Thanks for joining us for the last market update before we take a break over the holiday period. I’m Sophia Mavridis with Bell Direct and today is Friday 12th December.

As the end of the year draws closer, let’s review what analysts are expecting for 2026 and some key takeaways for your portfolio.

The ASX200 is reflecting a 5.39% increase YTD and is heading toward a third consecutive year of gains. The Accumulated Index, which looks at all cash dividends reinvested on the ex-dividend date, shows an increase close to 9%. On the surface, that’s a solid result, however, Australia has lagged behind many of its global peers. This is as a lack of heavy-hitting technology stocks and a sticky inflation problem has forced the Reserve Bank to keep the brakes on the economy longer than expected. Meanwhile, tariffs have impacted commodities trading with China.

Heading into 2026, the biggest risk is valuation. The local index is currently trading at a price-to-earnings ratio of roughly 18 times, which is well above the long-term average of about 15 times. Therefore, Australian stocks are expensive right now.

We’re also seeing the that financials have struggled, gaining less than 4% this year. Meanwhile, the materials sector has surged over 24%. The trend may continue in 2026, shifting away from the banks and firmly into resources.

The optimism for miners is driven by China. Despite trade wars and tariffs weighing on growth, there are signs our largest trading partner is finally exiting its deflationary spiral. If China stabilises, Australian commodities look attractive, with analysts expecting the materials sector is the strongest contender to outperform in 2026, picking up the slack where the banks and tech stocks have fallen short.

As for the RBA, after cutting rates by 0.75% in 2025, the RBA is expected to hit the pause button for the first half of 2026. Inflation has crept back up, largely due to persistent housing costs, and the unemployment rate is forecast to tick up slightly to 4.4%. Economic growth is expected to stabilise around 2%.

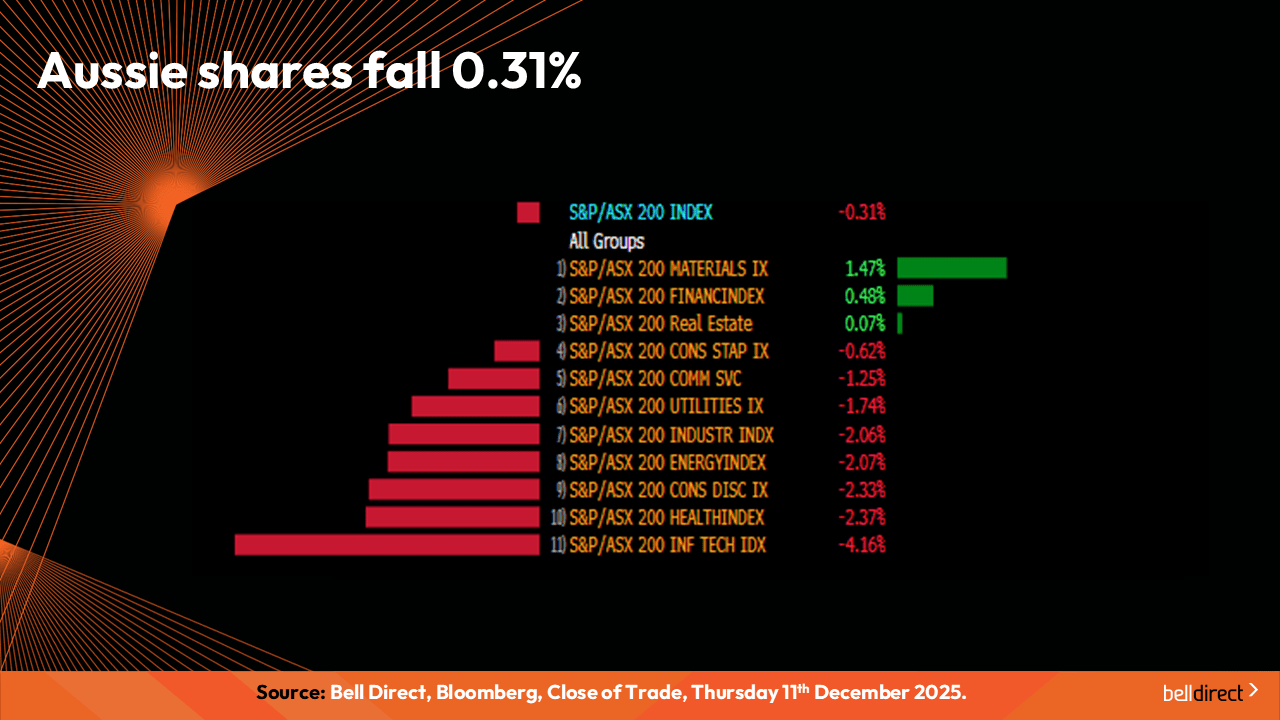

Now looking at the markets performance this week so far, the ASX200 declined 0.31% this week so far Monday to Thursday, with materials and financials in the lead, while technology and healthcare have weighed down on the market the most.

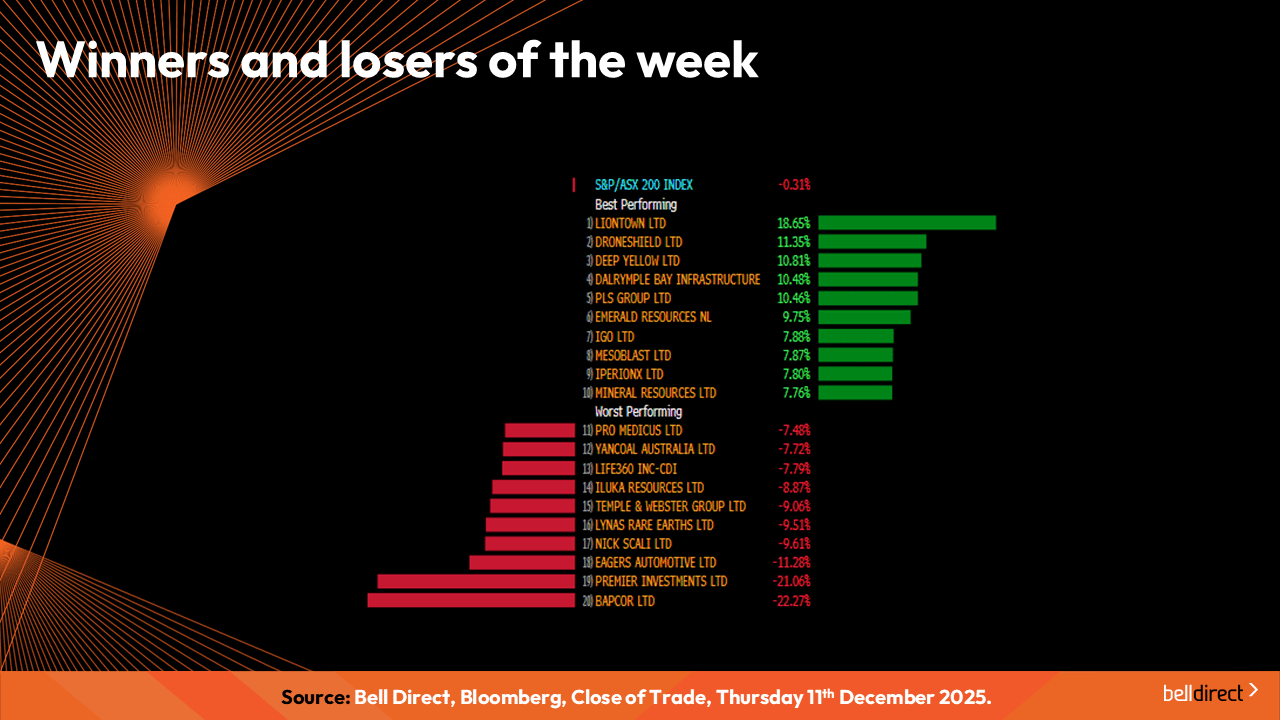

On the ASX200 leaderboard, battery minerals provider Liontown Resources (ASX:LTR) advanced almost 19% this week. LTR recently executed a binding offtake agreement with Canmax Technologies, which will supply 150,000 wet metric tonnes of spodumene concentrate annually over 2027 and 2028. And auto equipment retailer Bapcor (ASX:BAP) decline the most this week after the company reported it’s heading for a bottom-line loss in the December half- year following a below-par sales performance in October and November.

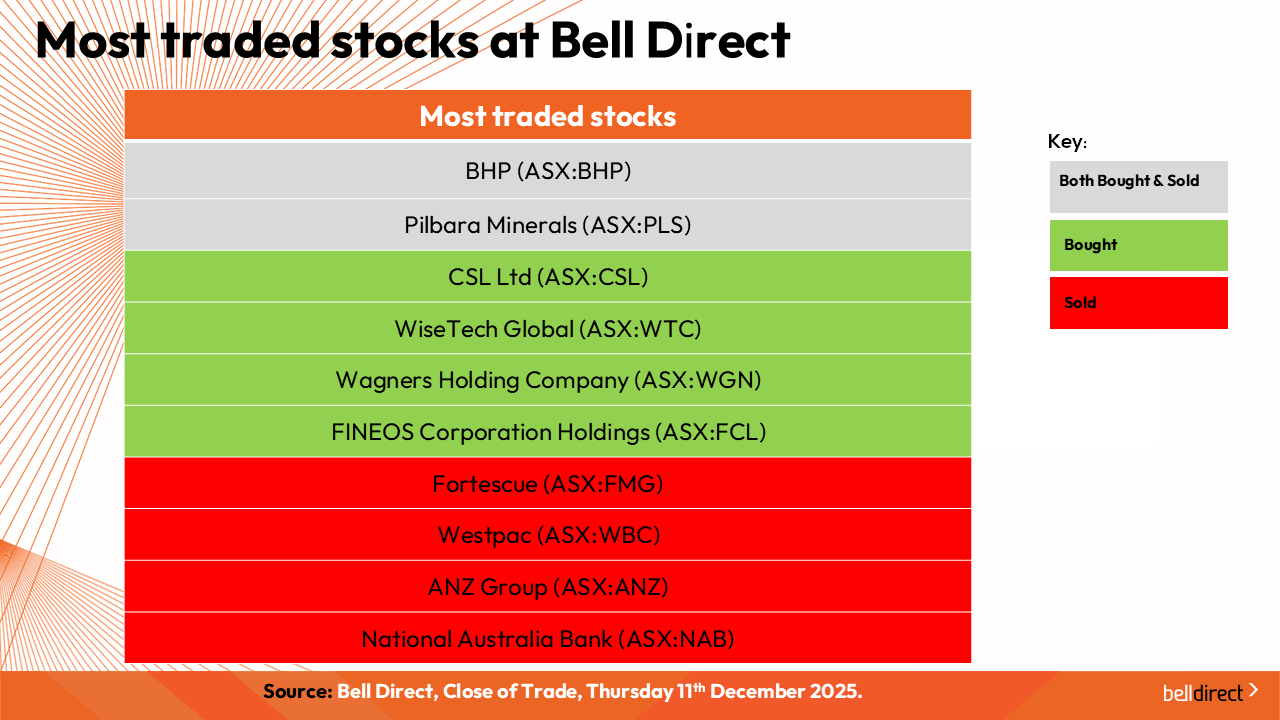

As for the most traded stocks by Bell Direct clients this week, these were BHP Group (ASX:BHP) and Pilbara Minerals (ASX:PLS). Clients also bought into CSL Limited (ASX:CSL), WiseTech Global (ASX:WTC), Wagners Holding Company (ASX:WGN) and FINEOS Corporation Holdings (ASX:FCL), while took profits from Fortescue (ASX:FMG), Westpac (ASX:WBC), ANZ Group (ASX:ANZ) and National Australia Bank (ASX:NAB).

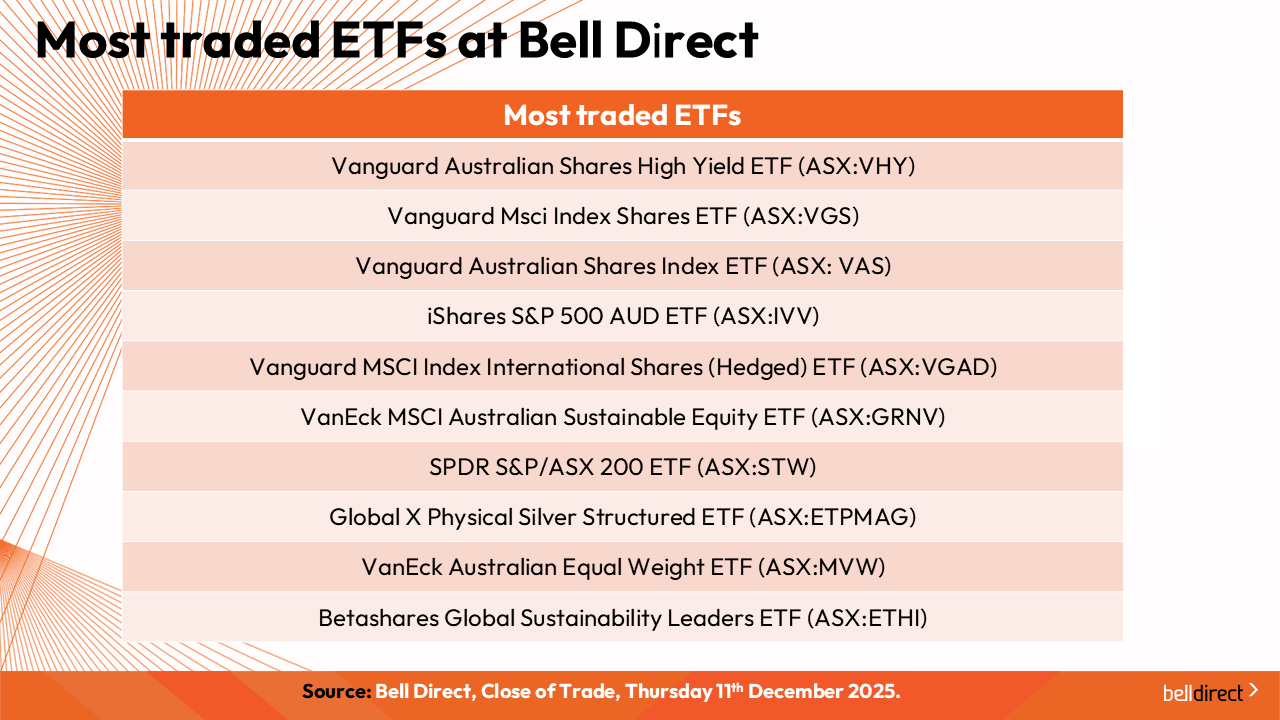

And the most traded ETFs were the Vanguard Australian Shares High Yield ETF (ASX:VHY), the Vanguard MSCI index International Shares ETF (ASX:VGS) and the Vanguard Australian Shares ETF (ASX:VAS)

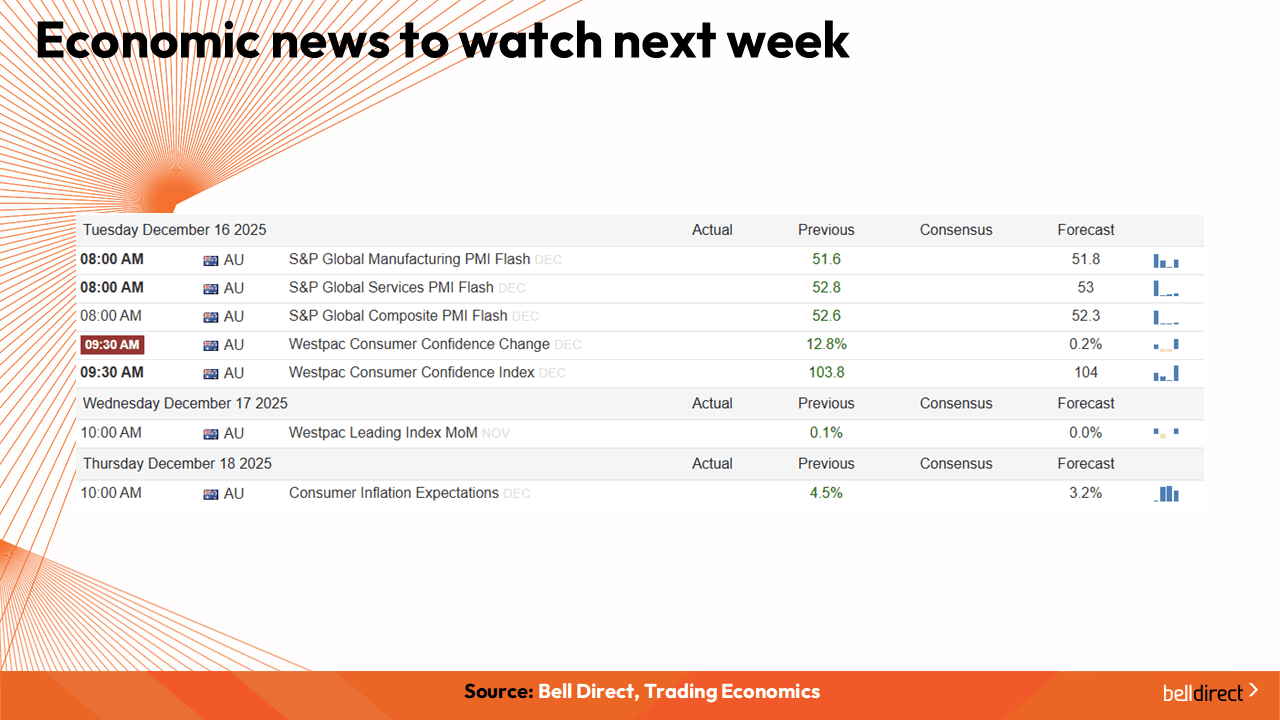

And to end on economic news items to watch out for next week:

On Tuesday, the S&P Global Manufacturing and Services Flash PMI will be out, a forward looking estimate of the final PMI out the week after. This is an identifier for economic trends in the sector and a reading above 50 will indicate an expansion from the prior month. Also on Tuesday, Westpac’s consumer confidence data will be released and on Thursday, consumer inflation expectations will be out.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great day and happy trading.

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.