Transcript: Weekly Wrap 15 March

All eyes were on the US this week as the release of key economic data provided insights into how the world’s largest economy is faring on the inflation front as well as providing an outlook for how the Fed may respond rate wise in the months to come.

Firstly, Investors took confidence in the slight rise in inflation through the latest CPI data indicating core inflation rose 0.4% in February from January and 3.8% year-on-year, while the inflation rate in the US rose just 0.1% to 3.2% in February. While the inflation rate was slightly higher than economists were expecting, markets responded positively with investors finding reason to pile back into the magnificent 7 and specifically, Meta and Nvidia, midweek.

U.S. retail sales rose 0.6% month on month in February from January but were below market expectations of 0.8% which is a positive sign for the Fed to cut rates soon as consumer retail spend is a key indicator of inflation. The biggest increase in spend came from building materials and motor vehicles which indicates consumers are spending on the larger goods front as opposed to low ticket fashion retail spending. In February, the producer price index in the US, which is another key driver of inflation, rose 0.6% month-on-month from January which is the largest increase since August 2023 and doubled market expectations of a 0.3% rise. With goods prices rising 1.2% over the month, this is a conflicting indicator to the slowdown in retail spend, and suggests that inflation on the producer front continues to rise, thus adding to inflation remaining sticky in the world’s largest economy. Services inflation is another driver of inflation and the cost of services rose 0.3% over the month of February which also presents as a significant factor for the Fed to consider at the next FOMC meeting. With this in mind, the market pricing in any interest rate cuts by the Fed in the very near future may now be in doubt as inflation related data indicates inflation remains sticky above the target 2% rate in the US. While investors are aware that inflation may remain elevated for some time to come, they are still optimistic that rate cuts are on the horizon both out of the Fed and around global central banks as economies continue to struggle through the currently high interest rate environment.

On the local market this week, it was a mining giant sell-off as iron ore slumped to US$111/tonne, the lowest level since August last year, due to ongoing demand weakness out of China, the world’s largest importer of iron ore, causing stockpiles of the commodity at ports globally, and on news this week of further production cuts expected from Chinese steel producers.

BHP (ASX:BHP) fell 1.5% over the last 5 trading days, FMG lost 5.85% and Rio Tinto (ASX:RIO) fell 1.15% over the same trading period.

A few latecomers also released earnings results this week including department store giant Myer (ASX:MYR) which reported total sales down 3% to $1.829bn, EBITDA fell 10.4% to $215.7m, NPAT declined 19.9% to $52m and cost of doing business rose 1.6%. The fall in sales was largely due to store closures while online sales lifted 2% to $390.1m. Management attributed the tough macro-economic conditions to the poorer results over the first half. Board changes and outlook though boosted investor sentiment with shares in Myer rising 4.5% over the trading session on Thursday after the results were released. Comparable sales for the first 6 weeks of H2FY24 are up 4.9% indicating recovery in consumer spend with Myer.

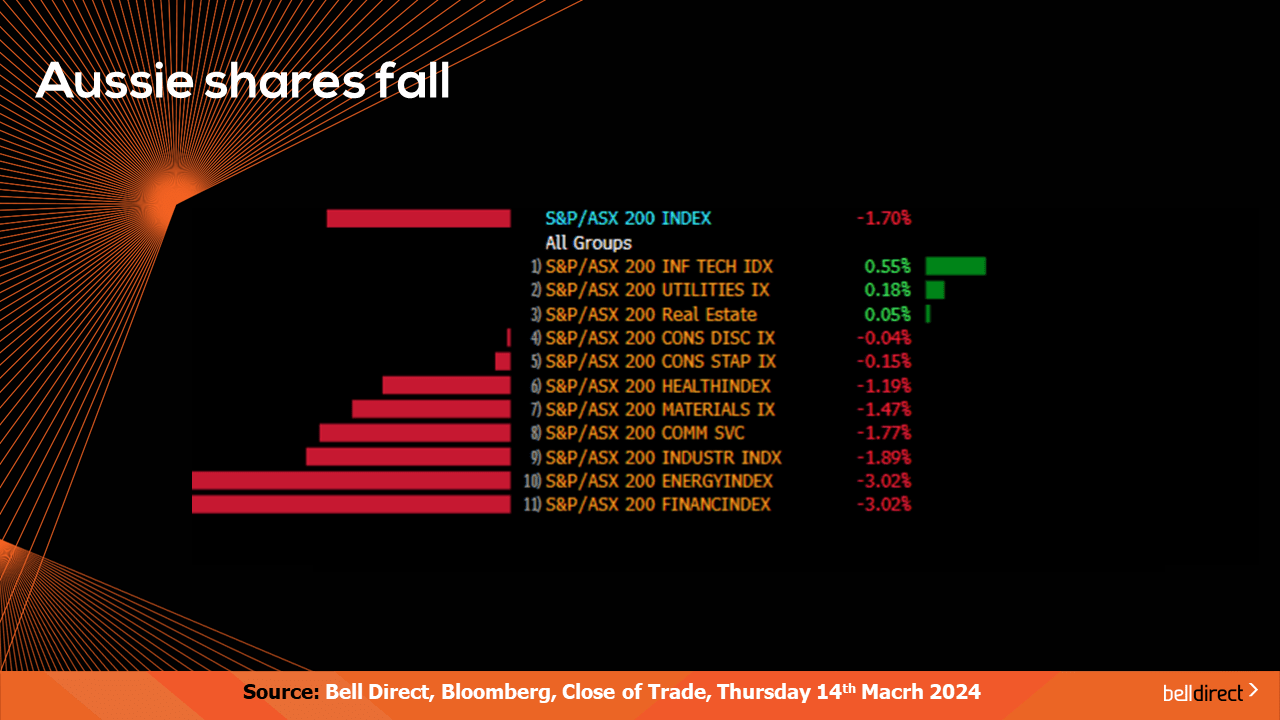

Locally from Monday to Thursday the ASX200 fell 1.70% led by a selloff in the energy and utilities sectors. The information technology sector offset some of the losses with a 0.55% gain across the 4-trading days, taking a strong lead from the Nasdaq on Wall Street this week as investor appetite regains momentum for the high growth sector.

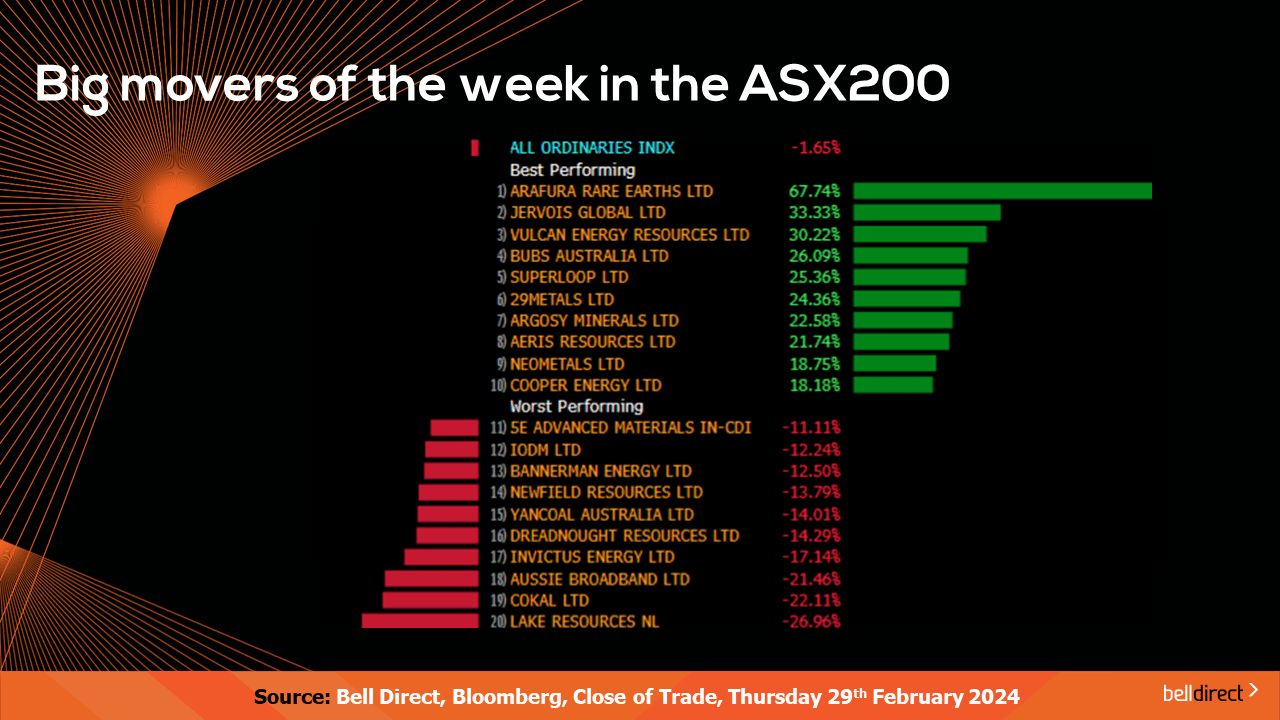

The winning stocks over the four trading sessions were led by Arafura Rare Earths (ASX:ARU) soaring over 67% after the Australian Federal Government conditionally approved a US$533m debt finance package to support Arafura’s flagship Nolans NdPr project. Jervois Global (ASX:JRV) rose 33% this week and Vulcan Energy Resources (ASX:VUL) added 30% over the 4-trading days.

And on the losing end Lake Resources (ASX:LKE) fell 27%, Cokal (ASX:CKA) lost 22% and Aussie Broadband (ASX:ABB) dipped 21.5%.

On the broader market, the All Ords, closed the 4-trading days down 1.65%.

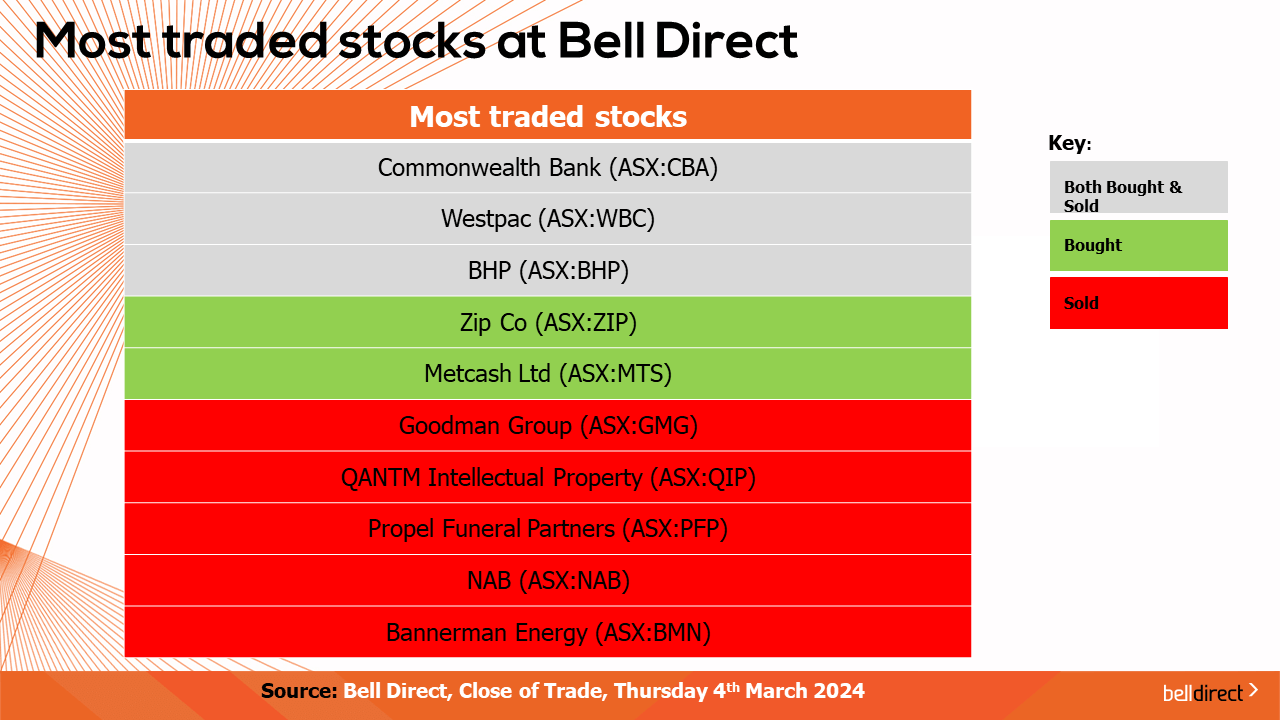

The most traded stocks by Bell Direct clients from Monday to Thursday were CBA (ASX:CBA), Westpac (ASX:WBC), and BHP (ASX:BHP). Clients also bought into ZIP (ASX:ZIP), and Metcash (ASX:MTS), while taking profits from Goodman Group (ASX:GMG), QANTM Intellectual Property (ASX:QIP), Propel Funeral Partners (ASX:PFP), NAB (ASX:NAB) and Bannerman Energy (ASX:BMN).

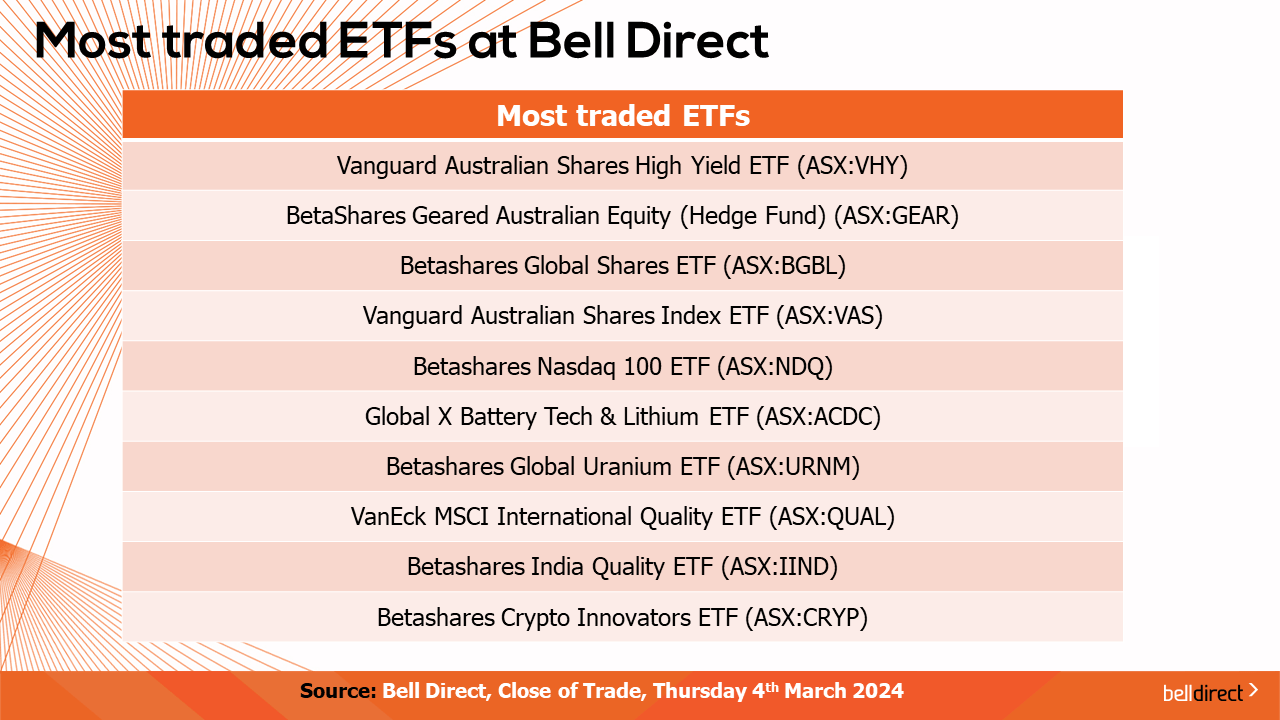

And the most traded ETFs were led by Vanguard Australian Shares High Yield ETF, BetaShares Geared Australian Equity (Hedge Fund) and Betashares Global Shares ETF.

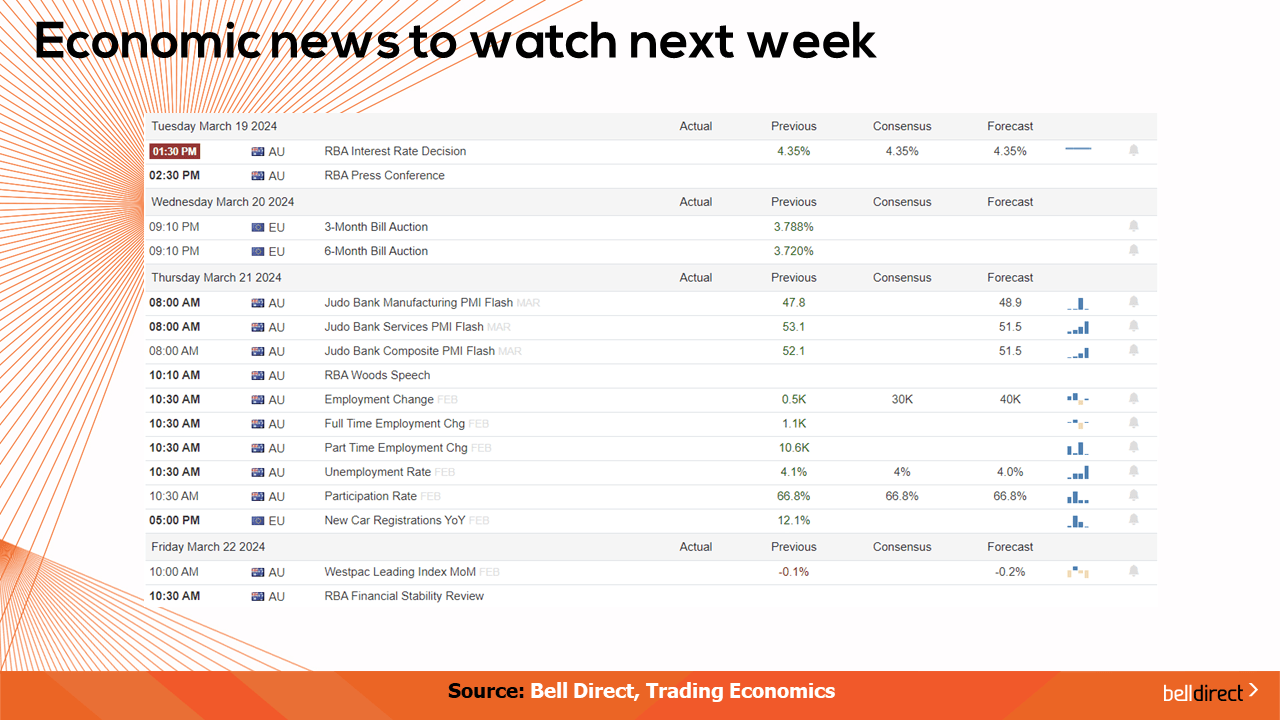

On the economic calendar next week, Australia’s RBA interest rate decision is announced on Tuesday with the expectation of a hold at the current rate of 4.35%, likely due to inflation of housing prices, wages and PPI remaining elevated.

Overseas, key economic data out of China will provide key insight into how the world’s second largest economy is faring in the post-pandemic, low economic growth environment. China’s retail sales data for January – February is out on Monday with the expectation of a decline in sales to 5.3% from 7.4% in the prior period, which paints the picture of ongoing economic slowdown in the region. Industrial production data in China is also out on Monday with markets factoring in a decline from 6.8% in January to 4.9% in February, also providing further evidence of a continued slowdown in economic activity in the region.

In the US, the Fed’s latest interest rate decision is out on Thursday with economists’ expecting the maintenance of the current interest rate as inflation remains sticky in the world’s largest economy as shown by CPI data out this week.

And that’s all we have time for today, have a wonderful Friday and weekend, and as always, happy investing!