Payouts at a record high despite Telstra cut

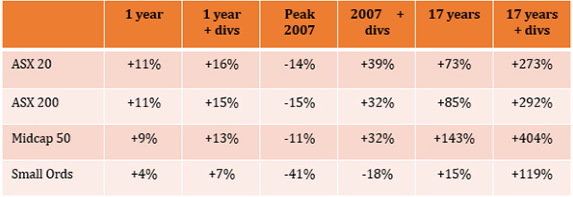

Dividends have always played a key part in the returns from the Australian sharemarket. Although the Australian market is struggling to regain the record-high levels seen in 2008, returns look better if dividends are included.

Since the peak of the market on 1 November 2007, the Australian sharemarket is down 15%, while the accumulation index, which includes dividend returns, is up 32%. This highlights the importance of dividends in returns to shareholders in Australia.

Source: Iress, Bell Direct Research, at 13 September 2017

Source: Iress, Bell Direct Research, at 13 September 2017

Reporting season is an important time for investors and professional fund managers. It’s a time to reset portfolios based on the newly released information. There’s a known effect around the months following reporting season whereby companies that beat expectations will continue to outperform over the next six months. Hence, it’s an opportune time for investors to identify where the strong trends are and which companies offer earnings growth.

The good news is that for income investors, dividends being paid out by Australian companies are at a record high. In the month of September, it is expected that those companies listed on the market will pay out more than $16 billion in dividends. That’s a growth of around 15% from the previous year.

(Editor’s note: Do not read the following ideas as stock recommendations. Do further research of your own or talk to a financial adviser before acting on themes in this article).

Disappointment from traditional defensives

Defensive shares are usually ones that are characterised by consistent earnings and a high dividend. These shares usually are in the utilities, telecom, staples and property sectors. These sectors often outperform when markets are falling, as investors seek shelter in dividends. Dividends can act as a buffer to falling prices because they are paid out regardless of share-price direction.

This reporting season has seen disappointments from the traditional defensive stocks such as Telstra (TLS), QBE Insurance (QBE) and Transurban (TCL).

QBE Insurance in recent years has seen a series of profits downgrades. Earnings unpredictability has meant the share price has been under pressure. This stock should be benefiting from the global macro environment of increasing interest rates. Unfortunately, another year of sub-optimal returns has investors cautious despite the macro headwinds coming the company’s way.

Transurban came out with a good result but the market was disappointed by the outlook. The guidance provided implies a lower growth year for the company, which trades at a premium yield compared to interest rates. The key risks of investing in a company like this are rising bond yields, project delays and lower-than-expected traffic numbers.

Stagnant earnings can mean dividend cuts

If the earnings outlook is not strong, dividends are more likely to be cut or cancelled. The biggest lesson came from Telstra this reporting season. Historically, Telstra has paid out 90-100% of underlying earnings as dividends. This will now be 70-90% of underlying earnings.

While Telstra still aims to increase dividends over time, this seems aspirational over the medium term and looks a longer-term target. Hence, Telstra lost more than 10% of its value in August.

The market outlook for dividends has been skewed by Telstra’s cut to its dividend payout policy. Excluding Telstra, dividends are expected to increase by 0.1%. Including Telstra, dividends are expected to be down half a per cent.

Telstra operationally came out with a result that met guidance. The stock was hit by the capital review and the prospect of lower future dividend payments. Investors need to evaluate whether most of the bad news is now out of the way and hence the share price has stabilised.

Increasing dividends are related to increasing profit

Income investing is more than getting dividends. It’s also about getting a sustainable dividend. Generally, companies that have increasing profits are also more able and more likely to increase dividend payments over time. Companies like Sydney Airport, Westpac and SG Fleet not only have earnings growth in common but also share-price outperformance and growing dividends.

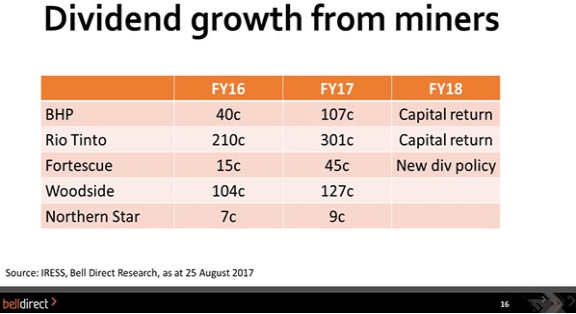

Dividend growth from mining

Traditionally, investors don’t expect strong dividends from mining investments. A strong recovery in commodity prices and strong cash flow have seen strong earnings and dividend growth from the miners. Dividend growth from miners was positive at 3.7%, with expected dividends in 2018 revised higher.

Conclusion

All in all, the Australian share market can be one of the most tax-effective ways to generate income. This reporting season has once again proved that increasing profits are linked to rising dividends and conversely falling dividends are linked to falling profits.

While the outlook for dividends is looking weaker for investors in 2018, that’s due to the dividend cut expected from Telstra.

This reporting season has been one that has highlighted the importance of growth in earnings to support the growth in dividend payments. From an earnings perspective, the Australian share market has seen growth and this is forecast to continue into the current financial year.