in rates, surprisingly Australian investors are increasingly relying on term deposits. In fact, at the same time interest rates are at all-time lows, the amount held in TDs is at an all-time high.

This situation is leaving many Australians with less and less income. Every time a TD matures, they have to roll into a new lower yielding alternative.

Add to this the fact that many investors roll 3 to 6-month TDs multiple times – they are effectively tying up their investment for 18-months, but without the benefit of an 18-month rate. Have you ever left the decision on your maturing TD to the last day, and then just “rolled” into another 3-month offering, convinced that you will sort out a better option next time? If so, you are certainly not alone. That is possibly why the banks report that over 90% of TD money is in short term TDs with the lowest yielding 3 and 6-month deposits being the most popular.

SMSFs have a similar problem

TD investors are not alone. More than $160bn of the total assets held by self-managed superannuation funds is in cash. Most of this is likely to be in cash management accounts, in addition to Term Deposits. If you have an SMSF, when was the last time you checked the rate you were getting in your cash account? If you check it now, I would bet that very few of you would find you’re getting over 1.5% and many would be looking at considerably lower rates.

TDs and corporate bonds: Similar defensive tools for investors

Corporate bonds and XTBs over them are securities and TDs are bank accounts. While different in many respects, they also have some key similarities making it relevant to compare and contrast them.

Like corporate bonds, TDs have a fixed life and they provide regular income payments during that life, or alternatively at expiry.

TDs and corporate bonds are essentially loans from the investor to a bank or bond issuer. You lend them money, they pay it back at the end and you receive interest along the way.

Both TDs and corporate bonds belong in the defensive part of your investment or superannuation portfolio. They provide highly predictable and reliable returns compared with more risky growth assets such as shares and hybrids.

Understanding risk vs reward

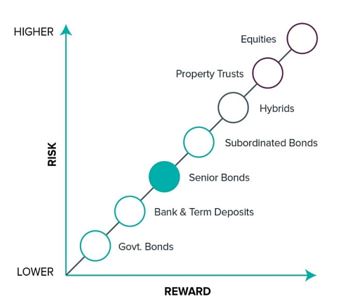

In theory, yields are progressively higher when you move from government bonds, to TDs, to corporate bonds. This is in keeping with the risk/reward chart that shows the more risk you take on, the greater the reward should be and vice versa.

TD rates are generally higher than government bond yields but lower than equivalent corporate bond yields. This is because the risk of lending money to the government is lower than the risk of lending it to a bank (when you invest in TDs). In turn, the risk of lending to a bank is lower than the risk of lending to a company.

Raise your rate by investing in corporate bonds

Corporate bonds or senior bonds are the next step up the risk – reward chart. So what level of additional “reward” do they offer?

Looking at the range of close to 50 corporate bond XTBs (Exchange Traded Bonds) on the ASX, the yields available range up to 3.6%(1) on 6 Oct 2017.

This demonstrates that corporate bond yields should provide greater returns for the added risk of lending money to a company rather than the bank. This difference becomes especially relevant if you rely on the income from your savings to pay your bills and fund your cost of living.

Assuming you shop around the Top-4 banks and find a 6-month TD rate of 2.3% – higher than current rates displayed on Canstar of 2.1%(2), if you chose to move your money into higher yielding corporate bonds you could boost your income by over 40%. The highest yielding corporate bond XTBs offer rates of up to 3.6% (1).

A greater return of 1.3% may not sound like much, but on a relative basis, for investors selecting the highest yielding XTB it is 56% more. If your income from your savings was $50,000, then 56% more from a XTB portfolio provides over $75,000.

Don’t forget that TDs have a 31-day lock in

It’s important to remember that TDs cannot be traded. If you want your money back early, you have to “break” the TD. When doing this there is a strong risk you might lose a significant portion, or all of your return (the interest). Part of the principal may also be at risk, depending on the break fee incurred.

If you are forced to break your TD you have to provide 31 days’ notice. This means you can’t access your cash for 31 days.

With XTBs you can access your money should you need it earlier

The timing of accessing your capital is important when you need it. If you invested in a three-year TD but need your capital a year later, you risk losing some or all of your return by breaking it. If instead you invested in a three year XTB, you always have access, subject to liquidity (being able to buy and sell at a reasonable price).

Rolling downwards with your TD rate isn’t your only option

TDs and corporate bonds or XTBs are different in many ways, but also share some common features. They all belong in the fixed income asset class sitting next to each other on the risk-return spectrum.

Corporate bonds and XTBs deliver a considerable uplift in returns for the added risk of lending your money to an ASX100 company versus a bank. The uplift in returns can be significant on a relative basis, particularly for savers who rely on their savings income.

In the defensive part of your portfolio, it is worth considering the income advantage XTBs can provide alongside TDs. Next time you face the prospect of having to roll your TD and lower the income you receive, you now have another choice available to you.

XTBs can be traded via Bell Direct – simply visit https://www.belldirect.com.au/smarter/invest-in-xtbs to find out more, or log onto your trading account and search for the 50 XTBs available.

Sources:

(1) Australian Corporate Bond Company 09 Oct 2017

(2) Canstar Term Deposit Comparisons 09 Oct 2017