Thank you for joining us this Friday the 14th November. I’m Sophia Mavridis, a market analyst with Bell Direct and this is the weekly market update.

Commodity prices have been moving markets this week — we’ve seen the strategic metals driving the energy transition, infrastructure securing bulk exports, and a crucial signal from the world of precious metals—all pointing to a market grappling with future supply.

The headline remains the elevation of copper to an official “critical mineral” status in the United States. This designation isn’t just a label; it signals a fundamental recognition of copper’s indispensable role in the clean energy economy, as it’s the metal that rewires Net Zero goals. Applications like Electric Vehicles and renewable energy grids require up to five times more copper than traditional systems, pushing global consumption on track to nearly double by 2050. However, this unprecedented demand is colliding with a constrained supply, with experts warning of a potential 10 million tonne shortfall by 2035 due to slow mine development and geographically concentrated production. The new “critical” label is translating national security concerns directly into market pricing as strategic stockpiling via commercial means increases. Copper futures climbed back above US$5.00 per pound, reaching a one-week high as risk appetite strengthened amid optimism that the historic US government shutdown may soon end.

Now, while the world focuses on the future supply of energy transition metals like copper, we’re seeing parallel, billion-dollar action being taken to secure the stability of established bulk commodity exports. Away from strategic metals, BHP announced a $1 billion infrastructure plan for its iron ore operations at Port Hedland in WA.

And this quest for reliability extends to the traditional safe-haven metals, where the gold-silver ratio is providing investors with a key insight into relative value and market sentiment. Gold-silver ratio is simply, how many ounces of silver it takes to buy one ounce of gold. Gold and silver prices continued to surge this week, with the ratio dropping to 80-to-1. Investors can trade the ratio by hedging one metal against the other for profit. As the known safe-haven metal, we’ve seen a lot of buying into gold this month. Thinking about silver, it is heavily relied upon for industrial demand, particularly in electronics, and this industrial link, which accounts for nearly 50% of its demand, means that if economic or speculative sentiment improves, silver is poised to outperform gold, leading to ratio compression. This links directly back to the copper story, highlighting that the entire market is sensitive to the industrial rollout and supply needs of the energy transition.

And crude oil fell towards US$58 per barrel on Thursday, extending an over 4% decline from the previous session to reach a three-week low, after OPEC signalled a well- supplied market outlook. OPEC said global oil production is expected to align with demand by 2026, reversing its earlier forecast for a deficit, and noted that supply already exceeded demand in Q3.

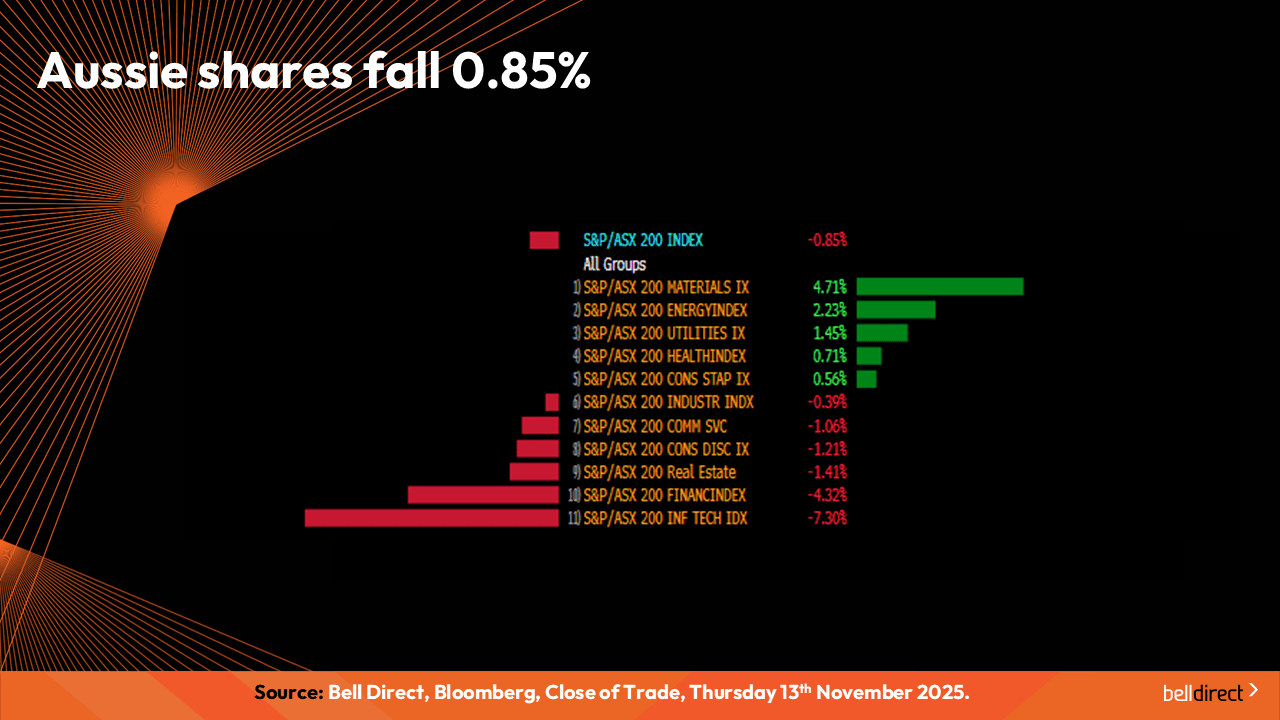

That’s this week’s commodity report. Now looking at the market’s performance this week so far. Materials and energy sectors are in the lead, while information technology and financials weighed down on the market the most, bringing the ASX200 0.82% in the red over Monday – Thursday this week.

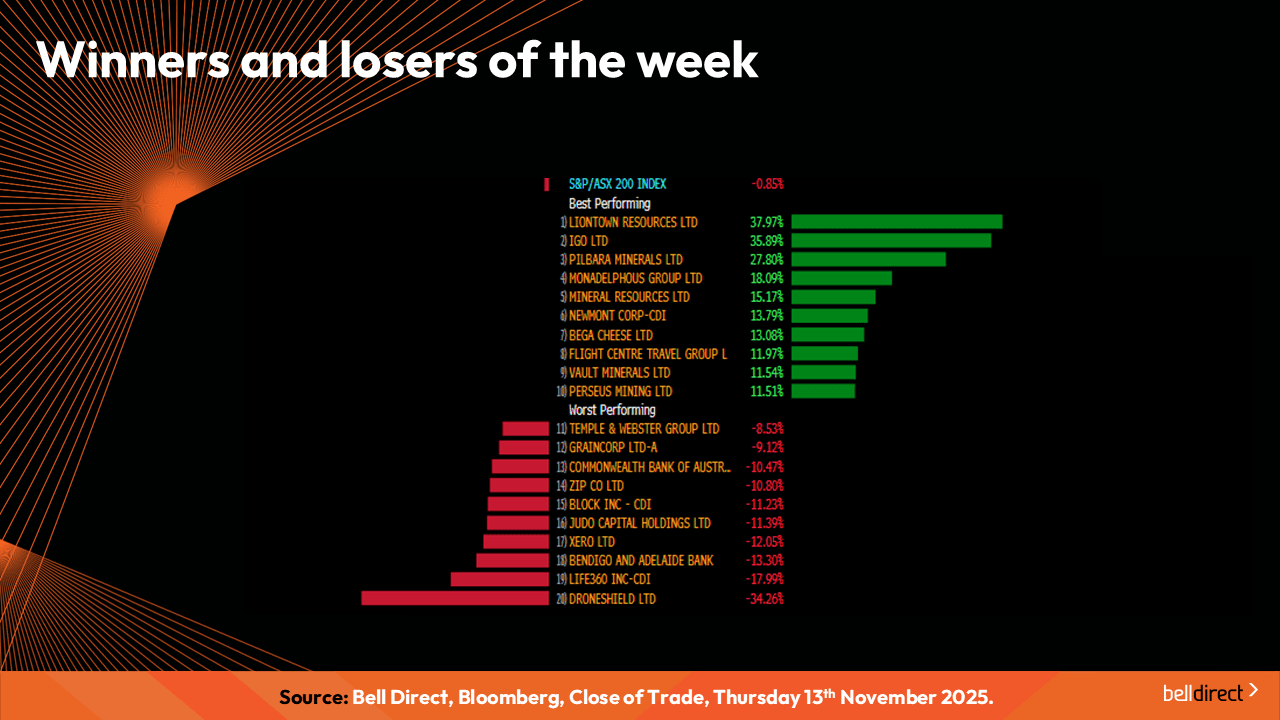

On the ASX200 leaderboard, Liontown Resources (ASX:LTR), IGO Limited (ASX:IGO) and Pilbara Minerals (ASX:PLS) have made impressive gains between 27 and 38% this week, as China’s new lithium royalty framework increased costs by US$20-30 per tonne for domestic lepidolite producers, therefore lifting the global cost floor and boosting Australian spodumene miners.

Meanwhile, Droneshield (ASX:DRO) was the worst performer after CEO Oleg Vornik sold his stake in the company, $49.5 million in shares.

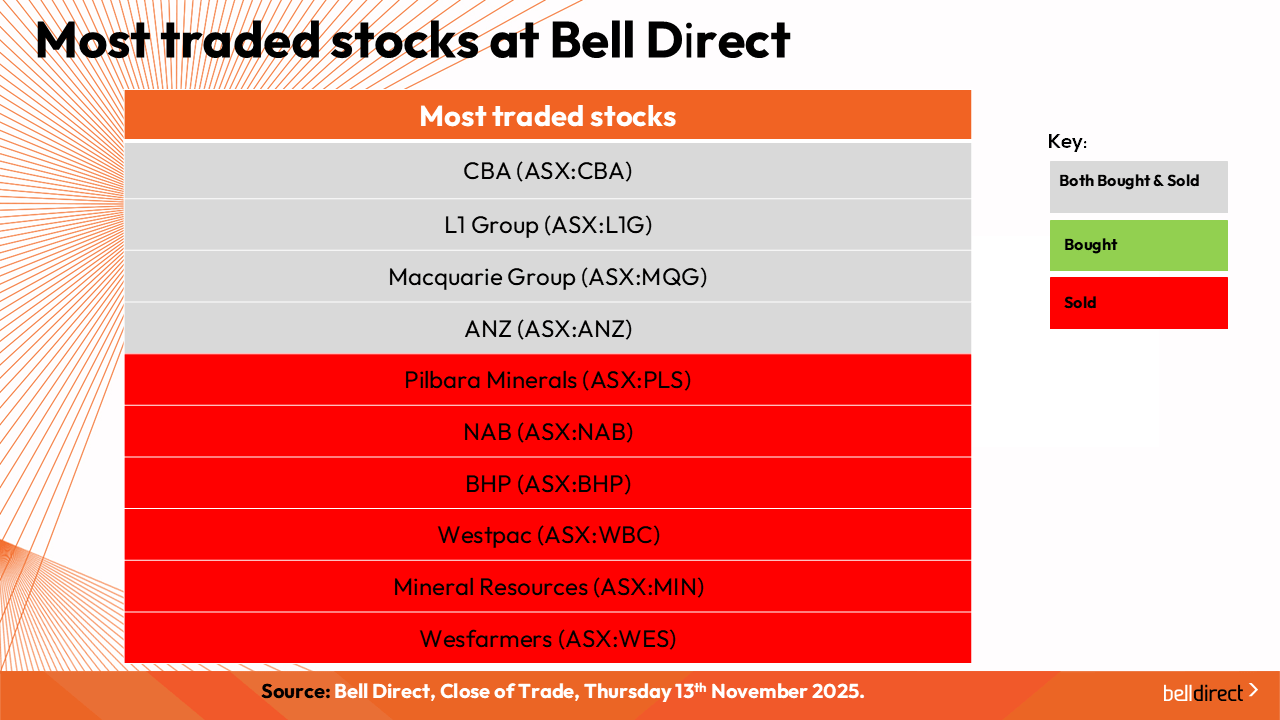

As for the most traded stocks by Bell Direct clients, these were Commonwealth Bank (ASX:CBA), L1 Group (ASX:L1G), Macquarie Group (ASX:MQG) and ANZ Group (ASX:ANZ). And clients were taking profits from Pilbara Minerals (ASX:PLS), NAB (ASX:NAB), BHP Group (ASX:BHP). Westpac (ASX:WBC), Mineral Resources (ASX:MIN) and Wesfarmers (ASX:WES).

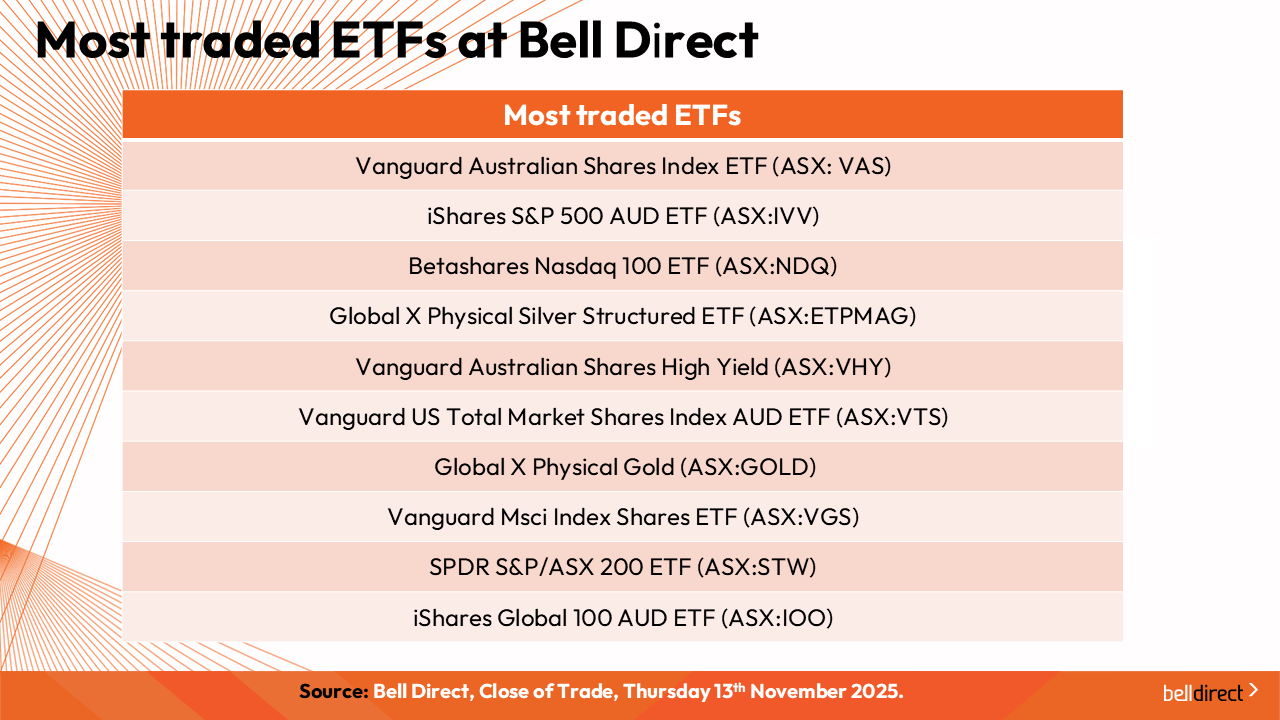

And the most traded ETFs by our clients were the Vanguard Australian Shares ETF (ASX:VAS), the iShares S&P 500 ETF (ASX:IVV) and the BetaShares Nasdaq 100 ETF (ASX:NDQ).

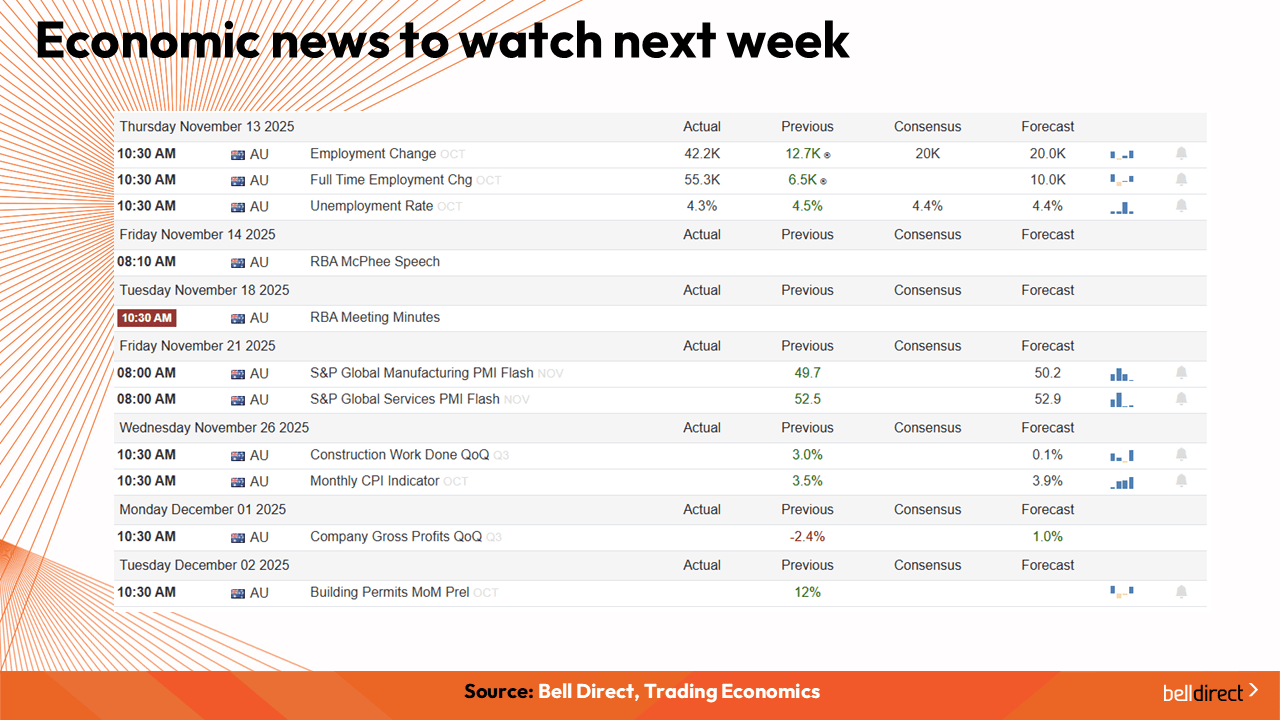

And to end on economic news items to watch out for next week:

The RBA’s latest meeting minutes are out on Tuesday, the wage price index on Wednesday and on Friday, the S&P Global Manufacturing and Services Flash PMI for November will be posted. This is a forward looking estimate of the final PMI which will be released the week after.

And that’s all for this week. I’m Sophia Mavridis with Bell Direct. Have a great Friday and happy trading.

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.