Why finding a pot of gold at the end of a rainbow may not be an urban myth in 2024.

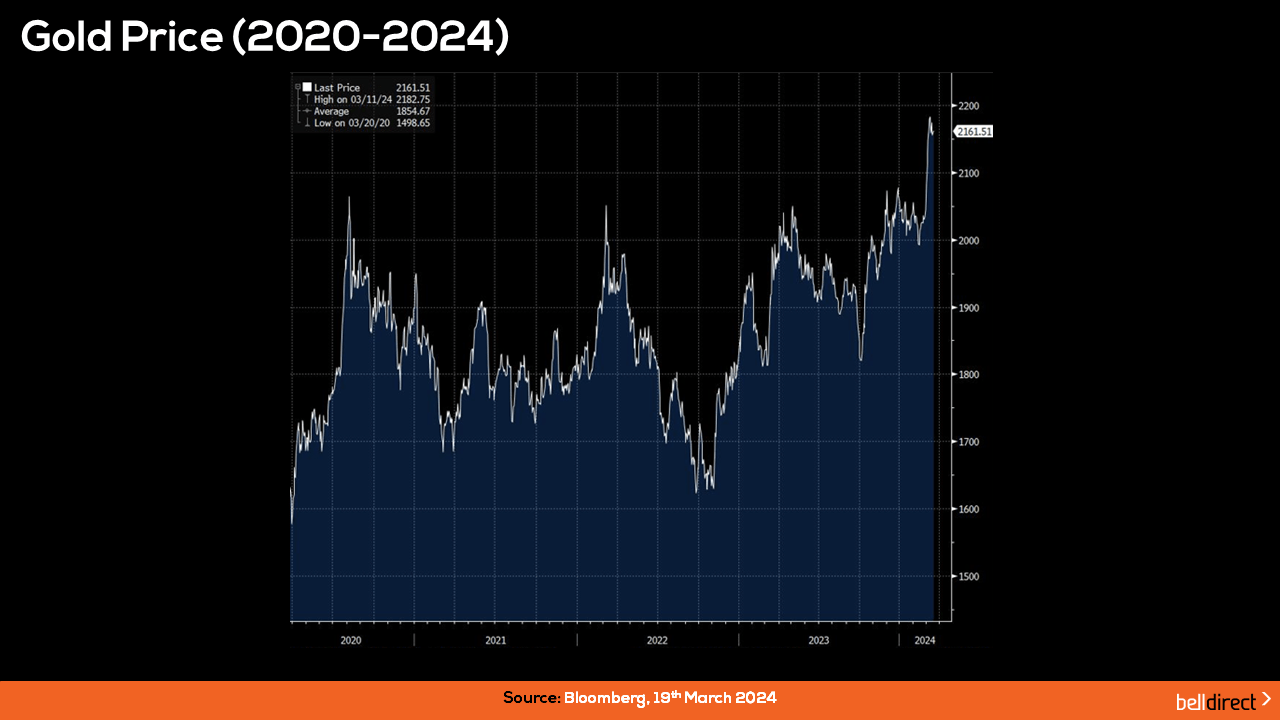

There’s no denying the resurgence in popularity of holding gold in an investor’s portfolio over the last 12-months, but there are many contributing factors driving the desire to invest in the precious commodity. Traditionally, when interest rates rise the price of gold falls. But on average across the last 12-months, this has not been the case as gold has topped all-time high spot prices (except for a few recent dips). Let’s dive into why.

Firstly, a key factor driving the price of gold over the last year is the notion of gold’s hedge against inflation, which is a tale as old as time. While inflation in the US has had a slight uptick to 3.2% in February and remains above target levels of 2 to 2-3% pending the economy in question (US and Australia respectively), gold acts as a natural hedge against the rising effects of inflation and cost increases of everyday life. While other currencies and commodities fall during times of high inflation, gold maintains value due to its global scarcity and historical role as a store of value. Conversely, it may not experience rocketing growth like technology stocks, but its value as a precious commodity makes it a stable investment option during the different economic cycles.

Rate outlook impact on gold price.

Next up we have the driver of interest rate outlook and rate uncertainty boosting gold prices. A trend over the last 12-months has been investors piling into ‘safe-haven’ assets at times of rate outlook uncertainty, such as after FOMC or RBA meetings, or when fresh economic data outlines inflation remaining sticky. At such times we have seen spikes in the spot price of gold and upticks in share prices for gold explorers, miners, producers, and gold-related ETFs.

On the other hand, when interest rates are likely to rise, gold tends to fall. One such example of a dip occurred in October 2023 when retail inflation in the US spiked thus increasing the risk of another interest rate hike out of the Fed, which led to a dip in the price of gold from a peak of US$1945/ounce in September to US$1818/ounce in October. This dip was very short-lived as the spot price of gold topped US$2000/ounce by November 2023.

The most recent peak in the price of gold occurred on the 8th March where the precious commodity topped US$2195/ounce due to the weakening of the USD (which gold has an inverse correlation with), and the outlook for interest rate cuts out of the Fed in the near future given favourable economic data released indicating inflation continues to ease.

Geopolitical impact on gold price.

Geopolitical uncertainty also plays a role in driving the price of gold. Where there is uncertainty in geopolitical conflict and economic unrest, investors tend to pile into gold due to its ‘safe-haven’ nature. Gold stands as a strong store of value and is a universally accepted form of wealth which therefore brings in the underlying economic idea of supply vs demand. When demand for gold is high, the price increases. Thus, when geopolitical tensions are high, demand is high and therefore the price of gold rises. The war between Russia and Ukraine ongoing, rising geopolitical tensions in the red sea conflict expanding from Israel’s war with Hamas and the US-China strategic competition instability are just a few cases of current geopolitical tensions that are contributing to the rising price of gold in 2024.

Finally, falling bond yields and a weaker USD are other contributing factors to the rising price of gold. The simple way to understand the USD – Gold relationship is that when the USD is stronger, it costs more to buy gold thus weakening the price of the commodity, and when the USD falls, the price of gold rises as more gold can be purchased when the USD is weaker. Bonds, like gold, are deemed a ‘safe-haven’ asset during times of economic instability and rising interest rates. Thus, when bond prices rise, the yields fall and the attractiveness of investing in bonds weakens. With the idea of interest rate cuts on the horizon, bond prices have begun to rise and yields have started falling. The recent US CPI report indicating inflation continues to ease has caused bond prices to rise and the yields to fall. Therefore, it is clear that the price of gold has a positive relationship to the price of bonds, and while bonds are currently rising, the price of gold is rising too. It is also therefore clear that the price of gold has an inverse correlation to bond yields, i.e. when yields fall, gold prices rise and vice versa.

Big global banks and finance houses are also weighing in their opinions of just how high the gold spot price can go by the end of 2024 with J.P. Morgan Research estimating gold will peak at US$2300/ounce in 2025, and UBS expects the price of gold to hit US$2200/ounce by the end of 2024, while locally, ANZ economists also believe gold will hit US$2200/ounce before the year end.

How can you invest in gold in 2024?

Gold Miners

Greenfields gold miner will raise some capital and go exploring for gold. They either won’t find it, in which they’ll go back to shareholders for more money; not much upside for investors yet as initial capital burnt. If they do find gold, then that’s exciting for investors and the focus becomes on valuing the ore reserve found and working out if it is feasible or cost-effective to get it out of the ground. Once the company evaluates if it can get the gold out of the ground in an effective and affordable way, then the focus moves to a capital raise for extraction, so a gold explorer then becomes a gold producer.

The gold they are producing then becomes leveraged to the gold price.

During the exploration process it is higher risk of reward, but once the gold is discovered and mined the gold is leveraged to the gold price at that point onwards.

Keep in mind though, the process of investing in gold miners is a lengthy one though – as you are investing in the exploration process which isn’t guaranteed to be successful – it may end up in just a pile of dirt. You can invest in a gold producer that has already found gold and is producing gold; however, then you are more exposed to the price of gold, i.e. the company’s share price is more likely to go up and down relative to movements in the price of gold.

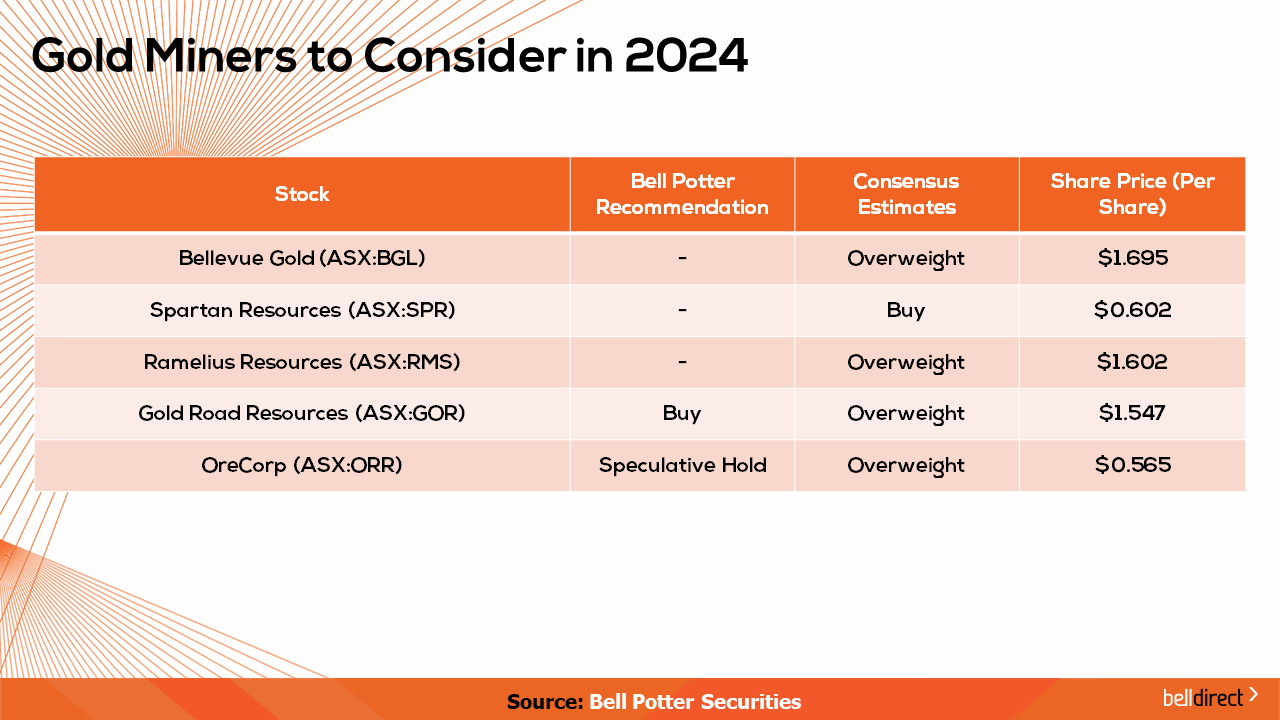

Some gold miners to consider in 2024 include: Bellevue Gold (ASX:BGL), Spartan Resources (ASX:SPR), Ramelius Resources (ASX:RMS), Gold Road Resources (ASX:GOR) and Orecorp (ASX:ORR).

Physical Gold

Buying gold coins, gold bars or gold jewellery from a bullion dealer or jeweller is another way to invest in gold. Doing so has the advantage of giving investors full control of their own gold. Jewellery can also be used for reasons other than investing.

The drawbacks here however are security and transaction costs. Storing gold bars, coins and jewellery is tricky and risky business for anyone.

Gold ETFs (Physical gold)

The final, and among the most popular, ways to invest in gold is through gold ETFs. Gold ETFs have risen greatly in popularity the past 20 years and currently house over US$210 billion worth of gold around the world, according to the World Gold Council (1). They’re also the most common kind of ETF, appearing on exchanges globally from India, to Russia to Egypt.

Gold ETFs are shares or units in physical gold bars that trade on exchange. In many respects they offer something like the mashing together of buying shares in gold miners (gold ETFs, like gold miners’ shares, trade on exchange) and buying bullion directly (gold ETFs are backed by physical gold bars). They also look after security of the gold bullion, with the gold bullion that backs gold ETFs held in the ultra-secure bank vaults of JP Morgan in London

One ETF might give you pure exposure to the price of gold through buying gold bullion, while another ETF might invest in a diversified portfolio gold mining companies. There are a few options out there including the Global X Physical Gold ETF (ASX:GOLD), BetaShares Global Gold Miners ETF – currency hedged (ASX:MNRS) and Perth Mint Gold ETF (ASX:PMGOLD).

Investor preferences may vary between those who want exposure to the gold price ETFs that buy and hold the physical gold, or those that wish to invest in ETFs that use derivatives, as each derivative contract carries the risk of counter-party default.

Is it time to consider silver?

And in 2024 we can’t forget about the stepsister to gold, silver. For investors around the world, silver has been a forgotten stepsister to gold over the years, but the price of the commodity is trading 11% higher over the last year thus is another investment opportunity to consider in the market landscape for 2024.

(1) https://www.gold.org/goldhub/data/gold-etfs-holdings-and-flows

This information is general in nature and does not take into account your financial situation, objectives or needs. You should consider whether it is appropriate for you. You should read our Financial Services Guide and any relevant Product Disclosure Statements before making an investment. For more information visit belldirect.com.au or call 1300 786 199. Bell Direct is the trading name of Third Party Platform Pty Ltd ABN 74 121 227 905, AFSL 314341.