Transcript: Weekly Wrap 15 December

What a year it has been and what a bright year 2024 is shaping up to be with the prospect of 3 interest rate cuts out of the Fed announced just this week, while the RBA may wait until later next year to reduce our local cash rate.

So what else is making 2024 look so bright and where are the key opportunities for investors to reposition their portfolios heading into the new year?

Firstly, considering sectors that have pulled back in 2023 is a great place to start. Healthcare is a sector that has outperformed the market over the last 10-years but experienced a pull back over 1.5% in 2023 due to companies shifting focus away from COVID-19 and back into clinical trials and treatments they were working on prior to the pandemic, thus slowing income and growth outlook for the short-term.

However, in saying that, some companies in the healthcare sector that are making money already were caught up in the healthcare sell-off and present as key investment opportunities for consideration.

Bell Potter has included Clinuvel Pharmaceuticals (ASX:CUV), the distributor of the world’s only approved drug for the treatment of the rare skin condition, EPP, and Telix Pharmaceuticals (ASX:TLX), the company behind the prostate cancer imaging agent, Illucix, as buy ratings in the analyst outlook and stock picks for December 2023.

With the outlook for gold remaining very bright heading into 2024 according to our analysts, fund managers and the markets in general, Bell Potter has included Regis Resources (ASX:RRL) as its strong buy rating for December 2023. Regis is the fourth largest ASX-listed gold producer with an all-Australian asset base and strong guidance heading into 2024.

Expanding into the strategic materials space, Lynas Rare Earths has garnered a buy rating from Bell Potter after a turbulent year for the leading producer of rare earths after its Malaysian operations ran into cracking and leaching bans that were eventually downgraded, and operational challenges with the shift to operations in Kalgoorlie. The outlook for Lynas is strong with a trajectory towards doubling capacity over the next three years via the expansion of their mining and concentrating capacity at Mt Weld, which is complemented by the recent recover in the price of NdPr to US$70/kg.

Corporate Travel Management (ASX:CTD) has recently been added to the Bell Potter analyst coverage, attracting a buy rating for its growth outlook and market leading position as the corporate travel market continues to recover, especially in the wake of CTD having already exceeded pre-pandemic total transaction value driven by new client wins.

Of course, the retailers have surprised across the market in 2023 with the sector jumping 14.26% throughout the year, despite rising interest rates hiking the cost of living for all Australians. Bell Potter is bullish on leading global online luxury personal goods retailing platform Cettire (ASX:CTT) and Accent Group (ASX:AX1) which boats a 30% market share in the $3bn Australian footwear retailing market. What you’ll notice about these two companies is they target a very specific market, Accent specialises in footwear and targets the younger demographic which isn’t impacted by cost-of-living pressures, while Cettire targets luxury retail which has seen modest growth in 2023 especially in markets like China.

A few months ago there was speculation that a recession in the US could lead to a downturn in markets heading into the new year, but now among the current Santa rally, the outlook in 2024 is for a soft landing both locally and in the US, and market rally heading into 2024.

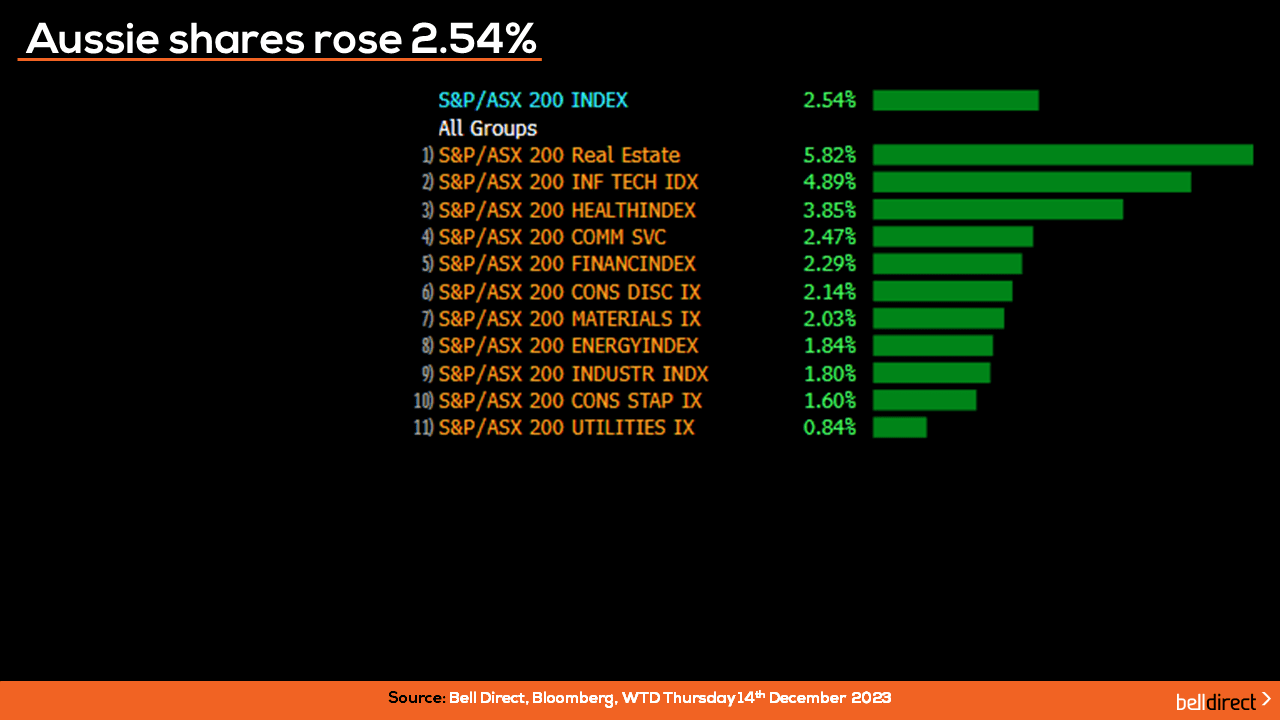

Locally from Monday to Thursday, the ASX200 rose 2.54% in a very strong week buoyed by Wall Street hitting a 52-week high for the Nasdaq and S&P500 while the Dow Jones hit an all-time record high over 37000 points after economic data showed inflation easing in the US and the Fed signalled rate cuts on the horizon in 2024. The ASX took strong lead from Wall Street this week with rate-sensitive sectors leading the gains including the REIT sector rising 5.82% while tech stocks jumped 4.9%.

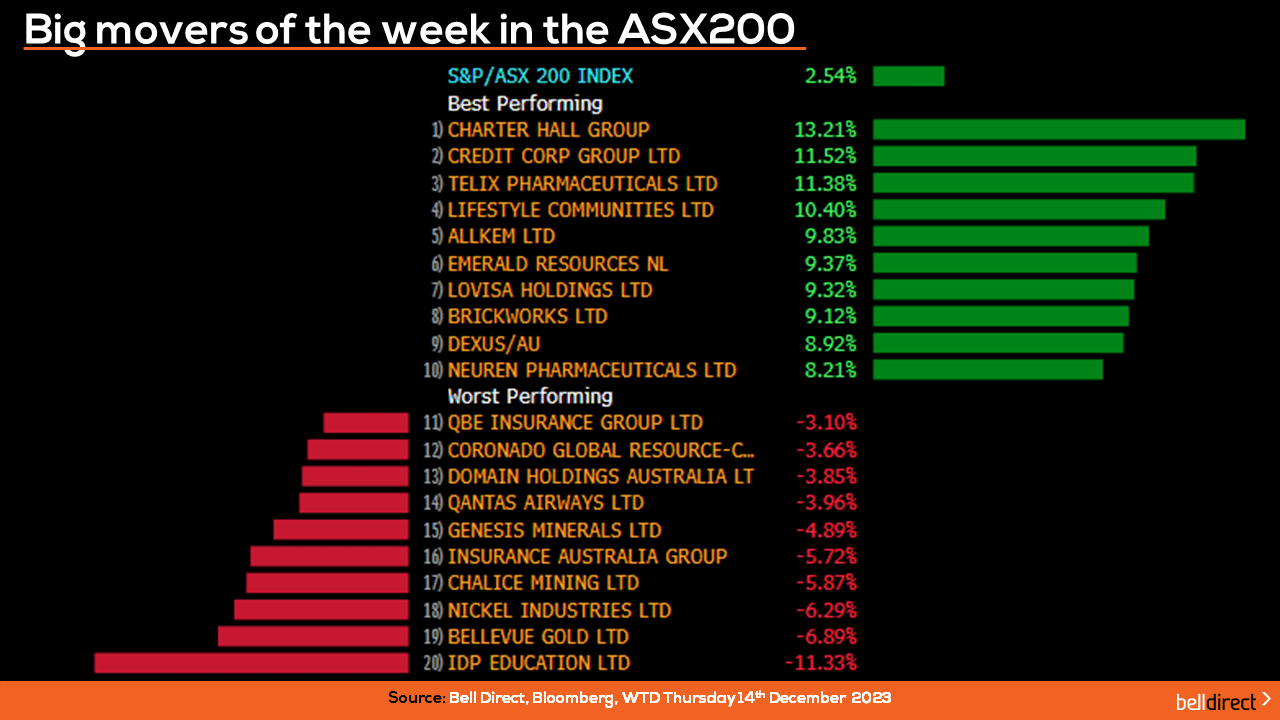

The winning stocks on the ASX200 over the week were Charter Hall (ASX:CHC) adding 13.21%, Credit Corp Group (ASX:CCP) rallying 11.52% and Telix Pharmaceuticals (ASX:TLX) climbing 11.38%.

On the losing end IDP Education (ASX:IEL) tumbled 11.33%, Bellevue Gold (ASX:BGL) lost 6.9% and Nickel Industries (ASX:NIC) fell 6.3%.

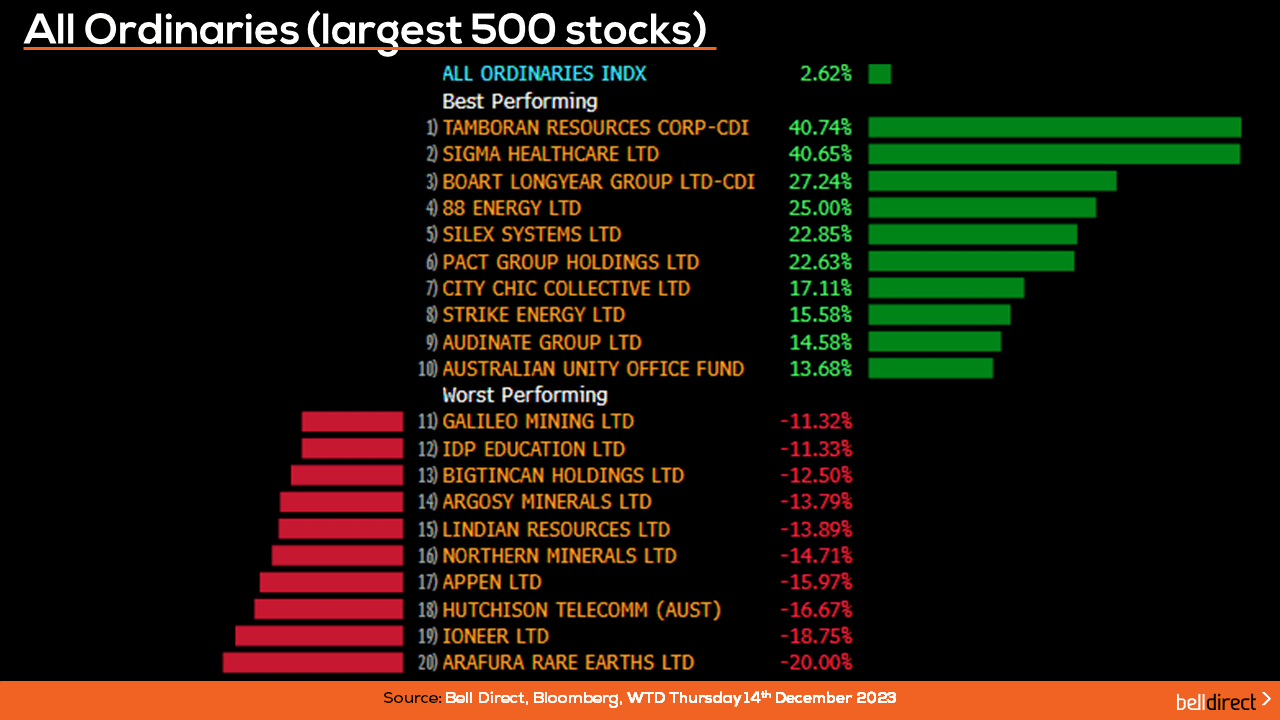

On the broader market, the All Ords rose 2.62% led by Tamboran (ASX:TBN) rocketing 40.74%, Sigma Healthcare (ASX:SIG) soaring 40.65% after agreeing to a transformational merger with Chemist Warehouse and Boart Longyear Group (ASX:BLY) adding 27.24%.

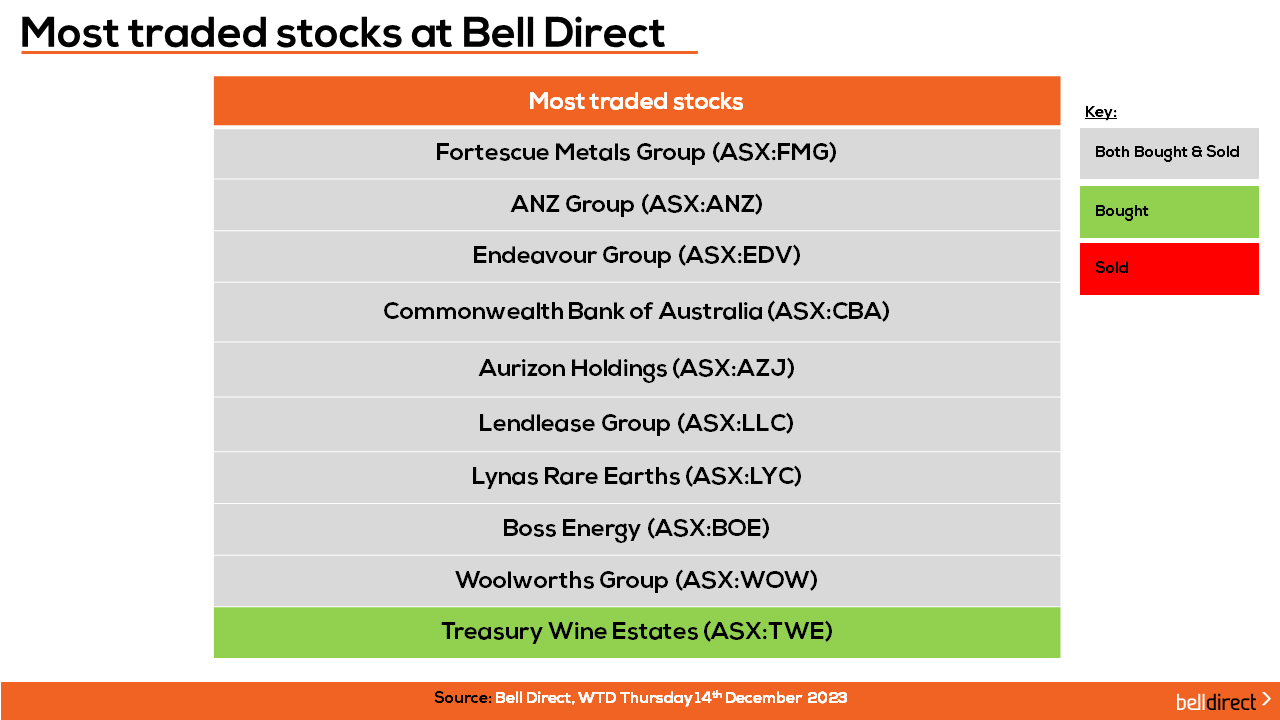

The most traded stocks by Bell Direct clients over the four trading days were Fortescue Metals Group (ASX:FMG), ANZ (ASX:ANZ), Endeavour Group (ASX:EDV), CBA (ASX:CBA), Aurizon Holdings (ASX:AZJ), Lendlease Group (ASX:LLC), Lynas Rare Earths (ASX:LYC), Boss Energy (ASX:BOE), and Woolworths Group (ASX:WOW).

Clients also bought into Treasury Wine Estates (ASX:TWE) this week.

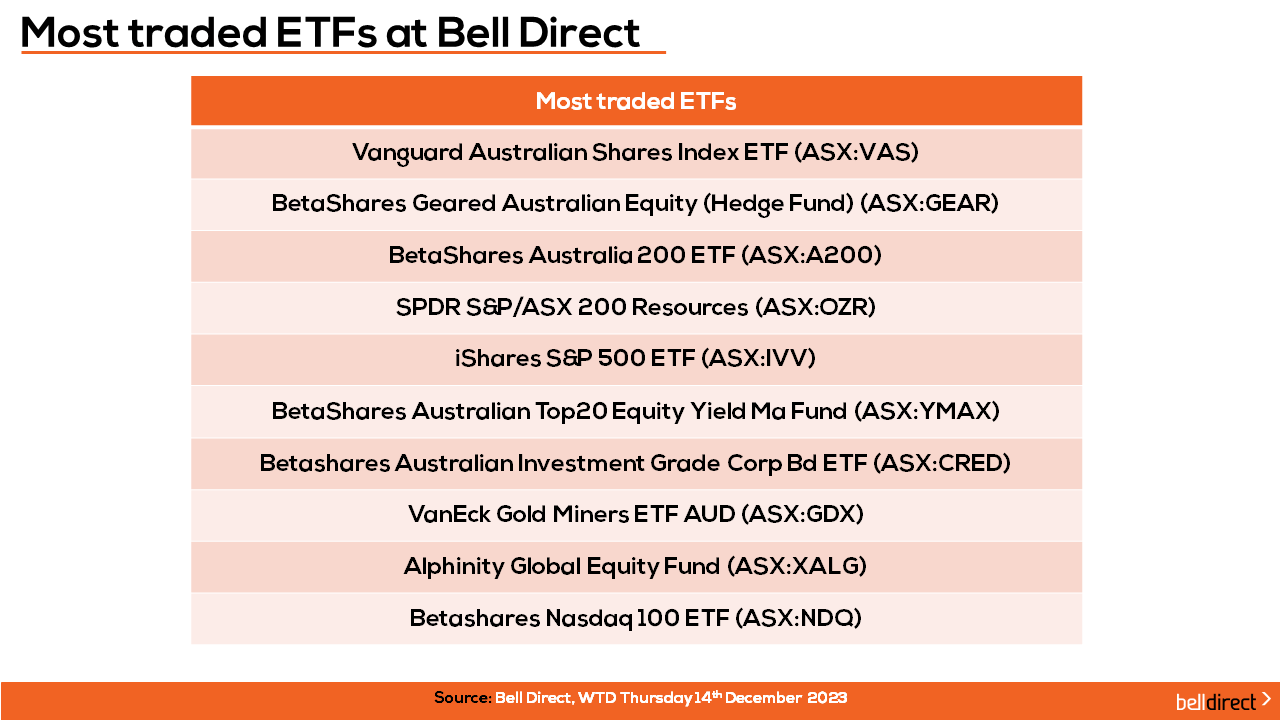

The most traded ETFs by Bell Direct clients this week were led by Vanguard Australian Shares Index ETF, BetaShares Geared Australian Equity (Hedge Fund), and BetaShares Australia 200 ETF.

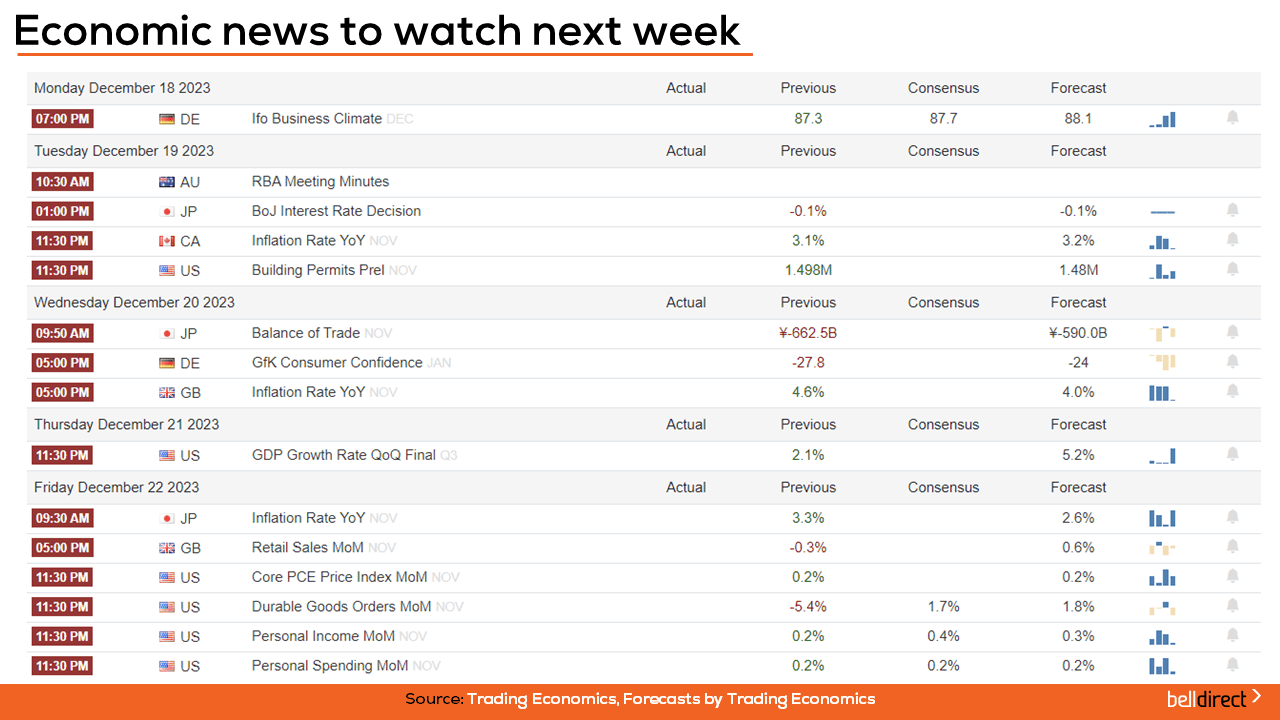

On the economic calendar front next week, the latest meeting minutes out of the RBA will be released on Tuesday which will provide investors with insight into the rate outlook locally over the coming months especially any signals for rate cuts on the horizon will be very welcomed by investors and Australians alike.

Overseas, the Bank of Japan’s interest rate decision is out on Tuesday with the expectation that the -0.1% rate will be maintained for yet another month.

Key US data is also out next week with building permits, personal income spend, and GDP Growth Rate data out for Q3 later in the week.

And that’s all we have time for today and this year. We’ll be back with our market commentary from the week commencing 15th January. I’m Grady Wulff and from all of us at Bell Direct we hope you have a safe and wonderful Christmas and the happiest of New Years.