Transcript: Weekly Wrap 19 January

Thank you for joining us this Friday 19th January. I’m Sophia Mavridis from Bell Direct and this is your weekly market update.

This week, commodity prices and economic data moved markets. Let’s recap what happened, as well as what to watch next week.

After leading the market on Monday, the energy sector retreated this week, following concerns over future demand. China’s economic growth in Q4 fell short of expectations, and this saw investors doubt projections of increased Chinese demand that would lead oil growth globally this year. However, several OPEC+ countries have agreed to voluntary cuts to support the balancing act facing oil markets. Citi Group has stated that “non-OPEC+ supply growth coupled with declining year-on-year demand could see a significant surplus in FY25” and that they anticipate “oil equities will underperform in a surplus market, based on historical precedent”. In addition, a strong US dollar dampened investor appetite for risk.

A company to watch in this space is Santos (ASX:STO). On Monday, the company won a Federal Court case launched against it by traditional owners, related to the company’s Barossa gas project in the Northern Territory. The Federal Court has ruled the project won’t harm Indigenous cultural heritage assets. In addition to the $5.7 billion Barossa win, investors are watching Santos this week after news over a potential merger with Woodside Energy Group (ASX:WDS), creating a global liquefied natural gas (LNG) player.

Meanwhile, UK and European natural gas prices have sharply declined this week, despite their cold winter, as supply remains abundant and ample pipeline gas and LNG compensate for the high demand, preventing shortage concerns. The price of UK gas is down more than 11% this week.

Another commodity on the decline this week was iron ore, as miners continue to watch the spot price for the steel-making material ease. Weaker demand from Chinese steel mills is one hurdle; China’s December crude steel output was 15% lower on the year, the weakest monthly showing since 2017, as officials sought to cap production of alloy.

On the other hand, the uranium price continues to advance, extending the surge from late last year, to its highest level since late 2007, following signs of strong demand and risks to supply. This is as volatile fossil fuel prices and ambitious decarbonisation goals drove over 20 countries, including the US, to announce that their nuclear power will be tripled by 2050. China leads the bets on nuclear energy, while Japan has restarted projects to increase nuclear power output.

As for economic data out this week, retail sales data in the US was announced, rose 0.6% last month, greater than expectations, after an unrevised 0.3% gain in November. Retail sales are mostly goods and are not adjusted for US inflation data. Year-on-year, sales increased 5.6% in December. Locally, Australia’s unemployment rate for December was released yesterday, remaining unchanged at 3.9%.

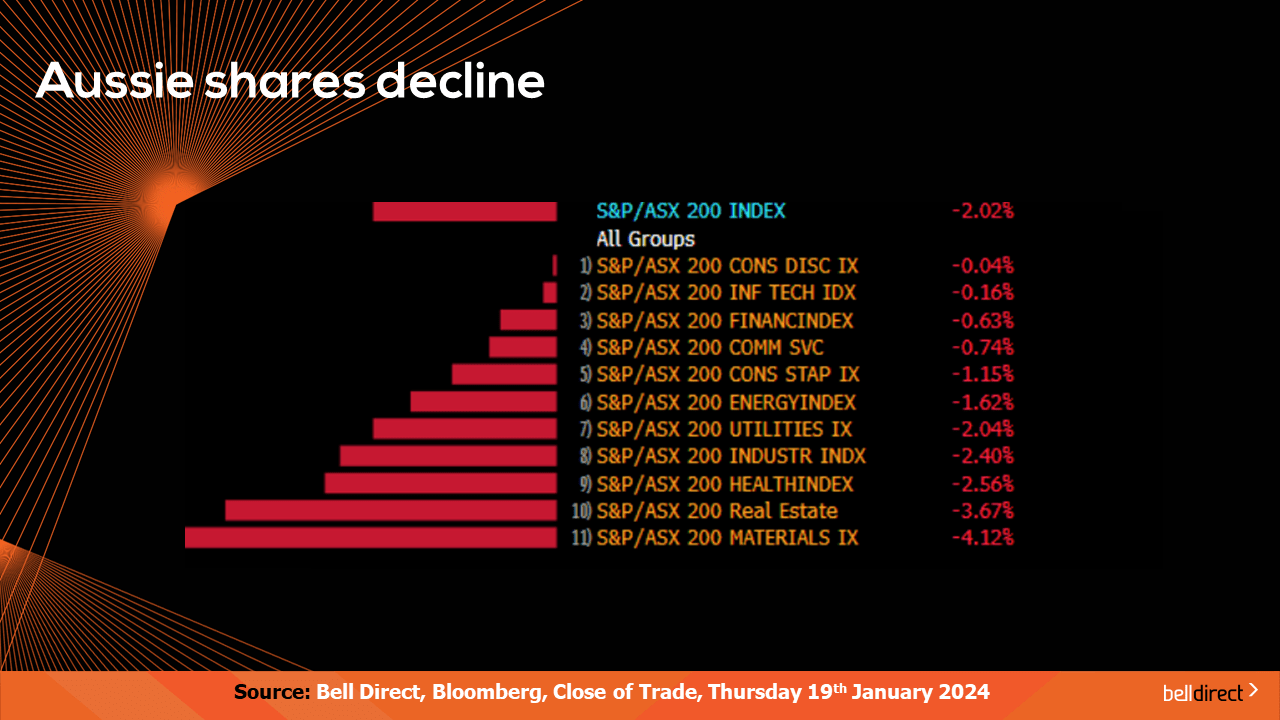

The local market is down 2% this week so far, with all 11 industry sectors in the red. Materials and real estate posted the largest loss, down 4.1% and 3.7% respectively.

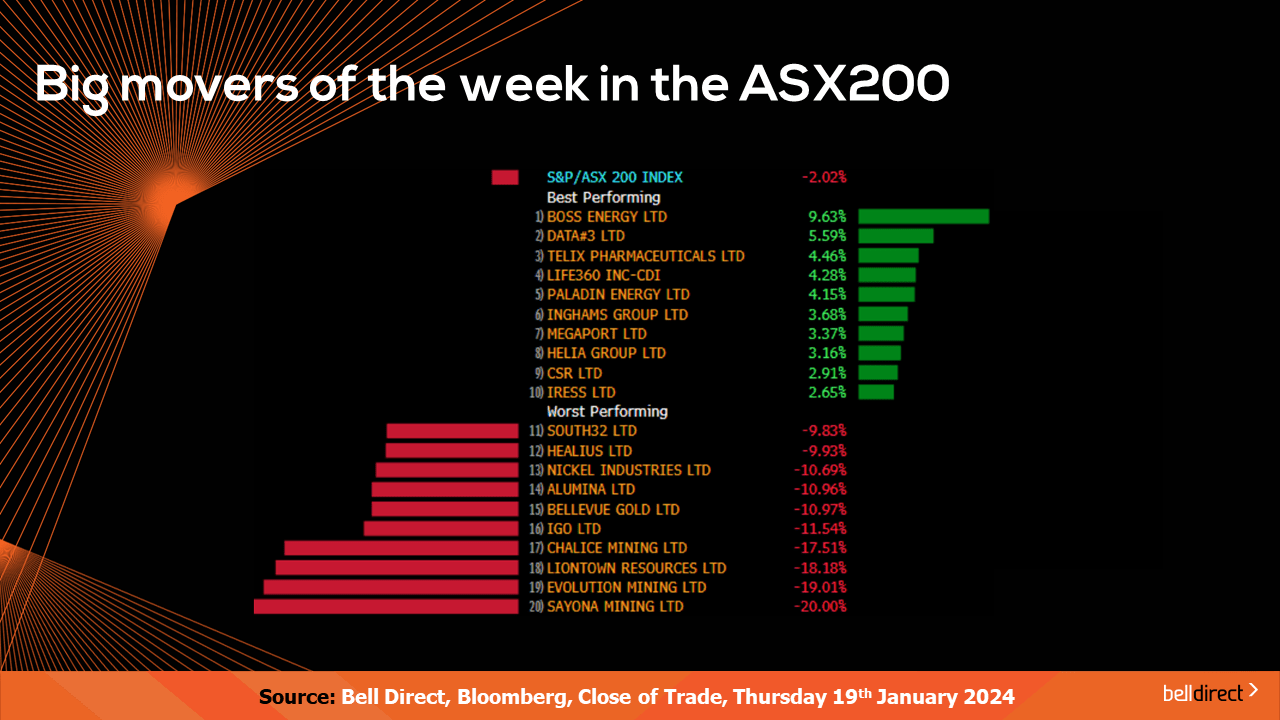

Looking at the ASX200 leader-board, Boss Energy (AX:BOE) lead the market as the price of Uranium continues to rise. Bell Potter have a Speculative Buy rating on BOE with a $5.69 price target. Cloud computing company Data#3 (ASX:DTL) and Telix Pharmaceuticals (ASX:TLX) followed Boss Energy as the best performers this week, while Sayona Mining (ASX:SYA), Evolution Mining (ASX:EVN), Liontown Resources (ASX:LTR) and Chalice Mining (ASX:CHN) all sharply decline between 17% to 20%, as commodities declined and the materials sector suffered.

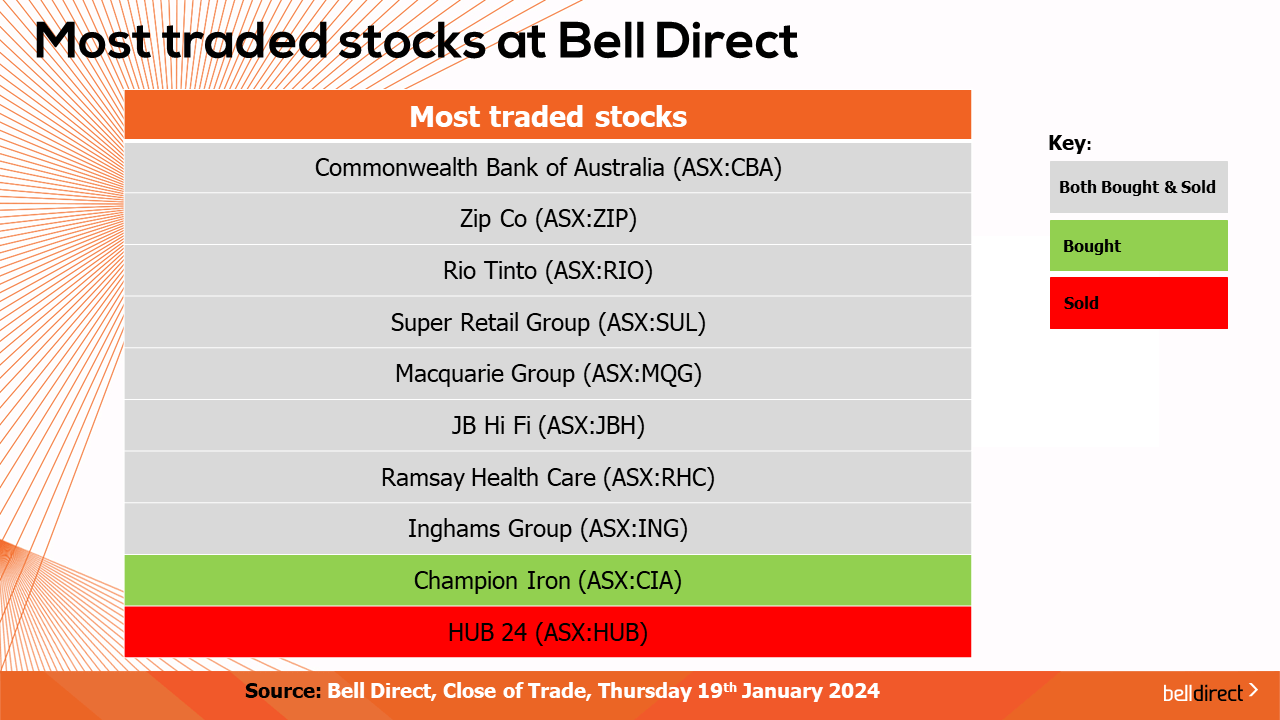

As for the most traded stocks by Bell Direct clients this week, these included Commonwealth Bank (ASX:CBA), Zip (ASX:ZIP), Rio Tinto (ASX:RIO), Super Retail Group (ASX:SUL), Macquarie Group (ASX:MQG), JB Hi Fi (ASX:JBH), Ramsay Health Care (ASX:RHC), and Inghams (ASX:ING).

Clients also bought into Champion Iron (ASX:CIA), while took profits from HUB 24 (ASX:HUB).

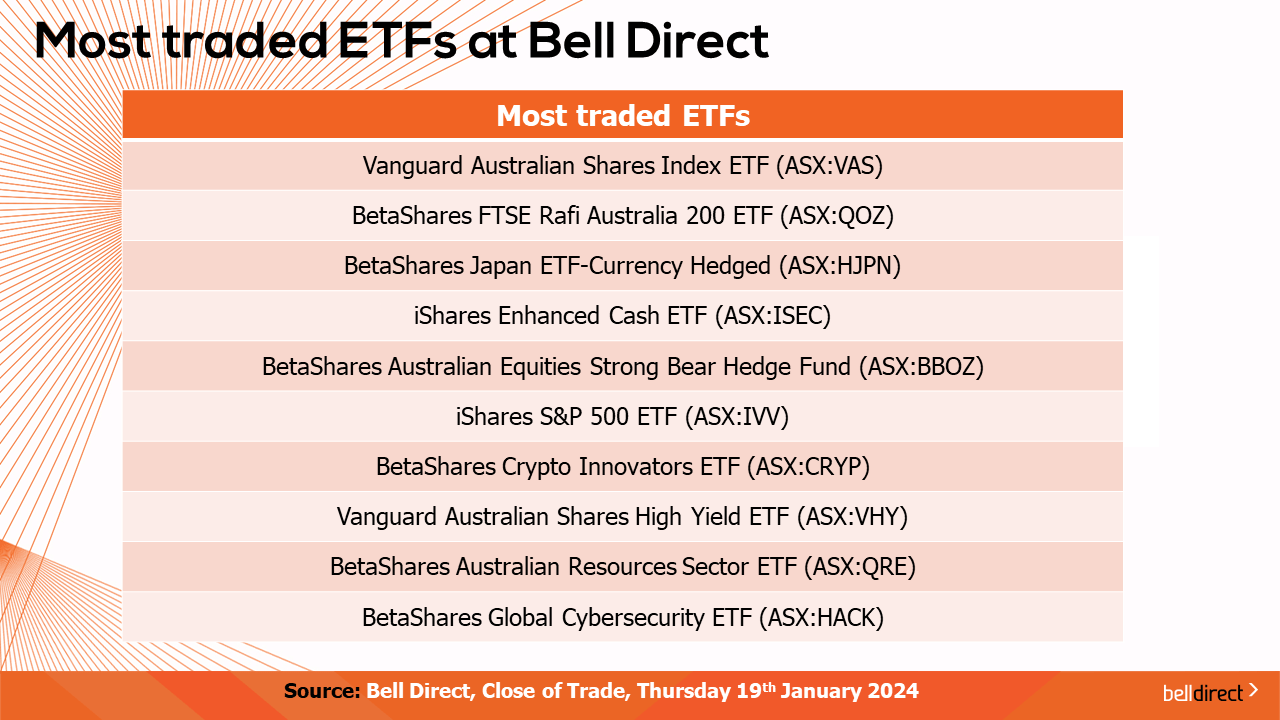

And the most traded ETFs by Bell Direct clients this week the Vanguard Australian Shares ETF (ASX:VAS), the BetaShares FTSE Rafi Australia 200 ETF (ASX:QOZ) and the BetaShares Japan ETF (ASX:HJPN).

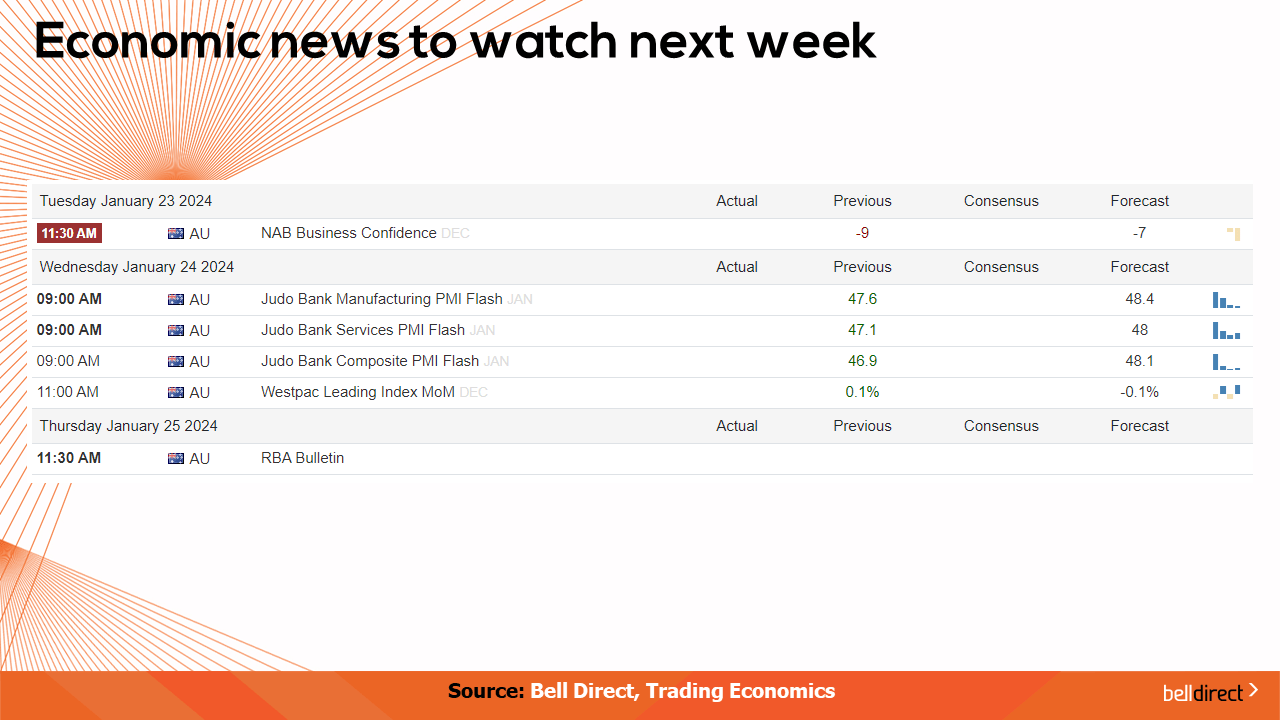

On Tuesday, NAB’s business confidence data for December will be released, and on Wednesday, we’ll receive the Manufacturing and Services Flash PMI. That’s the Purchasing Manager’s Index, and remember that the flash PMI is a forward looking estimate of the final PMI released the following week. A PMI above 50, will indicate an expansion from the month prior.

And that’s all for this week, I’m Sophia Mavridis with Bell Direct. Have a great day and happy trading!