Transcript: Weekly Wrap 13 October

Thank you for joining me this Friday the 13th October, I’m Grady Wulff, a Market Analyst with Bell Direct and this is the weekly market update.

The global rally that started the week on global markets was driven by the price of oil surging 5% on concerns of a prolonged war between Hamas and Israel. While no immediate impact is felt on the oil supply and demand front from the Hamas attacks on Israel, global economies are factoring in prolonged periods of geopolitical tensions which caused the price of oil to surge.

Companies with exposure to the region were sharply sold off early in the week, with Weebit Nano (ASX:WBT) falling 9% on the ASX before regaining 6% after confirming its operations in Israel were unaffected by the attacks, while Energean tanked over 20% on Monday despite the company announcing that supply, production and work offshore would continue after the attack on Israel where it operates in the northern region of the country that is not currently under attack.

The price of oil retreated 3% later this week on signals that the Israel-Hamas war’s effect on oil flows and output will remain limited. The New York Times reported that US intelligence shows Iran was surprised by Hamas’ attacks thus potentially reducing the chance of additional sanctions on Iranian oil. OPEC+ leader, Saudi Arabia, also reiterated its support for balancing oil markets this week. The price of oil rose immediately after the initiation of attacks despite neither Israel nor the Gaza Strip being significant oil producers. The reason prices rose was due to fears that the conflict would lead to wider regional instability and have further repercussions for the Middle East which is home to some of the world’s largest oil producers including Saudi Arabia and Iran.

Reports of a material stimulus package to be announced in China in the form of an at least 1 trillion-yuan package boosted local miners on the ASX later in the week.

The expectations of further stimulus stemmed out of a rare mid-year revision to China’s national budget to include higher stimulus by raising the country’s budget deficit for 2023. The reports from Bloomberg suggest the world’s second largest economy is weighing new stimulus to meet the annual growth target by increasing funding on water conservancy projects, building packages and more.

And we are now seeing the release of first quarter FY24 trading updates which had investors making some moves this week. Air New Zealand fell 3% after providing initial earnings guidance for the first half. The airline said in the context of the uncertain economic environment and assuming average jet fuel remains elevated at US$110/barrel for the remainder of the first half, Air New Zealand currently expects earnings before tax for the first half to be between the range of NZ$180m – NZ$230m indicating lower earnings compared to the NZ$299m expected for the same period a year ago. The softer outlook comes despite travel demand soaring post pandemic, indicating rising costs are weighing on margins.

Redbubble (ASX:RBL) also soared 27.1% on Thursday after the global online art-printed-merchandise marketplace posted a return to positive underlying cash flow in the latest quarter with underlying cash flow of $700,000, which is an increase of $16.0m on the PCP, and up $5.5m on Q4 FY23. Redbubble also strengthened its cash balance from $4.2m at June 30, 2023 to $39.9m at 30 September 2023.

And Tabcorp (ASX:TAH) fell 6% on Thursday after reporting Q1 FY24 results including revenue falling 6.1% on the PCP while gaming and services revenue declined 12.7% following the company’s sale of eBet. One positive note in the first quarter for Tabcorp though was a 1% growth in digital turnover against softer market conditions.

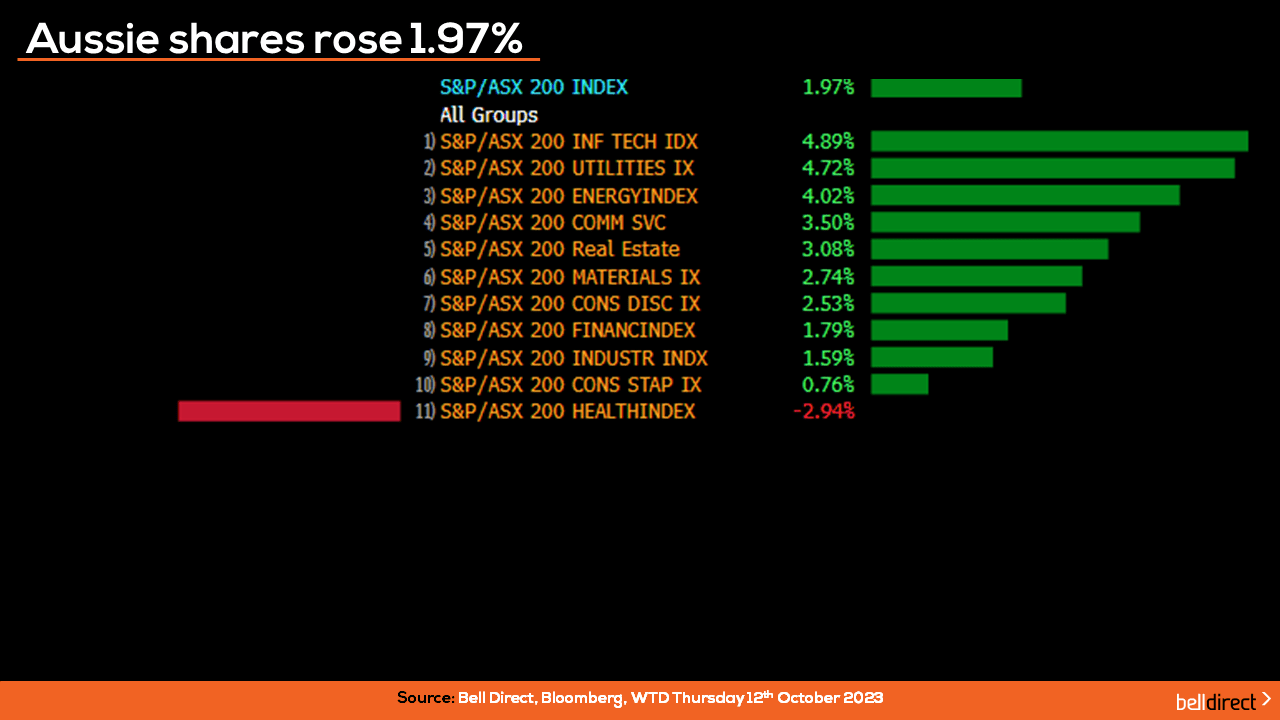

Locally from Monday to Thursday the ASX200 added 1.97% as global markets rallied on boosted investor sentiment around easing inflation and a more dovish interest rate outlook in the US. Tech stocks led the charge locally with the sector rising 4.9% while Utilities stocks added 4.72% and the energy sector lifted 4.02% on the rising price of oil.

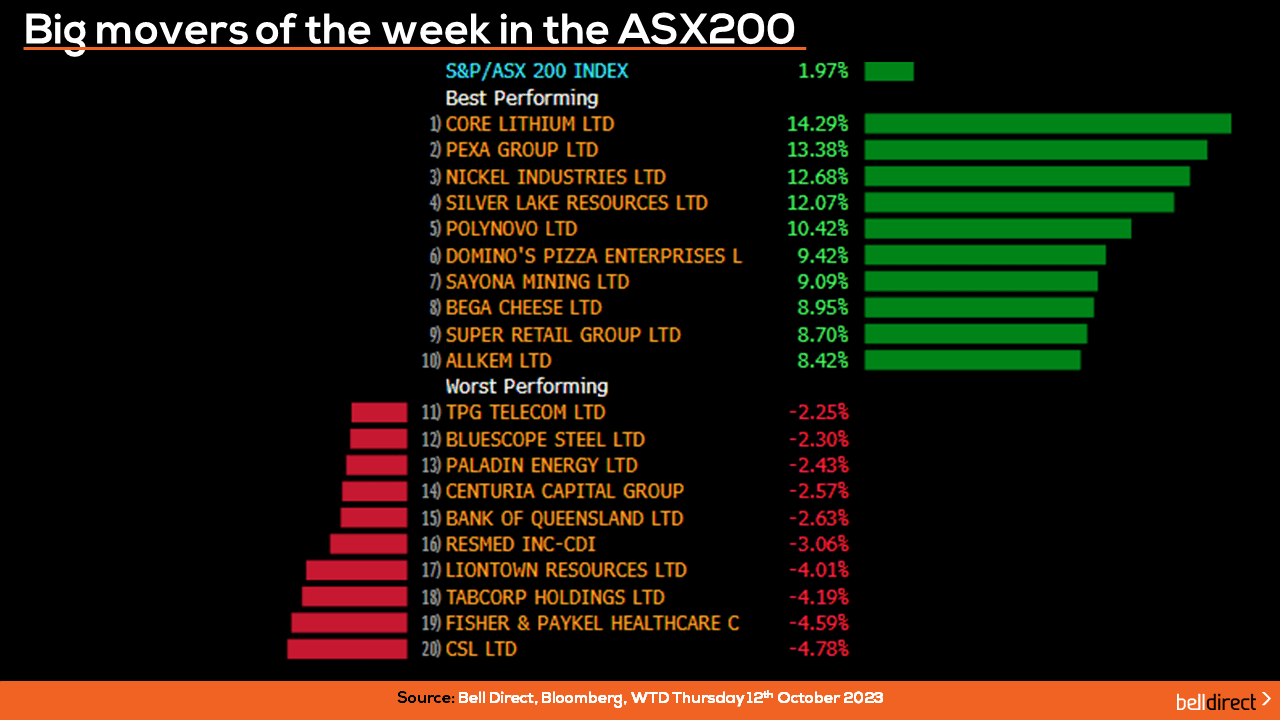

The winning stocks on the ASX200 over the four trading days were led by Core Lithium (ASX:CXO) soaring 14.3% after Citi upgraded the lithium miner to a neutral rating. Pexa Group (ASX:PXA) rose 13.4% over the four trading days and Nickel Industries (ASX:NIC) added 12.68%.

On the losing end CSL (ASX:CSL) lost almost 5%, while Fisher & Paykel Healthcare (ASX:FPH) shed 4.6% and Tabcorp (ASX:TAH) fell 4.2%.

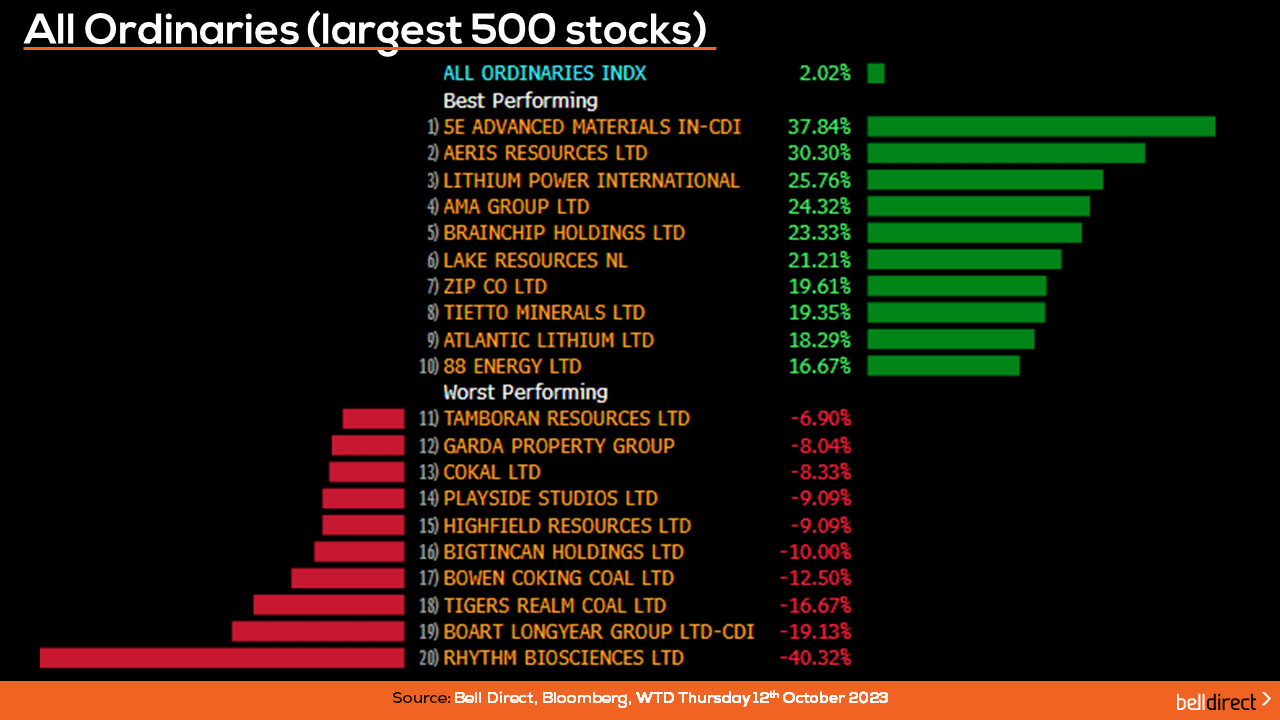

On the broader market, the All Ords 5E Advanced Materials rocketed 38% after receiving approval for Step-Rate Testing to commence on October 9. Aeris Resources (ASX:AIS) soared 30.30% and Lithium Power International (ASX:LPI) added 25.76% on takeover speculation.

At the other end, Rhythm Biosciences (ASX:RHY) tanked over 40%, while Boart Longyear Group (ASX:BLY) fell 19.13% and Tigers Realm Coal (ASX:TIG) lost 16.7%.

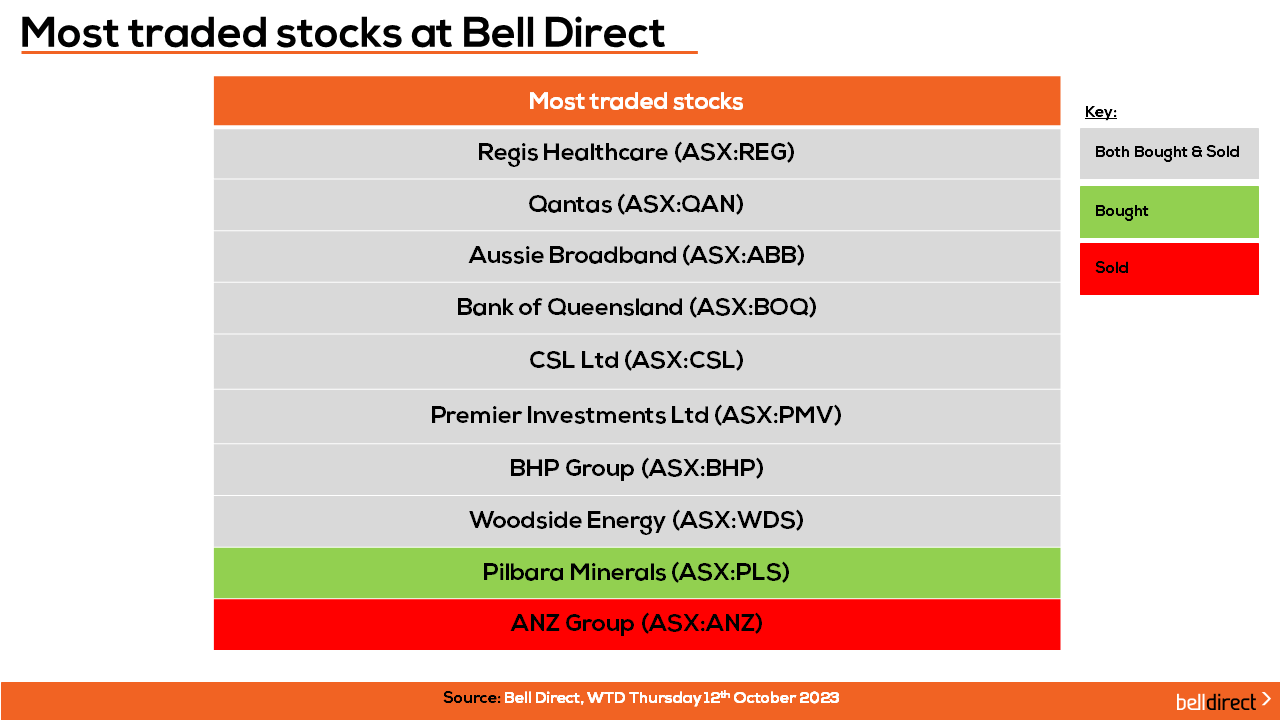

The most traded stocks by Bell Direct clients from Monday to Thursday were Regis Healthcare (ASX:REG), Qantas (ASX:QAN), Aussie Broadband (ASX:ABB), Bank of Queensland (ASX:BOQ), CSL (ASX:CSL), Premier Investments Limited (ASX:PMV), BHP (ASX:BHP) and Woodside Energy (ASX:WDS).

Clients also bought into Pilbara Minerals (ASX:PLS) while taking profits from ANZ (ASX:ANZ).

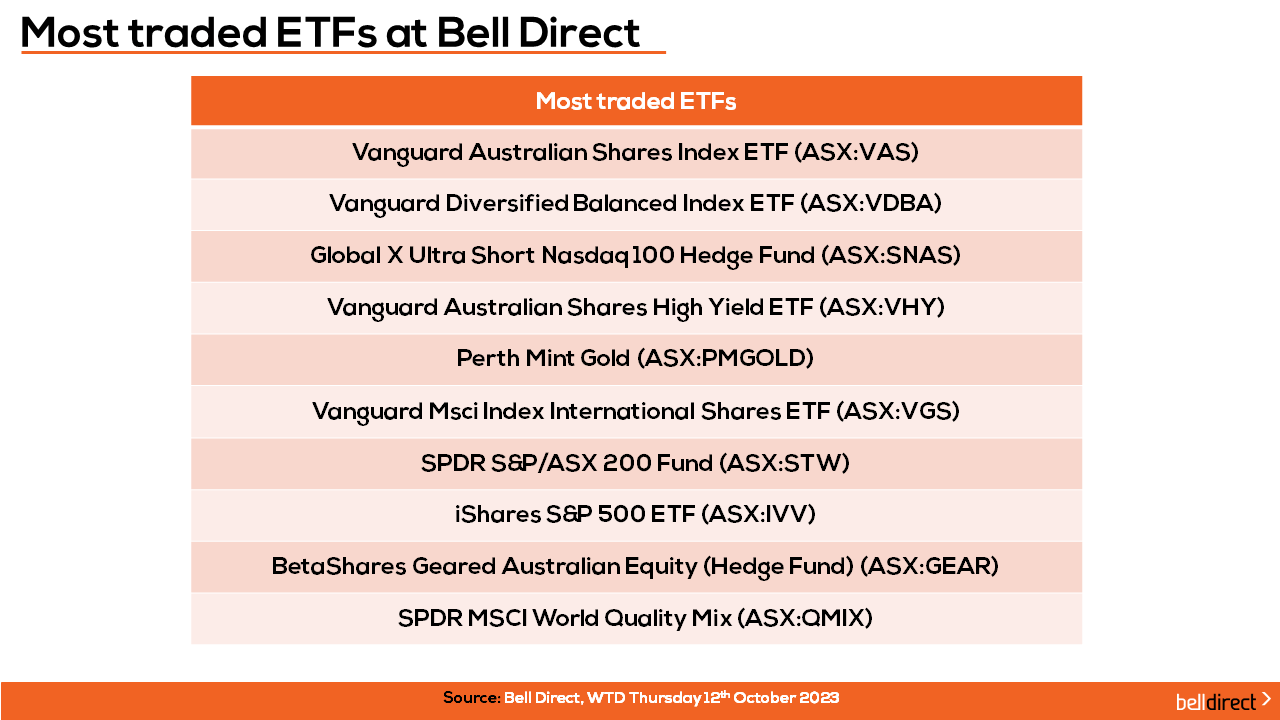

And on the diversification front, the most traded ETFs were led by Vanguard Australian Shares Index ETF, Vanguard Diversified Balanced Index ETF, and Global X Ultra Short Nasdaq 100 Hedge Fund.

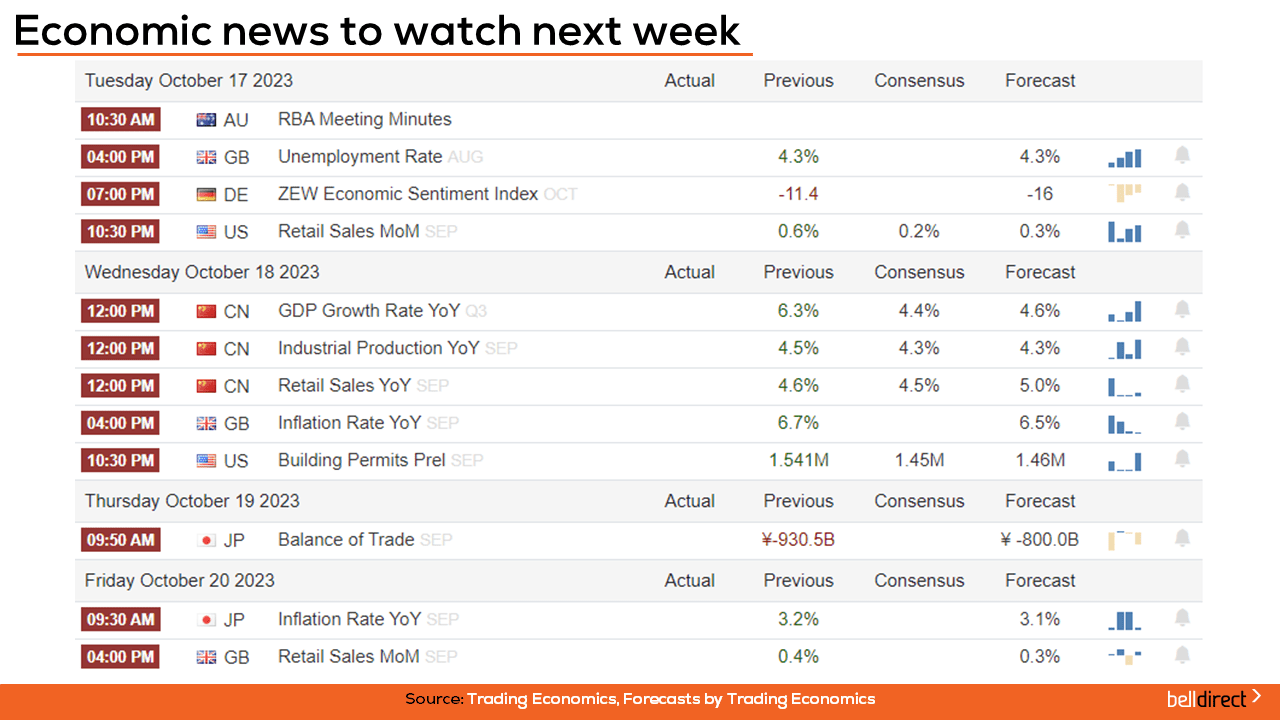

Looking at the week ahead the RBA meeting minutes will be released on Tuesday which will give Aussie investors an insight into the rate outlook from Australia’s central bank. Overseas, UK unemployment rate data is out on Tuesday with the forecast for the rate to remain at 4.3%, while in the US retail sales data for September is also out on Tuesday with the expectation of a 0.3% rise, down from 0.6% growth in August.

And that’s all for this Friday, have a wonderful weekend and as always, happy investing.